Last week, the State Statistics Service of Ukraine released Ukrainian industry indices for May 2013: the decline compared to the same month in 2012 constituted 9.3%. A closer look at a wider range of data reveals that the current pace of decline is not random and the economic situation is in fact worsening rapidly. In May, the volume of work in the construction industry dropped 29.1% year-on-year (in April – by 21.7%). As a result, the industry lost 17.8% in production volume in the first five months of 2013 and fell below the lowest figures of 2010, the period between the 2008–2009 economic crisis and the recovery in the run-up to the Euro 2012.

Since the lack of investment today means the absence of growth tomorrow, such dynamics signal that the worst months for the economy lie ahead. The crisis is also deepening in the transportation industry: over Jan-Apr 2013 cargo turnover dropped 10.7% compared to the same period last year; over the past five months the decline hit 11.4%. The crisis is mitigated by a moderate growth of agricultural output and retail trade at 5.1% and 11.6% accordingly in the first five months of the year, compared to January – May 2012. However, this is not enough since agricultural output growth remains unchanged for the second month in a row, while retail trade turnover fell 12.7% in four months. The situation on external markets is more likely to deepen the economic crisis in Ukraine rather than lead to economic recovery.

READ ALSO: The Government Hushes Up a Crisis

According Eurostat, the decline of industry in the EU continues, although it slowed to 0.8% in April year-on-year, after almost 18 months of 2–3% monthly declines. This could be seen as a positive trend that could support Ukrainian industry in time, particularly if Ukraine signs the Free Trade Zone Agreement with the EU in November 2013. However, the Russian factor is currently putting pressure on the Ukrainian economy. According to RosStat data, Russian industry faced a 1.4% decline year-on-year in May. This is now the third negative monthly result in 2013 after several years of continual growth. Unsurprisingly, this made Ukrainian mechanical engineering an outsider of domestic industry after it lost 18.1% in May, since the Russian Federation is its main target market. How deep down the industry will drag Ukraine’s entire economy will be clear in the second half of 2013 when Russia is likely to plunge into recession itself.

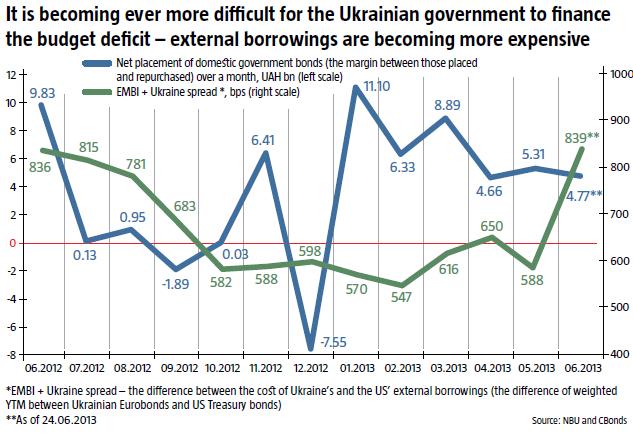

Financial sector indices look menacing against the backdrop of declining industry. In four months of 2013, Ukraine’s consolidated budget deficit hit UAH 18.9bn, which is three times more compared to the same period in 2012. Meanwhile, this year’s budget revenues listed UAH 10.7bn of advance income tax payments from enterprises in Q1’2013. Thus, if the government had not pumped money out of business, the consolidated budget deficit of Jan-Apr could have been almost twice as high. Over Jan. 1 through June 24, the amount of outstanding domestic government bonds increased by UAH 41bn. Of this, the NBU undertook the liabilities worth UAH 23bn by issuing the relevant amount of hryvnias for this. Commercial financial institutions undertook another UAH 19bn.Two more international government bonds placements were made replenishing the Treasury with USD 2.25bn. This left the government with a UAH 13.1bn reserve on the NBU’s accounts and UAH 5.2bn in commercial banks. This should have been enough to finance the budget deficit “from loan to loan”, but for two factors.

READ ALSO: Between a Rock and a Hard Place

First, Ukrainian Eurobonds have already started to see a rapid loss in value. For example, Ukraine-2013 is currently trading with a 9.75% YTM, although these bonds were listed at 7.5%, and traded at 6-7% only two-three months ago. Foreign borrowings are growing more expensive and this is unlikely to improve, if only Ukraine will be able to borrow anything at all. Secondly, domestic borrowings are seasonal: In 2012, the amount of domestic government bonds increased by UAH 28bn in the first six months, but did not change for the rest of the year. While banks had sufficient liquidity to help out the government by buying out bonds worth almost UAH 18bn in the first half of 2012, subsequent liquidity problems caused them to reduce their government bond portfolios and the NBU was forced to intervene by repurchasing them.

This signals that the solvency of the government will be under threat within the next few months. The present condition of the economy and public finances is far worse than it was last fall. The Family’s young reformers team is making last-ditch efforts to stave off economic collapse turning to Treasury bills, struggling with transfer pricing, etc. However, all these measures will merely worsen Ukraine’s prospects once “stabilization” resources have been exhausted.