After Ukraine gained independence in 1991, it faced the need to transition to a market economy. There was no alternative option for it as people who ended up out of the Soviet Union days ago, their consumption appetites suppressed for many years, were lured by the welfare they saw in developed countries. However, Ukraine had no economists who knew how to effectively lead it to a market economy. Thus, an institutional vacuum emerged in Ukraine, while the intellectual elite experimented on the national economy. It started to be filled with things inherited from its Soviet past and the products of natural selection, including racketeering, bandit wars for assets and overwhelming corruption in government. Over a period of 20 years, these phenomena have become legitimized and have grown into a social norm, their instruments somewhat altered. As a result, Ukraine’s economy has yet to transform into a market one. It still operates under an oligarch-controlled model that threatens to leave Ukraine underdeveloped for many years to come.

Ukrainian oligarchs generally gained their wealth from commodity-based industries. They exploited Ukraine’s abundant natural resources and its developed industrial infrastructure inherited from the USSR, mostly concentrated in commodity production. This did more harm than good: easy wealth and profits did not motivate owners to upgrade the assets generating it. Eventually, oligarchs began to see their business as a cash cow that should bring income instantly. Before 2004-2005, local oligarchs barely invested into projects with a payback period of more than two years. Their business strategy did not entail any new investment ideas, innovations or actual entrepreneurship. Their only interest then and now is quick cash.

READ ALSO: Ukraine’s Robber Barons: Where They Come From?

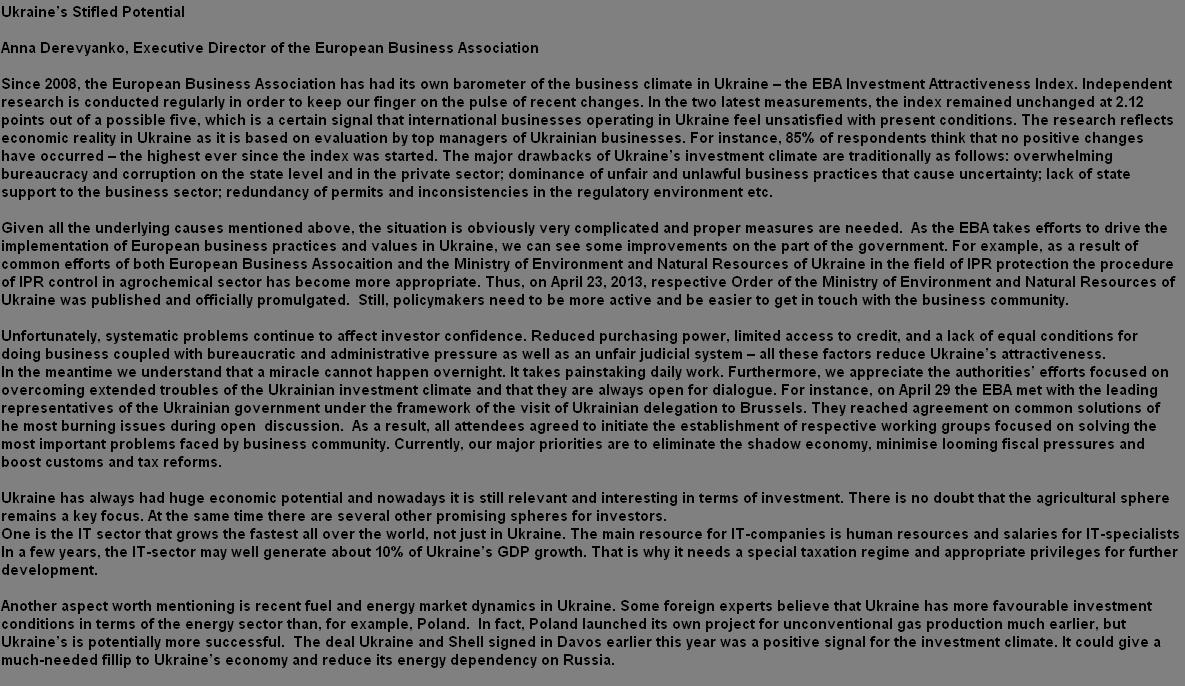

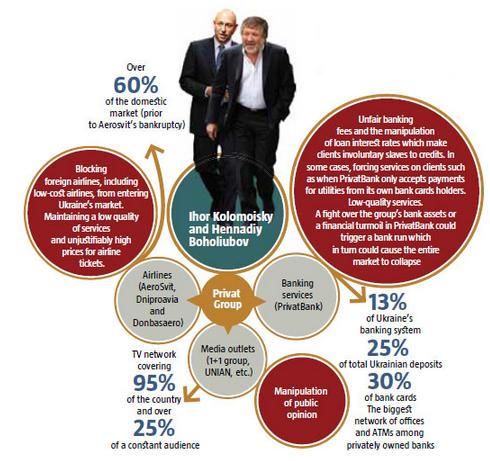

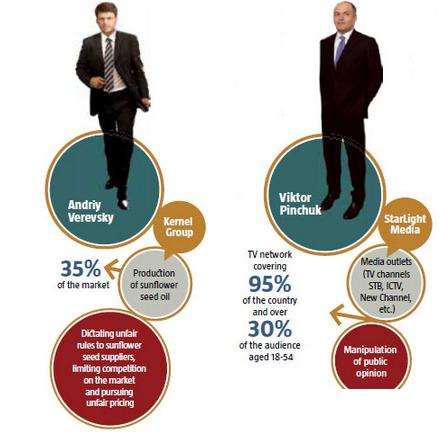

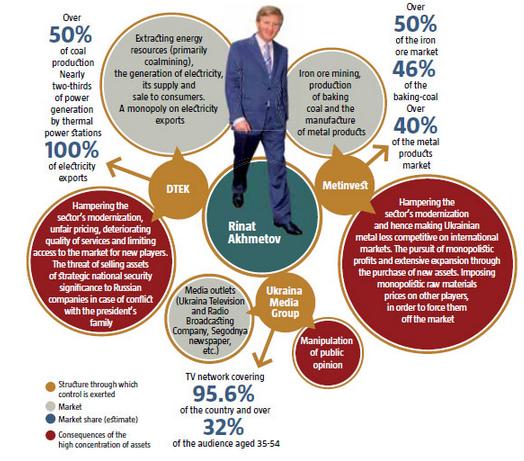

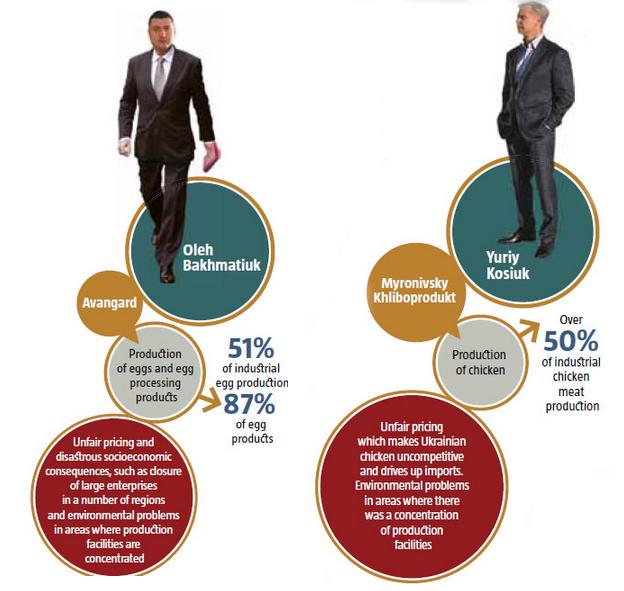

As a result, the Ukrainian economy has failed to transform from a commodity-based to a high-tech one over 20 years, since oligarchs bypassed the engineering sector, vehicle manufacturing, the IT sector and the like, which would require billions in investments to develop and a have a long pay-back period. Instead, they proved very inventive in fighting over assets, establishing win-win relations with those in power, arranging the privatization of stat property for peanuts and designing tax evasion schemes. Sometime later, once oligarchs had gained multibillion assets, and available resources were no longer adequate for all oligarch groups, Ukrainian tycoons were forced to channel their asset-accumulating efforts and some of their cash into less profitable businesses, including retail, banking, power supply, airlines, construction, chemicals production and so on. Through huge inflows, a handful of players quickly monopolized these industries. The government helped them create a comfortable environment to operate in while turning a blind eye to the growing market concentration. Today, the biggest markets in Ukraine are essentially distributed between Rinat Akhmetov, President Yanukovych’s Family, Ihor Kolomoyskyi and Dmytro Firtash.

However, the Ukrainian economy remains export-oriented, while poor population leaves its domestic market underdeveloped. Unsurprisingly, the oligarchs have opted to grab export-oriented industries. In 2012, exports accounted for 51% of total GDP. 52% of total exports were primary commodities produced by the mining and steel complex, as well as the chemical and agricultural sectors. These are largely in the hands of oligarchs. It is the structure of Ukraine’s economy that torments it more than anything else. When the world economic situation makes it hard for Ukrainian owners to sell their goods on foreign markets, exports drop significantly and BoP shrinks, putting huge pressure on the hryvnia on the interbank market. As a result, NBU reserves are often insufficient to support the hryvnia exchange rate, and the national currency collapses along with citizens’ real disposable income. This was how Ukraine underwent three massive waves of devaluation over its years of independence. The 2008 one was the easiest of them, knocking just about 1/3 off the hryvnia value. The resulting drop in living standards is so steep though, that most people have started to spend almost 70% of their income on food and residence, while anything else is barely affordable.

The source of oligarchs’ wealth and the mindset of its current Ukrainian owners have shaped the present economic system that barely resembles a market economy. Typical components include highly monopolized markets, obsolete industries and overreliance on commodity-based sectors, administrative support from the oligarch-controlled government that has huge influence on business processes through manual economic management, and the lack of incentives for personal development among the population. This will never change without real reform of the judiciary as Ukrainian courts are currently making their verdicts based on the government’s instructions or bribes.

READ ALSO: Investing in Ukraine’s Future: Removing Barriers to Open Opportunities

Oligarchs realize this, so are not rushing to invest into plants that are 70-90% worn out. Domestic raw material companies not only lack investment, but also equipment, efficient technologies, organization and management, so they lose out to their international competitors on all these counts. Their only competitive advantage that knocks down the cost of production and boosts profits is cheap labour force. Labour costs on average account for nearly 20% of the original cost. This is two to three times less than in developed economies. Average gross earnings in Ukraine are about 280 Euro per month, and new inexpensive employees keep coming in as they have no other alternative. Oligarch-controlled enterprises pay paltry wages, yet hire 30-50% more people than they actually need. As a result, Ukraine has one of the lowest productivity indexes in Europe. This plays into the hands of oligarchs. Their enterprises lay off employees from time to time, contributing to the army of the unemployed and eager to work for lower salary – this helps the oligarchs keep the money they offer down. Subsequently, employment in Ukraine has barely grown 1% over the past 12 years and virtually stays at 20 million employees. 5-10 out of 45 million Ukrainians are forced to seek work abroad.

The shortage of investment (kept away by manually constructed barriers) has made major industries so inefficient that even a cheap labour force often fails to generate better profits. Based on the data from three quarters of 2012, 41% of big and medium enterprises in Ukraine operated at a loss. The average operating margin of big and medium enterprises was 4.3% for the entire economy, and 3.4% for the industrial sector. This is several times less than that in developed economies despite much higher pressure on profitability from competition there. In fact, the low operating margin of Ukrainian enterprises comes from transfer pricing in addition to obsolete facilities. Running export-oriented business, virtually all oligarchs use mechanisms to take their capital into safe havens abroad. As a result, Ukraine loses 5-7% of GDP annually, while business reports low profitability. Transfer pricing is by far not the only scheme used by oligarchs to export their capital – some of them perfectly legitimate. According to different data, 80% of the capital of the top five oligarchs is located abroad. This proves two things. First, Ukrainian oligarchs are not a national business although they persistently attempt to portray themselves as such through their pocket media, in an effort to persuade society that foreign business in Ukraine (their potential competitor) is not a panacea for the economy, while they are its only possible drivers. They do not believe in Ukraine’s prospects and fear losing their assets, so squeeze every possible penny out of it. Their personal life reflects this; oligarchs buy up real estate abroad and their families live there most of the time. Second, they invest into Ukrainian enterprises mostly to keep their companies alive and generate cash flow for as long as possible. They exhibit no systematic efforts to create anything new or more efficient.

The business environment designed by tycoons to fit their interests best, essentially blocks access to Ukraine for foreign companies, or the emergence of new startups capable of growing into real competitors of big business. This is why many local markets have no competition whatsoever, since they are dominated by oligarchic monopolies. The most highly-monopolized industries include chemicals (Dmytro Firtash), passenger airlines (almost all under the total control of Ihor Kolomoyskyy’s entities), metallurgy (Rinat Akhmetov), and coal mining (entities close to Yanukovych’s family).

All this makes Ukraine lag behind European countries as regards investment inflow. As a result, GDP growth is sluggish and the escalated lagging behind of the economy. In Q3-4’2012, the real investment rate in the Ukrainian economy shrank by 22% and 23% respectively, while investment into fixed capital fell by 7% and 8%. 2013 doesn’t look any better, as construction is down 17% year over year in Q1’2013.

READ ALSO: Erosion of Capital Signals Economic Degradation

The oligarchic system has a very strong grip on the economy as tycoons have firm support from authorities and officials. Big business owners have good contacts both in the government, and the opposition. As a result, they stay afloat even when governments shift in Ukraine. Whenever this happens, they can swap their political interests easily, taking over the political forces that come to power. The army of underpaid civil servants is always willing to serve the interests of oligarchs, too. The transfer pricing law is one example of the tycoons’ close ties with those in power. The original concept was to stop massive capital outflow and add another UAH 20bn in revenues to the budget. After discussions and amendments, initiated by oligarchs among others, this amount went down to a mere UAH 0.5bn.

This knot of tycoons, government and officials persistently aggravates Ukraine’s investment climate and ousts all other investors willing to invest their cash here, given the vast potential of local market. This is a piece of cake in Ukraine. Tax authorities can exhaust non-oligarchic businesses with inspections, courts can rule to change owners, law enforcers will help raiders take over a company as per the government’s instruction, while local officials will hold back the piles of licenses and certificates one needs to run a business in Ukraine. Even state-owned companies sometimes contribute to ousting disloyal business: when required, they can cause troubles with transportation, electricity, gas supply and the like.

As a result, most non-oligarchic projects, including those with foreign investment, have a negative NPV in most industries. This implied FDI stock per capita at EUR 908 in early 2013, which is five times lower than that in Poland and 8-14 times less than in developed countries. Cypriot investments account for 32% of this. These are mostly the funds of Ukrainian oligarchs taken out earlier, or stakes gained by Cypriot companies through shadow schemes rather than for real money. The model works to ensure that non-oligarch investors do not see the economic sense or benefit of investing in Ukraine and turning into competitors of the local oligarchs. They latter prefer this status quo as it rules out competition for a labour force that would sooner or later increase employee pay to a level whereby oligarchic business would become unprofitable and ultimately collapse. Meanwhile, oligarchs are unable to develop the economy and make it more efficient on their own, because they pursue different objectives, such as quick cash that they can turn into expensive real estate in London. Rinat Akhmetov, for instance, owns the most expensive apartment in the heart of the UK.

READ ALSO: Government in the Service of Monopolies

The current structure of Ukraine’s economy essentially rules out any development, the transition to higher efficiency and the emergence of new industries with high value-added production. All the players that could significantly change the system are not interested in such change, giving priority to short-term gains. Tycoons expect windfall profits and fear losing their property if anything changes. Government officials focus on returning whatever it spent on the election campaign, and earning more – and fears the ascent of opponents. It sees its term in office as a business project with a high ROIC. Bureaucrats direct their efforts to earn some shadow bonuses to their low wages inventing more and more new ways to obtain bribes from business. Ukraine’s social and economic systems are profoundly rotten and corrupt. The only option now is radical reform including the elimination of the oligarch model driving Ukraine into poverty while enriching just a few families.