There are two diametrically opposite (in terms of their status and size) strata of population that exercise key influence on Ukraine’s life, and together they make something resembling a pyramid in the structure of society. At the top are oligarchs, who shape the situation within the country due to their financial and political potential. At the base there is a mass of low-income citizens who also influence state policy when they act together, at elections. They are a means for preservation of the status quo, since their poverty and, consequently, critical dependence on state or employers makes them easy to manipulate by the state political machine (using populist, paternalist slogans), run by a symbiosis of oligarchs and high-ranking officials. The machine is interested in the preservation of the status quo as it allows them quick enrichment.

No matter how different they are by all imaginable characteristics, these two groups still constitute the backbone of the oligarch-and-lumpen model of Ukraine’s economy. On the one hand, oligarchs have practically proven their inability to influence economic policies in such a way as to create a modern national economy on the principles of efficient use of domestic resources, work, capital, and national competitive advantages, in order to guarantee decent living standards for the people, together with a responsible treatment of nature and the interests of society. On the other side, the poor, socially slack and disorganized classes, whose primary concern is day-to-day survival, cannot make the changes either.

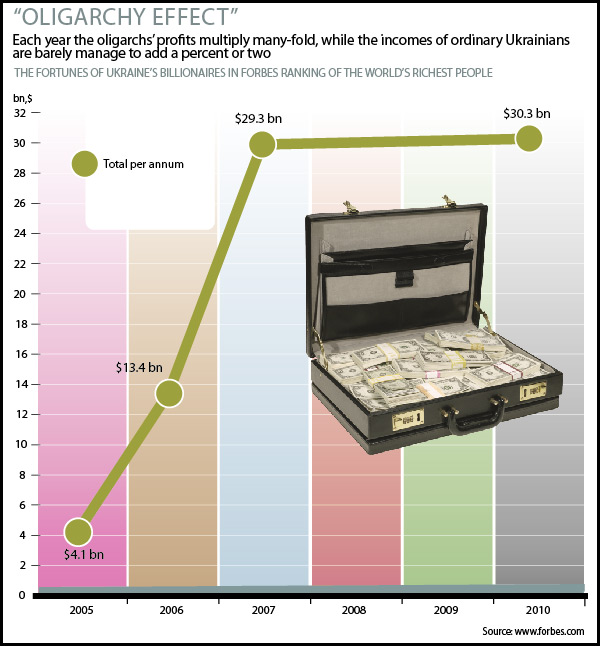

Thus oligarchs continue to rapidly accumulate more and more economic and political resources: one in four of Ukraine’s one hundred richest people is a member of the ruling party and thus can promote his or her own business and influence the allocation of budget funds due to connections at the top official level and control of state machinery and officials at various levels. The study of the decisions passed by state reveals that they promote the enrichment of the very rich, to the detriment of the development of the country. They completely ignore such issues as support to citizens’ initiatives or the securing of decent living standards.

That is why the current model of domestic economy is inefficient, and the country’s competitiveness in the international arena is slumping. Ukraine’s economy is characterized by low work and capital efficiency; very high energy intensity; monopolies and unfair competition; overregulation; extreme social polarization of citizens in terms of income and living standards’ weak and biased legal regulation; contempt or selective application of law; total corruption in the system of public administration, etc.

Rich in natural resources, resourceful people, and fertile lands, Ukraine might be a leading European economy. Yet, according to Forbes, it ranks third last in the world list concluded by Madagascar, where 77 percent of population lives below poverty line.

Ukraineis facing a problem of utterly uneven distribution of income and extreme concentration of capital, which hinders its progress.

POLARIZATION

If European nations have an income ratio of the poorest and the richest citizens of 1 to 6, in this country, according to the UN data, it is 1 to 30. As this gap keeps growing, it intensifies the polarization of society and distorts economy and social sphere.

According to various assessments, the assets of the 100 richest Ukrainians grew in 2010 by 20-30 percent, (to $80-90 bn.) compared to the previous year, which is comparable to two-thirds of the country’s GDP. Meanwhile, the UN data show that last year Ukrainians’ real earnings dropped by 10 percent on average. The data of the State Statistics Service of Ukraine suggest that today each fifth citizen receives a monthly income below minimum subsistence level (911 hryvnias). The number of people whose earnings are not sufficient even to buy food alone, has grown from 13.7 to 17.5 percent in the last six months (according to the Kyiv International Institute of Sociology). Even people with jobs are stricken with poverty, while 79 percent of poor households have unemployed members.

MONOPOLY AND THE DOLE

In Ukraine, the process of concentrating capital and the creation of monopolistic unions is continuing steadily. This results in the skewing of competitive market conditions, since monopolists have lobbyists in government, they have laws written to suit their needs, they get fiscal preferences, and some are even subsidized from state budget, as is the case with coal industry. Thus even big companies find it impossible to compete with them, let alone small businesses.

The concentration of capital is intrinsic to the most profitable industries (this being the major strategy of Ukrainian oligarchs), as the Antimonopoly Committee turns a blind eye. However, even its report remarks that in the recent year competitive markets shrunk by 6 percent, whereas the proportion of those with a “pure monopoly” grew by 2 percent, and those with signs of dominance, by 8 percent. The level of monopolization has grown in 29 industries, while only in 14 it has declined. The “pure monopoly” percentage has risen in all sectors of economy from 14.2 to 17.2 percent, while that of the markets with signs of dominance has soared from 36.6 to 64.5 percent.

Under current circumstances it is control over raw materials, rather than the possession of technologies, that allows oligarchs to buy metallurgical and chemical enterprises and gain competitive advantage in the market.

Surprisingly, neither the chemical nor metallurgical industry, which are under total control of oligarchs, are major donors to state budget. Thus, out of 93.7 bn hryvnias of all taxes to the treasury in the first half of 2011, only 1.5 bn came from metallurgy (1.6 percent of total), while the chemical industry contributed a ridiculous 0.8 bn hryvnias (0.85 percent). Meanwhile, the food industry and wholesale and retail trade, oriented towards domestic market, yielded 14.1 bn (15 percent) and 13.3 bn (14.2 percent) respectively, and even construction, which is still in recession, earned 2.5 bn for the budget.

Monopolies result in groundless growth in domestic prices due to the absence of competition. Big corporations dominating their markets get superprofits – the result of abuse through overpricing, the decrease of quality of products, etc.

COUNTRY AS A PASTURE

One of the major characteristics of oligarchical policy is the exploitation of available resources without systemic investment in upgrading and innovations.

Most Ukrainian oligarchs’ business strategy – the purchase of assets which give rapid profit – has remained unchanged since the times of the primary accumulation of capital in this country. Most oligarchs still cannot boast of long-term investments. Their empires do not comprise a business which they would have built from scratch or hi-tech companies. Thus, the present structural excesses in economy only worsen instead of being corrected. At the present level of the country’s technological development it is impossible to considerably raise productivity and speed up GDP growth. It takes a large-scale upgrading of the leading industries and incentives for new, promising business areas, as the present-day motors of economy (metallurgy, chemical industry, and agriculture) are incapable of such a feat due to the depreciation of the capital assets, obsolete technologies, etc.

Energy-intensive branches such as chemical and metallurgical industries (given the present-day sky-rocketing oil and gas prices) can only sustain competition in foreign markets only if power input is reduced. Instead, the economy in these branches is typically achieved at the cost of cutting wages.

A paradoxical situation is in place now. An abrupt transition of industrial giants to up-to-date technologies would cause a social shock, as most of the workforce would become redundant. This problem would be the worst in big industrial cities where such enterprises are major budget donors and the main source of jobs. This situation has created a certain dependence of the government on the owners of major enterprises. Wary of protests by the lower classes, the government is forced to give in to oligarchs and grant preferential tariffs for energy carriers, transportation, and so on – often at the expense of companies which are outside the major business groups. Here also belong overwhelming entitlement payments, the leftovers from the masters’ table for the poor, which only cripple the budget – instead of granting every individual decent condition for supporting himself or herself.

Other post-Soviet countries have also faced similar situations, when after the privatization of major enterprises large numbers of people were left out of work. This problem was solved through all-round support to entrepreneurial initiative and implementation of small business support programs. In a short time, this produced good results, whereas in Ukraine, the priority of metallurgical and chemical industries increases the economy’s dependence on imported gas and oil, on the one hand, and demand in foreign markets, on the other.

The export structure includes 35 percent non-precious metals, with 29.1 percent unprocessed, 7.8 percent – chemical products, and 13.7 percent mineral products. Over the past three years, the export of raw materials including energy resources and ores has grown from 8.7 to 13 percent. Exports claims the lion’s share of Ukrainian steel, whereas in other major steel-producing countries it is mostly sold in the domestic market.

The crises of 2008-09 has revealed that this structure makes Ukraine’s economy extremely vulnerable to possible changes in the global markets: the slump of its GDP was one of the worstin the world, just as the devaluation of its national currency. The 60 percent cut in metallurgy export and 80 percent in chemical industry export has considerably reduced the dollar and euro influx and thus caused a 15 percent slump in the GDP, together with a considerable deterioration of living standards.

A guaranteed acceleration of the Ukrainian economy requires investments into hi-tech industries with a large proportion of added value in their products. Meanwhile, now it is already very hard to find a niche in foreign markets of hi-tech products. Thus the country needs ample financial resources and highly advanced technologies. However, neither state nor big business (which is used to getting quick yields) will invest into research. At the same time, Ukraine is not able to supply even its own consumer market, which only worsens its dependence on imports.

UNFAVORABLE INVESTMENT CLIMATE

Over the recent year, foreign companies have invested nearly $7 bn into domestic economy. Direct investment over the recent 20 years comprises only $47.2 bn. The key reason for such low influx of capitals to Ukraine is the absence of favorable business climate and the investors’ mistrust of the government, which results from the latter’s policy of preferential treatment of loyal and close supporters. Few will invest their money into branches dominated by just a few, close-knit players. Foreign companies working in Ukraine constantly complain about unstable legislation, overregulation of business, and horrendous corruption at all levels of state administration.

Ukraine’s foreign investors are mostly offshore firms, and the capital is mostly owned by Ukrainian and Russian subjects. As a result, the budget misses out on earnings while the owners of the firms can promptly transfer their capital to accounts outside the country. This testifies to a lack of trust in the government and uncertainty owners have about the possibility of defending their rights in court should they suddenly face a lawsuit. Thus, the owners of capital, i.e. “oligarchs,” also do not trust the system which was created with their direct involvement.

THE MIDDLE CLASS AS AN ALTERNATIVE

To overcome the ruin of “oligarchonomy,” the middle class should become a major economic subject, as it is capable of promoting crucial and, most importantly, efficient social and economic transformations. Most nations rely on the middle class to create rapid GDP growth and considerable improvements in social conditions for the population. In EU states, small and medium business provide up to 60 percent of national GDP. In Ukraine, this index is a mere 10-15 percent; moreover, it is decreasing. Unlike in many developed nations, our middle class is weak, mostly because the development of small and medium businesses in Ukraine is artificially slowed down. The analysis of the regime's recent decisions and initiatives (restrictions on the simplified taxation system, the idea of moving unemployed population from depressive to more prosperous regions) suggests intentional action for turning the major part of the population into cheap workforce for the big business.

The power of the middle class is in its ability to invest into the development of economy, in particular, in high technologies, while poor people lack these resources and cannot produce anything. Furthermore, the middle class comprises several different social strata making it possible to ensure the development of traditions of trust and partnership in society.

The experience of other countries shows that this part of society could re-orient national economy towards innovative development.

A society with a prevalent low-income population gradually forms loose standards and standard of living expectations, which results in passiveness and the inability to take decisive action. Hence, another paradox of Ukrainian society: here the middle class lacks the support of both the masses and the oligarchs. If the latter will not allow critically minded people in power, the former perceive the middle class as “strangers” and do not believe that they can care for the interests of the poor.

Such stereotypes were largely created by media owned by the oligarchs. An analysis of reports and stories published during the weeks of the Tax Maidan makes this clear. All the calamities of old-age pensioners, teachers, and health care workers were blamed on “fat” small business, as one of the regime’s puppet journalists put it.

In developed countries, small business cooperates closely with big business, taking over the low-profit production which is in limited demand. This is where the specialists, redundant in the course of large-scale industry restructuring, can find the perfect niche for their expertise.

But as long as there still remain undistributed social resources (such as land, enterprises, large budget funds, etc.) which are a tidbit for the big business, it looks like the oligarchs will preserve and profit from the current system of exploitation. The words of Dmytro Firtash, a new representative of this class, are extremely revealing here: “We find it important to buy everything which is sold here, and then go on to buy outside Ukraine.” This phrase can become the slogan of Ukraine’s oligarchs – the future of this country is nowhere on their list of priorities.

The oligarch-and-masses economic model has no future. Ukraine’s chance to join the developed economies with high living standards critically depend on the dismissal of this model and on support for the middle class, which is a natural ally for any reforms genuinely aimed at the development of the country and helping it out of poverty.

THEY BET ON THE MIDDLE CLASS

Singapore

This country’s success stems from incentives for entrepreneurship and an all-round support for the small business. In the book written by Singapore’s ex-prime minister Lee Kuan Yew, From Third World to First, “trust” is the most frequent word. Trust enabled the republic to rise from misery without having any resources. 92 percent of enterprises are small and medium businesses. They make up 25 percent of the country’s annual GDP and 7 percent annual increase of employment.

Small enterprises enjoy preferences in taxation and loan resources with an annual interest rate of only 5 percent. There are about 100 government programs to support small and medium business.

In 1959, Singapore had only $400 GDP per capita, but in 1990 this figure had grown to $12.2,000, and by 1999 was almost $22,000. In 2010 – almost $57,000.

The World Bank ranks Singapore the first in ease of doing business and competitiveness, and it ranks No.2 in terms of the best investment potential, the highest GDP per capita, and the highest real income of the population. The population quintupled within just one generation.

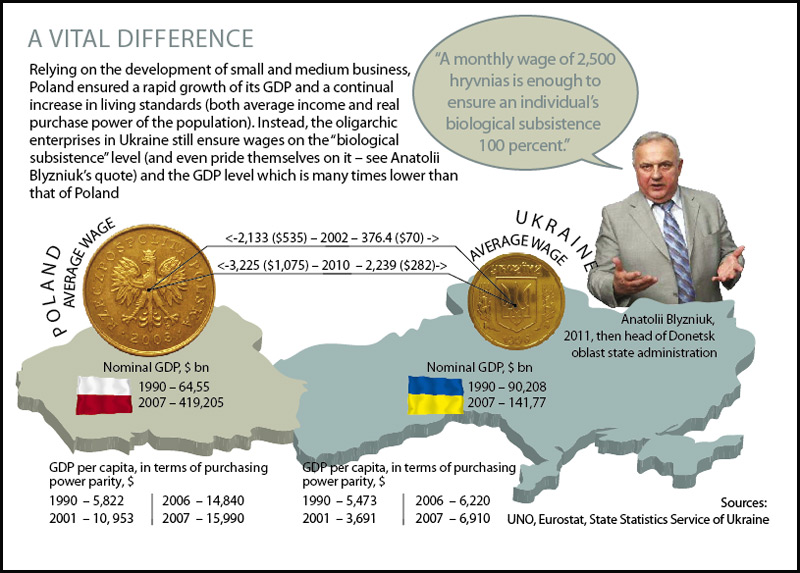

Poland

The stability of Poland’s economy is first of all ascribed to the priority of small entrepreneurship in the early 1990s, rapid and transparent privatization, and the liquidation of state monopolies. The conditions for starting and doing business were drastically simplified. Loans for opening a business were made available, and programs to support small and medium business launched.

Small and medium business is responsible for nearly half of the country’s GDP, with a dollar equivalent of $200 bn.

The conditions of running business, and taxation and regulation policies in Poland were reformed as to make it unnecessary for business owners to pursue a political or administrative career in order to promote their own interests. Besides, the state closely supervises the revenues of officials and their families, which helps nip corruption in the bud.

An average salary in Poland is above $1,000, with prices comparable to those in Ukraine.