In June 1941 William Beveridge left the office of Arthur Greenwood, a British cabinet minister, with tears in his eyes. A well-known academic and civil servant, Beveridge had sought a big job in the war effort. The 62-year-old was brilliant, but also obsessive, vainglorious and prim. To sideline him, Greenwood proposed what seemed a thankless task: reviewing Britain’s social-insurance schemes.

What emerged was a blueprint for the modern welfare state. In December 1942, having stretched his brief to the point of bursting, Beveridge published his account of the “Five Giants”: disease, idleness, ignorance, squal- or and want. He proposed new benefits for the retired, disabled and unemployed, a universal allowance for children and a nationwide health service.

On the night before publication a long queue formed outside the publishers. Polls found majorities of all social classes backed its proposals. It was translated into 22 languages and the Royal Air Force dropped summaries on Allied troops and behind enemy lines. Two copies, heavily annotated, were found in Hitler’s bunker.

Such zeal for the welfare state is rare these days. On the right, critics accuse it of sucking the dynamism from capitalism and individuals alike. For Paul Ryan, the out- going Republican speaker of the House of Representatives, it is not a safety-net but “a hammock” that “lulls able-bodied people to lives of dependency and complacency”. Peter Sloterdijk, a German philosopher, calls it a “fiscal kleptocracy”.

The left, as seen in the grainy nostalgia of politicians such as Jeremy Corbyn, leader of Britain’s Labour Party, lays claim to the welfare state as a left-wing creation, and thinks it is under unceasing threat. It does indeed face profound challenges: from ageing populations, im- migration and the more varied nature of work, none of which Beveridge had to worry about.

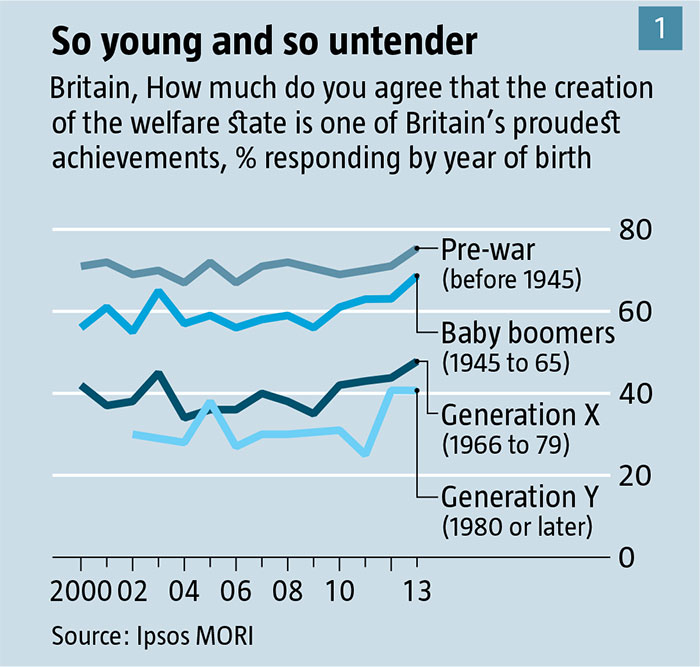

Public support has flagged. Data from the British Social Attitudes survey, for example, show successive generations taking less pride in the welfare state (see chart 1). In America views are increasingly partisan. In the late 1980s and early 1990s most Republicans agreed with the idea that government should ensure citizens have enough to eat and a place to sleep. Today most disagree, according to data from Pew, a pollster.

The name may be part of the problem. In Sweden it is known as Folkhemmet (people’s home), in Germany Sozialstaat (social state), but in the Anglophone world “welfare state” has stuck. Beveridge hated it, for implying a “Santa Claus” state at odds with his belief in personal responsibility. “Welfare” historically has a broad meaning, but is often associated with aid to the poor, especially in America. Yet this is only a small part of what a welfare state does.

Indeed its origins and aims are widely misunderstood. It is not so much a left-wing creation as a product of an intellectual coalition, in which the critical strand was liberalism. Liberals such as Beveridge believed that people should take more responsibility for their own lives, but that government should support them. They saw it not as industrialised charity, but as a complement to free-market capitalism.

The welfare state predates the modern form that emerged in the late 19th century. Ancient Rome gave out “doles” of grain to the hungry. In Renaissance Europe towns such as Ypres collected alms to pay for ways of putting paupers to work. During the Industrial Revolution, England built workhouses where the destitute broke stones and untangled rope in return for food and a bed.

HARD TIMES

By mid-century the rise of unfettered markets brought demands for protection against their effects. Charity and churches were seen as failing to cope with poverty, as mass urbanisation weakened traditional social bonds. Pressure came from the left. But conservatives responded, too. Otto von Bismarck introduced the first social-insurance schemes in the 1880s. Worried about the fitness of “degenerate” masses to fight wars, European leaders backed improvements in public health and education. So the welfare state was also entwined with rising nationalism.

But as Chris Renwick, a historian at York University, explains in “Bread for All”, the early welfare state “owes most to liberalism”. “New liberals” such as John Stuart Mill and Leonard Hobhouse, argued that freedom meant ensuring that people had the health, education and secu- rity to lead the life they wanted. Some of these ideas underpinned early state-pension schemes and unemployment insurance in New Zealand, Australia and, in the first decade of the 20th century, Britain.

The development of welfare states was hastened by the Depression and the Second World War. War brought people of different backgrounds together, fostering a sense of unity against a common enemy. And as middle classes shared these risks, their demands for support meant the welfare state became about more than just looking after the poor. Writing his report in this atmosphere, Beveridge tackled some of the tensions that still strain debate about the welfare state. When is a benefit a right and when is it conditional on your behaviour? When do benefits erode the incentive to work? How much can the state afford?

The balance Beveridge struck was a liberal one. He argued there should be “bread for all… before cake for anybody”. But people “should not be taught to regard the state as the dispenser of gifts for which no one needs pay.”

The post-war government implemented much of his plan, and reforms soon followed elsewhere. By 1954 the core institutions of the welfare state were in place across the rich world—social-insurance schemes, means-tested support for the poorest, free or subsidised health care, social work and employment rights. That year President Dwight Eisenhower said that if any politician tried to dismantle social security, “you would not hear of that party again in our political history.”

Welfare states have always differed from country to country. But from the 1970s, approaches diverged fur- ther. In 1990 GøstaEsping-Andersen, a Danish sociologist, described three varieties of “welfare capitalism”. First were the “social democratic” versions in Scandi- navia, with high public spending, strong trade unions, universal benefits and support for women to stay in the workplace. Second, “conservative” welfare states, such as Germany’s, were built around the traditional family and had a strong contributory principle. Finally, Anglo-American welfare states put greater emphasis on guar- anteed minimums than universal benefits.

Perhaps the commonest charge against mature welfare states is that they have created a culture of dependency. So policymakers have made programmes more “conditional”, forcing recipients to look for work, for example. To help them, many countries expanded “active labour-market policies” such as retraining.

Yet the welfare state has not shrunk in recent decades. In a paper published in 2011 Paul Pierson of the University of California, Berkeley, described a “frozen landscape”. For several sorts of benefit—unemployment, disability and state pensions—he showed that their gen erosity had risen until the 1980s, then barely changed since.

If the shrinking welfare state is a myth, so is the no- tion that it is mainly about redistribution from rich to poor. Nicholas Barr of the London School of Economics points out that its role is more to allow people to smooth consumption over their lifetimes, in effect shifting money from their younger selves to their older selves.

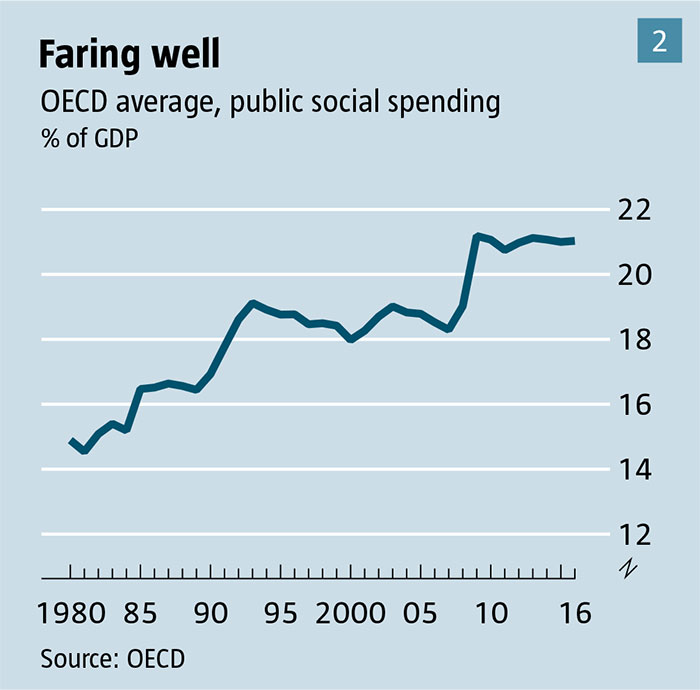

Another misunderstanding is about how welfare spending relates to economic growth. As countries be- come wealthier, public spending increases as a share of GDP (see chart 2). Spending on “social protection” (pensions, benefits and the like) in the OECD club of coun- tries has increased from 5% in the 1960s to 15% in 1980 to 21% in 2016. In a paper published in 2011, two econo- mists, Andreas Bergh and Magnus Henrekson, estimated that a ten-percentage-point increase in the size of the state in rich countries is associated with a fall in the an- nual rate of GDP growth of 0.5 to one percentage point.

Nevertheless, since 2000, Canada and some Scan- dinavian countries, for example, have combined high levels of public spending with high rates of economic growth. Peter Lindert of University of California, Davis, describes this phenomenon as the “free-lunch puzzle”.

This is a misnomer. Taxpayers still pay for those lunches. But MrLindert is correct that the effects of welfare depend not just on how much is spent but how. Subsidised child care, which helps (mostly) women stay in the labour market, is more growth-friendly than pensions, say. The introduction of the Children’s Health Insurance Programme in the United States in the late 1990s increased the rate of parents opening their own businesses.

Growth also depends on other areas of policy. Since the 1990s Scandinavian countries and Canada have liberalised their economies, selling public monopolies, cutting regulation and reducing trade barriers, although most have maintained high levels of public spending. According to Will Wilkinson of the Niskanen Centre, a think-tank in Washington, DC, (an occasional contributor to The Economist), “big welfare states needed to become better capitalists to afford their socialism.”

That may be too cute. But the difficulties faced by welfare states in rich countries are about more than just their size. The three main ones relate to demography, migration and changing labour markets.

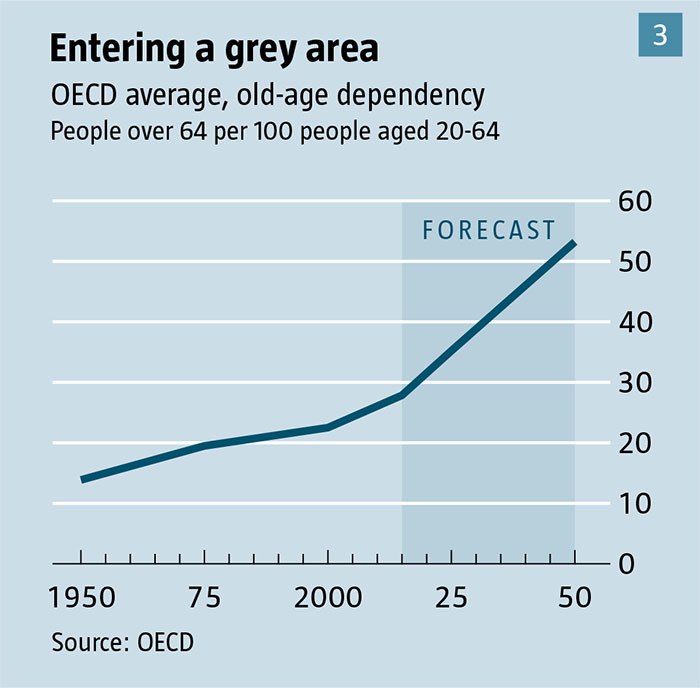

The first is the ageing of the population. In the OECD longer life-expectancies and, since 1990, stagnant fertility rates, have raised the ratio of adults over 65 to those of working age (see chart 3) from 19.5 in 100 in 1975 to 27.9 today. Welfare spending is increasingly tilted towards the elderly. On average, as the median voter in OECD countries ages by one year, the share of GDP spent on pensions increases by 0.25 percentage points. The same applies to health spending. Today the share of state spending that goes on public pensions averages 8.2% of GDP across the OECD. In France it is 14%; in Italy, 16%.

This threatens the implicit contract between generations. In Britain baby-boomers can expect to receive in benefits and services over a fifth more than they paid in tax, reckons the Resolution Foundation, a British think-tank. But today’s workers face rising taxes. To maintain current welfare provision, the Office for Budget Responsibility, a fiscal watchdog, estimates that spending as a share of GDP would need to increase by seven percentage points by 2066, to over 45%, meaning higher taxes.

Denmark and Finland, among others, have linked state retirement ages to life expectancy. In 2022 so will the Netherlands. In Germany, Japan, Portugal and Swe- den pension levels are adjusted according to the ratios of workers to non-workers. Yet elsewhere reform has proved difficult. Of the six countries in the OECD that changed their retirement ages in the past two years, three cancelled previously planned rises.

Immigration poses another challenge to the welfare state. In 1978 Milton Friedman argued that you could have open borders or generous welfare states open to all, but not both, without swamping the welfare system. Moreover, taxpayers are more tolerant of benefits that are seen to look after “people like them”.

Experimental evidence suggests that there is a tension between diversity and generosity. Studies have found, for example, that Swedes are more reluctant to give to Bulgarians than to Dutch migrants. Another study published in 2017 using survey data from 114 European regions found a correlation between areas with higher shares of migrants and a lack of support for a generous welfare state.

Or rather, a lack of support for immediate generosity to “outsiders”. A survey of changing attitudes in European countries between 2002 and 2012 found both rising support for redistribution for “natives” and sharp opposition to migration and automatic access to benefits for new arrivals. Pandering to such views is a core part of the appeal of populists such as the National Rally in France, the Sweden Democrats, and the Danish People’s Party, which has been instrumental in Denmark’s curbing of rights to benefits for non-EU migrants since 2002. But Denmark is not alone in pursuing “welfare chauvinism”. Bill Clinton’s reforms in the 1990s limited illegal immigrants’ access to benefits. More recently, Sweden has limited paid parental leave for new immigrants and cut support payments to some asylum-seekers.

Other research suggests that the nature of the benefit influences attitudes. Christian Larsen of Aalborg University found that a small majority of Danes thought immigrants should have immediate access to health care and public education; few thought that generosity should extend to unemployment or child benefit. Moreover, attitudes towards immigrants are volatile and swayed by the political climate. In 2011, for example, 40% of Britons said immigrants “undermined” the country’s cultural life, and just 26% said they enriched it. By last year, in the wake of the Brexit vote, only 23% went for undermined, compared with 44% for “enriched”.

And if immigration is a second challenge to the welfare state, it may also offer a partial solution to the first one: ageing. Economic research from Britain and Denmark, has found that since at least 2002, EU migrants have contributed much more in taxes than they have cost in public services.

The third issue is adapting to changing labour markets. “The welfare state developed in an era of big gov- ernment, big companies and big unions,” writes Andrew Gamble of Cambridge University in “Can the Welfare State Survive?” In most countries it was assumed that there would be full male employment. Today this no longer holds. Recent research by the OECD in seven of its members estimated that 60% of the working-age population had stable full-time work. Of the other 40%, no more than a quarter met the typical definition of unemployed: out of a job but looking for one. Most had dropped out of the labour market or worked volatile hours.

The causes are complex and overlapping. But they include the incentives and disincentives to work that complex benefits systems produce. In many countries when the jobless do find work, their benefits are withdrawn in such a way as to create a high effective marginal tax rate. Nearly 40% of the unemployed in the OECD face a marginal rate higher than 80% on taking a job. Welfare recipients also often suffer from bureaucratic traps. For example, some have to wait weeks between losing a job and receiving benefits. (Long enough to throw many on the mercy of loan sharks.)

Universal basic income (UBI) may be one way to avoid such problems. It takes many very different forms, but at its heart it replaces a plethora of means-tested benefits with a single, unconditional one, paid to every- one. Scotland and the Netherlands are running experiments involving UBI and many others are set to follow. But in no country is it yet the foundation of the benefits system for working-age adults.

The OECD recently modelled two forms of basic income. Under the first, countries’ spending on benefits was divided equally among everyone—a revenue-neutral reform. Under the second, everyone would receive benefits equal to the current minimum-income guarantee, and taxes would rise to pay for it, if necessary.

ETERNAL TRIANGLES

The results, as ever in welfare policy, reveal a “trilemma”: between the overall cost, how much it alleviates poverty and its effect on work incentives. They also show that the effects of introducing basic income vary hugely based on what welfare system it would partly replace. Countries such as Italy, Greece, Spain, Austria and Poland all spend more on welfare for the richest 20% than for the poorest. For them, spreading benefits more evenly would benefit the poor, even under a revenue neutral model. But in countries that target welfare spending on the poor (such as Britain), UBI would either lead to large tax rises, to maintain a minimum income for everyone, or see benefits cut for the worst-off.

A more realistic alternative for many countries may be a negative income tax (NIT). Championed by Friedman, the NIT means that, below a certain income threshold, the taxman pays you. As you earn more, tax kicks in, tapering your income. The effect is similar to a basic income, especially since most UBI models assume that rich people would have to pay more tax to afford them. A NIT, however, is more efficient in that it does not give the rich a stipend only to take most of it back in tax.

Versions of a NIT have been part of welfare policy in Britain and America for decades, in the form of tax credits that are paid to those working on low incomes. Britain’s Universal Credit, a (sputtering) attempt to merge six working-age benefits into one, takes the approach further. A recent analysis by the OECD finds this a better way at targeting the poor than UBI.

A paper published in 2015 by Luke Shaefer of the University of Michigan, and colleagues, suggested that money from current welfare programmes such as food stamps and housing subsidies could be replaced with a NIT that ensured no American had an income below the federal poverty line. The marginal tax rate it assumed (50%) is high, but the work shows that a NIT may not be out of reach, at least in a country with a weak safety net.

What would Beveridge have made of ideas such as basic income? He believed that “complete idleness, even on an income, demoralises”, so would probably have scoffed at some forms of UBI. But he also thought reform had to take account of “the modern social risks”. The welfare state should not get stuck in the past.

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook