When a person is tirelessly working their way towards their goal, it may at first seem as if the circumstances were aiding them, somewhat making it easier to reach the aim. However, as soon as one stops giving enough effort, everything immediately starts falling apart – a sort of a punishment for the weakness. Many of us have probably encountered this phenomenon at some point of our lives. Now, it seems this rule applies not only to people and their lives, but also to countries.

When Ukraine faced an immediate danger of losing its international financial support and loan payments, country’s top politicians have made it their top priority to solve this problem. They have agreed for a number of rather unpleasant conditions offered by IMF, they kept looking around for other sources of investment, sold state bond at unpleasantly high interest rates. These efforts, have, however, paid off – Ukraine’s gold reserves have been growing, while the risks for economy have been decreasing.

Presidential elections have somewhat discouraged Ukrainian political establishment from pursuing their aim, while the elections’ outcome has left the country on crossroads and possibly on the verge of turmoil. Economic consequences did not make us wait for too long – Ukraine has been facing economic challenges one after the other, and if the country’s government is not able to deal with those issues properly, it will take less than few quarters for Ukraine to fully feel its negative impact.

Problematic budget

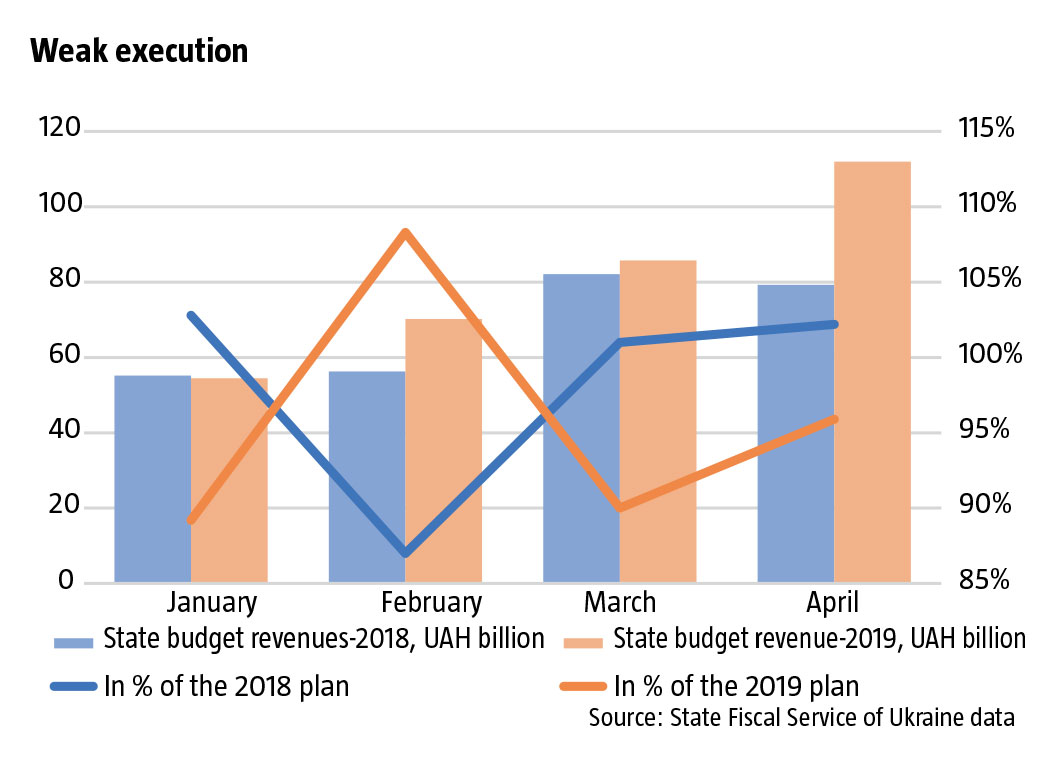

Key problem of Ukraine’s domestic policy is its state budget. During the first four months of the current financial year, it was not satisfactory to say the least (see Weak execution). At first glance, everything seemed to be normal – budget received UAH 322 billion, which is a 18% growth compared to the same period of January – April 2018. However, the actual state of affairs was worse than it seemed. In April National Bank of Ukraine (NBU) earned UAH 47.6 billion for the state budget, which the official revenue of the year 2018, and according to current Ukrainian legislation this sum has to be transferred to the budget by the end of the current financial year. If we compare this year’s state revenues to the previous year without NBU’s contribution, overall economic growth within the first four months will only account to some 7%. This number does correlates neither with the nominal GDP growth, proposed by the Ministry of Economic Development and Trade (10.9%), nor with the anticipated growth, projected by the government in the 2019 state budget (11.7%). Therefore, over the period of four months Ukraine’s earnings seem to be at least UAH 15 billion short. In practice, however, State Fiscal Service of Ukraine confirmed these shortcomings, stating in its reports that anticipated revenue was only fulfilled by 91.4%.

Why is this worrisome? We can compare this data to the previous year’s one. According to the State Treasury Service of Ukraine, over the last year anticipated state revenue was completed on 98.2%. This result is indeed unsatisfactory; however, these numbers are not critical and are nevertheless manageable. However, the revenues continued falling over the following months. As a result, in July and August 2018 Ukraine’s state budget faced a bitter liquidity deficit, and the government was forced to withhold some payments and pay offs until they received a short-term loan of $ 725 million by the end of August 2018. Over this period media raised a question about possible delays in paying salaries and retirement payments, however the government has quickly dismissed those claims, saying that there is no need for panic and there are no signs of negative impact on economy. Nevertheless, this did have certain effect on economy – the real GDP growth rate in the 3rdquarter slowed down to to 2.8%, while the previous few quarters it constituted 3.5%.

This financial year the situation is visibly more complicated. Budget implementation rate in January-April was 95.2%, and if we exclude the NBU’s earning from the equation, this number will decrease to 90%. Therefore, theoretically problems paying the salaries may begin even earlier this year. Hereby, there are two factors to consider.

RELATED ARTICLE: Persuasive economy vs uncertain policy

First of all, according to NBU reporting standards, its annual revenue, prior to transferring the budget its share, is UAH 64.9 billion. Ukrainian parliament may revise the sum supplied by NBU, and the state will receive additional UAH 17 billion – this, however, won’t last long and will barely be enough to cover the deficit of the first four to five months.

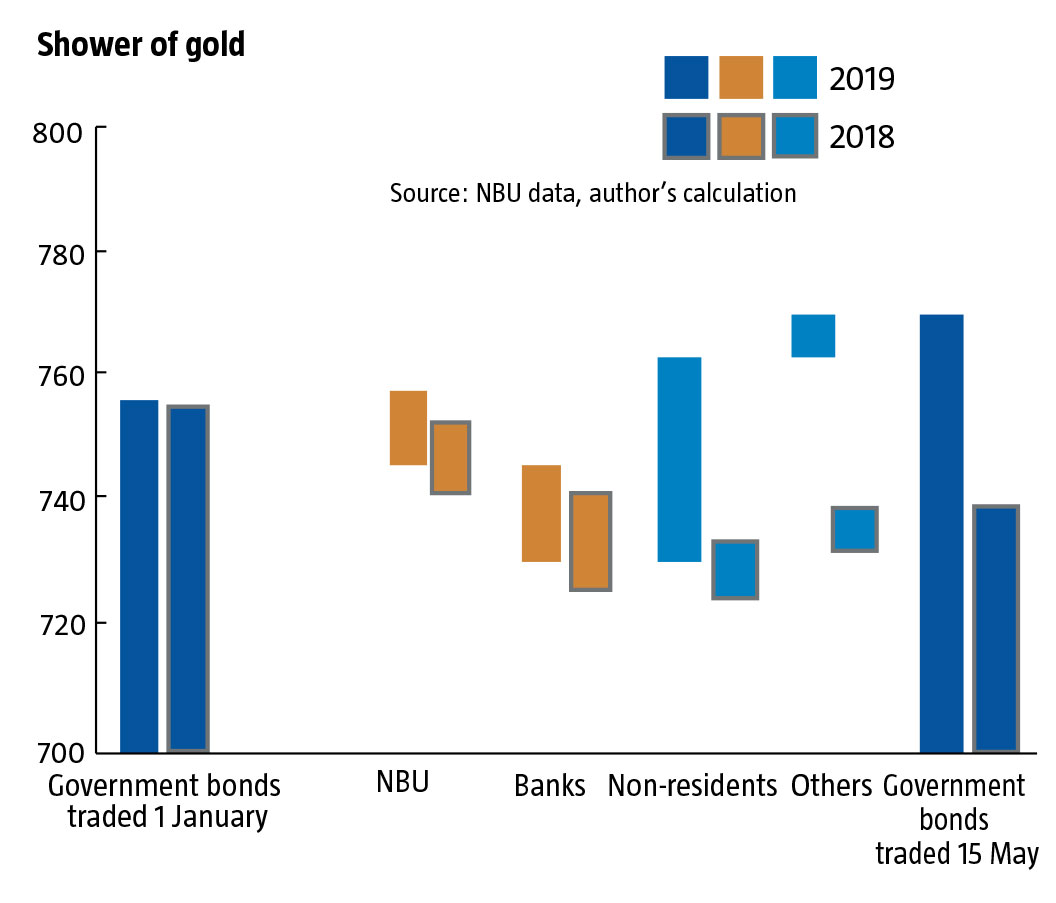

Secondly, this year Ukraine has been quite successful in selling its state bonds, receiving UAH 13.3 billion in revenue in the period from January to April this year – compared to 11.1 billion in the same period last year (see Shower of gold). However, there is one little detail. Current growth is a result of foreigner investors’ inflated interest in Ukraine’s state bonds. Non-residents hence bought obligations on more than UAH 33.3 billion in the past four months, while the interest rates were high and the national currency is still very cheap. There are however, well-grounded concerns that by the end of the summer foreign investors will initiate the sale of the bonds.

External threats

There are extensive external threats for Ukraine and its economy. These are less apparent at the moment, because currently there are other, more positive events, dominating the economic scene in Ukraine – for instance, an increased inflow of foreign currency, stabilisation of the national currency – hence nothing hints immediate problems. At the same time, if one projects these current trends in the few months’ perspective, the picture will be much grimmer.

One of the key reasons for the relatively stable hryvnia, Ukrainian national currency, is the recent successful harvest of wheat and oil. According to some estimates, revenue from this harvest brought Ukraine additional $ 1 to 1.5 billion, most of which was transferred to the budget in the early 2019. According to the State Service of Statistics, in March this year wheat export has increased on 28% compared to the previous year, and foreign currency cash flow has increased on 52% in the first quarter. This effect will eventually wear off within the next couple of months, because all of the produce from the previous harvest will be sold, and this year’s harvest does not seem to be as fruitful. Additionally, prices for agricultural products have dropped – for instance, wheat prices have decreased by 7%, corn prices – by 3%, soya – by 19%. This will also decrease the foreign currency inflow.

Interestingly, from the early 2019 Ukraine has received nearly one additional billion dollars as a result of a very successful harvest this year, as well as more than a billion dollars after non-resident foreign investors began buying government bonds. These are nearly $2 billion of additional revenue owing purely to fortunate and temporary external factors. Nevertheless, these funds became the key reason for hryvnia’s strengthening against the major global currencies. This did have, however, one side effect – import indicators shown in hryvnia were lower, than expected, and as a result revenues gathered by the custom authorities were significantly lower – in January-April customs authorities reported only 88.1% plan execution figures.

At the same time, according to NBU, foreign currency purchases on the interbank, the top-level foreign exchange market, reached on billion dollars. This means, that had it not been for the above-mentioned temporary circumstances, Ukraine currency market would face a significant dollar deficit, and as a result, a very different exchange rate. Thus the current strong hryvnia is a temporary occurrence and is likely to change in the near future. Quite possibly that the impact of the agricultural trade factor described above will wear off relatively soon – however, will the non-resident foreign investors lose their interest in government bonds and when will this happen?

Unstable world

Global financial and economic situation in the world currently is only increasing external risk factors described above. Federal Reserve has recently increased its discount rate several times, and kept reducing its balance sheet, and in the IV quarter its pace rose to $ 50 billion per month. European Central Bank (ECB), at the same time, has slowed down its asset-purchase programme known as the quantitative easing (QE), and by the end of the year it stopped its bond-buying scheme. Developing markets painfully reacted on cash-flow decrease during 2018. This has hit the shares, bonds and currencies of the developing countries and this was enough for the key central banks across the world to correlate its policies. The Fed has taken a break in increasing the discount rate. ECB decided to pursue its reinvestment programme.

This has temporarily calmed down the markets, but has not solved the global problem. US Federal Reserve keeps decreasing its discount rate on $ 50 billion a month, leading to decrease of the currency in the global financial system. Thus, problems in the troubled countries’ financial sectors lead to problems in the other sectors. Here is where Ukraine may face the real danger.

Geographically, for Ukraine the closest troubled economy is Turkey. In the IV quarter, Turkey’s GDP has decreased by 3% compared to the same indicators in 2017. It is important to know that weakening of Turkish lira began in 2010 and then accelerated again in 2015. This, however, did not prevent the economy from growing, which began right after the global economic crisis in 2008-2009 and finished in the early 2018. Nowadays Turkey, the 19thworld economy, enters an evident recession with the unemployment rate of 15%.

This will constitute a potential problem for Ukraine, because the Turkish market is the fourth, after Russian, Polish and Italian in terms of export. Weakening of Turkish economy will lead to a lower purchasing power of Turkish consumers, and as a result – decrease in Ukrainian export to Turkey. This tendency became visible in 2018, however it has only become important now. Turkey’s key trading partners are Germany and China, which means that Turkey’s domestic economic problems will have an impact on already troubled economies of Eurozone and China.

Another trade partner of Ukraine, beset by problems, is Italy. In the I quarter its economy showed a positive growth of 0.1%, which is a noticeable decrease compared to a 1.8% growth in 2017. This has also coincided with the end of the ECB’s QE program. Nowadays Italy is quickly approaching recession based on a number of indicators – performance of the industrial sector, retail trade and PML index. So far global analytical centres do not predict drastic decline of Italian economy. For instance, according to IMF projections, Italy’s real GDP will increase on 0.1%. Based on IMF’s conservative approach and the fact that its earlier prediction was 1.1%, it is possible that the real result will be worse than the official prediction. By the way, IMF has also predicted a 2.5% decline in the Turkey’s economic growth, thus practically acknowledging its recession.

These factors are a direct threat for Ukrainian economy – Turkey and Italy together share 10.5% of Ukrainian export. Additionally, Italy is the third economy of the Eurozone. Its problems will be immediately felt by Germany and France – this will reflect on the euro’s exchange rate and economic indicators in those countries. Real economy sector’s problems in Italy and Turkey will not only affect hryvnia’ exchange rate, but also overall demand, which, will subsequently hit not only financial sector, but also the other industries in Ukraine. Some indications of this tendency are already visible now – for instance, Ukraine’s industrial production index (IPI) has fallen to the 0.9% per year. This relatively small decrease is difficult to interpret, but the lack of growth in the industrial production gives reasons for concern.

There are also troublesome Argentina and Pakistan, next in line to as troubled Brazil and Indonesia. Their domestic economic complications are relatively insignificant for Ukraine; however, turbulent events in their economies do impact global markets. For instance, by the mid-May MSCI EM, index that captures large and mid-cap representation across emerging markets, were down by nearly 10%, which is an unusual dynamic for such a diversified index. This means that if the monetary policy of the global central banks across the world is not modified within the next few quarters, it may lead to a financial crisis across many emerging markets. The crisis will not only affect Ukraine financially, but will also hit its material sector (prices of exported raw material may decrease) and trade sector (Ukraine’s export may decrease, and not only to Turkey or Italy).

Different signals

Thus Ukraine has ended up in a very uneasy and complicated situation. On one hand, Ukraine’s economy is doing relatively good – there is foreign currency inflow, hryvnia has strengthened, Ukraine is able to repay its one billion dollars financial obligations. Hryvnia has also reacted well on the results of the second round of the presidential elections, inauguration of the new president and the news of the potential dissolvent of the parliament. At the same time, NBU has indicated that it is ready to start decreasing its discount rates. This is a peaceful gesture aimed at calming down foreign investors, who are expected to start buying government bonds and strengthen the national currency.

On the other hand, looking in long-term perspective we have a lot of very significant risks. Most of the external risks are part of the global tendency that became obvious after the policy conducted by Feds and ECB. If the Fed’s monetary policy doesn’t change it is highly likely that all of the above-mentioned risks will cause an effect of domino. At some point NBU may decide that decreasing discount rate is an early measure. In this case not only foreign investors may stop buying bonds leading to a currency deficit on interbank, but they may also start selling the bonds. This may lead to a further depreciation of hryvnia – not necessarily in the same pace as it happened in 2014-2015, but it will still be noticeable compared to the recent, relatively stable, exchange rate.

Further, this may cause certain complications for state budget implementation indicators. While hryvnia is strong, budget revenues won’t fit the plan. Even after hryvnia gradually becomes cheaper, economy will need time to correlate dollar and the national currency. At this point government bonds may become less attractive for non-resident foreign investors, and the government will start losing money. This will force the government to either try to get the money from somewhere else, begin budget sequestration or cut off the public pensions, which was the case last year. While the first two options are difficult to implement, the third one will most probably cause many negative side effects both for economic and social situation in the country.

RELATED ARTICLE: Is this the end of “the era of poverty”?

Political factors

Unsurprisingly, if Ukrainian politicians could work to implement the long-term goals and prepare a safe back up plan, we could have avoided many of the above-mentioned problems. IMF could have provided a loan. However, before the presidential elections Ukrainian political elite has been rather idle, reassured that there are no evident economic difficulties in the nearest future. Now, as the country sinks in a political vacuum, which will not be filled any time sooner than at least three months, it will take time for the new government to form its new own team and establish the trusted partnership with IMF. Nobody, apart from the new president can take responsibility for the country – and he does not have the authority in these issues.

Additionally, it will still take a lot of time to receive a new, hypothetical, transfer from IMF even after the new government has been established. There may be many reasons for IMF’s caution – for example, Ukraine’s failure to implement the anticipated budget, and the experience of the past four months only proved that. This will be followed by the period of talks, consultation and bargaining combined with an evident worsening of the economic situation in the country. Additionally, due to the legislative and executive power vacuum it will be difficult to regulate the risks. Such future doesn’t bring in much optimism. There is a hope that IMF will adequately evaluate situation and will act preventively, with full understanding of the fact that Ukraine faces complete reload of the central power institutions. But is IMF really interested in doing this? Future will show.

One may be surprised by the obvious euphoria expressed by the new president’s advisers. They have been reassuring the public that Ukraine can easily get by the end of the year without any loans provided by IMF. This would be an ideal scenario and perhaps very few people would object it, however, tendencies and risk described above really beg to differ. New president’s advisers are not only wrong in their claims, but they are also ignoring the global financial situation, and their reckless self-assurance may end up being very harmful for the country. Such ruthless attitude also guarantees unexpected consequences. In Ukrainian case that means practically guaranteed panic of the foreign currency o market.

Yet, if this year Ukraine is destined to survive another financial and economic shock, its consequences will still be less devastating than the ones in 2014-2015. Ukraine’s banking sector will be tested, and it seems like it is strong enough to handle middle-size crises. It is likely that the economic growth will eventually slow down to 1-1.5%, in the worst case scenario, which is currently unlikely, will fall slightly below zero. Ukraine’s economy should be able to handle such blow rather quickly. However, it is not the blow itself which is concerning, but the fact that the country could have avoided it in the first place. All Ukraine need is responsible political class which would be willing to take the country’s destiny in its hands. Unfortunately, it seems that Ukraine wasn’t able to achieve this for more than 28 years now.

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook