The phrase, money is the lifeblood of an economy, maybe a bit hackneyed, but its essence is quite correct: just about everyone in a country depends on financial relations. And so if we want to change a country and its economy for the better, we have to reform both relations within the banking system and the financial infrastructure. This simple logic makes it quite clear why banking reforms are necessary, and why it, highly symbolically, was one of the first to be launched after the Revolution of Dignity.

Perhaps when the reform of the banking sector was planned, removing it from the clutches of the oligarchs was not an explicit priority. Perhaps the idea wasn’t even on the agenda. But today it’s obvious that the changes to Ukraine’s banking system have not only brought more reliability, technology and efficiency, but also removed the lion’s share from the influence of oligarchs. And this means the reforms have been successful even if they aren’t yet completed.

Competition for depositors

There are a number of ways that the work of the banking sector and the reforms it is undergoing can be analyzed, but the most clarity is provided when looking at regulations that have been adopted or not adopted as part of the reforms. This kind of analysis is interesting only to a narrow circle of financial specialists, because the details of how banks work are too complicated for the average non-specialist to grasp. What’s more interesting to most people is the qualitative changes in the operation of the banking system and what impact they will have on individual customers, especially ordinary people.

In theory, the basic function of a banking system is to turn savings into investments. How have reforms influenced the effectiveness of these functions? To start with, we can analyze savings.

Personal deposits, and, to a lesser extent, business deposits, are the basic funds with which the banking system operates. To lend money, the bank has to get money from somewhere and that means attracting depositors. Basically, financial institutions compete for people’s savings, and how successful they are determines whether or not they can turn those savings into investments.

RELATED ARTICLE: Deputy Finance Minister Oksana Markarova on 7 steps to a new bank strategy for Ukraine

How successful have Ukrainian banks been in the competition for financial resources from individuals and businesses? How much has the situation changed since reforms began? The answer is reflected in a number of ways.

First is the question of trust. There’s a huge segment of the population in Ukraine who remember the early 1990s, when soviet banks collapsed and their savings disappeared overnight. These people don’t trust banks on principle and keep their savings “under the mattress.” No reforms are going to affect them, because they still remember the huge losses they incurred. However, this segment is gradually leaving the economic arena, both numerically and in terms of its economic impact. Another segment of Ukrainians who don’t trust banks suffered due to the bankruptcies of a large number of commercial banks in recent years and the memory is very fresh.

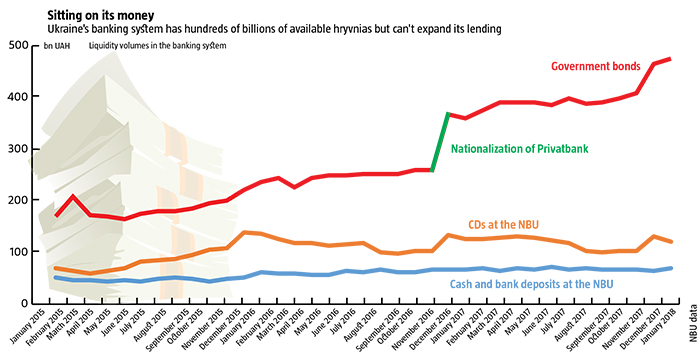

But if we look at the indicators for the banking system itself, the basis for confidence in domestic banks is probably the highest it’s been in many years. Firstly, banks are properly capitalized: as of February 1, capital adequacy across the system is 16.25%, compared to a norm of 10.0%, and the highest it’s been since the Revolution of Dignity. On average, banks have more than 1.5 times more capital than they need, although this is an average, meaning some are higher and lower. Banks are highly liquid (see Sitting on their money). At the end of January, they were holding cash and highly-liquid assets—NBU deposits, certificates of deposit or CDs, government bonds—worth nearly UAH 500 billion. This is the most for the entire history of Ukraine’s banking system. So they have enough capital and liquidity to survive even a noticeable outflow of deposits and to let all those who want to take back their savings.

This may be the main factor that can restore trust in the financial system, but it’s not the only one. For one thing, the crisis of 2014-2016 was passed without instituting a ban on the withdrawal of deposits, a harsh measure that limited depositor freedom during the worldwide financial crisis of 2008-2009. Secondly, the Personal Deposit Guarantee Fund has been slowly paying out all the depositors of bankrupt banks within the UAH 200,000 cap. This is important because it shows that the government is becoming more responsible. Finally, there is talk about gradually raising the guaranteed amount to €100,000, which is standard in most EU countries. This demonstrates both greater responsibility on the part of state and hopefully will build trust over time, although it will not ease the damage suffered by those who had accounts in bankrupt banks over 2014-2016. And so, even if trust in domestic banks is still relatively low, the conditions for this trust to rise are being put in place.

Instruments and interest rates

Second is the question of options for holding cash. In the past, the choice of instruments for savings was considerably larger: prices for land and property were on the rise, the stock market offered decent returns, and money could also easily be moved to a foreign account. In short, bank products were not especially attractive and Ukrainian banks had a much smaller share of the savings market. At the same time, the NBU, which was supposed to monitor the sources of incoming funds, turned a blind eye on many practices, so plenty of dirty money was circulating in Ukraine’s banking system. As a result, the deposit base grew an astonishing 30-60% during certain years.

These days, the appeal of alternate instruments is questionable: neither real estate nor the stock market offer attractive long-term returns for the risks involved, while moving earnings abroad has become far more complicated. Moreover it matters little because financial monitoring has become far stricter and now very little dirty money manages to make its way into Ukraine’s banking system—certainly not in the volumes it once did. Having been purged of bad banks and even worse practices, it appears that now, although the country is floating in money, dirty money cannot be moved offshore and it’s almost impossible to get it into the banking system. Instead, it’s finding its way to non-banking financial intermediaries: the number of pawn shops, called Lombards in Ukraine after a medieval banking system, and exchange points has mushroomed, and construction has skyrocketed: the volume of housing currently being built in Kyiv, as just one example, will have to be sold over the next few decades, based on current demand. For now, the banking system is closed to this money because it’s been cleaned up, is operating according to new rules, and will no longer work with dirty money.

RELATED ARTICLE: How Ukraine can prepare for a probably termination of Gazprom's gas transit through its system after 2019

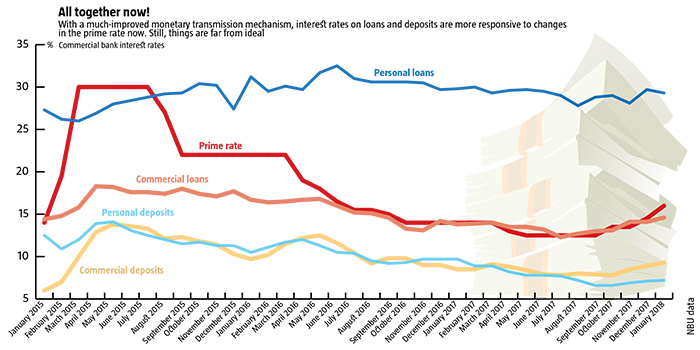

The third point is interest rates on deposits. On one hand, the higher they are, the more money people will put on deposits. But the other side of this coin is that this raises lending rates sky-high. Until not long ago, the domestic system had a considerable number of banks that simply vacuumed up cash: they offered huge interest rates, up to 40% in some cases, but then refused to return deposits because they were little more than financial pyramids. High interest rates on deposits also raised the risk of a poor-quality depositor base. Today, interest rates are much lower (see All together now)—last year many forms of deposits were down to their lowest rates in the history of Ukraine’s banking system. On one hand, it seems that banks are no longer competing for savings, which has a certain logic, given their high level of liquidity. On the other, it suggests that deposits are significantly less risky and that, too, reflects on interest rates.

In short, the situation is such that, given all the positive and negative effects of reforming the banking sector, deposits have grown 9.7% in the past year, taking the impact of the exchange rate into account. This is well down from the 15-20% growth posted in the period between crises, which suggests that system could absorb far more domestic financial resources. They aren’t higher because Ukrainians have been forming their opinions of bank reforms more on feelings than on carefully-analyzed judgments. Moreover, as long as there are huge volumes of corrupt cash in the country and until it can be reduced to a minimum or legalized, the domestic financial resources available to the country’s banks will be artificially low. This is something all government agencies should be aware of and take the necessary steps.

Operational efficiency

Once they attract the savings of individual and commercial clients, banks can use this money at their own discretion. This is precisely where the hands of oligarchs were the most visible, for, when they attracted deposits, the banks always acted as clean as the driven snow. No one could say with certainty that something not quite above-board was going on—they could only guess because of the excessively high interest rates or because of little information coming from online financial forums. Has the effectiveness and security of banking operations changed since reform? Most definitely, and this can be seen in a variety of parameters.

Firstly, it’s much more difficult to move cash abroad, especially in large volumes. A monthly cap of no more than a few thousand dollars from a given account has been instituted at all the most common channels for transferring money abroad. All large operations need to be documented to confirm that the money is legitimate and will be used for commercial purposes: export, import, investment, other types of financing, and so on. "Laundrobanks" or pocket banks that used to launder money and help transfer it abroad have met their Maker. For Ukraine’s economy, this means that more money is staying at home and that, possibly, after a few cycles, more of it will get to SMEs.

Secondly, lending to individuals linked to a bank has been reduced to a minimum and almost eliminated. This was one of the key redoubts of the oligarchy. Previously, these pocket banks sucked in deposits, generally by offering sky-high interest rates, for one purpose only: to finance the businesses of their owners, especially abroad—effectively moving cash out of the country. The economy lost hundreds of billions of hryvnia in this way. More important than the fact that many of the conned depositors will never see that money again is the problem that these pocket banks were instruments for expanding the economic power of the oligarchs, which they later used to their own benefit against the country. In the end, this also meant that non-oligarchic SMEs, many of which had projects that were very appealing to potential investors, remained underfinanced and could not develop as rapidly as the potential of their ideas should have allowed. All of this is gone now, and with time, this factor will play a major role in the recovery and growth of Ukraine’s economy.

Thirdly, internal control over banking operations was very weak. A large share of active operations, especially the issuing of loans, was, without exaggeration, a complete scam. Over 2005-2008, loans began to be widely issued without any confirmation of income, unjustified loans were issued to bank employees, “political lending” through acquaintances in state banks was common, collateral was documented but the financial institution was unable to recover it or to exercise its right to it through the courts. Many of these phenomena no longer exist, but their consequences remain a deadweight on the balances of many banks as non-performing loans. At the end of 2017, 56% of all corporate loans and 54% of retail loans were in this category.

Today, every bank is obligated at the time it issues a loan to assess the credit risk against a slew of criteria established by the NBU and if the potential borrower does not meet enough of them, the bank must set aside the necessary reserves. It’s simply inconvenient for a bank to lend to poor-quality borrowers, whether it’s MPs who borrowed under previous Governments and don’t want to return the money, or oligarchic companies that operate opaquely and in the red by moving all their profits abroad. Otherwise, the bank will have to cover these loans out its own pocket. The quality of lending has improved cardinally compared to the old loan portfolios. The one negative consequence is that there aren’t as many highly qualified borrowers and statistically the pace of lending is now very low.

Today, every bank is obligated at the time it issues a loan to assess the credit risk against a slew of criteria established by the NBU and if the potential borrower does not meet enough of them, the bank must set aside the necessary reserves. It’s simply inconvenient for a bank to lend to poor-quality borrowers, whether it’s MPs who borrowed under previous Governments and don’t want to return the money, or oligarchic companies that operate opaquely and in the red by moving all their profits abroad. Otherwise, the bank will have to cover these loans out its own pocket. The quality of lending has improved cardinally compared to the old loan portfolios. The one negative consequence is that there aren’t as many highly qualified borrowers and statistically the pace of lending is now very low.

All these examples illustrate that, thanks to the reform of the banking sector, financial institutions have begun to manage their depositors’ money far more effectively. In time, people will draw the necessary conclusions and confidence in Ukraine’s banks will grow.

The puzzle of lending

And now for the last link in the main functions of banks: lending and financing economic growth. How much has changed here? Once again, the answer lies in several aspects.

First of all, banks have finally resumed lending after the break caused by the crisis of 2014-2016. NBU data shows that in 2017 the gross volume of hryvnia lending to individuals and business at solvent banks grew 16.2%. The equivalent in foreign currencies went down 7.7% but only because of restructuring and writing off of a portion non-performing loans issued prior to the crisis.

Secondly, interest rates on loans are relatively low. Many analysts say that banks are supposedly not lending because credit is not accessible at such high interest rates, but that is simply not true. In 2017, the average interest rate for a hryvnia commercial loan went below 14%. This has happened only twice: in 2007-2008 during the lending boom that preceded the financial crisis, and in 2010-2011, when the economy began to recover after the crisis and the new Administration resolved, however briefly, relations with the IMF, which increased liquidity in the financial sector. Credit rates for corporate loans in hard currency were down to 6.1% in January 2018, a historic low. Of course, after the huge losses of 2008-2009 and 2014-2015 when the hryvnia sharply lost value, there is a long list of restrictions that limit the expansion of hard currency loans.

Compared to the past, interest rates are very low, even if we take into account that they are primarily in hryvnia and have been slowly going up again in response to hikes in the prime rate. Why, then, with interest rates so low and huge volumes of free liquidity, we aren’t seeing lending boom? The reforms to the banking system are why. As noted, today, borrowers are required to meet far stricter criteria compared to the free-for-all that dominated earlier, but these criteria are completely in line with European and world practice. There are three consequences of this.

(1) After banks were limited in their options to lend to linked individuals, the businesses of oligarchs lost a reliable source of funding from their pocket banks. It turns out that when they have to compete for resources like everybody else, such companies are too inefficient to easily do this. As a result, the capital that went to finance their businesses is now lying on the balance sheets of banks and waiting for better times. Statistics clearly confirm that a structural surplus liquidity has appeared in Ukraine’s banking system.

(2) There are not enough quality borrowers. The theoretically ideal banking system cannot work effectively in a far-from-ideal economic environment. If the flaws of big business are its inclination to take their money offshore and to influence the government to get economic dividends—crony capitalism—, SMEs also have their issues: opaque operations, tax evasion, ineffective business models, and so on. In short, the reformed banking system is having a hard time finding the necessary quantity of qualified borrowers.

RELATED ARTICLE: How Ukraine's banking system has been reformed over the past few years

(3) Entire segments of Ukraine’s economy are effectively closed to lending, because they have controversial issues that have not been regulated by law or by jurisprudence. This includes problems with collateral, which no bank will be able to seize from them if they stop paying off their debts, problems with bankruptcies, where assets may not easily be sold off to cover debts, and much more. Reforms have made the banking system begin to learn from the mistakes of the past and not hand out credits in situations where they have already burned their fingers before. No one would even guess that dozens of bills have been languishing in the Rada that are intended to protect lenders’ rights, improve the mechanism of collateral, and so on. And no one intends to vote for them because many MPs have themselves borrowed left and right in the past, and have no desire to pay those loans off. For them, a properly functioning banking system means taking responsibility for their own misdeeds, which they will do anything to avoid. And of course, this brings the subject around to the judiciary system, whose ineffectiveness has led to many of the problems financial institutions suffer from. Unfortunately, that’s another huge, popular theme that cannot be tackled here.

Understandably, these obstacles will gradually disappear over time. Enterprises will learn to meet the criteria for borrowing, and transparency and efficiency will become the norm in business—otherwise they won’t be able to borrow. Sooner or later, the surplus liquidity in the banking system will find those who can make most use of it. And eventually the Verkhovna Rada will pass the legislation, even if it means waiting through a few more election cycles and a re-launch of the legislature until it is dominated by honest, responsible individuals, not the kind that are in it now. All of this needs time, although the first indications that there has been a qualitative shift are already evident today: according to the NBU’s latest Financial Stability Report, in QIII 2017, banks issued hryvnia loans worth UAH 11.5bn to private Ukrainian companies that are outside the 40 largest business groups. This was 49% more than all the other loans issued put together—and this is only the beginning.

New problems on the horizon

Of course, the process of reforming the banking system has revealed new problems that are also not so easy to resolve. The main one is the domination of state-owned banks in the industry. At the end of 2017, the share value of state-owned banks was over 59% of the sector, and it managed to add another 6ppt in the year since the nationalization of PrivatBank. This problem, too, has a couple of components.

First is that governments are rarely good at managing businesses. This is particularly true of Ukraine, where thousands of state companies have had their assets stripped since independence and the government was left with only the paperwork. This leads to the logical risk that, with such a large share of the market, the state-owned banks will degenerate, even after reforms. To prevent this, the management of state banks must be changed, especially with the introduction of independent supervisory boards. This concept has been supported and promoted both by the National Bank and the Finance Ministry. But there are many who oppose it, especially in the Rada, because many politicians have used their political connections to take loans out at state banks that they had no intention of returning. This kind of “public assistance” for political activities will be paid for by Ukraine’s taxpayers, because those banks need capital and it’s being provided at the cost of growing public debt. Plenty of politicians are reluctant to lose this milch cow and so Bill #7180, which is aimed at increasing the quality of management at state banks and its independence from politics, has languished for five months and two attempts to include it in the VR agenda failed. That’s the kind of MPs Ukrainians have elected.

RELATED ARTICLE: The benefits and flaws of PrivatBank transfer into state hands

Secondly, the state banks carry a huge weight of non-performing loans. At the end of 2017, PrivatBank’s loans portfolio consisted of 88% bad loans, while other state banks had 56%. By contrast, banks with foreign capital have 41% and Ukrainian private banks have only 27%. Public financial institutions were constantly drawn into “political lending” or lending to linked individuals, as happened with PrivatBank, which is why they have so many non-performing loans today—the result of oligarchic influence. Where in privately-held banks it was possible to clean things up, to remove them from the market or force their owners to write off bad loans and capitalize out of their own pockets, in the case of state banks the situation is more complicated. This kind of tumor needs to be cleaned out with skill and long-term treatment, for it will continue to create problems for a long time yet, getting in the way of the banking sector’s efforts to renovate and work in a completely new way.

Still, whatever the problems of the banking system are today, qualitative shifts are already evident in the way it operates. They aren’t strongly felt just yet, because the path to a system that works like quality clockwork or like the best models in the world is a very long one. But the path is the right one and the pace is strong. All Ukraine’s banks need now is time.

Translated by Lidia Wolanskyj

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook