Ukraine’s economy has been restoring fast in the past four years after it plummeted in 2014-2015 as a result of Russia’s aggression. This restoration has not been linear: some industries and regions developed faster, while others lagged behind. Still, the main indicators were either restored to the level of 2012-2013 or higher in 2019.

This provoked a very misleading euphoria that has been especially visible since the change of government. Ambitious claims of 40% real GDP growth during the presidency of Volodymyr Zelenskiy; expected economic growth between 3.7% and 4.8% in the budget, depending on different scenarios, in 2020; a discussion of threats from sharing the skin of an unkilled bear with external lenders according to the terms of foreign debt restructuring conducted in 2015 by then-Finance Minister Natalia Jaresko – all these manifestations of euphoria merely distract the attention from the major threat. It is quite likely that 2020 will be the end of the growth of all these years. And maintaining it without a dramatic change of economic policy will be impossible.

The downward spiral experience seen in Ukraine in the past decades has proven more than once that short restorations are followed by serious downfalls. For example, real GDP in 2013 and 2019, after two periods of growth in 2010-2012 and 2016-2018, was lower than in 2007-2008, the crisis years.

This time, the end of restored growth effect after the 2014-2015 decline in Ukraine will likely layer over a serious external challenge as the global economy is approaching yet another big crisis of the 2007-2009 scale.

RELATED ARTICLE: A reality check

An increasing number of signals point to this. In the US, industrial decline has accelerated to -1.1% annually. Industrial output in the eurozone fell 1.7% in September. GDP of Germany, its most powerful economy, grew a mere 0.5% in Q3 compared to the same period of 2018. In Japan, one of the world’s biggest economies, GDP growth in Q3 slowed down to 0.2%. Annual growth of industrial output in China fell 4.7% in October 2018 compared to 5.8% in October 2018, and retail sales fell to 7.2% compared to 7.8% in 2018. Investment in capital assets hit the absolute minimum since 1998.

The economy of cannibalism

Ukraine’s industrial output started falling in Q2’2019 while economic activity was mostly driven by better figures from agriculture, construction, passenger transport, retail trade and different services. Wages were still growing fast in nominal and real terms. In 2020, these factors will be exhausted. Pointing to the worsening situation in the industrial sector is the fact that the growth of producers’ prices has slowed down dramatically, hitting the lowest level since early 2014. A stronger hryvnia and the inflow of cheap imported goods to the vulnerable domestic market will only aggravate this process.

Retail trade is the beneficiary of this for now as it has the opportunity to maximize the margin between buying and selling goods to final consumers who are now in a boom as consumer sentiment is the highest in 12 years after the crisis of 2008-2009.

Still, the gap between consumer lending and bank lending to companies grew throughout 2019. Consumer lending had positive dynamics, growing from UAH 203.7bn to UAH 212.5bn, while lending to companies shrank from UAH 88.53bn to UAH 765.9bn over the same period. Growth rate for deposits accumulated by businesses on bank accounts exceeded growth pace of deposits from the population by fall. For example, deposits by individuals grew from UAH 528.9bn in September 2018 to UAH 540bn in September 2019, while non-financial corporations deposited UAH 365.4bn in September 2019 compared to UAH 333bn in September 2018.

This is because of the double gap in profitability between consumer loans and loans to the business, and this gap keeps growing. While consumer loans were issued at an average of 35.5% in September 2019 (compared to 32% in September 2018), companies were lent money at 17.7% in hryvnia (compared to 19.8% in September 2018). Meanwhile, the citizens are driven by consumer excitement and do not want to save even as deposit interest rates grow rapidly from 10.6% in September 2018 to 14.5% in September 2019. Interest rates for loans to businesses is lower at 13%, unchanged since September 2018.

It is increasingly obvious that the lending system works upside down. Instead of lending to business development at the cost of individual deposits, it funds consumer loans – mostly for imported goods – using the deposits accumulated by companies. This lays a time bomb under economic growth in the future and manifests itself in a steep decline of investment in key industries. Moreover, this cements the economy of consuming its current potential instead of developing it.

Party over

Meanwhile, the conditions are ripe for a steep decline of consumer demand. This will hit retail trade and services hard.

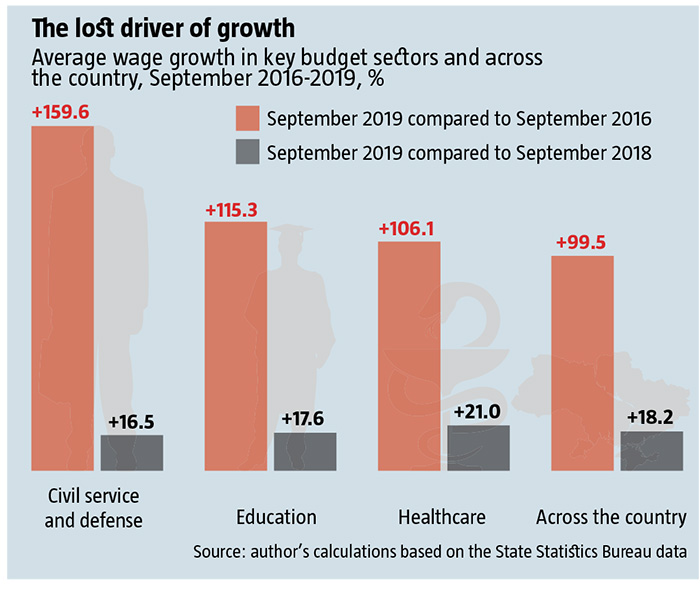

In the past few years, it has been driven by the robust growth of public spending, including payments to people employed in government-funded segments (see The lost driver of growth), pensioners and other recipients of social benefits. Rapid growth of labor migration in 2016-2018 is another contributor. Personal income tax became the main source of revenues to the budget. For example, it grew to UAH 8.9bn in September 2019 compared to UAH 7.5bn in September 2018, while corporate income tax almost halved from UAH 2bn to UAH 1.2bn over that period. VAT grew only slightly from UAH 31.1bn to UAH 32.2bn, while excise duty increased from UAH 11bn to UAH 11.4bn.

According to the National Bank of Ukraine, the growth of personal income and consumer demand in 2019 boosted public spending on social benefits from UAH 115.3bn in the first three quarters of 2018 to UAH 156.5bn in the same period of 2019 respectively. In September 2019, wages in the education sector were 17.6% higher than in September 2018 and 36.3% higher than in September 2017. The increase in healthcare was 21% and 42% respectively. The growth in civil service and defense was 16.5% and 53.2%. This growth happened alongside slower inflation and a stronger hryvnia compared to the key currencies in September 2019 compared to September 2017, fueling steep growth of consumption and rejuvenating trade and services.

Yet, the 2020 budget shows that most contributors to that economic growth resulting from domestic consumption will wear out. Wages in the key sectors are indexed at the level that is slightly above inflation and two-three times below the levels of 2017-2019. As a result of hryvnia revaluation, the hryvnia equivalent of transfers from labor migrants will shrink and nominal wages in the production sector will grow slower as Ukrainian producers grow less competitive compared to their foreign peers. This will inevitably undermine consumer demand and hit growth in the sectors linked to services – from transportation to everyday services. As a result, this will also hit the income of people employed in these sectors.

The world won’t help

The situation on the global commodities markets keeps deteriorating. Prices of steel and iron ore are falling, even if grains have risen somewhat. And Ukraine is exhausting its capacity to increase exports of commodities. In 10 months of 2019 available when this article was written, commodities export growth slowed down to 7.4% compared to 10.3% and 20.9% in the same period of 2018 and 2017. This is despite the unexpectedly record-breaking harvest of 2019.

Meanwhile, output in agriculture has been growing for two years already. In 10 months of 2019, the industry’s output was 12.6% higher than in the same period of 2017. Collection of grain grew from 61.2mn t in 2017 to 70.1mn t in 2018 and 75mn t in 2019, while crop yield increased from 4.25 t per hectare in 2017 to 4.9 t per hectare in 2019. This growth is normally followed by a backslide, at least for plants as crops deteriorate for natural reasons. The development of Ukrainian agriculture over the past two decades shows this, and so does agricultural production of most other producers in the world.

In addition to that, investment in the agricultural sector have been declining lately after their growth peaked in 2015-2017 ensuring two record-breaking years in a row in 2018 and 2019. While capital investment in the industry grew 26.1% in 2015, 51.4% in 2016 and 31.2% in 2017, it fell to just 8.5% in 2018, and was down by 8.2% after H1’2019 compared to the same period of 2018, according to the latest data available. As a result, capital investment into agriculture in H1’2019 proved lower than they were in H1’2017.

Ukraine’s agriculture will likely pause in 2020 as a driver of economic growth or seriously go into negative growth territory, pulling down all of Ukraine’s economy that relies on it lately. With further stagnation or downfall of prices on global markets for commodities and steel in 2020, Ukraine will hardly export more commodities and goods than it did in 2019. Especially as Ukrainian non-commodity goods are growing less competitive with a stronger hryvnia in the period of trade and currency wars in the world.

The prospects of growth for Ukrainian services are unclear too. Firstly, just like with exports of goods, exports of services have been slowing down in recent years. It was 4.8% after three quarters of 2019 compared to 11.6% and 11.2% in the same periods of 2018 and 2017. Secondly, the prospects of gas transit, one of the biggest items in Ukrainian exports of services, remain uncertain. It is likely to lose a double-digit percentage compared to 2019 with the launch of the Turkish Stream that will meet the needs of Turkey first and foremost, as well as other South-Eastern European countries.

RELATED ARTICLE: In the trap of luxury

Revenues may fall from the main transit to the EU. Even if transit via Ukrainian pipelines does not stop as the launch of Nord Stream 2 fails by the end of 2020, the likelihood of a more or less lasting halt in the transit remains high. Ukraine should also expect that the EU buys lower amounts of Russian gas as its storage facilities were filled this year in expectation of possible breakdowns as a result of a Russia-Ukraine gas war.

In this environment, the “gurus of economy” promised by the new President bet on squeezing domestic demand via austerity budget instead of anti-cycle measures to stimulate the economy and protection mechanisms for domestic producers necessary in the situation where the fight for markets in the world intensify. They encourage the inflow of consumer imports to Ukraine, undermining the competitiveness of Ukrainian producers by strengthening the hryvnia and preserving a minimum tariff protection for the domestic market. Their way to compensate for this is via more debts and massive sellout of assets via privatization of enterprises and sale of land to foreigners.

Translated by Anna Korbut

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook