“When’s the dollar finally going to go up again?” asks a friend, nervously pulling on his cigarette. He started building, something that needs constant funding, moreover in hryvnia. But he’s been keeping all his savings in dollars, so the last few months, as the hryvnia slowly picked up strength, he has constantly been faced with a choice: keep up the dollars or the pace of construction. And with trembling heart, he has chosen the latter, changing the bigger part of his hard-earned bucks into hryvnia and buying building materials.

My friend’s system for making financial decisions is part of the arsenal of millions of Ukrainians. The entire period of independence has shown that our currency sooner or later loses value. The NBU recently calculated that the hryvnia has devalued to the dollar something like 15 times since it was first introduced in 1996. Even a brief period of revaluation, such as in the spring and summer of 2008, was inevitably followed by a much longer and steeper devaluation. People who have gotten used to this tend to keep savings in hard currencies, especially those who hang on to savings over the longer term and have neither the time nor the skills to regularly track the dynamics of the hryvnia’s exchange rate and projections for it.

RELATED ARTICLE: How commoditized is Ukraine's economy

Over the last three years, the hryvnia has been floating almost freely. In this situation, the dollar has tended to recoup its records every fall and winter. This has only confirmed for ordinary Ukrainians that the hryvnia will only continue to lose value. These days, even housewives can be heard to say, “The dollar’s going to go up.” Moreover, they say this in a tone much like that of the old prophets when they pronounced their visions.

Under the circumstances, the slow and steady, if not overly significant—under 10%—strengthening of the hryvnia this year was an unpleasant surprise for many. The nadir came on January 1, when the hryvnia fell to UAH 28.80 to the dollar—a hryvnia cheaper on the interbank currency exchange. After that, the hryvnia grew in value all the way to the end of August. Many of those who decided to buy dollars last fall or winter regretted it. Some lost their patience and even fell into a panic: these were the ones turned in their dollars or euros, fearing that they would grow even cheaper. But is there an economic basis for this kind of worry? What’s going to happen with the hryvnia’s exchange rate in the next while?

A shaky foundation

When a national currency has a floating exchange rate, its value is determined by the market and it’s determined by income and payments in foreign currencies. The National Bank of Ukraine regularly tracks these flows and consolidates these figures in the balance of payments, which it publishes monthly. The numbers that are included in the balance of payment are directly connected with fundamental trends in the domestic economy and are essentially its numeric representation. Given that trends generally last more than a month and often even longer than a year, analyzing them makes it possible to figure out where in general the currency market is likely to go and, with it, the hryvnia exchange rate.

When a national currency has a floating exchange rate, its value is determined by the market and it’s determined by income and payments in foreign currencies. The National Bank of Ukraine regularly tracks these flows and consolidates these figures in the balance of payments, which it publishes monthly. The numbers that are included in the balance of payment are directly connected with fundamental trends in the domestic economy and are essentially its numeric representation. Given that trends generally last more than a month and often even longer than a year, analyzing them makes it possible to figure out where in general the currency market is likely to go and, with it, the hryvnia exchange rate.

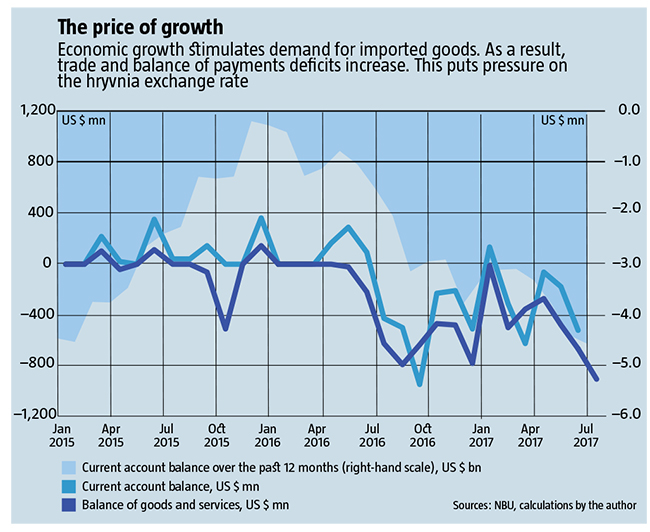

Today, there are several key trends. One of them is the growing current account deficit or CAD, whose main components are the export and import of goods and services, wages and salaries, interest and dividends to foreigners, and monetary transfers (see The Price of Growth). In the last 12 months to the end of July, the CAD has grown US $4.6 billion, higher even than it was in 2014, although GDP is considerably smaller now. The pace of growth of the deficit is striking: just a year ago, it was one third of what it is now, while one or two months actually posted a surplus. This trend is worrying, because if a country has a deficit on its current account operations, it means it’s taking in less hard currency than it is spending. At that point, the country either finds sources for financing this deficit, usually foreign investment or credits, or the deficit leads to a lack of hard currency on the domestic market and slowly exerts downward pressure on the local currency. If the CAD grows too quickly, the need for external financing becomes urgent and there is a growing risk that that investors and creditors will refuse to provide capital. In other words, a high deficit goes hand-in-hand with a currency crisis and often turns into one.

Again, the key factors in a current account deficit are exports and imports. Exports are in a healthy state in Ukraine right now: in the first half of 2017, exports of goods grew 24.2% and exports of services grew 9.6%, although their total volume is considerably smaller. Exports of goods grew thanks to growing prices for key products, an average of 10-15% almost every month for the previous half-year. Physical volumes grew as well, especially for agricultural products. In other words, exports grew not only because of better prices on world markets for raw materials, but also in higher demand for Ukrainian-made products. In short, it’s possible to expect exports to continue to grow, which, in and of itself, is a good thing.

RELATED ARTICLE: New growth areas in the Ukrainian agricultural sector are gradually changing the industry

Unfortunately, against this accelerated growth in exports, imports grew even more quickly: In the first six months, imports of goods jumped 29.9%, plus services another 7.1%, although here, too, volumes were relatively small. This is what determined the sharp growth in the CAD.

What’s important is that Ukraine began to import much more, not in the way of consumer goods, but of goods that are used for production and manufacturing, from fuels and mineral fertilizers, to various kinds of machinery and equipment. This has two positive aspects to it. Firstly, an economic recovery demands that businesses replenish stores of raw materials and supplies. Because many of these are imported, the inflow of such goods grew. But the minute the volume of industrial supplies is restored and becomes enough for the planned volumes of output, imports of those categories of goods will become steadier. This could eventually lead to a reduction in the current account deficit.

Secondly, a significant share of these imports is investments. For four quarters in a row now, starting in QIII of 2016, capital investments in Ukraine have been growing 20% and more. It’s clear that most equipment and machinery is not made in Ukraine and needs to be brought in. The negative impact of this kind of imports on the CAD is temporary and limited, given that capital investments generate production, and this production will either increase exports or replace imports. This is why the hard currency spent and the goods imported for investment purposes soon pay themselves off because the current account will improve permanently.

It follows from this that, although the CAD has been growing sharply and putting pressure on the hryvnia, it is a positive trend and thus, unlikely to remain at this high level for too long. If this is indeed the case, then this will not jeopardize the stability of the hryvnia and Ukraine will be easily able to finance it.

A matter of finances

Regardless of the nature of the CAD, however, it has to somehow be financed. In other words, the country needs to attract money to its balance of payments account, and that means getting money from equity or portfolio investors and lenders—not a simple task. Over the last three years, when Ukraine’s economy was in the doldrums, the main sources of external financing were IMF lines of credit and assistance from other international donors. This was enough for a while, when the CAD was not overly large and restructuring gave the country breathing space on paying back its debts. But time stops for no one and the situation has changed.

Over 2017-2019, the Government alone will have to pay back US $8.9bn, not even counting the “Yanukovych debt” of US $3bn. The peak of payments comes in 2019, an election year. Payments are also going to go up in the private sector, where a slew of businesses restructured their external debts together with the Government. Given the growth of the CAD, there already isn’t enough to even cover international donors during this period—even if Ukraine keeps receiving funding in the planned quantities, which no one can guarantee. The question arises whether there are alternative sources of external financing that might supplement international financial assistance or even substitute the lion’s share of it? Indeed, there are some hypothetical options.

Traditionally, the healthiest source of external financing is foreign direct investment (FDI). In 2016, Ukraine received US $3.4bn. But most of this sum was only on paper being actually the transfer of the foreign debts of banks into capital as part of NBU’s requirement to recapitalize financial institutions. Very little came in as live money. Moreover, this can be seen in the indicators for 2017, reflecting the low level of recapitalization this year: for the first 7 months, US $1.3bn in FDI came to Ukraine, not even close to enough to cover the country’s needs. This is fully 48% less than FDI for the same period of 2016, but this time there’s more “live” money. It’s a seemingly positive trend, but the quantity of high currency gained through FDI is immeasurably less than what is actually needed. Even if this amount grows steadily over the next few years—and there’s no guarantee it will—, it will still be too little. Ukraine needs to be looking for other source of financing.

The situation with private credits is very similar. Over January-July, net inflows of hard currency from the issue of eurobonds to non-financial corporations added up to US $283mn, with another US $322mn from other external credits. These sums are much larger than in 2016, when almost nothing was drawn on. But this is miniscule compared to what Ukraine needs to pay back. It’s important that this year, Kernel and Myronivskiy Khliboprodukt both also placed eurobonds that garnered them US $500mn each. But this money does not figure in the balance of payments, meaning that this money went to managing companies registered somewhere on Cyprus. If these kinds of placements were to grow and the money came to production companies located in Ukraine, the country’s balance of payments would be far healthier. Right now, this isn’t the case, so the risks remain.

RELATED ARTICLE: Which model Ukraine could apply in its further economic interaction with Russia

Finally, state borrowings on global financial markets might also help ensure significant hard currency inflows. In its April memorandum, the IMF predicts that this item will bring Ukraine a billion dollars this year and two billion each in the next two years. Again, however, things are not so simple. Ukraine has not gone to international lending markets since the Euromaidan revolution. Meanwhile, the vapid pace of reforms has become a real stoplight for many potential investors and will complicate this option for the foreseeable future. Experts say that real demand for government eurobonds is not especially high today. Although announcements by MinFin officials suggest that the Government is preparing for another eurobond placement and has already hired a number of big name international banks to handle it, there’s serious doubt that this will attract the billions that the IMF has projected.

In short, it turns out that Ukraine does not have iron sources of financing today, sources that would allow it to smoothly go through the next two years of increased external debt payments, in combination with a serious CAD. Under the circumstances, the only sure thing, realistically, is IMF credits. But even to get them, the government will have to put in some sweat equity.

All this comes down to the reality that this year offers only a misleading, even false, impression of hard currency stability. On one hand, the peak of external debt payments has not started yet, and although Ukraine paid the IMF back US $500mn in August, this did not place much pressure on the FOREX market. In a sense, this makes 2017 a mere continuation of the previous few years.

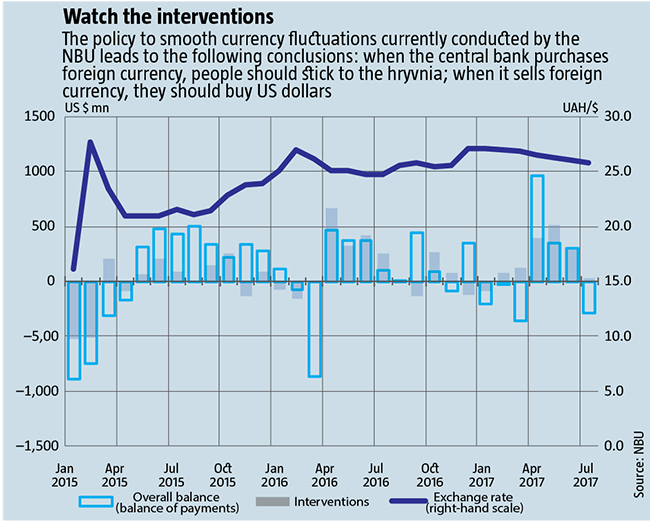

On the other hand, a certain increase in inflows from direct, portfolio investments and private debt did have a positive impact on the balance of payments. For one thing it created a surplus of hard currency on the market, which lasted for several months (see Watch the interventions). As a result, the NBU regularly intervened in the FOREX market, buying up hard currency and strengthening the hryvnia. The impression, thus, has been that everything’s just fine in Ukraine. However, the minute serious foreign debt servicing begins, it will be clear that these inflows to the balance of trade account were really marginal compared to what was actually needed. And the deception will be exposed like a September fog under the warm noon sun. If the country doesn’t have any spare sources of financing at that point, there will be no way to avoid the return of hryvnia instability.

surplus of hard currency on the market, which lasted for several months (see Watch the interventions). As a result, the NBU regularly intervened in the FOREX market, buying up hard currency and strengthening the hryvnia. The impression, thus, has been that everything’s just fine in Ukraine. However, the minute serious foreign debt servicing begins, it will be clear that these inflows to the balance of trade account were really marginal compared to what was actually needed. And the deception will be exposed like a September fog under the warm noon sun. If the country doesn’t have any spare sources of financing at that point, there will be no way to avoid the return of hryvnia instability.

A taste for risks

The strengthening of the hryvnia has lasted for some time, but it’s a passing phenomenon. By the end of the year, the risks will remain at today’s levels, because no serious debt payments are planned. This means that there’s also unlikely to be any sharp movement in the hryvnia. Moreover, the currency could gradually depreciate simply with the seasonal influx of growing imports, and with them, a growing current account deficit.

Still, this devaluation is unlikely to be more than 10%, because the balance of payments will remain relatively balanced. The NBU has enough instruments in its financial arsenal to smooth out any local deficit of hard currency on the market. That this is likely can be seen in NBU interventions: over August, the Bank largely bought up hard currency, i.e., there was a surplus and the hryvnia kept inching up, but between August 31 and September 5, the regulator was forced to sell hard currency, which led to a noticeable improvement in the dollar, over 50 kopiykas within a few days. Soon, interventions involving the sale of hard currency are likely to grow in frequency, a clear indicator that the hryvnia exchange rate has begun to depreciate.

At the beginning of 2018, risks will begin to grow significantly because the question of where to find external financing to cover the country’s needs will loom ever more strongly. At that point, the equilibrium of the FOREX market could disappear and the amplitude of fluctuations begin to increase.

RELATED ARTICLE: No transit, no cry. The threats and opportunities brought by Gazprom's probably termination of gas transit through Ukraine after 2019

There is only one market factor that could prevent this scenario, and that is a stir on global financial markets due to surplus money, similar to what preceded the 2008-2009 financial crisis. The thing is that economic indicators have been improving around the world in recent months and uncertainty has subsided. As a consequence, the appetite for market risks has grown and capital has been glowing to developing countries. It’s possible to say that, in some cases, there has been real interest in assets in undeveloped countries. There are plenty of indicators of this, such as the fact that most currencies have grown stronger against the dollar lately, especially the currencies of poorly developed countries, while yields on government bonds in these countries have, in some cases, fallen to record lows.

Since the beginning of 2017, the euro has gained nearly 15% against the dollar, while the currencies of Ukraine’s western neighbors—Poland, Czechia, Hungary and Romania—, whose economies are closely tied to the eurozone, have grown against the dollar almost to the same extent. The currencies of many developing countries have strengthened by 7-10%. Even the Chinese yuan has gained 5% against the dollar. Yields on Bulgaria’s government eurobonds are now down to 1.67%, compared to 8% less than a decade ago, which is what Ukraine’s bonds are at now. There are plenty more such examples.

If this trend were to maintain for at least a few quarters, it would be clear that the capital that is currently actively looking for places to work in these countries would partly also come to Ukraine. All the more so as a recent survey by Institutional Investor covered 214 fund managers, 32% of whom said that, given a choice of Europe, the Middle East and Africa, their first choice would be to go to Ukraine, in order to study market opportunities. This kind of capital might even suffice to finance Ukraine’s demand for foreign currency. The question is whether this stir on global financial markets will last long enough, and for that there is neither certainty nor guarantee. And, even if there were, this form of capital inflow is very volatile: tomorrow, it could equally swiftly be standing in line to exit, having caused more harm than that from which it might save us today.

Non-market factors

There are two more non-market factors that could potentially shift the balance of payments over 2017-2019 and thus have a significant impact on the hryvnia exchange rate. The first has about a zero percent likelihood, whereas the second is almost 100%. But each of them could potentially be decisive.

The first is the Yanukovych money. The confiscation of US $1.4bn of the Yanukovych Family’s money that was on Oschadny Bank accounts was a pleasant surprise for the Budget. Now there’s information about a half tonne of Yanukovych gold that investigative agencies have tracked down to Switzerlandю On one hand, it’s hard to count on the money stolen by that regime, because the process of finding and returning them to the state could drag on for years. On the other, the Prosecutor General’s Office has reported that the total stolen by the Yanukovych clique was nearly US $40bn. This cannot possibly all be in cash: a large proportion is in gold and possibly in tangible material assets such as property or ownership shares in businesses.

None of this is a needle in a haystack. It should be fairly straightforward to track these assets down and eventually confiscate them in favor of the state. Even if only a tenth of this were returned to the budget, it would provide serious support for public finances—most importantly for the balance of payments. If Ukraine’s investigative agencies continue their efforts steadily and persistently, they could return fairly substantial sums. This element in the stability of the hryvnia exchange rate needn’t be discounted, although when and on what scale it can be brought into play is something nobody knows for sure.

The second factor is the political cycle. Although Ukraine’s next elections come up only in 2019, barring a snap election, the campaigning has already begun, even if unofficially. This can be seen not only in the actions of the Poroshenko Administration, which is already actively searching for ways to ensure their boss is elected to a second term and eliminating potential rivals and the opposition: who are the more highly rated potential nominees and how often they show up on television. Election campaigns are for the Ukrainian politician what crushes are for the teenager: both sides lose their heads and behave in irrational ways.

RELATED ARTICLE: How reforms have changed Ukraine's banking system

In this situation, a rational approach means recognizing that the only definite source of external financing is support from the IMF and other international donors. But in order to qualify for it, the Verkhovna Rada must vote for the bills that will allow various reforms to go ahead. But how likely is it that the legislature will support reforms initiated by the President and a Cabinet that is friendly towards him, if all the election rhetoric of the multi-colored opposition is focused on criticizing this Administration? It’s much simpler not to vote for the necessary changes, get the IMF to stop lending, cause a currency crisis, and then blame the current government for everything in order to boost their own ratings. Even though this line of action is obviously aimed against the people and their country, it’s the shortest path to the top position in the land. Given that among Ukraine’s top politicians, very few act responsibly, the most likely scenario is that the Rada will be blocked and cooperation with the IMF stopped. The outcome—a hard currency crunch, hryvnia devaluation and the entire bouquet of problems that goes along with that—is something that most Ukrainians remember all too well from the not-so-distant past.

To sum up, the general picture looks like this. The fall will bring a seasonal depreciation of the hryvnia, as a result of which the hryvnia should not go down any further than about UAH 28.00/USD. The Government might get one more tranche from the IMF or portfolio capital will begin to come to Ukraine in greater volumes, including for the purchase of newly-issued government eurobonds. These factors will extend the period of relative equilibrium in the FOREX market for a few more months, but they will not eliminate the problem of financing for the next year or two.

What happens next is a good question. The only thing we can be certain of is that FOREX risks will grow and the hryvnia rate will fluctuate more sharply, whether it goes up or down. However, this is only next year. For now, Ukrainians can sleep peacefully.

Translated by Lidia Wolanskyj

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook