Representatives of the government and the National Bank of Ukraine (NBU) repeat the following phrase in unison: “there is no threat to the stability of the hryvnia”. However, independent economists have predicted a significant devaluation for more than a year now, while the unceasing reduction in gold and exchange reserves and the ever more extravagant initiatives of the government in the area of currency regulation are evidence of the fact that the situation on the currency exchange market is on the verge of being critical.

FUNDAMENTAL FACTORS

The main factor of long-term action, which predetermines the devaluation of the hryvnia is a trade balance deficit. In Ukraine, the trade balance deficit for last year constituted USD 10.2bn, or 6.2% of GDP. The amount is significant, but in itself, it does not mean inevitable devaluation.

First of all, transition economies and the economies of developing countries often operate with trade balance deficit on an ongoing basis. This is caused by the low competitive capacity of export and a high demand for the import of high-technology in the process of the structural transformation of the economy. For example, in the last three years, on average, Poland’s trade balance deficit constituted 4.6% of GDP, but was offset by foreign investments and loans, which totaled 8.5% of GDP.

Secondly, the structure and growth of the deficit are important. If the amount is stable, and the structure leans towards goods that are within the range of investment demand that will become part of new manufacturing capacities producing goods that will squeeze out import or increase export, the deficit is safe for the currency exchange rate. If there is such a deficit, international creditors and private foreign capital will always help to resolve temporary foreign currency problems.

Unfortunately, not one of the aspects that allow Ukraine to avoid hryvnia devaluation with significant trade balance deficit present, is inherent in Ukraine. In the structure of commodity imports, investment designated technological production only amounts to about 15%. Another 35% is consumer goods, which make up almost half of the domestic commodities market. The remaining 50% is raw materials, from the existence of which, the operation of the Ukrainian economy, including exporters, has been dependent since Soviet times.

There is a negative growth in the deficit of foreign commodities trading. In the first nine months of this year, it constituted USD 9.3bn and grew by 57% in comparison to the relevant period of last year. Under such growth, Ukraine risks ending the year with a deficit of almost USD 14bn, which is almost as much as Azarov’s government in Kyiv pays for all of its imported gas! Against such a background, the government continues to stress that Ukraine pays an exorbitant price for imported gas, although the economy, at a gas price that is 20% lower than at present, will not even cover the growth of the deficit, not to mention its entire volume.

In other words, the problem is not actually in the gas price, but in the fact that Ukraine is losing its domestic market, while at the same time, export does not ensure adequate compensation. Moreover, in the last quarter, deficit growth has accelerated. On the one hand, the European crisis, which is gradually gaining global dimensions, has restricted demand for Ukrainian noncompetitive export. On the other, for the time being, enterprises are literally bearing the whole brunt of the blow, in other words, the income of Ukrainians has yet to feel the impact of the crisis in full, so at an unchanging hryvnia exchange rate, it ensures a significant increase in imports (via the commodities market).

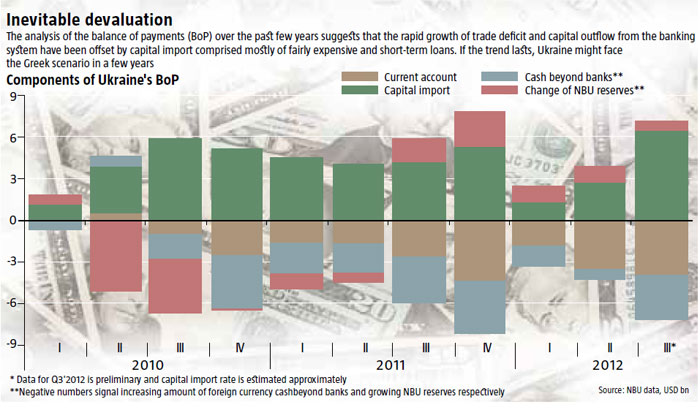

Prior to the beginning of this year, there was enough import capital to compensate the trade balance deficit, satisfy the demands of Ukrainians for cash currency and every now and again, even replenish the reserves of the NBU. However, in 2012, trends changed, and now, the influx of capital is too little to even cover the trade balance deficit. And don’t let the large volumes of capital, attracted in the third quarter fool you, because USD 2.6bn of them are expensive state Eurobonds. They, together with the USD 1.25bn, received from the additional allocation of funds in November, replaced the USD 3.5bn of the national debt, paid out to the IMF. Their servicing will be more than twice as expensive, and subsequently, in the near future will further worsen the problem of the balance of payments and currency deficit.

The inflow of capital did not stop covering the needs of the current account simply because of the increased deficit of the latter. The first two quarters of 2012 clearly indicate that investments and loans started to come to Ukraine at a much slower rate. And if the problems with the trade balance emerged as a result of the passivity of the government, then the dynamics of capital inflow – is the result of its single-minded actions, which have led Ukraine to lose its investment attractiveness in the eyes of non-residents.

So, the situation regarding foreign currency inflow is very complicated. First of all, under an unchanging hryvnia exchange rate, the trade balance deficit will increase. The national commodity producer will even lose his competitiveness on the domestic market. And since the global economy is heading towards recession, Ukraine will be feeling the effects of this to an even greater extent in the near future. Secondly, the inflow of capital will continue to decrease. The investment climate in Ukraine is extremely unfavourable. Thirdly, as previously indicated, the government is building a debt pyramid, paying external debt at the expense of new loans, but at rates that are several times higher than existing ones. Finally, next year, the repayment of previous loans will increase sharply in comparison to current ones, but the possibility of new borrowing, even under higher interest rates, will become more complicated, in view of the crisis on external financial markets. All of the above-mentioned factors are considerable, while the development of the situation in Ukraine and the world shows that they will continue for at least several financial quarters. For this reason, the deficit of foreign currency inflow is structural, so they will be impossible to overcome by one-off or moreover, exclusively administrative measures, which the government is resorting to.

ARBUZOV’S “CAST IRON” ARGUMENTS

However, the NBU is turning a blind eye to the logical arguments that are not in favour of supporting current hryvnia exchange rate – at least, in public, and for more than a year now, it’s counting on ever more extravagant methods for the administrative tightening of the screws which are supposed to prevent the collapse of the hryvnia rate.

Firstly, the NBU resorted to creating an artificial deficit of hryvnias on the market, so that banks would not be able to buy foreign currencies and instead were forced to sell US dollars and euros they got from loans and deposits. Having reduced refinancing volumes and increased reserve standards, at a certain stage, the NBU provoked a hryvnia deficit on the market and the sharp rise in its price on the interbank exchange market. Loans for enterprises became significantly less accessible, and this could not help but impact the further folding of business activity. Recently, individual credit rates exceeded crisis figures, posing a threat of bankruptcy for individual banks and a further increase in the cost of loans for enterprises. However, the greatest danger lies in the fact that money is leaving the economy and Ukraine is steadily moving towards chronic default and barter settlements.

There is also a kind of manipulation of the balance of payments (BoP), which the government, together with several oligarchs, has been practicing since the beginning of 2011. In less than two years, Ukrainian enterprises have received USD 6.3bn in trade credits compared to just USD 162mn in trade credits they issued. This means that either goods have been imported into Ukraine on credit (without relevant payment for them in foreign currency) for this amount, or money has been received for future export. The fact of the matter is actually a concealed article of the balance of payments deficit, which can hit it hard, and subsequently provoke additional demand for foreign currency at a later date.

Quite a resonant measure was the introduction of a requirement for individuals to show their IDs exchanging money. As a result, in the first nine months of 2012, the volume of the purchase of foreign currencies by banks from the public, constituted USD 11.3bn, the volume of sale – USD 17.6bn, a decrease of 23% and 29% accordingly in comparison to last year. The volume of the net sale of foreign currency to the public during this period constituted USD 6.3bn, which is 37% less than in the previous year. However, at the same time, according to various evaluations, the volume of shadow foreign currency circulation increased by at least 50%: foreign currency now passes through banks less frequently and more often through shadow currency exchange points. Thus, the scale of the currency issue is such, that passports have not significantly changed the situation.

Two more measures have recently been introduced to support the hryvnia – the restriction on the withholding of foreign currency earnings by exporters for a period of 90 days and a share of 50% as well as the obligation to sell currency earnings to private individuals on the interbank currency market in a volume of no less than UAH 150,000 per month. The first measure was practiced in Ukraine several times and was effective, to a certain extent. But it should be understood, that exporters, just like all other enterprises, pay salaries and buy raw material, so they cannot withhold a large amount of foreign currency without reducing production volumes. If there is a fall in production, the amount of money on accounts will be limited to inventories (raw material and finished production), which under current volumes of export and financial proportions, will not yield more than USD 5bn, but this will not even be enough for three months. As for the second measure, it is even less effective, after all, most money transfers by migrant workers to their Ukrainian beneficiaries, is directed towards consumption, so is exchanged into hryvnias. So only time will tell whether it will be possible to obtain at least several hundred million dollars from this measure.

And finally, the draft law on a 15% tax for the sale of cash currency. Prior to the implementation of such measures, it is necessary to be aware that the economic system generally finds means by which its currency flow evades most excessive barriers. As a rule, part of the shadow circulation of salaries will transfer into the hryvnia, however savings will continue to be made in foreign currency, particularly during a period, when the devaluation potential exceeds 15-20%. In addition, people often save for large purchases, which generally takes a long time. After all, it’s very likely that this is the manner in which the government has decided to simply provoke people into the large-scale sale of foreign currency “prior to the introduction” of the tax, and then either not actually introduce it, or cancel it.

WHAT NEXT?

To a greater or lesser extent, all of the above-mentioned measures in the battle with the currency deficit are temporary and one-off. Fundamental factors prove that the foreign currency deficit under the current exchange rate, and the pace of trade balance and BoP deficit growth will only increase. The government will have to consistently devise something new, but each new measure will be less effective each time. But taking into account the fact that within just under two years (as of the beginning of October) the NBU has spent about USD 5bn to maintain reserves (according to unofficial information, they are currently at a level of USD 24bn, against USD 29.2bn as of the end of September), the foreign currency market will “swallow up” the calming effect from even the most severe measures within a matter of weeks.

Meanwhile, negative trends will gain pace: the growth of the trade balance deficit, the decreased competitiveness of Ukrainian producers on both the external and domestic markets and subsequently lay-offs and a greater number of workers being sent on unpaid vacation, a reduction in the consumption of goods and services and subsequently, further pressure on the domestic market. At the same time, the government’s “foreign currency experiments” will force small and medium-sized business into the shadow and choose the dollar as a medium of exchange and measure of value. Should this be the case, not only will the hryvnia not gain, but will even lose its existing positions in the Ukrainian economy and risks repeating the fate of the coupon-karbovanets of the 1990s. In such an economy, only a select few will be able to ensure themselves a worthy existence, and there’s no point in even thinking about development, since people are very reluctant to invest in such a system and demand excessive interest rates.

Why does the government need this? The election is over and it can now duly respond to the challenge of the economic situation. The government could even benefit from hryvnia devaluation because it would manage to fill the budget with a larger amount of hryvnias, albeit substantially depreciated hryvnias, and plug the obvious holes in this year’s budget, and most importantly – next year’s as well. The oligarchs, oriented towards the steel and agricultural business, would obtain far greater proceeds in the Ukrainian currency. After all, for a certain period, they would be able to halt the unjustified high flow of imports and the fall in the competitiveness of domestic production, and thus, slow down the unemployment growth rate under global economic crisis conditions.

Could this whole battle with the dollar domination be provoked by the fact that the premier’s office is being prepared for the current Governor of the NBU and “Family” representative, Serhiy Arbuzov, and the collapse of the hryvnia prior to this appointment must be avoided at all costs? In any case, the hryvnia exchange rate remains a political factor, making the economic situation in Ukraine a hostage of not only party, but also specific personal interests.