The National Bank’s attempts to restrict demand for hard currencies on the currency market by administrative means have caused quite a buzz. In actual fact, the central bank has virtually not changed its currency rate or monetary policy since its inception, when Ukraine gained independence. The IMF and the World Bank have always imposed a formula of success on governments with transition economies, the purpose of which was to curb inflation and currency fluctuations using monetary methods. The practical reality of the formula is strict control of the amount of cash, but in essence – monetary hunger. Ukraine has already been taking measures to curb inflation and stabilize the hryvnia rate for more than 20, while setting the strategy and tactics for economic development as a secondary priority. The only exception was the period from 1999 to 2004, but it only confirmed the rule. At the same time, the fact that the formula does not work for transition economies was proved a long time ago. Moreover, the measures it entails only aggravate an already complex situation. Assuming that a transition economy will develop under monetary hunger conditions is simply nonsense. At the same time, a stagnant economy does not generate the cash flow needed to fuel its further development. So, here we are, trapped in a vicious circle.

It appears that the NBU leadership sees all these difficulties, understands the reasons for Ukraine’s weak economy, and even regularly sends letters to the Government, making note of threats and offering solutions. Meanwhile, the IMF, which is the key financial donor that has made Ukraine addicted to loans, is concerned with the growing inflation in the country. The Cabinet of Ministers is supposedly refusing loans, yet in fact, current economic policy barely differs from that implemented earlier. It uses the NBU to tighten the belt administratively, issues government bonds on an ongoing basis, designs some new instruments, such as currency rate-pegged government bonds, and collecting detailed information on all bank clients… All this only strengthens monetary hunger.

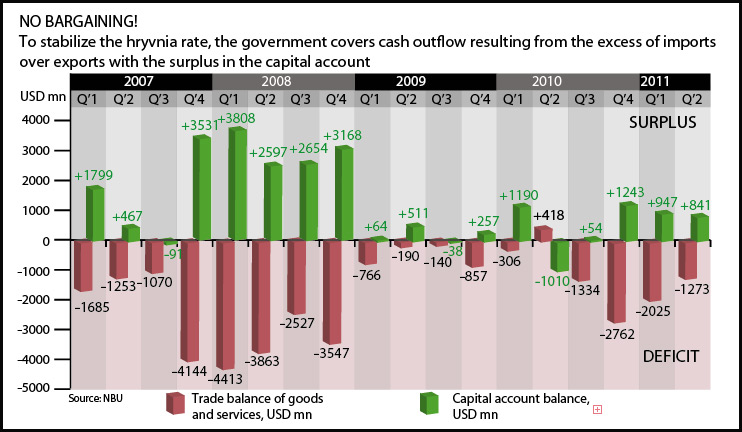

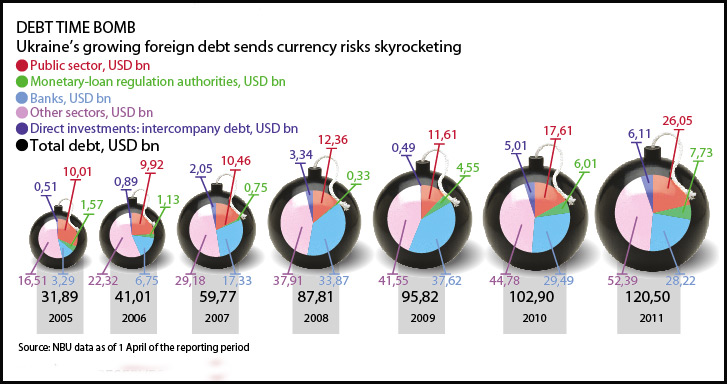

Meanwhile, the key question for Ukraine remains unanswered. How will national manufacturers develop in a situation like this? Even if they have access to financial resources, the latter are extremely costly, borrowed under an annual rate of at least 15-25%. Bank loan portfolios tend to become thin or barely change during crisis years, while manufacturers end up with no free cash – in other words, they stop developing and bring in no income… At the same time, developed economies have other strategies. They cut their discount rates to a minimum, leaving only a symbolic 3-5% interest rate for loans, while companies get subsidies from state funds. Is it possible for Ukrainian manufacturers to strengthen their already weak positions under these circumstances at least in Ukraine, not to mention foreign markets? Without doubt – no… Under such circumstances, Ukraine’s balance of payments inevitably remains negative – it cannot be otherwise, while currency risks grow. As a result, those in power are killing Ukraine’s economy and creating all prerequisites for further devaluation while outlining good intentions for curbing inflation and keeping the hryvnia stable. In fact, though, it is real manufacturing that provides resources and improves the balance of foreign trade, and accordingly, stabilizes the hryvnia rate.

In 2007, the IMF and the World Bank diagnosed Ukraine with an overheated economy and forced a tough monetary policy on the government. But this was wrong. More than that, it was a killer! Ukraine had an overheated demand, which was not the case with the economy, something that is completely different. The treatment should have been different, too. Now, Ukraine faces an inflation of expenses that has nothing to do with the amount of cash in circulation. Firstly, the USA has been printing ever more money since 2008, which is directed towards virtual markets, primarily stock and financial markets. This, in turn, sends oil, gas and food prices soaring on global markets and hurts manufacturers, particularly Ukrainian ones. Secondly, the growing cost of loans in Ukraine is the consequence of a decision for overcoming the banking system crisis in 2008 by means of the erroneous suspension of lending and the collection of debts to show good results to shareholders. Yet, both factors are in no way related to the excess of money! On the contrary, they signal a shortage of cash in Ukraine. Therefore, continuing to treating the illmess with monetary hunger is absurd. Domestic enterprises get weaker by the day, accompanied by a growing demand for imported goods and a deteriorating trade balance.

Ukrainian economic policy looks inconsistent, to say the least. On the one hand, the NBU liberalizes the currency market, allowing banks to buy and sell currencies within the limits of the foreign currency position, introduces currency swaps and so on. Then, it accuses financial institutions of fraud, launches a battle to stabilize the hryvnia exchange rate via administrative means, particularly the tough control of currency exchange transactions and causes private individuals to panic. Before declaring war against the shadow market, it would make sense for the NBU to find out, first and foremost, why it has emerged and developed to an unacceptable extent. Most individuals have nothing to do with this! Moreover, the shadow market has always provided the cash that the legitimate one lacked. The government’s attacks on the grey zone will only make the country more cash-hungry. Meanwhile, the restriction of cash resources by the NBU is the source of serious problems. The 2008 devaluation did not bring the expected results and domestic manufacturers became less competitive, yet nobody learned anything from this bitter experience. The policy that the NBU is currently implementing is simply a repeat of its old mistakes. The 2008 scenario is as follows.The National Bank’s attempts to restrict demand for hard currencies on the currency market by administrative means have caused quite a buzz. In actual fact, the central bank has virtually not changed its currency rate or monetary policy since its inception, when Ukraine gained independence. The IMF and the World Bank have always imposed a formula of success on governments with transition economies, the purpose of which was to curb inflation and currency fluctuations using monetary methods. The practical reality of the formula is strict control of the amount of cash, but in essence – monetary hunger. Ukraine has already been taking measures to curb inflation and stabilize the hryvnia rate for more than 20, while setting the strategy and tactics for economic development as a secondary priority. The only exception was the period from 1999 to 2004, but it only confirmed the rule. At the same time, the fact that the formula does not work for transition economies was proved a long time ago. Moreover, the measures it entails only aggravate an already complex situation. Assuming that a transition economy will develop under monetary hunger conditions is simply nonsense. At the same time, a stagnant economy does not generate the cash flow needed to fuel its further development. So, here we are, trapped in a vicious circle.

It appears that the NBU leadership sees all these difficulties, understands the reasons for Ukraine’s weak economy, and even regularly sends letters to the Government, making note of threats and offering solutions. Meanwhile, the IMF, which is the key financial donor that has made Ukraine addicted to loans, is concerned with the growing inflation in the country. The Cabinet of Ministers is supposedly refusing loans, yet in fact, current economic policy barely differs from that implemented earlier. It uses the NBU to tighten the belt administratively, issues government bonds on an ongoing basis, designs some new instruments, such as currency rate-pegged government bonds, and collecting detailed information on all bank clients… All this only strengthens monetary hunger.

Meanwhile, the key question for Ukraine remains unanswered. How will national manufacturers develop in a situation like this? Even if they have access to financial resources, the latter are extremely costly, borrowed under an annual rate of at least 15-25%. Bank loan portfolios tend to become thin or barely change during crisis years, while manufacturers end up with no free cash – in other words, they stop developing and bring in no income… At the same time, developed economies have other strategies. They cut their discount rates to a minimum, leaving only a symbolic 3-5% interest rate for loans, while companies get subsidies from state funds. Is it possible for Ukrainian manufacturers to strengthen their already weak positions under these circumstances at least in Ukraine, not to mention foreign markets? Without doubt – no… Under such circumstances, Ukraine’s balance of payments inevitably remains negative – it cannot be otherwise, while currency risks grow. As a result, those in power are killing Ukraine’s economy and creating all prerequisites for further devaluation while outlining good intentions for curbing inflation and keeping the hryvnia stable. In fact, though, it is real manufacturing that provides resources and improves the balance of foreign trade, and accordingly, stabilizes the hryvnia rate.

In 2007, the IMF and the World Bank diagnosed Ukraine with an overheated economy and forced a tough monetary policy on the government. But this was wrong. More than that, it was a killer! Ukraine had an overheated demand, which was not the case with the economy, something that is completely different. The treatment should have been different, too. Now, Ukraine faces an inflation of expenses that has nothing to do with the amount of cash in circulation. Firstly, the USA has been printing ever more money since 2008, which is directed towards virtual markets, primarily stock and financial markets. This, in turn, sends oil, gas and food prices soaring on global markets and hurts manufacturers, particularly Ukrainian ones. Secondly, the growing cost of loans in Ukraine is the consequence of a decision for overcoming the banking system crisis in 2008 by means of the erroneous suspension of lending and the collection of debts to show good results to shareholders. Yet, both factors are in no way related to the excess of money! On the contrary, they signal a shortage of cash in Ukraine. Therefore, continuing to treating the illmess with monetary hunger is absurd. Domestic enterprises get weaker by the day, accompanied by a growing demand for imported goods and a deteriorating trade balance.

Ukrainian economic policy looks inconsistent, to say the least. On the one hand, the NBU liberalizes the currency market, allowing banks to buy and sell currencies within the limits of the foreign currency position, introduces currency swaps and so on. Then, it accuses financial institutions of fraud, launches a battle to stabilize the hryvnia exchange rate via administrative means, particularly the tough control of currency exchange transactions and causes private individuals to panic. Before declaring war against the shadow market, it would make sense for the NBU to find out, first and foremost, why it has emerged and developed to an unacceptable extent. Most individuals have nothing to do with this! Moreover, the shadow market has always provided the cash that the legitimate one lacked. The government’s attacks on the grey zone will only make the country more cash-hungry. Meanwhile, the restriction of cash resources by the NBU is the source of serious problems. The 2008 devaluation did not bring the expected results and domestic manufacturers became less competitive, yet nobody learned anything from this bitter experience. The policy that the NBU is currently implementing is simply a repeat of its old mistakes. The 2008 scenario is as follows.

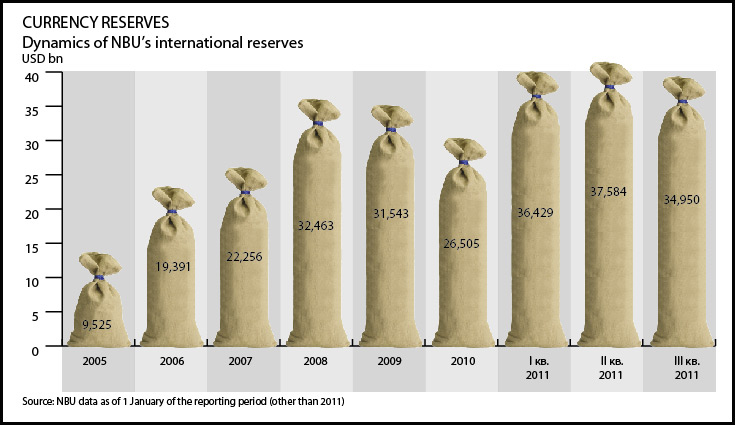

Generally accepted practice is to count the volume of Ukraine’s international reserves as an indicator of hryvnia stability. To support it, the regulator conducts transactions on the interbank market. However, a better strategy is to take into account the extent to which Ukraine’s currency reserves cover its external debt rather than the quantitative criterion, given the tightly intertwined political and business interests in the country. Ukraine has USD 50bn of government and corporate loans to repay by 1 July 2012. The expected decline in Ukrainian steel exports, unstable price of Russian gas, the declining amount of cash transfers from Ukrainian migrant workers abroad, and other factors do not inspire optimistic mid-term currency rate projections.