There was good reason why the appointment of Stepan Kubiv as Governor of Ukraine’s National Bank (NBU) was one the first things the new government did. The hryvnia seemed to have gone into free fall, and a bank run nearly sent the country’s banking system crashing. Against this background, the first steps Kubiv took in the new office seemed totally wrong. To announce the meagre volume of the state’s gold and hard currency reserves at the height of a hard currency rush and to issue UAH 2.8bn of direct refinancing – money that could go to the currency exchange market – on the first day looked like pure madness. But less than a month later, the situation has completely calmed down. The banking system has started long-term reforms needed for its strategic recovery. The several weeks that Kubiv has been at the helm of the National Bank have brought about a revolution in the banking sector, enabling financial institutions to develop, just like the EuroMaidan has empowered ordinary Ukrainians.

Success was secured through just a handful of the right steps. First, the National Bank switched to the floating currency exchange rate. By letting the hryvnia loose, the central bank refused to lie à la the previous government that there were “no economic preconditions for a significant devaluation of the hryvnia”. Instead, the National Bank started transparent and truthful dialogue with banks by holding two broad meetings with bankers within a week and promising to organize similar discussions on a regular basis. On Kubiv’s initiative and in an unprecedented move, free access to the NBU has been granted to all bank presidents, which will improve reaction time to challenges faced by the system. It became clear that the first measures taken by the new NBU governor, which initially did not seem to make any sense, are nothing else but an expression of transparency declared by the central bank. After being harassed by the old government for several years, bankers highly appreciated the new policy. They adopted a constructive stance, and though joint efforts the hard currency panic was overcome within days.

What followed was a pinpoint strike that hit at the root of the problem. The NBU set a limit of an equivalent of UAH 15,000 on withdrawals in hard currency and, in case of early withdrawals, permitted banks to pay out the money in hryvnias (at the exchange rate set by the bank on the day of withdrawal). This measure revealed a deep understanding of the situation.

The thing is that the bank rush was caused by rich and very rich Ukrainians. It so happened that under the Yanukovych regime, the majority of rich people joined the Party of Regions or drew close to it. It could not have been otherwise – it was their survival instinct at work. Later, after establishing contact, many businessmen began to participate in illegal schemes covered up by the government and redistribute money thus obtained. Again, it could not have been otherwise, because it was unreal to honestly increase one’s capital under Yanukovych – one could only honestly lose it. Therefore, when the EuroMaidan kicked off, it turned out that the majority of rich Ukrainians were linked to the Party of Regions and the regime. This is precisely the reason there were no major withdrawals in December, January and the first part of February while Yanukovych was in power. As soon as he was ousted, the pyramid crumbled and many people with millions on their accounts decided to run, fearing punishment for involvement in the regime’s illegal schemes. Initially, they tried to make money transfers abroad, but as foreign countries began to block dubious transfers, they decided to take cash. The banking system was losing billions of hryvnias from deposits every day, but not because of ordinary people. (According to Prime Minister Arseniy Yatseniuk, 85% of depositors have up to UAH 20,000 on deposit.)

The limit placed on daily withdrawals had virtually no effect on ordinary Ukrainians but squarely hit the frightened schemers of the old regime who caused the high demand on the hard currency market in the first place. Moreover, by permitting banks to pay this money in hryvnias, Kubiv made sure, with almost complete certainty, that it would stay in Ukraine. Amidst a hard currency panic, banks purchase limited amounts of foreign currency in cash to be sold to the population. This is done to avoid large losses if the exchange rate goes in the opposite direction. Thus, wealthy Ukrainians were unable to purchase foreign currency through cash departments, because they simply did not have it in sufficient quantities. No-one will take hryvnias abroad in briefcases, because it can only be used as waste paper there. The NBU made a truly brilliant move with a happy combination of efficiency and no side effects.

READ ALSO: Who Says Bankers Can Relax?

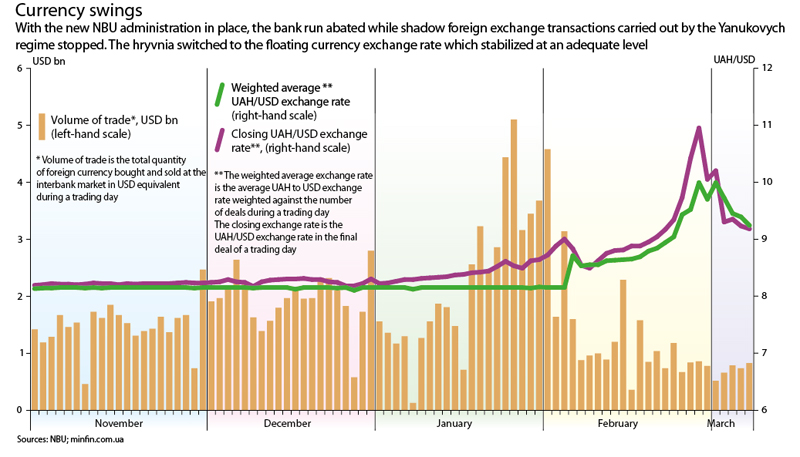

The results came quickly. As soon as on 28 February, when the NBU’s regulation on foreign currency withdrawals came into effect, the dollar shed nearly one hryvnia off its value, and the exchange rate hovered around UAH 10 per dollar for a week (see Currency swings). The currency exchange volumes plummeted to the normal levels recorded a year or two ago. There was no trace of panic. More important, the Currency swings graph shows that, before the fall of the Yanukovych regime, the average volume-weighted exchange rate on the interbank market was almost always lower than the closing rate of exchange. This means that back then the NBU sold foreign currency at a low (official) exchange rate to select banks linked to the president’s Family, and they resold it at the market rate. It is estimated that the USD 4.4bn that the NBU spent in currency market interventions in December through February enabled banks with close ties to the regime earn some UAH 1.3bn. That was money made out of nothing! And it happened against the backdrop of a systematic “fight against profiteers” that the Yanukovych regime kept lying about. As can be seen, profiteering was, in fact, legalized and involved quite respectable financial institutions. In contrast, other, non-legalized profiteers became the target group for the apparent “fight”. Kubiv has made a firm statement on plans to truly combat profiteering jointly with the Interior Ministry and the General Prosecutor’s Office. By doing so, he has generated hope for a comprehensive investigation of and just punishment for banking sector crimes committed under the old regime.

As soon as the currency deposit panic subsided, the National Bank tackled strategic issues. The Ukrainian Week has written that repressive initiatives of the previous NBU management aimed at maintaining the hryvnia’s exchange rate adversely affected the solvency of certain banks. This led to a situation in which more than a dozen financial institutions were essentially bankrupt by the end of 2013, even though the National Bank covered it up in every way to avoid paying compensation to the affected depositors. These problem banks are still there, so the NBU decided to act immediately. According to Kubiv, the central bank is already checking 16 banks that are violating its regulations on a daily basis. Eight financial institutions have been denied access to the interbank market. Temporary administrations have been introduced in Brokbiznesbank and Real Bank, whose solvency has raised doubts for a long time now. The National Bank is determined to cleanse the system of bankrupt entities.

Moreover, Kubiv has announced that work will begin on a long-term strategy to develop Ukrainian banks, emphasizing that the NBU will help financial institutions overcome the negative effect of the hryvnia’s devaluation on their balances and will also secure capitalization and long-term liquidity. In this aspect, Ukraine’s banking sector is the Augean stables part of which has not been cleaned since the 2008-2009 crisis. According to the S&P rating agency, the share of bad loans issued by Ukrainian banks is at 40%, while Moody’s places it at 35%. The figures may be a bit too high, but in any case they will give the new NBU administration its fair share of trouble, which it, however, seems to be fully ready to face.

Fairness and transparency – key values for central banks in developed countries – are being professed by the new NBU governor in everything. A crowd of defrauded depositors recently gathered in front of the National Bank demanding justice and their money back from bankrupt banks. Dozens, if not hundreds, of similar rallies were staged under the old government, but no-one ever reacted to them. Kubiv is the first governor of the National Bank to have personally come out to the protesters and answered their questions. He said he is planning to cut 100 employees with vague functions, which is about one per cent of the NBU’s staff. If need be, he will inject more money into the Deposit Guarantee Fund. A pure show, some might say. Even if it is, it is fully in line with the declarations of the new administration of the NBU.

Brilliant rapid moves made by Kubiv have changed the configuration of forces in the banking sector. Lethargic in the past years, bankers can now smell change, market and competition and have become active. Those who have engaged in “back-door competition” are now quickly losing their positions. Tellingly, the Austrian RBI holding has changed its mind and decided, after all, not to sell Raiffeisen Bank Aval, one of Ukraine’s biggest banks. The Austrian company spent almost a year searching for a buyer, but the Ukrainian banking revolution has turned everything upside down, and now, filled with expectations of financing (investments and loans) from the West and the restoration of free competition, RBI is willing to stay in Ukraine and open new prospects before the Aval bank.

The reaction of Russian banks has been the exact opposite. They are not used to open competition and know they will lose the battle against innovative and more efficient banks. In Ukraine, Russian banks often pursue a number of political goals which are now rapidly disappearing as the Kremlin’s agents are emigrating and the fifth column is downscaling its activities. The recent changes are not beneficial to them, so it comes as no surprise that subsidiaries of Russian financial institutions are imposing limits on loans and reducing transaction volumes in Ukraine. They may start pulling out from the Ukrainian market if the revolutionary processes in the country and its banking sector persist. (One idea that has been circulating is to refuse to pay back debts to the Russians, including Russian banks, in response to Vladimir Putin’s statement that the revolution has created a new Ukrainian state before which Russia has no obligations.) So, just like the EuroMaidan has shifted the vector of Ukraine’s socioeconomic development from east to west, the banking revolution is rapidly shifting the centre of bank capital in the same direction.

READ ALSO: Oleksandr Suhoniako: “We’ve passed the critical point and have reached the super-high instability zone”

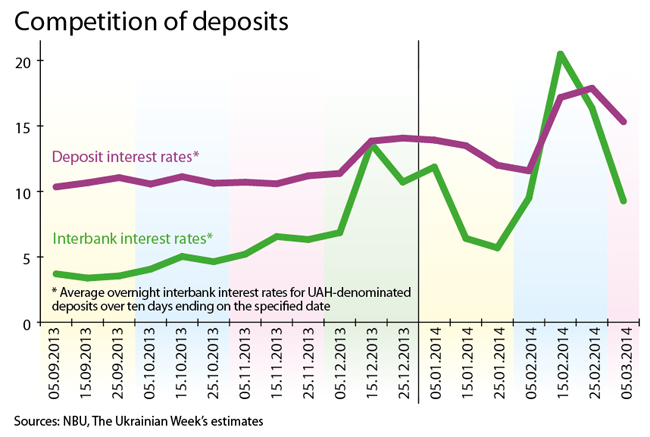

Free competition in the banking sector has again been made possible not only in terms of strategy but also directly on the market. Commercial banks which have suffered huge losses in terms of deposits in the past weeks are now engaged in the fight over clients through increased deposit interest rates (see Competition of deposits). Even though the NBU has provided sufficient refinancing to satisfy the demands of clients and depositors, bankers are aware that Ukraine’s economy is on the threshold of a new era, so they need to immediately build up their financial muscles in order to perform well and reap profits under the new conditions. Everyone is clearly waiting for American and European money to arrive and investments to start flowing more generously. That is why the current period of high interest rates will soon end. (Interest rates on deposits by companies have already dropped and stayed low in the past couple of days). Under certain highly probably scenarios, after a rapid fall interest rates may never again rise so high.

Judging by the dynamics of processes in the banking system started by the new government, they can be, without exaggeration, called revolutionary. Most important, all these changes are directly or indirectly aimed at serving people (bankers, clients and depositors). In this sense, the efforts of the NBU should become an example of transformation for all government institutions in a new Ukraine. Hopefully, the government (specifically its economy people), the president, the Verkhovna Rada and other high-ranking officials will from now on work for the good of people (all people!), keeping Ukrainian citizens at the front of their minds. Then, we will simply be bound to find ourselves in a country in which every working citizen prospers. This is the kind of country the heroes of the Heavenly Hundred have laid down their lives for.