The signs of a banking crisis have mounted in Ukraine. More and more banks are not returning deposits to their clients. Paradoxically, the National Bank of Ukraine (NBU) is not reacting to this. Most bankers that The Ukrainian Week tried to talk to only agree to speak off the record. They admit that they fear government sanctions against their banks. Oleksandr Suhoniako, President of the Association of Ukrainian Banks (AUB), has agreed to speak openly, despite the fact that many large banks have left the AUB after his harsh criticism of the policy of then NBU Chairman Serhiy Arbuzov in spring 2012.

UW: The Ukrainian Week has information that at least ten banks have difficulties with returning deposits to their clients. Is this just an individual problem of financial institutions that always exists in any economy, or does this signal a systemic crisis?

As far as I know, the sick banks that are failing to service their liabilities before depositors are Daniel and ZakhidIncomBank. They are not returning deposits, in spite of a court decision. Experts talk about 10 to 20 problem banks. Unfortunately, the NBU has no transparent information or clear position on this. What we are seeing is just the tip of the iceberg.

Problem banks have to be removed from the market, while the NBU is waiting. The Deposit Insurance Fund is taking a back seat as well. They have been inert since the crisis broke in 2008. This is dangerous because the problems are not being cured, just made worse, intoxicating the sound part of the banking system. A sound bank could give a loan to a sick one, which will never be repaid. As a result, a financial institution that is doing fine now will also become a problem bank. That will trigger a chain reaction.

READ ALSO: Systematic Recession

In the pursuit of mythical exchange rate stability, we have virtually lost the function of the national money market that could adequately respond to the needs of the real sector.

UW: The banking sector has normal liquidity now and interbank rates are fairly low. Does this mean that the industry has no problems?

Liquidity alone does not indicate the lack of problems. The key point here is how this liquidity works. When free cash comes into the real sector from banks at low interest rates, the economy is fine indeed. Unfortunately, this is not the case here.

UW: Why is the NBU not reacting to this?

This is an old disease: the Central Bank reacts to consequences, not causes. Many other institutions, not just the NBU, have such flaws. The current governance practice offers very few examples of successful preventive responses to crises. One was in 1998 when the authorities and market players came up with an effective solution. Unlike Russia, Ukraine managed to avoid a nationwide default and the collapse of the banking system back then. In 2008, however, the NBU did not react to our warnings (the AUB had warned it of the looming crisis in April 2008) and basically slept through the beginning of the global crisis. People say that the latest global crisis started with a mortgage default in the city of Stockton, California. Ukraine has to stay alert to nip its own Stockton in the bud.

READ ALSO: Erosion of Capital Signals Economic Degradation

UW: Could the NBU be turning a blind eye to the fact that some banks are on the brink of bankruptcy so that a select few can later buy them for peanuts?

This is not an option. The more troubled the bank, the cheaper it becomes. Meanwhile, its liabilities before clients do not disappear. The Deposit Insurance Fund will not cover all of the liabilities of such a financial institution. The entity that takes it over will have to cover all extra costs. The worse-off the bank is, the more the new owner will have to spend to recapitalize and rehabilitate it. The situation with assets is hardly better. Ukraine’s banking system is so bad now that even large banks with Western capital are ready to sell their local assets at knockdown prices. They do not see any prospects here.

UW: The media has reported that some Western financial groups are planning to sell their Ukrainian subsidiaries. For instance, UniCredit is supposedly selling UkrSotsBank, and Raiffeisen Bank – its subsidiary Aval. Why do they not see any prospects here? Is it about the Ukrainian economy, the banking sector, their own problems in Europe or is it that they can’t come to terms with the current government?

Ukraine seems to be seeking European integration but real European businesses are leaving it. This means that the government’s declarations do not correspond with the reality of its economic policy. In 2010, an economic development programme was developed. It provided for Ukraine to join G20 by 2020. Many of its provisions are effective. But it also required reforms, investment and increased export. The only real accomplishments so far, include a stable exchange rate and a low inflation rate. But these are just tools to accomplishing strategic goals, such as greater prosperity, improved quality of life and a more developed economy. In Ukraine, the tools have become an end in themselves. As a result, economic growth has ground to a halt.

READ ALSO: Deficit Looming Large

The main reason for the exodus of foreign banks from the Ukrainian market stems from 2005-2008 when the national capital market provided foreign financial entities with access that was not well thought out and uncontrolled. We did not set them any requirements or priorities. Our market was virtually left at the mercy of foreigners. And they were certainly not going to support our aircraft and space engineering or space technologies with loans.

All we gained was mortgages in foreign currencies, consumer and car loans. This is why these banks have now lost their strategic prospects in Ukraine. New priorities have not been developed, while old ones have been exhausted. The financial cycle is over. Banks can no longer earn on the gap in interest rates between deposits in Europe and loans in Ukraine. The current terms for lending to the real sector are clearly not adequate for foreign banks. Fortunately or unfortunately, foreign investors can no longer turn a blind eye to the risks we are used to. We have to start working now to restore the share of foreign banks in the Ukrainian banking system, but this work should be based on the well-articulated interests of Ukrainian society rather than on new strategic goals for foreign banks.

UW: Who could buy the subsidiaries of foreign banks in Ukraine if they continue to leave the country?

Economically, the acquisition of any banking assets in Ukraine is a foolish strategy at this point. There is no certainty that you will have any profit five years after such purchase. Angela Merkel said that the crisis in Europe will last 10 years. It will last much longer in Ukraine.

READ ALSO: Who Says Bankers Can Relax?

What will happen to the banks that stay here? Their only option is to cut costs, particularly interest costs, dramatically. Over the past two years, however, the interest expense growth rate has exceeded that of interest income growth as a result of high deposit interest rates. This is a problem of the government and commercial banks, not just the regulator. Unless we deal with it now, there will be very serious consequences.

UW: How do Russian banks feel in Ukraine?

They are generally facing the same problems. However, they have not been granting as many foreign currency loans as western banks. This made it easier for them to ride the crisis. Plus, they are mostly state-owned, so receive financial support from their parent entities.

Their mission in Ukraine is also political. And with such a mission, they’re not too concerned about expenses: oil dollars will help them implement any strategy. Russian banks can afford to intentionally operate at a loss, while European ones can’t: they are here for profits, not politics. The dependence on political decisions, however, makes economic strategy in Russian banks unpredictable.

UW: How close is the banking system to the critical point when no-one will be able to control the situation?

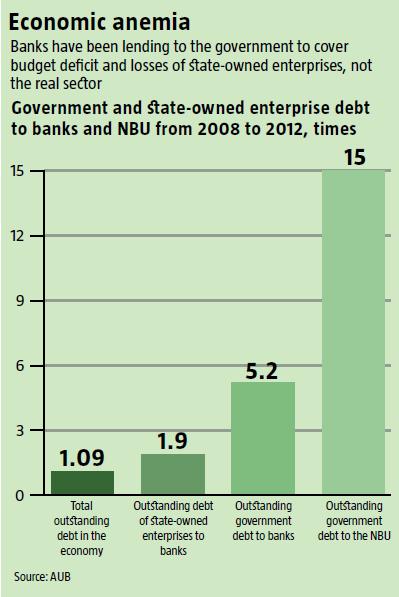

In my opinion, we are already operating close to this critical point. What are the signals? The budget is empty. Social benefits (pensions, wages for public sector employees and unemployment benefits) are delayed. The Premier blames local authorities for budget deficits and claims that banks support the eating up of money through lending. However, the government owes banks 5.2 times more than it did in 2008 in outstanding government bonds, and 15 times more to the NBU, while lending to the entire economy has only increased by 9% since then. Instead of funding the economy, banks are forced to grant loans to cover public spending. Some claim that interest rates on loans should fall to 14% by the New Year, but how is this possible, given that current deposit interest rates are as high as they are? This is why I believe we are just a step away from the critical point; we are in the zone of super-high instability.

READ ALSO: Mothballed Banks

UW: If the stable hryvnia exchange rate is a goal rather than a tool of the current government, will it have enough resources to maintain this rate, at least until the election?

During the previous crisis, the UAH:USD exchange rate dropped by 60%. According to our estimates, a comparison of the depletion of reserves back then and now shows that the exchange rate may fall 30% this time. So it could potentially be at a level of UAH 10.5:USD 1. The trade balance is still negative, covered by foreign borrowings in the balance of payments. In 2013, the appetites of importers have not decreased although it slows down quicker than exports do. So, the threat of steep devaluation is still there. When almost UAH 100bn was taken out of the economy during the sale of currency on the foreign exchange market, economic growth ground to a halt. Now, the GDP is in decline but the hryvnia exchange rate is stable. To maintain this, the government needs to withdraw hryvnia from turnover. But this will curb the purchasing power to buy foreign currencies, goods and services, so the economy will fall into stagnation. The public budget is already short of money but this shortfall will only worsen with this policy.