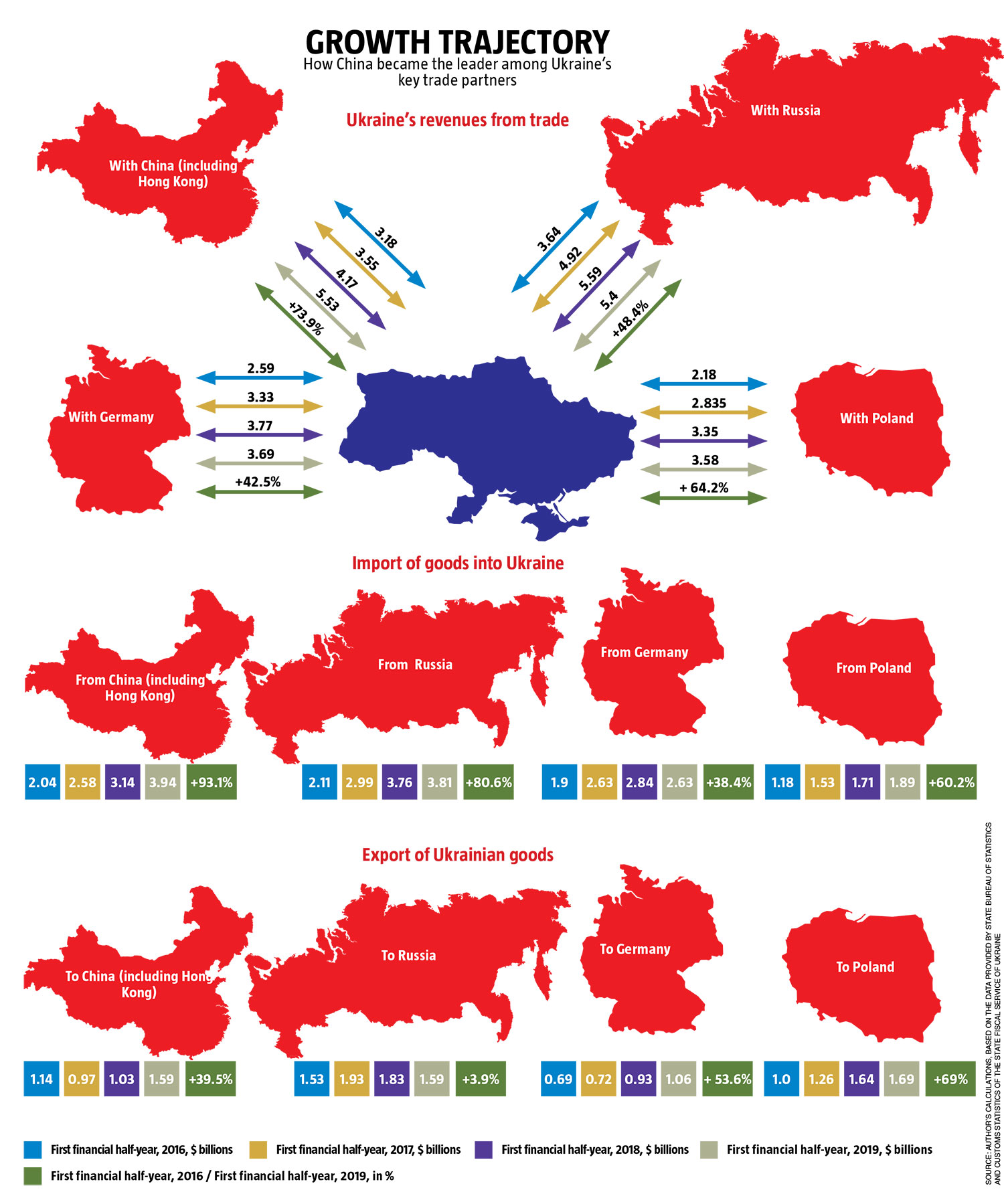

Based on the results of the first quarter of 2019, China became the leader among Ukraine key trade partners. The volume of foreign trade between Ukraine and China rose to $5.5 billion; while with Russians it came to $5.4 billion. At the same time, dynamics of the past several years proved that China’s role in the world markets will continue to increase – and Ukrainian market is not an exception (see Growth trajectory). Despite the fact that rising trade with China is a common thing for many countries across the world and European countries in particular, Chinese share in Ukraine’s foreign trade is nevertheless much more substantial than in Poland, Belarus or Moldova. It is only in Russia, where China controls disproportionally large share of country’s foreign trade.

China’s trade expansion, that has become noticeable over the past couple of decades, is a result of dynamic growth of Chinese economy and its influence in the world. From 1979 until 2010 its growth constituted nearly 10% a year. Country’s GDP in dollars gradually overcame economies of the G7 – Italy in 2000, France in 2005, United Kingdom in 2006, Germany in 2007 and Japan in 2010. Nowadays in terms of the volume Chinese economy is still smaller than American, however, in terms of purchasing power China overcome the United States in 2014. At the same time, Chinese growth has visibly slowed down in face of the economic crisis of 2008. While in 2005–2007 its dynamics amounted to 11.4–14.2%, in 2018 it fell to 6.6%, and since 2011 it has never been higher than 8%. In the light of recent trade war between the United States and China, Chinese economy has barely shown any signs of noticeable growth at all.

In order to compensate for its losses, Chinese companies are trying to be more pro-active in their trade with other countries around the globe, including Ukraine. Ukraine, on the other hand is trying to use cooperation with China as an opportunity to solve internal problems of Ukrainian economy. However, based on experience of the past decades, it has become evident that uncontrolled influx of Chinese products is either destroying the local industries or creating obstacles on a way to creating the new ones. At the same time, Ukrainian producers have little or no access to domestic Chinese market, one of the biggest markets in the world. As a result, since the 2008–2009 crisis and its aftermath, that Ukrainian economy, especially its industrial sector, is still struggling to overcome, Ukraine imported Chinese products on a total sum of $60.8 billion. However, Ukraine’s export amounted to $ 22.5 billion only. Therefore, trade deficit with China from 2009 to first half of 2019 has reached $38.3 billion.

While China is leading virtually colonial trade and economic, the nineteenth century-styled, policies towards its current trade partners, the country keeps its domestic market restricted and inaccessible for many sectors of Ukrainian economy, that could have supplied its produce to Chinese markets. At the same time, other countries are able to freely supply products to China worth of hundreds of thousands or even billions of dollars every year.

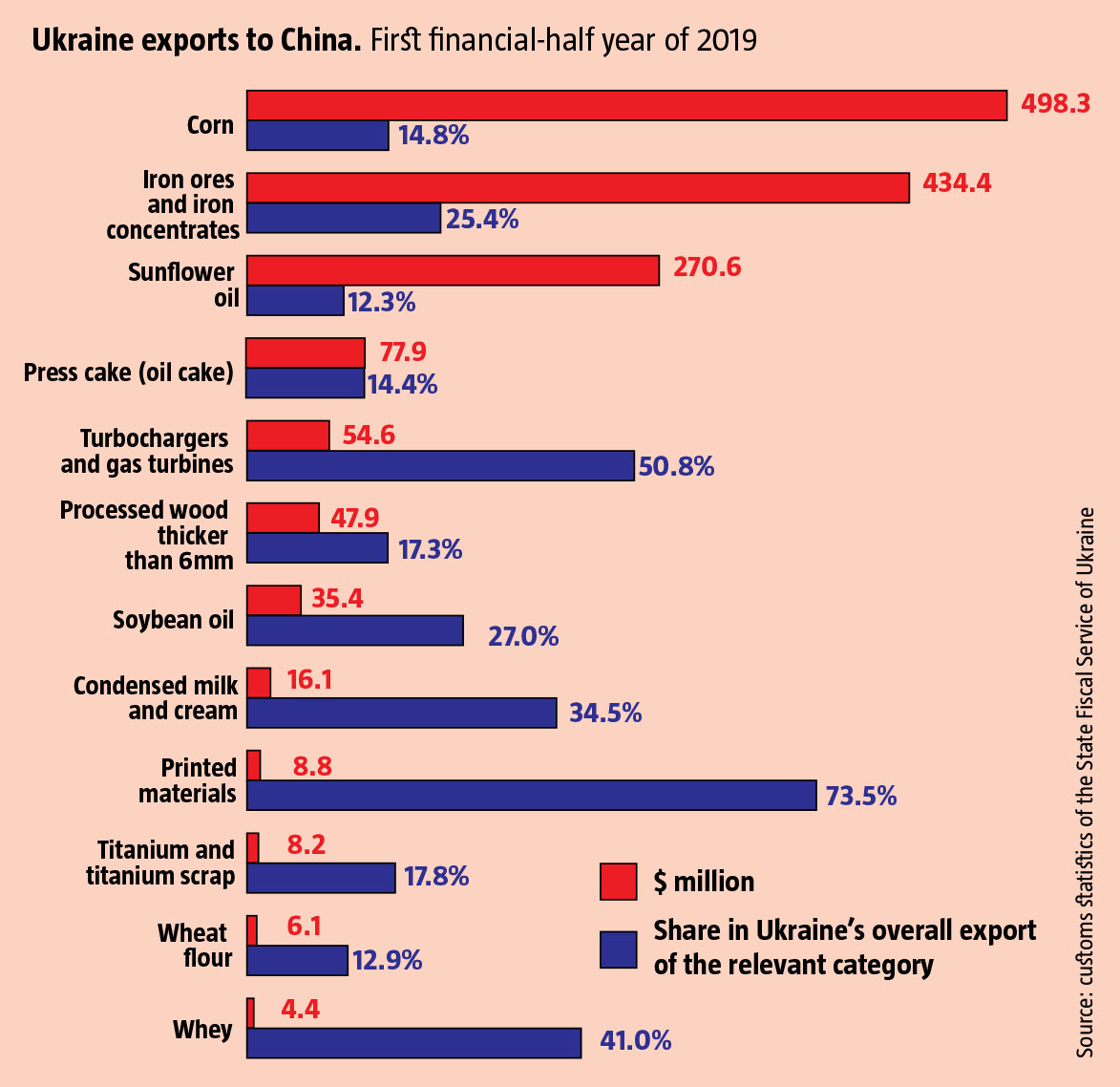

Currently Ukraine is only represented on Chinese domestic market with it metal and steel production, as well as corn, sunflower and soy oil, unprocessed wood and small amounts of food products. For instance, Ukrainian export of wood products to China has been steadily growing, however, hereby we are talking about semi-processed goods or those with lower levels of processing (see Ukraine exports to China). Namely, supply of timber to China grew from $14–15 million in 2015–2016, to $76.3 million in 2018; export of wood veneer grew from $3.4–3.9 million to $7.5 million within the same period of time. However, while Ukraine sends low-processed wood to China, it exports a rather high volume of value-added finished goods. For instance, Ukraine imported fibreboard and plywood on a total value of $13 million.

Until recently Ukrainian export of whey has been dynamically growing (from $0.5million in 2015 to $2.3 million in 2016 and $12.5 million in 2017), however there has been stagnation since 2018, while over the first half of 2019 the volume of supplies fell to $4.4 million. It is likely that similar fate is also awaiting Ukrainian condensed milk ($3.5 million in 2018, $16.1 million in the first half of 2019). Ukrainian produce is still underrepresented on several other lucrative segments of Chinese domestic market. For instance, Ukraine fails to export its high quality butter (only $3.7 million of export in 2018), or cheese (it is barely exported). At the same time China imports $0.5 billion of butter and cheese each year. Ukrainian exporters are represented much better on domestic markets of several other, much smaller countries. Last year Ukraine exported $1.8 million of chocolate products, and additional $4.5 million of other confectionary and bakery products to China. Ukraine supplies its meat only to Hong Kong – namely poultry ($18 million in 2018), pork ($2 million in 2018), beef, lamb or other meat ($0.5 million) and meat products ($2.6 million). As of now, access to the mainland Chinese lucrative markets is still restricted.

RELATED ARTICLE: Exports: A successful shift

Immediate damage

At the same time, every year Ukraine is being literally bombarded with Chinese machinery, electrical appliances and other consumer products. According to the 2018 data, Chinese import to Ukraine on 53.4% constitutes of machinery, 10% – mainly ready metal products and 9% – light industry goods. The share of imported machinery in Chinese imports grows even in the context of overall growth of trade between Ukraine and China. For instance, in 2017 this share amounted to 44%, in 2018 – 53.4% (as noted above), and since the beginning of this year this number has already reached 55%.

The list of products groups with an import value over UAH 50 million includes nearly 300 names. For instance, yearly import volume of 70 groups already grew over UAH 0.5 billion; 43 of them already account to more than UAH 0.5 billion and constitute nearly 33% of the overall applicable produce bought by Ukraine.

Out of all the Chinese products present on Ukrainian markets, the highest volumes are of Chinese diodes, transistors, photosensitive semiconductor devices and piezoelectric crystals ($398.5 million in the first half of 2019). Here the total worth of supplies reaches UAH 2 billion a month, and it is more than 90% of all Ukrainian import of such products. Second place goes to the devices of automatic information processing and their related parts, magnetic or optical reader-machines ($150 million in the first half of 2019) – those products have an import share of 66.5%. Third place belongs to various telecommunication devices ($197.7). Chinese exports of such products constitute a 53.4% share of all such supplies to Ukraine. Various ground digging or excavating machines and snow cleaning vehicles ($130 million) with the share in import of 61% came fourth.

There are products on the market, that are slightly lower in terms volume of supplies, but much higher in terms market share, such as Chinese bicycles (94.6% of import, $19.5 million in the first half of 2019); rubber and plastic shoes (87.6%, $ 57.6 million), hand electrical devices (75%, $39 million), lamps and other light devices (69.3%, $38.1 million); toys (86.1%, $72 million). Among other products where the numbers of supplies are high, but its overall share in the same trade category is lower, there are Chinese products for garden care ($102, 15.1% million), flat-rolled galvanic coated carbon steel ($ 63 million or 34%), tyres and wheel trims ($57,5 million or 28.3%), tractors ($36 million or 11.9%) and furniture ($37.7 million).

Over the first half of 2019 the above-mentioned volumes of supplies became almost twice higher and have a tendency to grow.

Earlier, The Ukrainian Week has already explained that, should Ukraine restrict access to its domestic market for certain Chinese goods, who are practically putting a stop to the development of local industries, it will have a rather high chances to grow its domestic production and at least fulfil its own needs.

In 2018 the import of machinery from China amounted to $4.06 billion, or UAH 110.4 billion, which is more than the overall profits of all the Ukrainian producers that year (UAH 102.9). Therefore we are talking about the rather comparable numbers. In the same year Ukrainian enterprises sold metal products on a sum of UAH 33.7 billion, while Chinese import amounted to $385 million, which is UAH 10.5 billion. We are also talking about nearly equivalent of nearly one third (31%) of Ukrainian metal production on Ukrainian domestic market.

Every year this equation between Ukrainian and Chinese only gets worse and is not in favour of Ukraine. Chinese have much bigger scale of production and powerful sated support and they are expanding their influence all over the world. In Ukraine, in addition to all the circumstances described above, Chinese also meet very little resistance.

There is a similarly poor, or at times even worse, situation in light industry, furniture and glass industries, in pottery and cement industry. Those industries could become the drive of change for Ukrainian small and medium business and generator of new work places Ukrainian regions with high levels of unemployment. Namely, only in 2018 Ukraine imported $16.4 million of canned fish and seafood, $14.7 million of fruits, vegetables and nuts. At the same Ukrainian food producers are struggling to get the same level of exposure to Chinese domestic markets – with the exception oil, whey, condensed and dry milk, as well as small amounts of flour.

The need to change the strategy

Further increase in trade and economic cooperation with China on practically colonial conditions, that have been formed over the past few decades, making Ukraine supply raw and semi-raw materials to China and opening up its completely unprotected domestic market to Chinese fished goods in return, is very dangerous. In 2007 Chinese GDP per capita amounted to $2,700 and was almost equal to Ukrainian one, while in terms of Purchasing Power Parity (PPP) it was even lower ($6,800 against $8,100 in Ukraine). However, by 2018 the situation has drastically changed. While Chinese GDP (PPP) has reached 18,100, Ukrainian has only grown to $9,300. Even despite recent slow-down tendencies, Chinese economy is still nevertheless growing almost twice quicker than Ukrainian. This will be the vase even if we analyse the GDP data per capita, when Ukrainian population is reducing, while China’s is growing.

RELATED ARTICLE: Start with China

Ukraine needs to radically change its approach to trade partnership with China and only guard its own national interests. Ukrainian producers must be given much broader rights and wider possibilities when it comes to accessing Chinese domestic market, and be allowed to supply Ukrainian value-added finished goods. At the same time, access to Ukrainian market for Chinese products must be restricted. It is true, that nowadays it will be more difficult to achieve this than in the past. However, passive stance of the Ukrainian state will only become the source of even bigger dangers and will keep increasing the disproportionate elements of the bilateral trade.

it is important to properly utilise recent changes in global international trade and turn those changes into Ukraine’s favour. Potential trade wars between the giants of the world economy certainly do not depend on Ukraine’s position. However, the new reality allows us to once more revaluate Ukraine’s economic policies and especially its foreign trade. Apart from losses to Ukrainian exporters, the era of economic nationalism can even aid the development of Ukrainian economy, should Ukraine adopt reasonable nationalist economic policies. It can also give a chance to reflect on past mistakes of the recent decades and prioritise what’s important. With the current volumes, and what’s important, structure, of the bilateral trade, Ukraine’s losses will definitely not exceed the benefits.

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook