Back at the beginning of 2019, The Ukrainian Week noted that launching an electricity market without resolving the perennial problems of Ukraine’s power sector not only would not improve the situation, but would likely give birth to even more challenges. Why? Because reformers were focusing on the sale of electricity but not on its generation. The first four months of operational electricity market in Ukraine unfortunately confirmed our concerns.

The fact that the launch of the electricity market took place on July 1, meaning in the midst of a major transfer of power in Ukraine, offered the perfect environment for a brisk informational war between the two oligarchic camps and made full use of new instruments to their own advantage. This might have been cause for joy for some corners, if the main victim in this war for domination weren’t the entire country, together with its energy and political security.

The Akhmetov market

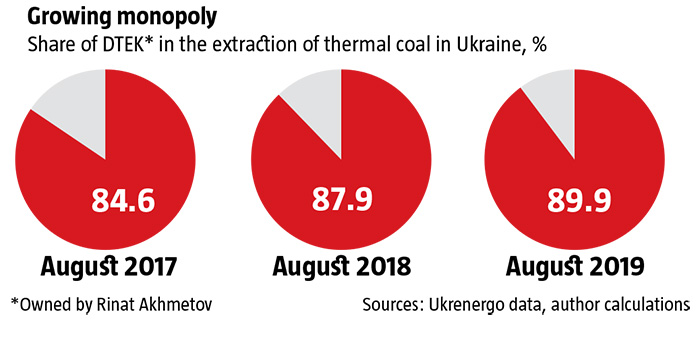

At Rinat Akhmetov’s DTEK, the launch of an electricity market initially fostered great expectations. People connected to the oligarchs were actively lobbying for rules in the law on the electricity market that would benefit his monopoly. Controlling up to 90% of all thermal coal extracted domestically and the generation of the lion’s share of power coming from co-generation plants or TESs, DTEK was counting on opportunities to force its conditions on consumers.

The reality was that, without DTEK, the other domestic power generators, dominated by state-owned Energoatom, Ukrhidroenergo and Tsentrenergo, were unable to cover all the demand for electricity. Since it had the possibility of regulating the scale of the shortage of electricity on the domestic market, DTEK immediately chose the tack of blackmailing participants and forcing utility rates up. The average price to buy electricity on the wholesale market by distribution system operators was UAH 1.32/kWh in May, slipping to UAH 1.19 in June. However, after the market kicked in, the average weighted price on the day-ahead market (DAM) jumped to UAH 1.64/kWh in July and to UAH 1.68 in August. In September it slipped again, to UAH 1.62, but that was still much higher than it had been in May or June.

RELATED ARTICLE: A little less conversation, a little more reforms

The result has been that since the market was launched, there is a continuing shortage of current, especially in those segments of the market where price caps limit prices. For instance, there was a shortage on the cheaper day-ahead and intraday markets and customers were forced to buy at the higher balancing market, where current is priced far higher and is intended to only cover minor unplanned customer needs.

What’s more, DTEK never made a secret of the fact that to cover the shortage it wanted to cancel limits or increase price caps on electricity rates and institute “premiums” on flexible generation, to which the company’s TESs belonged. In this way, DTEK’s monopolist interests were leading to a paradoxical situation: a huge power shortage on a domestic market that actually had a surplus of power capacity.

The Kolomoyskiy factor

Meanwhile, after the presidential and parliamentary elections this year, Akhmetov’s old rival gained significant leverage in the decision-making process in the new administration. Ihor Kolomoyskiy’s export-oriented businesses use a lot of electricity, but he has never owned power-generation capacities for his plants. And so, after the government changed hands, focus immediately went to having managers connected to the Dnipro oligarch establish control over Tsentrenergo, a state-owned utility that generates power at coal-fired plants. It became very clear that Kolomoyskiy’s intentions regarding Ukraine’s power industry or state stakes in the industry were as removed from Ukraine’s national interests as Akhmetov’s monopoly.

By summer, the new management at Tsentrenergo signed a contract to buy a large party of Russian coal for UAH 400 million through an intermediary company called Nafta-Force, whose founder and director is closely connected to Kolomoyskiy’s Privat business group. Later it turned out that the power generated using expensive Russian coal at Tsentrenergo was being sold at a loss to companies belonging to Kolomoyskiy. Market observers immediately pointed out that it was likely that this was an attempt to bankrupt the utility in order for business entities connected to the oligarch to acquire it for peanuts during the next round of large privatizations that the Government had already announced.

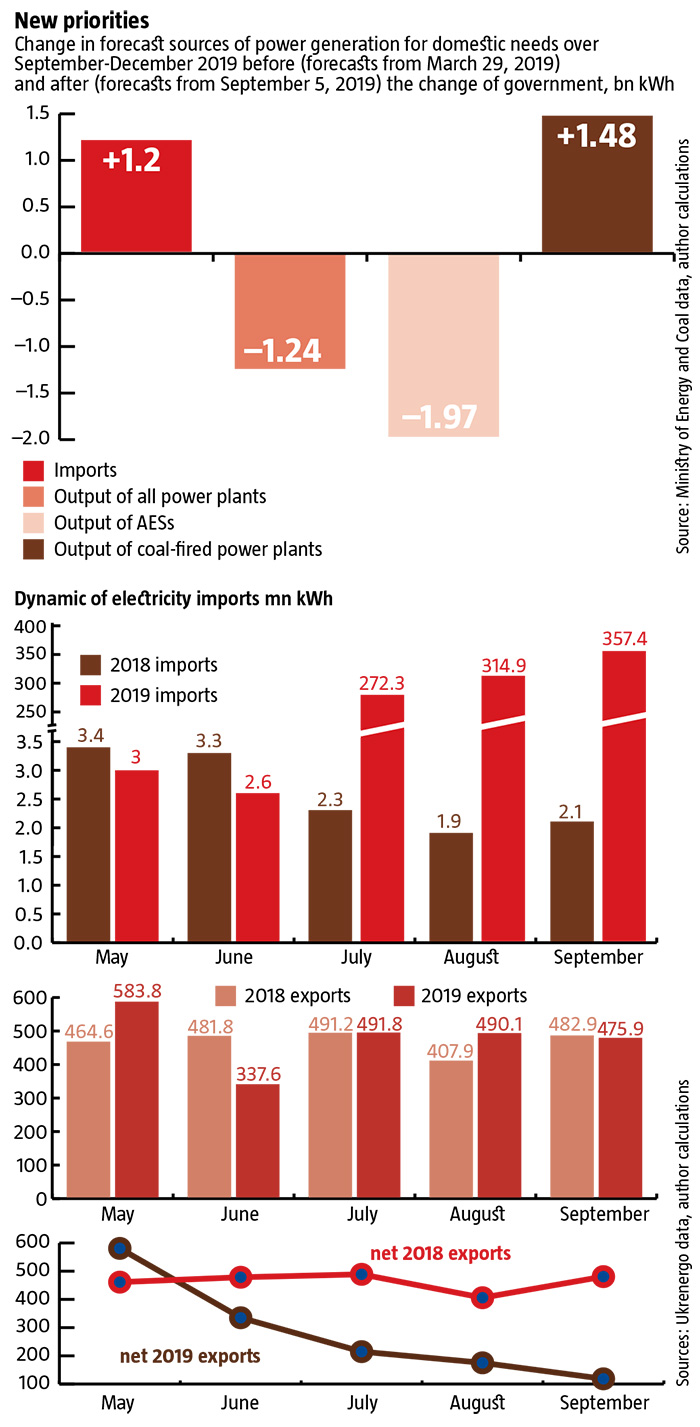

Another instance in which Kolomoyskiy was taking advantage of the new administration was a steep rise in imported electricity (see New priorities). This began back in July and by September it was coming from Belarus, but also from Slovakia for the Burstyn energy island. Still, in September, the chair of the VR electricity committee, Andriy Herus, lobbied for a scandalous amendment that removed obstacles to the massive import of power generated in Russia and to sharply increase imports from Belarus.

Given that Belarus doesn’t have any reserves to be able to increase its export of electricity to Ukraine –they could appear after the launch of a Russian-built Belarus AES slated to go online in 2020 – so for now it’s effectively Russian electricity that is transiting across Belarus territory. For instance, over January-August 2019, Belarus itself actually imported 17.4mn kWh of power from Russia and exported only 0.25mn kWh to Ukraine, according to Minsk’s statistics. Curiously, Ukraine’s Derzhstat, the statistics office, showed imports from Belarus of 104mn kWh, meaning that it was mostly transit Russian electricity.

In total, Ukraine imported 0.95mn kWh in QIII alone in 2019, with 0.44mn kWh of it coming directly from Russia. Since then, imports have nearly doubled to 106mn and 186mn kWh. Of the 85.1mn kWh increase in imports in September compared to July, 80.0 kWh came from Russia and Belarus.

Who really benefits from importing Russian electricity can be easily seen by looking at who bought power transmission capacities for imports in November: United Energy, a company linked to Ihor Kolomoyskiy and Ihor Surkis, increased such purchases for importing power from the Russian Federation fivefold compared to October, to 500 MW. By comparison, other companies such as DE Trading, linked to Donbasenergo increased 2.66% and Serhiy Tihipko’s TAS Energia Ukraine increased 12.9%.

Still, Kolomoyskiy is hardly the only one connected to the Zelenskiy administration who is interested in arranging large-scale imports of electricity from Russia and other countries. For instance, oligarch Viktor Pinchuk’s Interpipe holding company has assessed its potential losses from the launch of an electricity market at US $1 million monthly. The same interest can be seen among other influential players on the Ukrainian market.

The real danger lies in the fact that, in the interests of its two main sponsors in the 2019 elections, Kolomoyskiy and Pinchuk, the Zelenskiy team has opened a Pandora’s box and sent out a signal to market players that the way to make money going forward will be by importing and re-selling on the domestic market. Indeed, an in-depth look at the new Government’s changes to the forecast electricity balance for H2 2019 shows (see New priorities) that it is deliberately aiming to substitute domestic power generation with imported power. Moreover, this is not by cutting back on coal-fired TESs or co-generation plants, but primarily by reducing output at Ukraine’s AESs –the atomic energy stations. that currently generate close to 50% of domestic electricity.

Free cheese in a mousetrap

At first glance, it may seem that those proposing imports achieved the result that they wanted—a saturated market that would push prices down. The latest data that the state enterprise Operator Rynku or Market Operator reported on November 6 showed that the price was UAH 1.42/kWh ex VAT on the DAM, while on November 4 and 5 it was as low as UAH 1.39/kWh. In this way, any rising cost for commercial customers after launching the electricity market was largely eliminated.

But it’s important to understand the price paid to achieve this result. The DAM is more and more being determined by Russian electricity imported both directly and through Belarus, and this is growing rapidly. To cast a smokescreen over these developments, the Zelenskiy administration says that importers of Russian electricity are supposed to pay 2% duty, which will supposedly be used to compensate for the start of purchasing current from the enemy. However, this does not and cannot constitute a barrier to large-scale expansion of Russian electricity on the Ukrainian market.

What’s really striking is that the import of power from Russia and Belarus is growing by leaps and bounds, even as prices are in steep decline and it is evidently unprofitable. For instance, on October 24, Andriy Herus, chair of the profile VR committee and the main lobbyist for large-scale imports of Russian electricity, wrote on his Facebook page: “Based on current prices, importing power is unprofitable. From Belarus it’s slightly unprofitable, but from Russia it’s very unprofitable. Today, all importers sell their electricity on the day-ahead market and are losing money on every kilowatt hour. As to Russia, it’s losing money and paying customs to the state budget of Ukraine.”

However, the volumes of imports that were “loss-making” not only did not go down in November, which should have been the natural market response, but grew sharply. Among others, daily deliveries from Russia jumped from 4 million kWh to 12mn. Meanwhile Ukraine, which until not long ago was earning hundreds of millions of dollars on exporting electricity, became, in a matter of months, a net importer. According to Ukrenergo’s dispatcher data, the balance of power being transmitted between Ukraine and other countries became a stable surplus as of November 1. At the same time, peak net imports are already up to 0.9-1.2 GW, a volume very similar to the typical power block output at most of Ukraine’s AESs, 1 GW.

Critically, other than a temporary benefit to Ukrainian traders and, to a lesser extent, the country’s consumers,the continuous growth of Russian deliveries of electricity at a depressed price is following the classic scenario where a large outside player deliberately undercuts prices initially in order to take over a market and monopolize it. Any strategy designed to squeeze out domestic players includes compensating losses from depressed prices by hiking them once control is established.

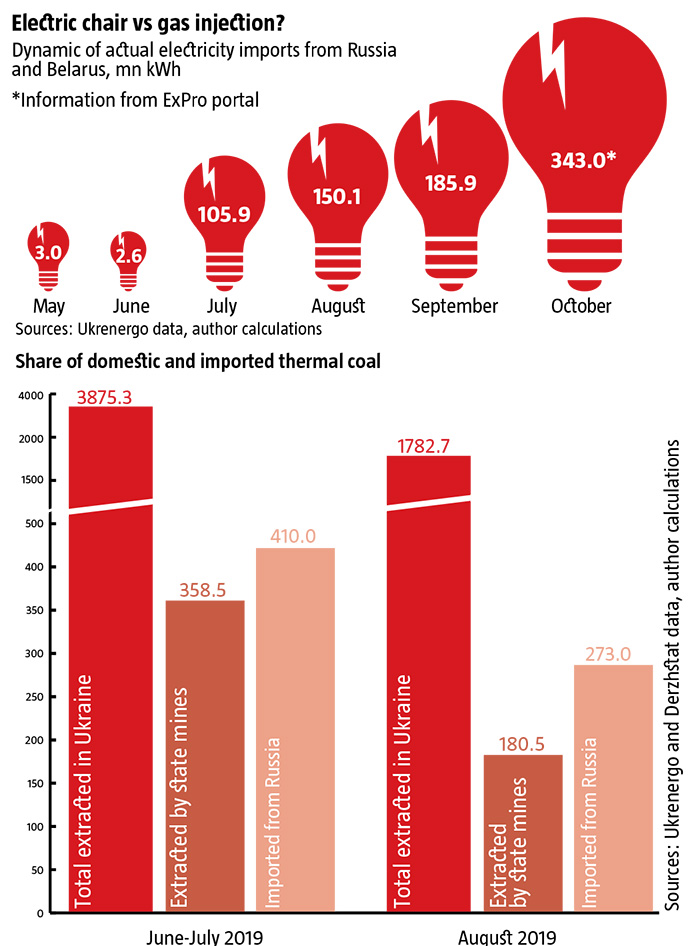

According to Operator Rynku, the overall volume of power sales on the DAM in Ukraine’s electricity system in October – not counting the Burshtyn electricity island – was 3.35bn kWh, while imports from Russia and Belarus added up to 343mn kWh, which was already more than 10% of the day-ahead market. As already noted, at the beginning of November, the average daily indicator for electricity imported from the Russian Federation grew another 8mn kWh, which could mean an additional 240mn kWh over the course of a month, even if import levels don’t increase at all. At this pace, the Ukrainian market share of imported Russian power, including that imported via Belarus, could easily reach 20-25%.

Why import? Demonopolize!

The new administration and lobbyists linked to Ihor Kolomoyskiy argue that there is no alternative to opening the Ukrainian market for Russian electricity monopolists to take over the market, either directly or via Belarus, suggesting that they are either unable or unwilling to make use of more appropriate and effective anti-monopolist instruments in this situation. What’s more, the informational noise caused by the war between Akhmetov and Kolomoyskiy around the question “to import or not to import” is dangerous in yet another aspect: it is distracting attention from resolving the problem of the way Ukraine’s coal and co-generation market has been monopolized.

After all, DTEK really is a monopolist on the Ukrainian market a problem that needs to be resolved as soon as possible because it is undermining the sector and harming the country. How can there be any competition on the domestic market if DTEK controls 90% of thermal coal extraction in Ukraine and then the lion’s share of what is used by TESs to generate electricity? Under the present circumstances, the Donetsk oligarch can obviously dictate prices to companies that sell it directly to consumers.

In the same way, it’s no secret that the path of coal from the mining company to the TES utility moves through offshore “gaskets” where most of the superprofits are concentrated. That’s why Akhmetov’s DTEK has no interest in extracting larger volumes of coal: it would only oversaturate the market and drive prices down.

Under the circumstances, the first thing that needs to be done is for coal extraction to be demonopolized and a properly competitive coal exchange set up for trading in Ukraine. This means forcing the break-up of DTEK’s coal extraction assets into at least 3-4 companies with truly independent end owners. These owners will be interested in expanding their output by pushing out competitors and that will be in a position to properly raise the profile of Ukraine’s hydrocarbons sector. This would immediately lead to lower prices for coal and, therefore, for electricity that is generated using it at the country’s TESs.

RELATED ARTICLE: A reality check

Instead, those lobbying for importing electricity from Russia come across as “useful idiots” promoting Moscow’s concept of an energy empire in Ukraine and control over other countries by gaining dominant positions on their energy markets – gas, petroleum products, electricity, nuclear fuel, and so on. By not focusing on demonopolization and developing a competitive market in Ukraine rather than importing more and more thermal coal and electricity produced in Russia has already led to a major reduction in output at Ukraine’s mines (see Share of domestic and imported thermal coal). In August, the latest month for which data was available, imports of thermal coal from Russia were already 150% more than what was produced at state mines in Ukraine.

What’s worse, the current government not only is not reducing but even strengthening DTEK’s monopolist position on the Ukrainian coal market. Until not long ago, the company controlled around 80%, but by August its share of domestic extraction was already at 90% (see Growing monopoly). This is all happening while Ukraine’s own coal extraction and generation are in decline because the current leadership is only deepening this process by its actions.

At the same time, efforts by officials in the government, such as Andriy Herus, to equate the import of electricity from Russia and the import of fuel rods for Ukraine’s AESs simply deflect attention and try to persuade everybody that it’s all “no big deal.” For one thing, the supply of nuclear fuel has been diversifying in recent years, even if not as quickly as we might like. According to Derzhstat, RosAtom’s share of deliveries was down to 56% in the first 8 months of 2019, while Westinghouse’s share was up to 44%. To focus on increasing imports of electricity and thermal coal from Russia, which the Zelenskiy administration is doing, on the contrary, guarantees a sharp increase in Ukraine’s dependence on the enemy in an area where it is completely unnecessary (see Electric chair vs gas injection?).

If Ukraine continues to play with fire by increasing its use of Russian electricity, it will simply be replacing the monopoly and blackmail of Akhmetov’s DTEK with the monopoly and blackmail of OAO RAO UES of Russia. This is not only completely unacceptable in terms of national security, but extremely damaging to economic growth, to the process of leaving the orbit of Ukraine’s one-time colonizer, and to the ongoing reorientation of Ukraine’s energy sector towards integration with the EU.

Translated by Lidia Wolanskyj

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook