When Naftogaz stopped delivering natural gas to the occupied territories of the Donbas, Russia used it as the latest excuse to once again confront Ukraine over the blue fuel. Gazprom has been supplying Russia’s proxies with gas against the advance paid by Naftogaz, reminding Ukraine once more how readily it drops any commitments given half an excuse. To resolve the situation, Brussels held a trilateral meeting on March 2 involving the EU Energy Commissar and representatives of Ukraine and Russia. But the only outcome was a postponement of the issue.

The gas supplies paid for in advance by Naftogaz as part of the winter package that operates until March 31 were supposed to be delivered by Gazprom in volumes that were clearly specified by the Ukrainian side to clearly designated reception points. Payments for gas to territories occupied by Russia’s proxies were supposed to be negotiated separately and the delivered volumes reconciled separately as well. The Russian side continues to claim that its deliveries are based on the contract with Naftogaz, so that, as before, it continues to tally it up as debt, subject to billing at any time that is convenient to Gazprom.

RELATED ARTICLE: Fueling Energy Independence

This means that 2015 and the 2015-2016 heating season will most likely be a prolongation of the gas—and more extensively, energy—war between Ukraine and Russia. The analysis presented here shows that Ukraine is quite likely to survive this even if it completely stops buying Russian gas after the current winter package comes to an end. At the same time, for this potential to turn into a real result and to avoid complaints about the short timeframes like those heard this past year in August and September, it’s time to start preparing Ukraine’s power industry now for a possible blockade on the part of the Russian Federation.

Skidding safely through 2014-2015

Total domestic consumption of gas from December 1 through February 28 this year was 14.95bn cu m: 6.65bn cu m for residential use, 4.1bn cu m for cogeneration, 3.87bn cu m for industrial purposes, and 0.32bn cu m for state entities. Moreover, industrial entities and cogeneration plants went over their limit of 1.3bn cu m. Had they not done so, total consumption would have been down to 13.7bn cu m.

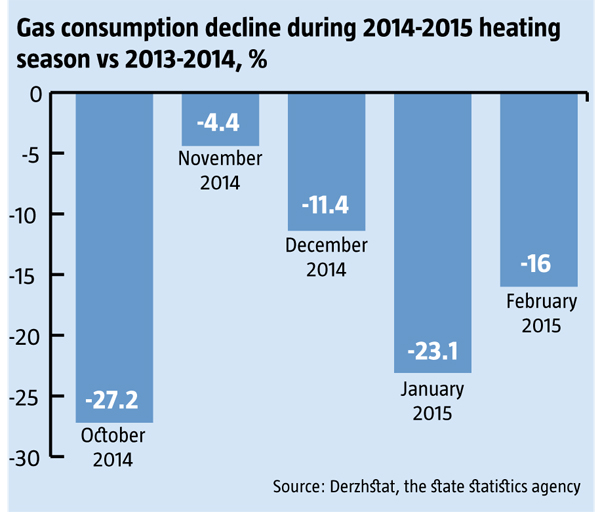

Fortunately, dire predictions that the country would be in collapse in the energy sector this past heating season proved wrong for a number of subjective and objective reasons. For one thing, the winter was unusually mild for the second year in a row. Gas consumption went down during this period partly because industrial and cogeneration users improved discipline and began to aim for the established caps, while household users and state entities significantly cut back on their consumption as well.

Still, industry and the cogeneration sector did not manage to stay within the limits they were given. For instance, they consumed 3.87bn cu m and 4.1bn cu m from December 1 through February 28, rather than staying within the caps set for this period, 3.27bn cu m and 3.49bn cu m. In part, this was because of a shortage of domestic coal, which had to be compensated for with natural gas. Otherwise, the level of excessive use of natural gas did in fact go down. Over October-November 2014, consumption was 7bn cu m, with the most excessive consumption appearing in November, despite the fact that there was a major decline in industrial production by then.

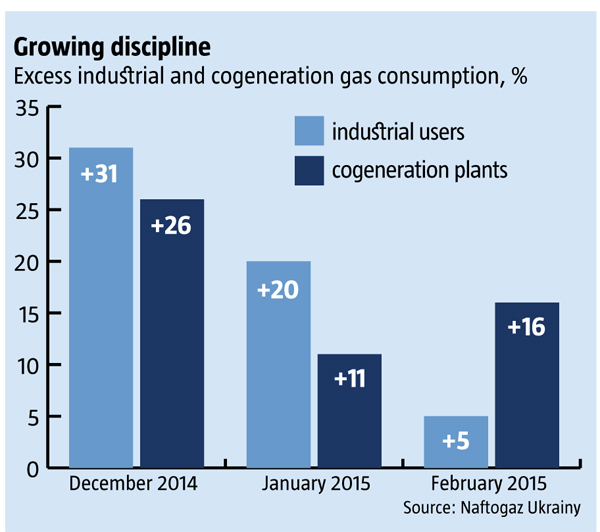

At the beginning of December, Naftogaz Ukrainy published exhaustive information about the limits on natural gas consumption by region and by category of consumer. By tightening discipline, excessive consumption really was brought under control. For instance, over-cap use in the first 10 days of December was 34%, whereas by February it was down to 5%. The fact that Ukraine stopped supplying gas to the Russian-occupied parts of Donbas as of February 18 made a huge difference, of course. In February alone, this saved nearly 100mn cu m of gas, and at least as much will be saved by the end of the heating season.

Meanwhile, more gas was being delivered than anticipated because of additional supplies coming in from the EU, while the fact that the war in Donbas did not go into high gear meant that Russia wasn’t about to tear up its “winter package” contract with Ukraine. Indeed, imports grew in January and February to 1.5-2 times what they had been in November and December. While during the first half of the heating season, October 20, 2014 through January 10, 2015, gas stocks in Ukraine’s underground storage system shrank by more than 6.1bn cu m from 16.75bn cu m to 10.6bn cu m, between January 10 and March 1, they only went down by 2.4bn cu m, to 8.2bn cu m.

RELATED ARTICLE: Alan Riley: Ukraine has enough potential to turn itself into the center of gas trading for Central Eastern Europe and Baltic States

The most noticeable reduction in the pumping of gas from storage tanks was in February: over Feb. 1-21, 2015 1.1 bn cu m were pumped out, compared to 2.1bn cu m during the same period of 2014, which was also a relatively mild winter. During the last 10 days of February as the weather grew warmer, Ukraine stopped supplying gas to the territories in the Donbas under Russian control just as deliveries from the Russian Federation sharply increased to prevent the delivery of supplies paid for in advance by Naftogaz to occupied Donbas. The juncture of these factors made it possible by February 25 not only to stop pumping gas stocks but even to begin replacing them in the underground storage system, which allowed stocks to be replenished by 105mn cu m by March 1.

As temperatures remain relatively high and winter package supplies from Russia continue to be delivered, by the end of the heating season, Ukraine will likely to be able to continue to simply store incoming supplies of gas. All the more since deliveries from Slovakia, Poland and Hungary increased as of March 1, so that even if Russia were to stop or reduce deliveries to a minimum, no more than 0.5-0.7bn cu m will have to be pumped from the gas storage system in March.

Checking the outlook for 2015-2016

Even though Ukraine managed to get through this year’s heating season without excesses and predictions of an energy collapse in March proved wrong, the issue of next year’s heating season is far from resolved. The thing is that in 2014, the gas storage system was actively being replenished with Russian gas until mid-June, which gave Ukraine sufficient stores that peaked at 14bn cu m on June 15, 2014. Meanwhile, Ukraine still hasn’t signed a summer package with Gazprom for 2015, so it will have to arrange for this only based on reverse deliveries from the EU and savings on some of the natural gas extracted domestically from May to September. Based on what happened this past year and recent trends, it’s possible to assess the potential balance of natural gas for the next heating season.

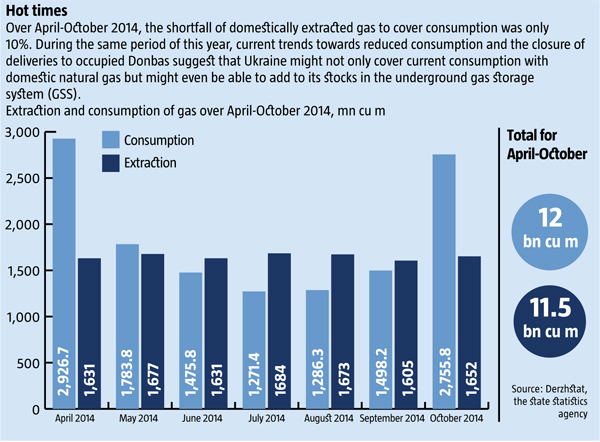

Domestic production in April-October 2014 was 11.6bn cu m, while consumption during that same period was 13.0bn cu m, a shortfall of 10%. But at that time gas was actively being consumed in occupied Donbas where significant industrial output was still being produced over April-June 2014, that is, prior to the start of large-scale conflict and the blockade of Russian proxy-held territories. As it happens, the volume of industrial output in other parts of Ukraine was also below 2014 levels in 2015. This means that not only can domestic extraction over April-October completely cover domestic demand, but it could even provide a small surplus of 0.5-1bn cu m for storage.

If conditions are right, the potential import of natural gas via Slovakia at a throughput rate of 40mn cu m/day over April-October 2015 could reach 8.4-8.5bn cu m. By the end of October, the Polish pipeline could supply an additional 0.6-0.8bn cu m by the end of October 2015. Despite its considerably higher throughput rate—3.2-3.3bn cu m, this past April-October—political obstacles such as Budapest’s playing up to Moscow, it’s hard right now to anticipate more deliveries from Hungary.

In short, using reverse pipelines from Slovakia and Poland, and at least partly from Hungary, and providing that domestic extraction is higher than domestic consumption over the warm seasons by about 0.5-1.0bn cu m, even without supplies from Russia, the stock in Ukraine’s underground storage system should be about 18bn cu m by the beginning of November 2015. That’s more than the 16.1bn cu m that the country had on November 1, 2014.

If consumption is kept within the caps set this year for industry and cogeneration use for a potential saving of 2.2bn cu m, occupied Donbas remains unserviced, saving 0.8bn cu m, and residential gas rates are raised substantially so that household consumption is kept down or partly replaced by other fuels for a possible saving up to 1.5bn cu m, total consumption should go down even further in the next heating season. In this way, Ukraine has the potential not only to get through the next heating season without further purchases from Gazprom after the current winter package expires, but also to enjoy a surplus of 7.0-7.5bn cu m.

Cutting obstacles down to size

All these resources will be very much needed, especially as the assessment is based on a mild winter similar to the 2014-2015 one. Since Ukraine has seen mild winters several years in a row now, the chances of a much colder one in the next heating season are growing. A second risk is the threat that Russia will sharply cut all gas transit through Ukraine to prevent the accumulation of stores, especially along the Slovak branch. In 2014, Gazprom already cut back transit through Ukraine to 62bn cu m or barely half of the 121.3bn cu m it delivered to the EU. Should transit supplies through Ukraine be further cut to 50bn cu m, as predicted, 15-16bn cu m of which will be reverse-flow, the proportion of Ukraine’s gas delivered via Ukraine’s gas transit system could fall to 25-30% of net Russian gas supplied to the EU next heating season. This increases the risk that Gazprom will cut deliveries through Ukraine altogether in order to increase the shortfall on the European market, which would be enough to put an end to reverse deliveries to Ukraine, yet not catastrophic in terms of covering EU demand for natural gas.

RELATED ARTICLE: The Third Gas Revolution

But for such a reserve to become a reality Naftogaz and the Government even now need to increase their efforts with industrial and cogeneration consumers to stop going over the established caps. One step that should help in this is Bill №2214 “On changes to certain laws of Ukraine to stabilize the financial state of NAK Naftogaz Ukrainy,” which has already passed first reading in the Verkhovna Rada. But the Government also needs to improve the system of carrots and sticks: incentivizing by raising gas rates—and penalizing with fines for going over the limit in the form of double or even triple rates and, in the case of repeat violations, a temporary interruption of gas deliveries altogether.All these potential risks demand that Ukraine use preventive measures to firstly ensure the maximum volume of gas coming via reverse-flow from the EU in Q2, without waiting for possible price reductions in Q3 2015. In the end, the surplus of 7.0-7.5bn cu m calculated earlier here is more than enough to compensate even for a complete halt in reverse-flow supplies from the EU during the five-month heating season, which requires 6.5-7.0bn cu m.

Cleaning rust off the runners

The urgent need for these measures is especially obvious when looking at Ukraine’s export-oriented gas-hungry chemicals industry. The latest data provided by Naftogaz Ukrainy shows that above-limit use of gas this past winter was highest in Rivne and Cherkasy Oblasts, where the chemicals giants RivneAzot and CherkasyAzot belonging to Dmytro Firtash’s Ostchem Holding are located. Comparison of the first three weeks of December, January and February show a growth trend in excessive use for these two oblasts, rising from 75% and 63% in December to 151% and 83% in January, and to 156% and 87% in February.

The other component that needs economic incentives in Ukraine already this year is domestic gas extraction. In 2014, Ukraine extracted 20.5bn cu m of gas, but whereas private companies that were able to sell the gas at market prices increased output by 18%, to 3.3bn cu m, state-owned companies either maintained previous levels or actually cut back on output.

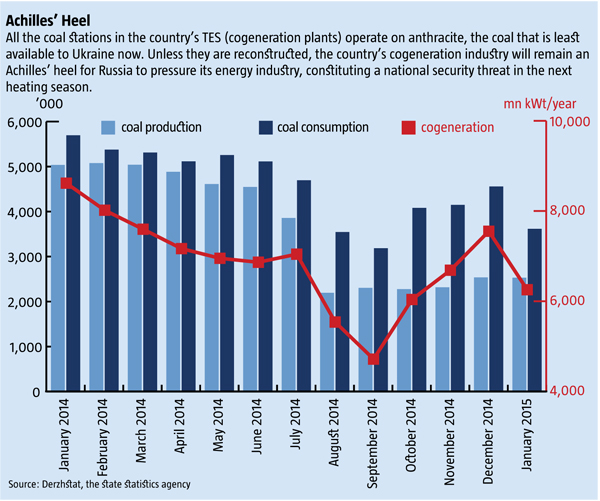

Two more problems that need resolution are coal supplies, as they is the main alternative to gas in the short term, and power generated at cogeneration plants.

Setting up a relatively clear trail

Still only at the discussion level although it needs an explicit action plan already now, and not in August or September, is upgrading the coal-firing stations at Ukraine’s TES or cogeneration plants, as well as community and agency boiler houses that work on black coal, which is in shortage outside the Customs Union and occupied Donbas. If work is begun in March and not July-September, then by November-December 2015 Ukraine has enough time to mobilize the necessary resources, using targeted programs and credit programs from European and international donors, to re-equip coal blocks and furnaces to work on coal grades that are readily available in Europe and elsewhere in the world prior to the next heating season. Specialists say that about 5-7 months are needed for this task and almost token investment on the part of domestic power companies—at most a few billion hryvnia.

Ukraine also needs to already be preparing its transport infrastructure to receive several million tonnes of imported heating coal both by rail from the EU and by sea through its ports.

Finally, the Government needs to approve and publicly announce a principled policy decision that states that neither electricity nor coal will be imported to Ukraine from Russia or Russian-occupied Donbas starting this summer—regardless of their country of origin.

There are no real obstacles to properly upgrading and diversifying Ukraine’s cogeneration industry. There’s also enough time, unless there is sabotage on the part of officials at state and community agencies or at private power companies. This is primarily with reference to DTEK, a huge cogeneration conglomerate owned by pro-Russian oligarch Rinat Akhmetov, who, for commercial reasons as well, continues to supply coal from his mines to Russia’s proxies in occupied Donbas. This makes it extremely urgent that proper state oversight over the activities of DTEK be established ASAP and/or the company’s power-generating assets nationalized as strategic to national security under the current circumstances.

RELATED ARTICLE: The Tycoon Effect

Ukraine also needs to take immediate steps to upgrade and develop its trunk and inside power lines in buildings to make sure that emergency breakdowns during the next heating season don’t get in the way of at least partial diversification of sources of power to residential users. Above and beyond that, the extremely uneven increases in rates for residential electricity and gas planned for this year—50-60% for power and 190-350% for gas—will make electricity the cheaper utility to use, even from an economic point-of-view.Meanwhile, diversification of nuclear fuel has been quite dilatory this past year as most of the country’s atomic energy stations (AESs) are supplied with fuel rods from Russia. Cooperating with western suppliers in this would not only improve Ukraine’s ability to withstand the Kremlin’s power blockade, but would actually strengthen interest in its fate among influential western businesses, which could then lobby their governments to provide more effective support to Kyiv.