Recently, the idea that turning towards the West will condemn Ukraine to being a commodity-based economy and turn it into a semi-colony where developed countries from EU and NATO will sell their finished products is being promoted more and more enthusiastically. At the same time, those who do not dare to directly advocate reorientation towards Russia and "traditional post-Soviet markets" as a serious alternative against the background of Russian aggression point to China as a sort of "third way". They argue that Ukraine needs to intensify links with China in its politics and diplomacy, as well as trade and economics. Apparently, there are opportunities for more economically advantageous and politically equal relations when compared to the West. On the wave of frustration with the focus on the West, the Chinese alternative is becoming another mirage of a rapid solution to Ukrainian problems, if only cooperation would be furthered with the world's second-largest economy. This has recently been fuelled by the demonisation of the IMF and reforms to public, medical and social services, as well as the realisation that they do not mean German or Dutch income levels in Ukraine right now.

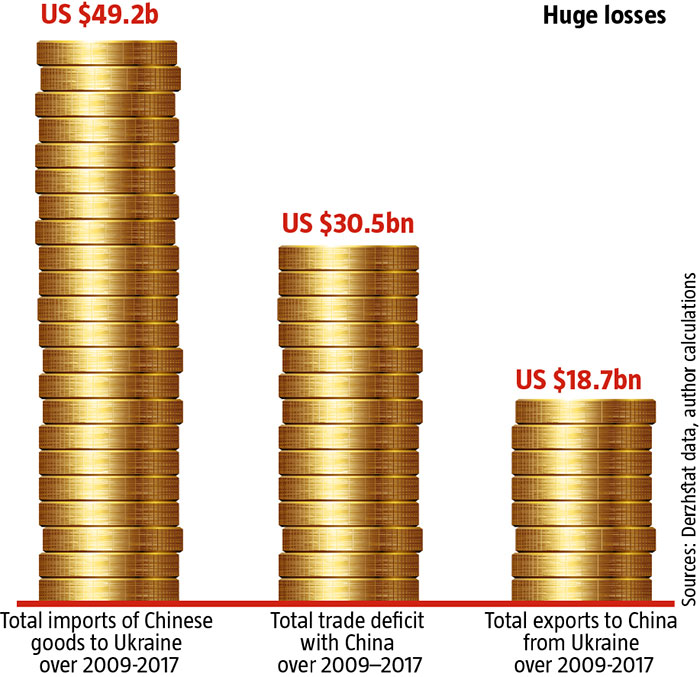

However, these illusions are shattered when taking a more detailed look at what is really happening in the trade and economic relations of Ukraine and other developing countries with China. In fact, trade with the PRC is perhaps the most striking example of inequality and harm done to the domestic economy. As we shall see from specific examples and figures, the influx of Chinese goods over past decades has killed off the widest variety of existing enterprises and entire industries in Ukraine or hindered the creation of new ones. On the other hand, most domestic producers have had practically no access to one of the largest markets in the world. Since the 2008-2009 crisis alone, from which the Ukrainian economy, especially heavy industry, is still unable to recover, imports from the PRC amount to $49.2 billion, while our exports going the other way were worth $18.7 billion. As a result, the aggregate trade deficit with China for 2009-2017 reached $30.5 billion, with a total of almost $43 billion since 2005. These are financial resources and market volumes taken away from domestic producers that have been destroyed by Chinese imports or simply did not have the opportunity to emerge. Without any compensation at all from the other side. Over time, this negative trend is only intensifying. In particular, over the first nine months in 2018 our exports to China (including Hong Kong) remained virtually at the same level as in the equivalent period one year earlier ($1.48 versus $1.46 billion, with market share decreasing from 4.6% to 4.3%). Conversely, Chinese supplies to Ukraine, as well as their share in Ukrainian imports, are growing rapidly: from $4.05 billion to $5.28 billion, and from 11.5% to 13.0% of total volume.

The Ukrainian Week has already drawn attention to the extremely dangerous trends in trade and economic cooperation with China six years ago. At that time, Yanukovych's regime attempted to solve the problem of tense relations with the EU and Russia, which insisted on integrating Ukraine into its Customs Union, with the help of China. Signing a law on 6 August 2012 that opened the way for state guarantees on two PRC "investment" projects worth $6.7 billion, he nearly opened a Pandora's box that would have made Ukraine greatly dependent on loans from Chinese state corporations under crippling terms. At that time, the process did not go too far, in particular thanks to the Revolution of Dignity, although Ukraine is still reaping the consequences of the oppressive contracts that were in fact signed. The State Food and Grain Corporation, for instance, has turned into basically the only unprofitable large grain trader in the country as a result of the first tranche of the Chinese loan ($1.5 billion out of a planned $3 billion).

Beijing's neocolonial approach towards trade with Ukraine has not gone anywhere since then.Chinese state corporations continue to refrain from direct investment and look for loans that are backed by the state. At the same time, they determine the areas in which the provided funds should be used for at their owndiscretion, as a result of which they quickly leave the "destination country" to pay for additional imports from the PRC.

Therefore, Ukraine must not intensify its cooperation with China on the basis of the current principles, but make a radical change to their foundations. If necessary, radical actions should be employed up to and including a trade war with the People's Republic of China. With the present levels and, most importantly, structure of bilateral trade, our losses will certainly be no larger than the benefits for domestic producers created by limiting the influx of Chinese finished goods.

RESTRICTED ACCESS

The access of finished goods to the Chinese market is a much more complicated issue than in the markets of developed countries and the United States. Those who do business with the PRC say only half in jest that local businessmen immediately warn them that they "only sell and buy nothing". Especially when it comes to finished products or basic semi-finished products and materials. This is a direct result of Beijing's aggressive economic policy.

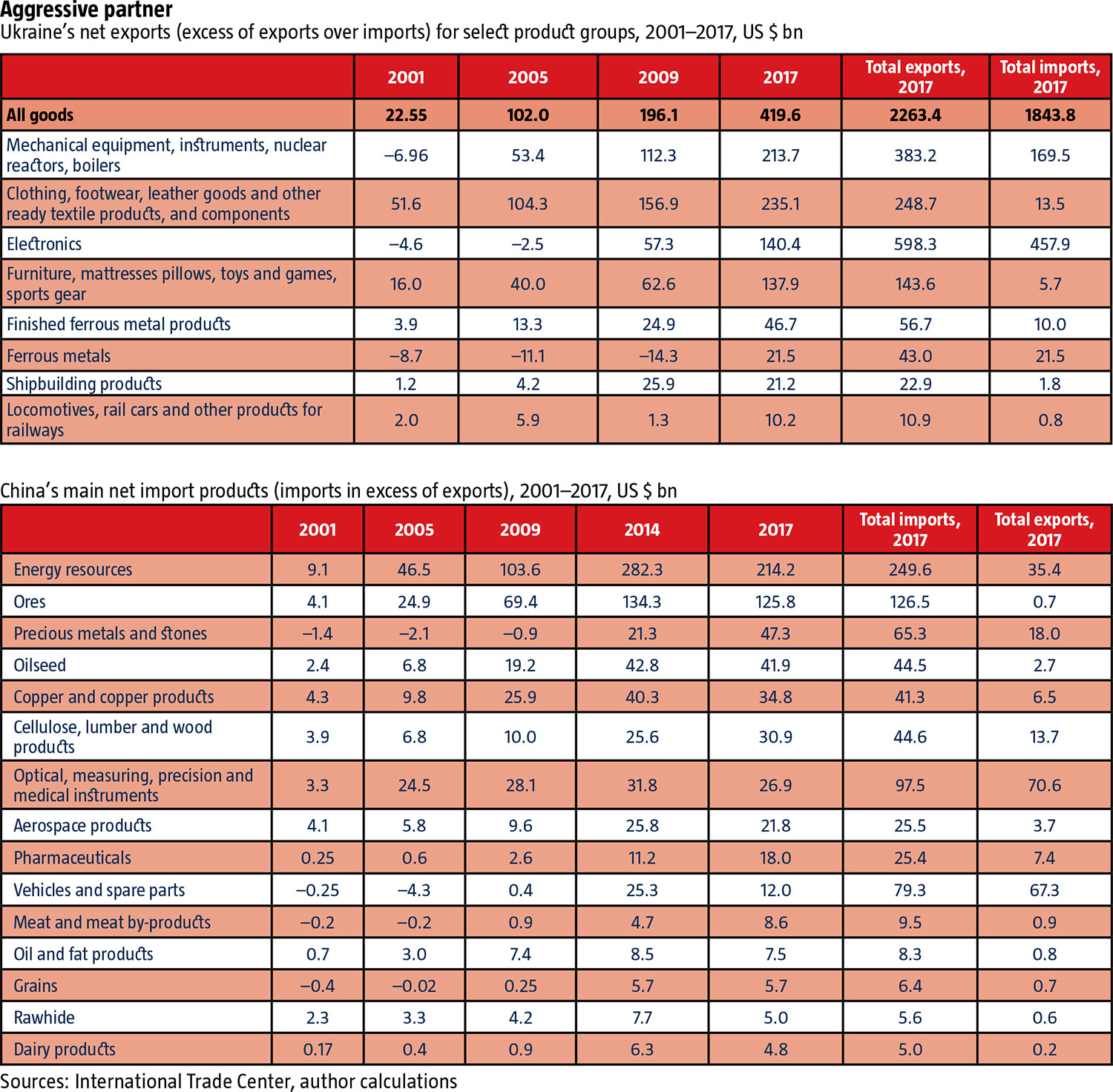

At the beginning of the century, the largest net exports from China were consumer goods ($51.6 billion of finished clothing, footwear, leather goods and other finished textiles or parts thereof) and furniture ($16 billion). Conversely, the country was a net importer of electrical goods and machines, spending $4.6 billion and $6.96 billion more, respectively, on purchasing them than it received from exports. Only in shipbuilding and rail transport products did exports slightly exceed imports.

RELATED ARTICLE: Exports: A successful shift

However, the situation changed radically throughout the first decade of the 21st century. Even before the international crisis of 2008-2009, China was exporting $112.3 billion more in machines than it imported, and the exports of electrical goods exceeded imports by $57.3 billion. Since then, net exports of machines have reached $213.7 billion in 2017 and started to come to the fore, almost drawing level with clothing, footwear, leather goods and other finished textile products. Total exports from China in this category ($383.2 billion) are more than double the import of similar products to the PRC from around the world ($169.5 billion). Net exports of electrical products sharply increased, surpassing China's revenues from sales of furniture and toys abroad ($137.9 billion). At the same time, aggregate exports of electrical equipment ($598.3 billion) are now the top category of Chinese exports. In the meantime, the country has also increased external shipments of shipbuilding and rail transport products, for whichexports are currently dozens of times larger than imports.

While prior to the 2008-2009 crisis the PRC aggressively increased exports of finished products made from ferrous metals, even increasing imports of semi-finished iron and steel products, semi-finished products have also been exported on a mass scale in recent years. In 2017, exports of ferrous metals from China were double imports ($43 and $21.5 billion), while the difference for finished products made of ferrous metals was almost sixfold ($56.7 and $10 billion respectively). Consequently, not only has access to the Chinese market been closed forever to Ukrainian metal products – the backboneof our supplies to the PRC in the late 1990s and early 2000s – but China has also pushed Ukraine out of markets in South and South-East Asia, as well as Africa.

Instead, the main categories of Chinese net imports have long been energy and raw materials, and to a lesser extent certain high-tech goods that China has not yet been able to copy and food products for which demand can not yet be satisfied by domestic production. So it is not surprising that it is extremely difficult or even unrealistic for Ukrainian industrial semi-finished products or food products to make it onto the market.

By resorting to an aggressive policy of economic nationalism and conducting not even a neocolonial, buta classic colonial trade and economic policy from the 19th and early 20th centuries with respect to its partners, China has kept and continues to keepits own market closed to the sectors of the Ukrainian economy that would now be capable of supplying it with significant volumes of products. Moreover, this is happening while other countries from around the world have sales volumes of tens and hundreds of millions or even billions of dollars on the relevant markets of the PRC.

In addition, not only our finished products with higher added value have limited access to the Chinese market, but also most raw materials and food. We are currently represented on the huge Chinese market, whose suppliers we have given a very large part of our market to, almost exclusively by iron ore, corn, sunflower and soybean oil, soybean seeds and almost unprocessed wood.

For example, in 2017, Ukraine's share in the supply of iron ore and concentrates amounted to 1.3% of total imports of this product to the PRC (worth less than $1 billion). In 2011-2014, the volume of such supplies to the PRC was almost 2.5 times larger ($2.3-2.4 billion), as was their share in Chinese imports of this product, which fluctuated around 2-2.5%. About 75% of Chinese imports were already controlled by the world leaders Australia and Brazil, and since then they have only strengthened their monopoly in supplying iron ore to China, bringing their share to 84%. Ukrainian iron ore has ceded the Chinese market to more closely located suppliers in Iran and India in the last three or four years. Imports of these products from Chile and Peru are also hot on our heels.

China is a major importer of soya, purchasing $39.6 billion worth in 2017. However, even in this market Ukraine is extremely weak ($9.6 million). Brazil and the United States remain suppliers of over 80% of this crop to the PRC, while Canada, Uruguay and Argentina account for 2-6% each of Chinese soy imports. In terms of supply volumes on the Chinese market, Ukraine is dozens of times behind even competitors from the Russian Far East. Ethiopia, one of the key countries in China's recent African expansion, is right behind us.

As in the rest of the world, Ukraine dominates the import of sunflower oil to China (78%, or $484 million, in 2017). Only Russia, Kazakhstan and Argentina are trying to compete with us, but their positions are many times weaker. Supplies of Ukrainian soybean oil also account for a significant share of Chinese imports (10.3%, or $55.3 million, in 2017) and they are slowly but surely growing, catching up in volume with the US and suppliers from the Far Eastern regions of Russia. However, Brazil has a practical monopoly in exporting this product to China, with a share of over 50%.

At the moment, Ukraine is also in first place for corn supplies to the PRC (over 61% of Chinese imports in 2017 and up to 80% in 2015). However, sales revenue is dropping rapidly and steadily – from $877 million in 2015 to $508 million in 2016 and $369 million in 2017. This is due to the fact that there are practically no competitors forthe Chinese market (except for the United States, with which Beijing is conducting a trade war, corn is only supplied from Laos and Myanmar, which have, however, been rapidly increasing export volumes in recent years).

Ukraine exports muchless barley to China ($148 million, or 8.2% of Chinese imports in 2017). It has pushed France out of third place, but the main role is divided between Australia and Canada, which account for almost 90% of all barleyimports to the PRC. On the other hand, there are no wheat supplies from Ukraine to China at all. Although the market is comparable in size to that of corn, it is still shared between Australia, the USA and Canada. Recently, neighbouring Kazakhstan and Russia, for which logistics are much cheaper, have started to make their move.

Currently, all Ukrainian exports of dairy products to the PRC are made up of dry whey. Supplies to China have been growing at an extremely fast pace in recent years ($0.5 million in 2015, $2.3 million in 2016 and $12.5 million in 2017). According to these figures, we have already bypassed or are at least neck-and-neck with such traditional exporters of dairy products as Belarus, Austria, Denmark, New Zealand and Finland. However, the concentration on one product and a still very modest share of its imports to the PRC (less than 2%) indicates that Ukrainian producers have a clear problem with entering the Chinese dairy market. The traditional leaders in supplying these products to the Chinese market, such as France ($113 million in 2017), the Netherlands ($64 million), Germany ($34.1 million) and even neighbouring Poland ($30.7 million), are still a long way away. Not to mention that we are absent from other attractive segments of Chinese dairy imports, such as dry and condensed milk (over $2.2 billion in 2017), butter ($0.5 billion) andcheese ($0.5 billion). Instead, Ukrainian producers of these products are represented on the markets of other countries.

RELATED ARTICLE: The cost of a good wage

Exports of Ukrainian timber to China have seen robust growth in recent years, but they are mainly made up of raw material from the saw-milling industry with a low level of processing. More precisely, in recent years exports of sawed timber to Chinahave increased from $14-15 million in 2015-2016 to $35 million in 2017 and veneer from $3.4-3.9 million to $8.2 million, while supply volumes of unprocessed wood have decreased lately: from $90-120 million in 2015-2016 to $14 million (mainly in early 2017). While Ukraine sends minimally processed wood to China, significant volumes of products with much higher added value go the other way. For example, more than $41 million of fibreboard, chipboard and other materials have been brought in from China in recent years, as well as almost $17.7 million of plywood and $10 million of woodworking and joinery products.

As for the few Ukrainian high-tech industries, companies andR&Dprojects, in this sector China is also focusing onlyon buying or illegally obtaining Ukrainian technology (copying, poaching experts, etc.). Indeed, they do not plan to establish long-term cooperation or – even more so – buy Ukrainian high-tech goods. The prospects of attracting "investments" from China boil down to loans with state guarantees for Chinese goods and engineering services, as well as selling certain strategic assets to its companies.

OPENUP ANICHE

On the other hand, Ukraine is plagued by Chinese machine building and electrical engineering products, as well as a large number of simple consumer goods in other industries. According to data for 2017, 44% of exports are accounted for by machine-building products, 11.8% – light industry products, 11.5% – chemical products and 10.2% – metal products.

By making access to our domestic market more difficult for Chinese importers, which are currently blocking or complicating the creation of new manufacturing industries in Ukraine, we have considerable opportunities for substantially increasing production, at least for the needs of the domestic market. Ensuring at the same time the creation of jobs and increased revenues for the state budget and social insurance funds.

According to the State Statistics Service, all Ukrainian manufacturers of machine-building and instrument-making products had sales of only 81.6 billion hryvnias on the domestic market in 2017, i.e. $3.07 billion at the average yearly exchange rate from the National Bank. At the same time, imports of machine-building products from China in the same year amounted to $2.88 billion. In other words, these figures are absolutely comparable. Imports of Chinese machine-building and instrument-making products are almost equal to domesticsales of similar products made by this entire sector of the Ukrainian economy.

Vehicles alone over the last five years have been imported from China to the tune of $1.11 billion. Other electrical and engineering products that were importedfrom China in 2017 for more than 1 billion hryvnias and which could be produced in Ukraine included scooters and electric wheeled toys for children ($113 million in 2017 and $305 million in the last five years) and pipe fittings ($87.8 million and $481 million respectively). As well as monitors and projectors ($81.5 million and $402 million), lights and spotlights ($81.4 and $485 million), air conditioners ($65.3 million and $267 million), gas and electric boilers ($57.8 million and $366 million), and electrical transformers ($38.4 million and $167 million).

In 2017, Ukrainian enterprises sold only 26.6 billion hryvnias of metal products. At the average annual exchange rate for 2017, which is calculated by the National Bank, this is equal to $1 billion. At the same time, finished goods made from ferrous metals worth $255 million were imported from China, even at the declared value for customs (which is often much lower than the real one). Therefore, this is more than 25% of the sales volume of all Ukrainian enterprises on the domestic market.

There is a similar situation in the consumer goods, furniture and glass industries, as well as with the production of ceramic products, stone, gypsum and cement, which should be an area for the active development of Ukrainian small and medium-sized businesses, as well as a powerful generator of jobs in towns with high unemployment. In 2017, clothing produced by Ukrainian enterprises was sold on the domestic market for 4.72 billion hryvnias ($177 million) and footwear for 1.55 billion ($58 million). At the same time, imports of the corresponding products from China, even at declared customs values, were worth $124.3 million and $126.2 million respectively. Furniture produced in Ukraine was sold on the domestic market in 2017 for 7 billion hryvnias ($263 million), while imports from China were equal to $110.9 million, again only at officially declared values for customs.

Over only the past five years, $1.33 billion of footwear, $0.56 billion of toys and sports equipment, $266 million in paper and cardboard, $297 million of ceramic products, $266 million of stone, gypsum and cement products, and $273 million of glass products were imported from China. These are revenues taken away from existing and potential medium and small businesses in Ukraine.

Significant volumes of food products are imported annually, particularly processed food, while access to the Chinese market remains closed. In particular, in 2017 alone $33.5 million of canned fish and fish products were imported from China, and over the past five years these supplies amounted to almost $125 million. Finished products made from fruits, vegetables and nuts were worth $25.4 million and $111 million respectively. At the same time, the Ukrainian food industry, with the exception of oil and dry whey,still has virtually no access to the Chinese market.

Translated by Jonathan Reilly

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook