According to the State Statistics Committee, Ukraine’s foreign trade deficit was USD 2.4bn in Jan-May 2013 compared to USD 5.8bn over the same period in 2012. This appears to be evidence of positive changes in the balance of payment. However, a closer look at the dynamics of certain commodity groups reveals how erroneous this impression is.

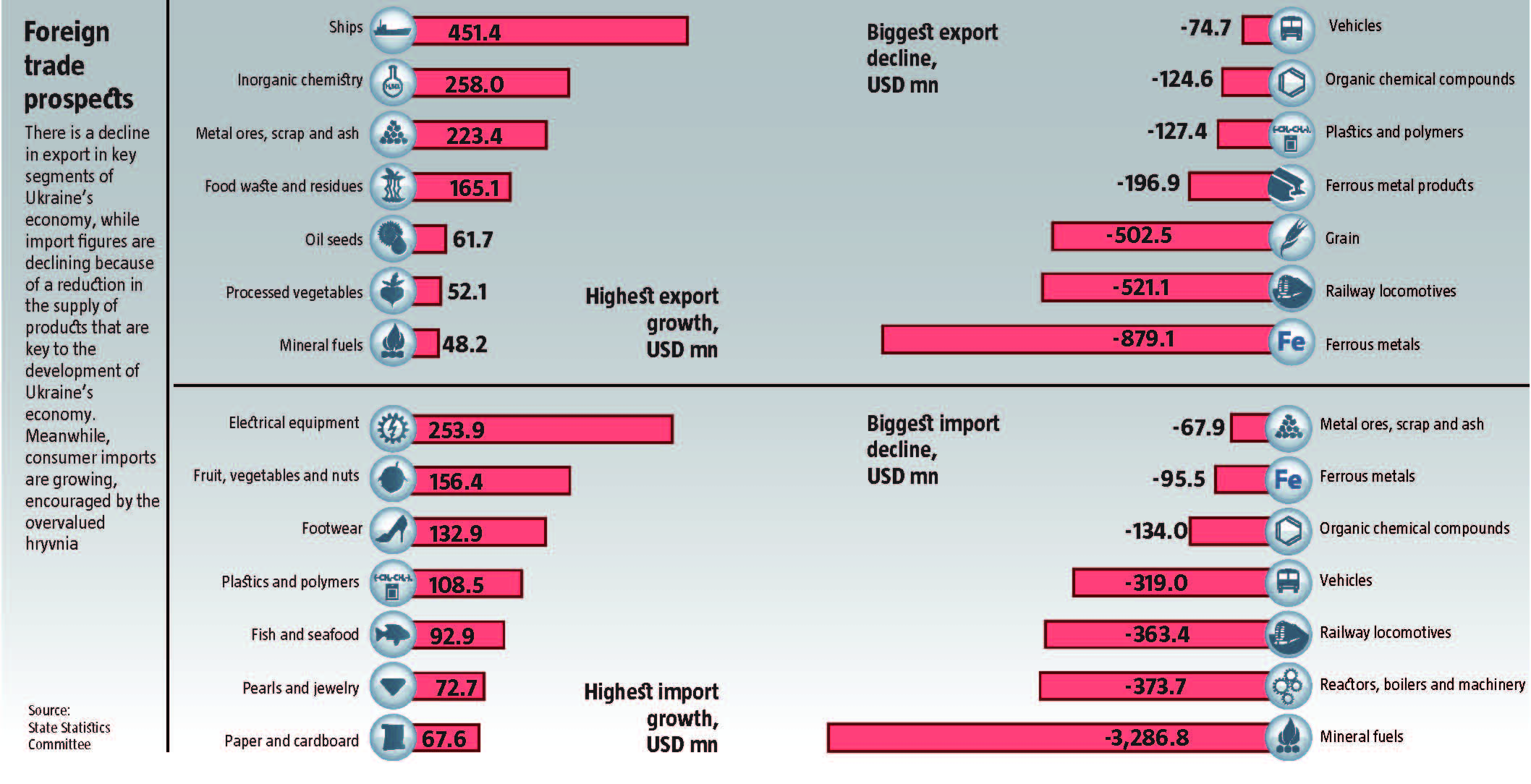

Exports shrank by 3.5% or USD 0.99mn, with steelworks contributing the most to this decline. Exports of ferrous metals and products have decreased by USD 0.88mn (see Foreign trade prospects) and USD 0.2bn respectively, making an overall, shortfall of over USD 1bn. They are in a difficult position now, but this is the cost of pumping out profits into offshore zones and decades without investment in modernisation. Therefore, the prospects for Ukraine’s steel exports and its contribution to the trade balance remain gloomy.

READ ALSO: Systematic Recession

Another group of goods that faced a significant decline in exports is Railway Locomotives with freight cars as the key exported item. Ukrainian rail carriage producers lost USD 0.5bn, which is no coincidence. Russia as its major market is building its own rail carriage building plants and taking ever more steps to support them. So, the losses of Ukrainian rail carriage builders on their traditional markets are likely to soar. Meanwhile, Russia is implementing a similar support policy in a wide range of other industries to replace imports from Ukraine. Grain exports saw the third biggest decrease but this can be explained by the poor 2012 harvest.

The Ships group saw the highest growth of exports. However, the 779% increase this year is because Ukraine delivered very few ships over the same period in the previous year. Moreover, the shortage of orders does not yet allow Ukrainian shipbuilders to operate seamlessly, so they cannot ensure a sustainable contribution to the trade balance. The next three groups of goods that saw an increase in exports are all raw material-based. These include Inorganic Chemistry (mostly ammonia and corundum, which are subsequently processed abroad); Metal Ores, Scrap and Ash (exports of iron ore are growing, which proves the inefficiency of the Ukrainian steel industry), and Residues and Waste Products from the Food Industry (cereals, pellets, bran, pulp, mill cake) for which a use cannot be found in Ukraine.

Meanwhile, the import of goods to Ukraine shrank by USD 4.3bn over the first five months of 2013. USD 3.3bn accounts for lower expenses for Mineral Fuels. Ukraine spent USD 1.45bn or 27% less on natural gas, partly because steelworks and chemical plants – its major consumers – used 8% and 2-18% less gas respectively. A warm winter and the use of gas from underground storage facilities also contributed to the decline. However, they will have to be refilled in the second half of 2013. This deferred import will affect the balance of payments in the second half of 2013. New coal import quotas pushed coal imports down by USD 531mn. The Family’s strong interests in this business have contributed to this. The import of oil and oil products decreased by USD 660mn (82%) and USD 560mn (20%) respectively. Ukraine’s oil refinery industry is in stagnation since Ukraine imports sixteen times more oil products than oil. However, while Ukraine produces only 10-12% of the amount of oil it consumes, it imported 33% less oil and oil products. Since consumption has not changed, the USD 1.2bn decrease in imports can be explained by shadow transactions. In short, this amount has been smuggled, something that the mass media has been reporting for a while now, saying that the respective entities headed by one of the “young and successful business owners” have close ties to Ukrainian top officials.

READ ALSO: Cure for Poverty

Plummeting imports of Reactors, Boilers and Machinery demonstrates shrinking investment that will later have an adverse impact on economic growth. The Railway Locomotives group, saw the procurement of the infamous Hyundai high-speed trains. The decline of car imports in Vehicles was triggered by a special import duty, which many countries, including the US, the EU and Japan, are preparing to respond to with sanctions. These will probably affect the trade balance by the end of this year or in the first six months of 2014. Overall, six of the seven groups of items where imports shrank, refer to capital equipment. As a result, Ukraine will have a deficit of raw materials or capital equipment in specific industries, and a relevant decline in them. Five of the seven groups where imports grew the most refer to consumer goods. These are imported in larger amounts, as the government keeps a fixed hryvnia exchange rate.

In an effort to maintain the stability of the hryvnia rate, the government is trying to mask the negative outlook of the trade balance and delay the deficit to future periods. This aggravates risks for the economy since it has no sources for covering the deficit. Moreover, a similar policy is being conducted in regards to other trade balance items, including external and internal foreign currency debt. These efforts will have a temporary effect, but a devastating aftereffect when the balance of payments shrinks in several segments at a time as a result of the inevitable decline in borrowing by the government and the private sector, as well as worsened trading conditions that WTO states

READ ALSO: Bank Reserves Diminishing