Ukrainians have slowly become used to fluctuations on the currency market. Swings in the hryvnia exchange rate bother them, while seasonal rises and falls in the dollar are no longer a surprise to anyone because they happen at almost the same time every year. This year was no exception: the Christmas period barely ended when the hryvnia began to firmly pick up pace and in about two months, the dollar became nearly UAH 2 weaker. At first glance, this is not the limit and the hryvnia is likely to continue to grow stronger. However, this expectation is in conflict with the political tension that is palpable in Ukraine today because of an extremely competitive presidential race whose outcome few are prepared to predict. And so people are complaining that tomorrow Ukraine will elect a president who will flip the country’s course nearly 180, while the forex market remains still as a waiting python. This is just the time to take a deeper look at why this is so and what might be expected with the hryvnia in the next few months.

A strong foundation

The situation on the forex market traditional depends on fundamental and psychological factors. The fundamentals are reflected in Ukraine’s balance of payments, which shows how much currency the country receives, how much it spends and what drives this. Today, the balance of payments is generally positive. The current account balance, based on exports and imports, was much better in December and January than a year ago, based on available data. This was the result of quite solid, long-acting factors –mainly growing exports – not temporary effects. The lively export dynamic has been driven by goods in the group “foodstuffs and raw materials for their production.” According to NBU data, this has been growing by 15% on an annual basis every month since October. Yet, prior to this they were not nearly this lively for an entire year.

The reason is that physical volumes of food exports have grown thanks to record harvests. According to the Ministry of Agricultural Policy, Ukraine harvested 70.1mn t of grains and legumes, which was more than 8mn t more than in 2017. The Ministry also predicts that this will make it possible to increase exports of grains from Ukraine from 39.9mn t in the 2017-2018 marketing year to 47.2mn t in the 2018-2019 marketing year, an increase of over 18%. Industrial crops also brought in good harvests: soybean, sunflower seed and rapeseed. As a result the production and export of oils also grew. In short, Derzhstat reports that the group “cereal cultures” saw physical volumes go up 25% in December compared to a year earlier, while the group “fats and animal- or plant-based oils” jumped 40%.

These indicators are quite meaningful as the results for last year show that these two groups ensured 24.8%, a full quarter of all of Ukraine’s exports of goods. Growing sales volumes of grains should allow Ukraine to bring in more than a billion more dollars in revenues, while the export of oils should add a few more hundred million. The addition of at least 1.5 billion dollars will be very useful in a year that the country has to service its considerable external debts. This sum is equivalent to a single tranche from the IMF and will have a positive impact on the forex market. In fact, it could cover the country should problems arise with getting loans from the Fund.

Indeed, a few months ago, the NBU already announced that the good harvest was supporting the hryvnia exchange rate during a period of greater demand for the dollar. Today, this continues to be the case and is unlikely to end at least until the new marketing year. The decline in world prices for food that has emerged in recent weeks has softened this impact somewhat, but is unlikely to completely cancel it out.

RELATED ARTICLE: The mirror of development

Import trends have also supported the hryvnia exchange rate. In December and January, inflows of foodstuffs grew only 1% compared to indicators from the previous year, although they had been growing in the double digits for many months in a row, with a few minor exceptions. According to NBU data, the main factors in this decline were energy and chemical products: the currency cost of these two groups has declined for two months in a row.

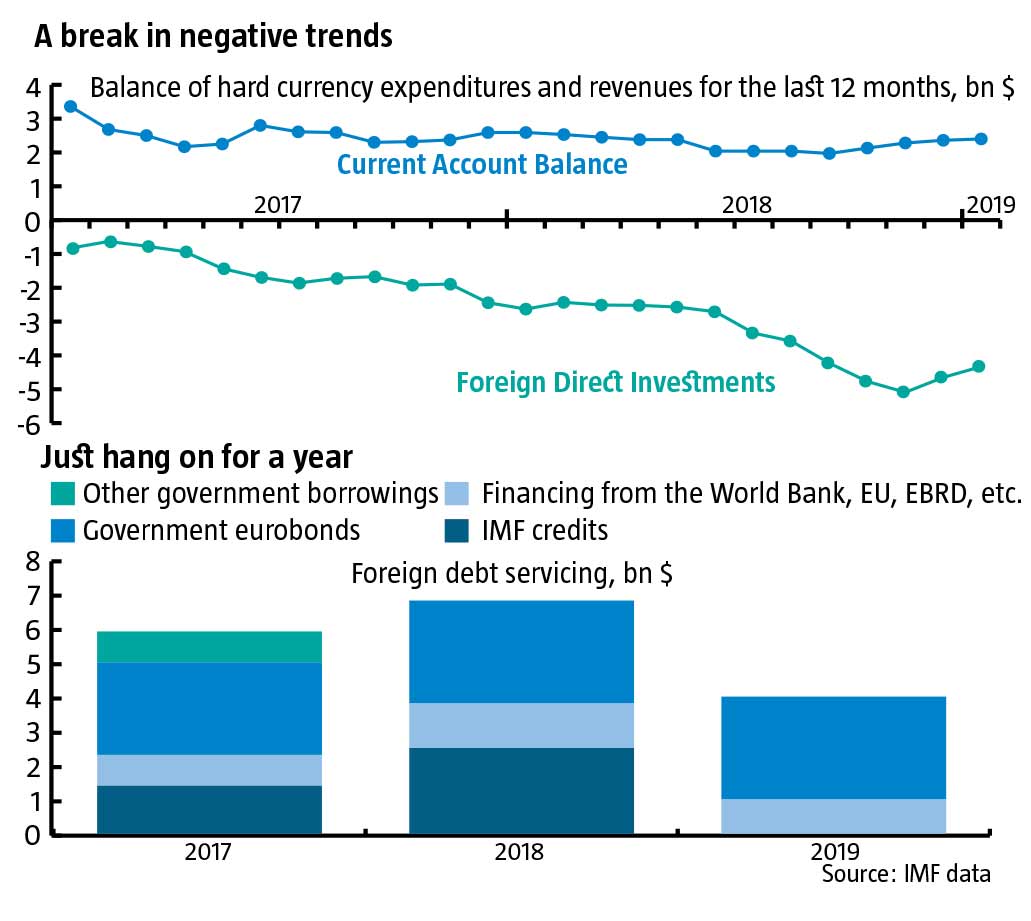

In short, the trend towards a shrinking cumulative 12-month current account balance (CAB) was broken in the last two months (see A break in negative trends). And so now the country needs less foreign currency to service its external trade operations, which means demand for foreign currency on the forex market has gone own. This is a fairly convincing trend that will continue to support the hryvnia for some time to come.

Financial milestones

The other part of the CAB, the financial account that reflects foreign economic operations, is also demonstrating a positive dynamic. The cumulative balance of FDI has been growing slowly since October (see A break in negative trends). Judging by its current dynamic, this indicator is already recovering from its post-crisis nadir, which merits particular attention. Last year, Ukraine saw a good deal of uncertainty because of the protracted break in cooperation with the IMF, a decline in asset prices among developing countries, and the approach of a double election year in Ukraine. Until the last minute, there was no certainty that the country would painlessly survive the peak external debt-servicing period. Despite all this, forcing investors began putting more and more money into Ukraine in QIV of 2018. This brought hope and the thought that, under less uncertain conditions, non-residents might invest even more actively.

Then came a number of positive developments, such as the launch of a new cooperation phase with the IMF and the Fund’s allocation of US $1.4bn in December. This started inflows of cheap loans that added up to over US $3bn in the last few months alone. Thanks to this, the government was able to properly close out a very uneasy fiscal year and set aside a reassuring financial reserve for the beginning of this year.

Ukraine started 2019 with NBU reserves of US $20.8bn. This is triple what it needs for external financing according to IMF projections for this year (see Just hang on for a year), and several billion more than the three months’ worth of imports that financial specialists consider the safe minimum. Even if the country were not to receive a penny more of what is being predicted, it would end the year with reserves of US $14bn, which is not bad at all. This means that Ukraine should survive the current year without any CAB or forex excesses, go through elections without any brouhaha, establish a new government, and not worry too much that the end of this political cycle might prove the end of the phase of economic growth as well.

In 2020, the country will need far less external financing, meaning that Ukraine could forget about the kind of fiscal stress that it faced in 2018 for a good while. The current Government deserves credit for having made the decision to meet IMF conditions, despite the inevitable social reverberations, which made this all possible. This was remarkably farsighted and quite unprecedented.

At the same time, the strength of the CAB fundamentals and the economy as a whole has done Ukraine’s political establishment an immense disservice. When the country was faced with the serious threat of an economic crisis, and that was only a few months ago, officials and MPs were more concerned with the national interest, the reforms necessary for the country to develop, and getting the IMF tranche. Now there’s the impression that achieving even temporary economic stability has led to the end of rational thinking among these same people. The most blatant example was the Constitutional Court’s ruling that illicit enrichment was not a crime. It unceremoniously rolled back Ukraine’s achievements in combating corruption, provoked a tsunami of criticism from civil society, and has led to a pause in financial cooperation with Ukraine’s international partners for what could be a very long time. Surely that was a very shortsighted move.

Another example is the relatively easy-to-meet new program of cooperation with the IMF. It includes some fairly nominal structural milestones that Ukraine could easily meet without excess effort. It would seem that the government should hurry to pass the necessary legislation, get an additional US $2.4bn from the Fund, and engage in completely different business over the next five-year political cycle: not putting out economic fires but preparing directly for accession to the EU and NATO. But no! Ukraine’s lawmakers think in terms of “Let’s cut a deal and play some political games” and collapse into a second childhood. If these decisions by Ukraine’s establishment change from the exceptions to the rule, serious threats to the hryvnia could appear out of nowhere.

A day in the life of forex

Judging by the hryvnia exchange rate, the forex market is currently playing off the positive fundamentals. Over the last year, participants had some doubts and questions on which their actions depended. With the arrival of the December IMF tranche to Ukraine, it seems that the answer to the final important question was found.

One significant nuance is that over the last few years, the winter peak dollar rate was a bit higher each year than the previous one. However, this time, the fall of the hryvnia on the interbank currency exchange market stopped at UAH 28.50/USD, which was about 50 kopiyka less than in 2017. One possible reason for this could be that the relatively expensive dollar hung in there a few months longer than in 2017. Or, possibly, market players were now more confident in Ukraine’s prospects and its national currency than a year ago. If the reason really is greater confidence, the summer minimum dollar rate should confirm it. Over the last few years, it has risen by about 50 kopiykas each year, ending last year at nearly UAH 26.00/USD. At this level, there were enough NBU interventions to balance the forex market and carry it into summer hibernation.

Today the dollar is at around UAH 26.50, so that if the trends of the last few years are extrapolated, the hryvnia should not fall any further. However, on one hand, it’s a long way to summer yet, while hard currency keeps coming in, which could increase pressure on the dollar to devaluate. On the other, there is the NBU, which understands that an overly expensive hryvnia could hurt the economy, especially public finances: this was fairly evident last year in the dynamic of budget revenues in the first six months. And the psychological factor of a presidential election has not gone anywhere.

Hints of uncertainty

In short, nothing appears to foreshadow something bad for the hryvnia exchange rate for now. Still, there are two implicit signs that forex market participants have not lost all their sense of uncertainty. The first is evident in the actions of non-residents, who are investing in state bonds. Just like a year ago, they were actively buying up government bonds after the New Year. The calculus was simple: with an expensive dollar, a larger number of bonds could be had for a given amount and when the dollar begins to slip, this same number of bonds can be sold off for more dollars. The scheme was fairly straightforward. And so just last year, non-resident portfolios of government bonds grew by UAH 8.6bn in just two and a bit months, while this year, they grew only UAH 7.7bn.

RELATED ARTICLE: The poorest country in Europe

Meanwhile, the NBU gave a clear signal that the interest rate could go down over the course of the year, which would increase the hryvnia value of the bonds. Based on this, foreign investors should have brought far more capital to Ukraine. But either they do not entirely trust the NBU announcement or, more likely, they are simply waiting for the presidential race to end. And this is the uncertainty that makes it hard to say firmly that the situation is 100% stable.

The second sign is that in the first 10 weeks of 2019, NBU interventions resulted in the purchase of a net US $689mn, meaning purchases minus sales. During the same period of 2018, it was US $677mn, because purchases were higher but sales were also higher than this year’s figures. If positive fundamental tendencies in the CAB were that significant, the NBU would probably have to buy far larger sums of hard currency, but this doesn’t seem to be the case. So, the counteragents are in no hurry, after all, to bring their money to Ukraine and are currently in a holding pattern.

These kinds of numbers tend to raise the idea that quite a few forex players think that the results of the election will affect their financial decisions. And so the public is expecting fundamentally different scenarios for the development of the country, depending on who wins. Economic theory says that sometimes market expectations form the market. This means that, if nothing basically changes after the election and the country’s development continues to be determined by international commitments and public opinion, a formal change of president could lead to substantial turbulence on the forex market.

Translated by Lidia Wolanskyj

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook