2020 is being ushered in with a slew of records for Ukraine, all of them linked to the currency market. The hryvnia has just finished its longest upward surge: with a few minor breaks, it’s been steadily strengthening since November 26, 2018. At the time, martial art had been declared in a number of oblasts in Ukraine because of the Russian act of piracy outside the Kerch Strait and the hryvnia fell to 29 to the US dollar on the cash market. For two-three days, there was a money panic. Now those who gave into it and rushed to buy bucks are probably kicking themselves.

The lengthy upward climb of the hryvnia led to the Bloomberg news agency calling it the strongest growing currency in the world in 2019. This really is a significant development, given just how deeply depressed Ukraine’s economy was just a few years ago. Moreover, the strong hryvnia has led to another significant achievement: in August, the average salary in Ukraine finally reached the dollar equivalent that it had reached in 2008 and 2013, before the two crises. Since then, the hryvnia has grown even stronger and the dollar value of wages has grown some more.

It would seem that currency records are a reason for Ukraine to be happy. If they had been the result of sustainable, fundamental changes in the domestic economy, then it would really be worth rejoicing over. But the key reason for the currency’s rise is financial, and not economic. 2019 saw a record inflow of foreign capital through purchases of government bonds. This is the fly in the ointment that undermines confidence that the idyll on the currency market can continue for long. If the situation remains uncertain, the expensive hryvnia will soon set the economy fermenting, which will ultimately restore balance to both the hryvnia and the overall economy. But it won’t be painless.

Unusual exports

In 2019, Ukraine restored its record for crops of both cereals and legumes: as of December 10, 75.2 million t were harvested, which is over 5mn t more than in 2018. The sunseed crop was also the biggest in the country’s history, hitting 14.6mn t. It would seem that this, too, was cause for celebration. Instead, Ukraine’s agribusiness was forced to radically change its sales strategy, which had a negative impact on the balance of the currency market.

In the last few years, Ukraine’s agricultural sector worked on a simple basis. Knowing that the dollar grew stronger every fall, while at the end of the marketing year, meaning May-June, world prices for foodstuffs tended to rise seasonally, they would take in the crop and store it at least until winter, when domestic prices were better, or until the end of the season, counting on the foreign market. But in 2019, the situation changed. From the beginning of the year, the hryvnia grew steadily, mostly driven by the inflow of foreign money in the form of state bonds. With every day, the dollar lost position on the currency market, causing the new crop to also lose value. This led to a kind of export frenzy. Every farm sector business tried to sell off its grains as fast as possible so as not to lose even more on the exchange rate.

RELATED ARTICLE: Old and new risks

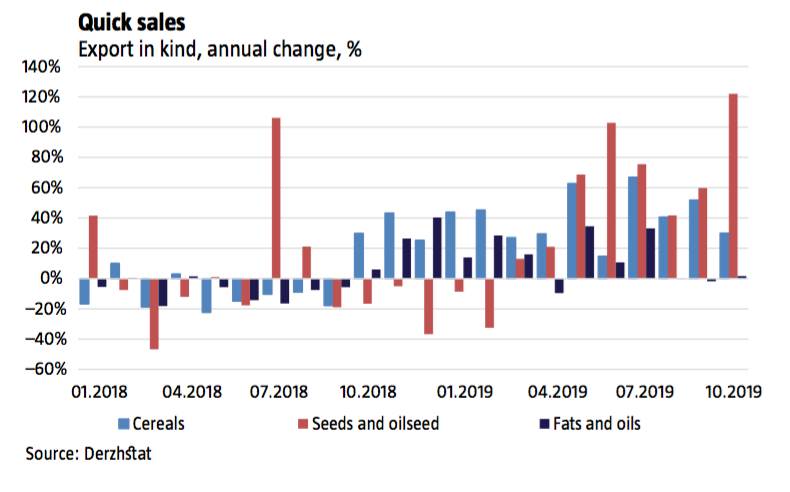

The result has been very interesting: over July-October, Ukraine exported 19.2mn t of grains and 3.8mn t of oilseed, which was 45% and 73% more than during the same period of 2018 (see Quick sales). Within four months of the harvest, Ukraine had shipped out the equivalent of 75% of what it had shipped in the way of wheat for all of 2018-2019, and nearly 100% of the barley. Although the latest figures from Derzhstat are only for October, there is good reason to believe that this trend was similar for maize, a crop that is harvested towards the end of fall.

Consider this: non-residents are no longer buying government bonds as intensively as earlier, but starting in mid-October, the hryvnia jumped even higher, while in November the NBU bought up a solid US $900mn on the market.

What does this mean? Ukraine’s farm sector harvested a record crop but was forced to watch the currency market cancel out its achievement. And there’s nothing the farmers can do because Ukraine’s transport infrastructure has limitations that unfortunately made themselves felt precisely this year with its huge harvests. Agribusiness saw itself becoming hostage to currency and infrastructure problems, and began to panic. They’re afraid that they won’t be able to ship the rest of their grains and that, even if they manage to do so, it will be for miserable prices. And so they’ve been doing their best to sell off quickly. But this kind of response only increases the already negative dynamics on the currency market, because it brings Ukraine more than US $1bn in hard currency, which is a substantial sum. In short, the reaction of the farm sector drove the interbank market into a stupor.

The trouble is, the faster they export their inventory, the less is left in storage for Ukraine’s agribusiness. If they export at the same pace as in H2 2019, they will clean out their elevators two months before the next harvest… if no sooner. At that point the muscular hryvnia will lose its main driving effect. Hypothetically, this point could come even sooner if the farm sector reduces its panic and understands that there’s no reason to rush. However, as long as the economy minister keeps talking about a possible rate of UAH 20 to the dollar, while the internet is filled with predictions of UAH 17-18/USD, that’s unlikely to happen.

In short, everything has been turned upside-down. In the fall, rather than getting stronger, the dollar slips because farmers don’t want to lose on the exchange rate. And in the spring, instead of falling, Ukraine is likely to see it get stronger because the farm sector won’t have anything to sell. And so Ukraine’s seasons have exchanged places and it has nothing to do with climate change.

Unfortunately, the successful crops and the expensive hryvnia connected to them will inevitably have an impact on many other sectors of the economy. Derzhstat has already reported that, in the first 10 months of 2019, exports grew by 7.4%. If the foodstuff categories – 24 of them grouped into animal products, plant products, fats and oils and processed products – are left out, export growth was a paltry 1.6%. What’s more the decline in growth is picking up pace: in October alone, non-food exports fell by 4.6%.

This decline is not price-based but volume-based. According to Derzhstat, volumes of exports in kind shrank for 42 of 73 non-food product groups in October. A year ago only 34 groups were affected and two years ago just 22. In short, the costly hryvnia is complicating things for more and more exporting sectors, as they have no markets where they can sell at a profit and are cutting down production. This can be seen in a different statistic: in November 2019, the industrial output index was 7.5% down from 2018. The last time Ukraine saw such a decline in industrial out put was during the depths of the country’s economic crisis in 2015.

Chicken or egg?

The decline in industrial output merits closer analysis, as there is serious debate going on in Ukraine over the factors behind it. Some say that it’s the result of growing protectionism around the world, which is slowing down global trade in general, and this inevitably affects industrial output. Others say that the strong hryvnia is the main reason. Who’s right?

The first argument is right to some extent. Global trends are having a negative impact on domestic production, especially since industrial output is falling in Europe, in Africa and even in the Middle East, which include some of Ukraine’s key markets. But global trends don’t explain why the decline is much stronger in Ukraine than in these other countries and why it has already reached crisis proportions, as November statistics suggest.

The second argument is also right to some extent. Every company has its profitability threshold and for exporters it depends on the exchange rate. While the rate remains within a specific range, the strengthening of the hryvnia reduces exporter profit margins, but doesn’t threaten to wipe them out altogether. That was the case throughout most of 2019. Then the main reason for the relatively small decline in industrial output was those same global trends, so the scales in this debate tilted towards the first argument. But when the exchange rate shifted too much, manufacturers began going into the red more and more. The more noticeable the shift in the hryvnia, the more companies find themselves losing money, and their number grows exponentially. If the fluctuations are brief, any losses can generally be survived, using accumulated reserves from previous periods. However, if it lasts a few months, it’s easier to just cut back production and lay people off. And that’s what’s happening right now. Moreover, the trend is picking up pace. At this point, the reasons move to the side of the second argument, which points to the costly hryvnia.

While Ukraine’s industrial decline was marginal, the key problem was its weakness relative to competitors in terms of technology, quality, marketing and other aspects. It’s normal that, as soon as a market tightens up, the weak ones are the first to go. Under these conditions, it meant Ukraine’s manufacturers needed to have worked to strengthen their positions. The government needed to ask the oligarchs who control most of the largest corporations a pointed question: why weren’t they investing in modernization? Maybe they don’t see any future at all for these assets and decided to just exploit them while they still run. In that case, there’s no need to worry because what’s happening is a natural process, albeit a painful one—the dying off of inefficient manufacturing.

Now the situation is different. Major cutbacks in output and workers, as well as the work week, have begun. Soon this will lead to lower household incomes, although that can be overcome, for now. But what is far worse is the threat of a slew of companies, factories and plants going under. This means that the government needs to focus on the serious problems facing industry, leaving chronic issues in the background. Right now, the exchange rate has to be taken in hand, simply because it’s a lot easier, technically, to close down a plant than to try to get it up and running again later. This could be the right time for the National Bank of Ukraine to ignore its own rules and more actively restrain the growth of the hryvnia, so that later on it won’t have to pick up the economic pieces later on.

A pause in imports

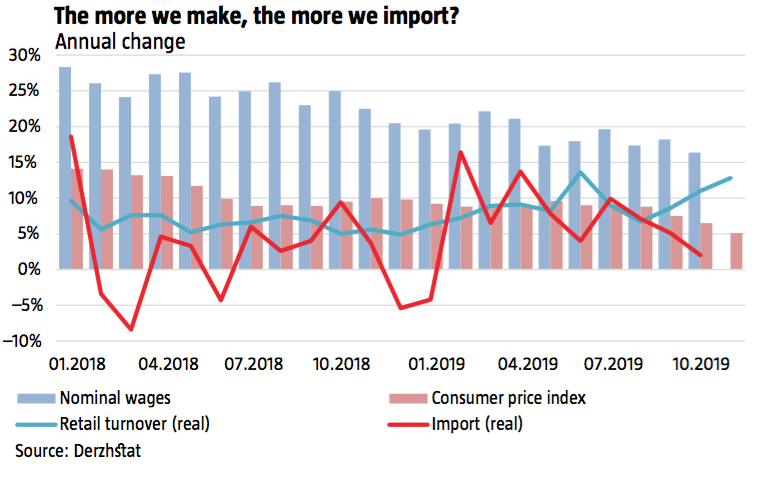

The success of the farm sector is already having a positive impact on Ukraine’s macroeconomic indicators, the failure of industry not yet. That’s why the last few months have been a time of record dollar-denominated wages for many years. Together with slowing inflation, this has led to the expected result: Ukrainians are consuming more at a growing pace (see The more we make, the more we import?).

Paradoxically, while retail turnover growth has been accelerating, imports have slowed down. So where are the retail chains finding the goods that they are selling in ever growing quantities to hungry consumers? What comes to mind first is that domestic products are substituting for imports. But this classic hypothesis is not confirmed by either the pace of GDP growth, let alone industrial output.

The means that the reason lies elsewhere. A closer look shows that the gap between retail sales and imports is being covered by older inventory. According to Derzhstat, in QIII of 2018, Ukrainian companies increased their stock of tangible working capital by UAH 152bn, while in 2019, this figure was only by UAH 89bn or 41% less. QIII is the time of year when inventories are traditionally filled up, especially with non-meat food products, which is why the scale is so substantial. In 2019, in this period, stores of foodstuffs grew more at first, thanks to a record harvest, but then fell more than usual due to the high volume of exports at the start of the season. Still, this fluctuation is too small to explain a total difference of UAH 62bn. The lion’s share is due to the reduction of inventory in retail networks.

The logic behind this is pretty straightforward. Importers, like farmers, also noted the steady growth of the hryvnia. But it played into their hands, rather than against them, as in the case of agribusiness. This means that those who were bringing in foreign goods to sell on the domestic market in Ukraine is interested in buying it as late as possible, that is, as cheaply as possible.

This development changed the seasonal cycle among importers as well. Whereas in the past they did most of their buying in the fall in order to be ready for the New Year’s peak of consumer buying and have a break in January and February. Of course, this helped balance supply and demand on the currency market. However, in 2019, the scale of autumn purchases was very much reduced. This means that, the minute inventory are at an end, importers will come to life again, which will increase both imports and demand for hard currency. Most likely, this will happen pretty soon, but economic indicators don’t offer enough information to hazard a guess as to just how soon.

The black hole

What we see developing now is quite interesting. Agribusiness is trying its best to sell off what it has harvested, leading to higher demand for hard currency than usual. Importers intend to work with their old inventory as long as absolutely possible in order to not over pay for new goods. This leads to lower demand for hard currency than usual. Neither one group nor the other will continue acting the way they are forever. But of such temporary dynamics are black holes born: an artificial but significant surplus of hard currency that continually pulls the dollar down and leads to a series of substantial negative side effects.

When this black hole disappears, the actions of the farmers and the importers will change to their opposites. The former will begin to hold up grain in anticipation of a stronger dollar, while the latter will begin importing more actively. The balance of supply and demand on the currency market will then shift. The only question is when this will happen. The feeling is that all it will take is for a small moth to sit on the scales and balance will shift for a long time.

There is, however, a strategic aspect to all this. When liberals explain that an expensive hryvnia is bad for exporters but good for importers, they make it sound as though the positive and negative effects are almost the same and cancel each other out. In fact, that’s not the case at all. In order to deliver goods to a market, importers don’t need a lot: sign a contract with the producer, pay, transport, take through customs, and that’s it. When importers wind down their operations, say, because the hryvnia is too cheap or there’s an economic crisis, their losses aren’t great because not that many people are involved and mostly they aren’t narrowly specialized.

When it comes to exporters, however, it’s very different: before they can deliver goods to a market, they have to make them, and this means finding personnel, often training then, spending money time and effort to build production facilities, and streamlining business processes. When this is all brought down by a costly hryvnia, enormous resources will be needed to restore operations – especially time and money. Qualified employees that are laid off could become migrant laborers and they will never return, while training new ones can take years.

This is why a single dollar sold on the currency market by an exporter has much more weight and history than that same dollar purchased by an importer. And so the advantage that importers gain from a high hryvnia is unlikely to make up for the harm it does to exporters. An economy doesn’t do well with flat thinking and living in the moment. The consequences could be devastating.

Unhealthy dependency

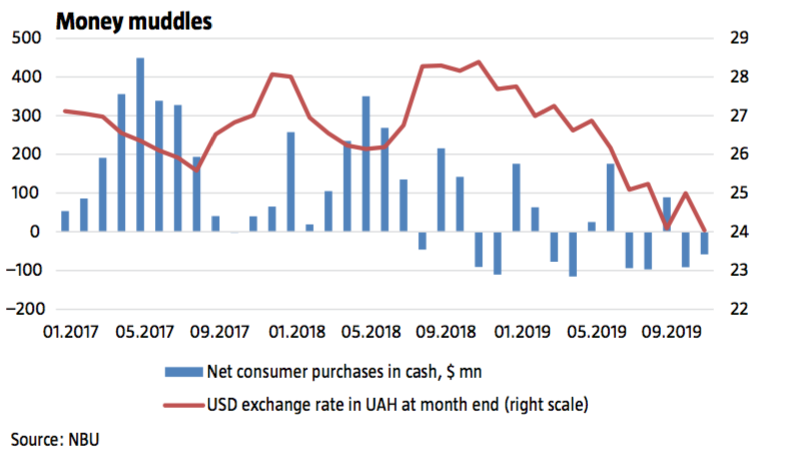

It looks like not just farmers and importers are looking or ways to take advantage of the stronger national currency. The same is true of ordinary Ukrainians (see Money muddles). In recent years, after seeing the hryvnia grow, they tend to buy dollars in the first half-year to take advantage of the higher exchange rate that tends to come with the fall. Today, though, this kind of behavior has stopped. It’s not so much that Ukrainians don’t have the money to buy dollars, which they are accustomed to holding their savings in: after all, salaries are at a record high. Then there must be another reason and that is that perhaps they are waiting for the dollar to go even lower so that it becomes convenient to buy it. What this does is postpone demand on the currency market – a factor that will make itself felt at the right time.

The situation today underscores a slew of strategic problems with the Ukrainian economy. First of all, the economy was unprepared for this year’s successful harvest. It’s not just that infrastructure is limited, which made moving grain to market difficult. It’s that the export of foodstuff sets off too much turmoil within the economy, illustrated by the situation on the currency market: the hryvnia rises or falls significantly based on the month in which agribusiness decides to export. And this means instability. If Ukraine wants to produce more farm products – which seems to be the purpose of land reform – then this problem needs very much to be resolved.

RELATED ARTICLE: The coming crisis

Secondly, the strength of Ukraine’s agribusiness makes the country dangerously dependent on the farm sector. This year, the growth that resulted from the excellent indicators in the sector was obviously a problem. Some day, the other side of the coin will be evident, when the economy has to live through a bad harvest. If a good year causes this many problems, a poor one could prove to be an epic struggle to survive.

Thirdly, for other sectors that, directly or indirectly, depend on the exchange rate, the success of Ukraine’s agribusiness this year proved to be a major test of their soundness. They can survive this kind of test one time, possibly without any losses. But crop production, by its nature, is an ever-shifting sector that is likely to present such challenges on a regular basis. If Ukraine isn’t ready for them, it will very quickly damage not only the country’s industries but other sectors as well. Ukraine needs to come up with instruments to smooth out such fluctuations in the farm sector today. Because when crises arise every few years, it could well be too late.

Translated by Lidia Wolanskyj

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook