A high-end boutique near the Olympic Stadium in Kyiv has had five tenants over the past year. They all sold different things but closed down after a few months. These businesses only incurred losses. 18 months ago a huge photo studio next to the boutique moved to an office that is three times smaller. The one it left stands empty.

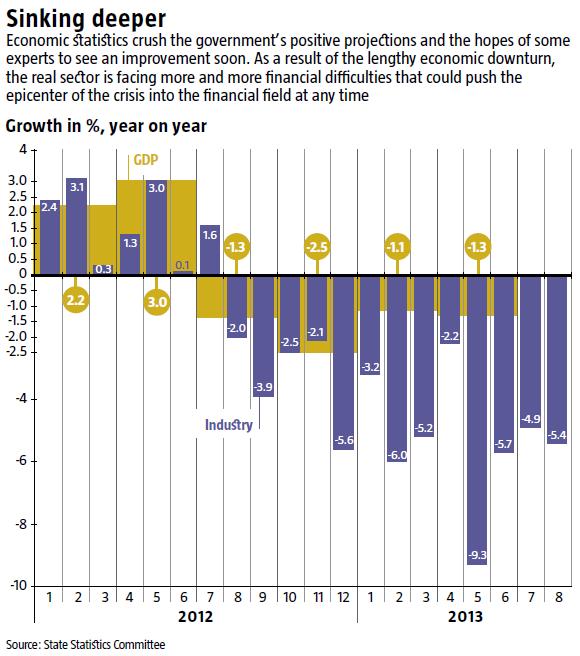

According to the State Statistics Committee, industrial output fell by 4.9% and 5.4% in July and August 2013 compared to a 1.6% rise in July 2012 (against July 2011) and 2.0% decline in August 2012. The processing industry sank 9.0% in August; its downward spiral is likely to continue. While the recent trade war with Russia explains the 14.5% decline in the engineering sector, which sells most of its goods to Russia, the fall in other sectors, including 25.0% in the chemical sector, 11.8% in light industry and 10.3% in furniture making, has different causes. Transportation is experiencing a decline as well: freight turnover fell by 7.1% over the first eight months of 2013.

The key factors driving this economic downfall are the “improvement” and “stabilization” experiments of the current government, and the fact that it ignores the recommendations of international organizations.

READ ALSO: A Cure to Fend off Poverty

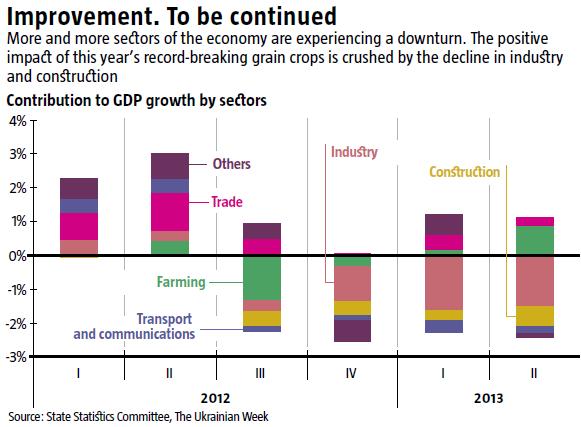

Farming is currently the key driver of economic growth. Over January-August 2013, agricultural output grew 13.3% compared to the same period in 2012. However, this sector is also slowing down. This growth was 1.5 p.p. below that of the first seven months of 2013. Moreover, as world grain prices plummet, income from production will not necessarily have a visible positive impact on the budget and the balance of payments. It is unlikely to offset the decline in other sectors or boost real GDP growth above zero.

Trade has also been contributing much less to GDP growth (see Improvement. To be continued). Retail trade turnover grew 10.2% over the first eight months of 2013. This reflects an increase in average nominal wages (8.8% in July this year compared to July 2012). However, Ukrainians spend more and more on imported goods.

While retail trade grows in volume, it generates less income. In Q2 2013, pre-tax loss in retail trade was UAH 0.4bn, compared to a profit of UAH 3bn in Q2 2012. The total losses of unprofitable retailers grew 2.6 times to UAH 8.2bn. This will mostly likely result in retail trade’s negative contribution to GDP growth, and the sector will join those currently in decline.

THE FINANCIAL SECTOR

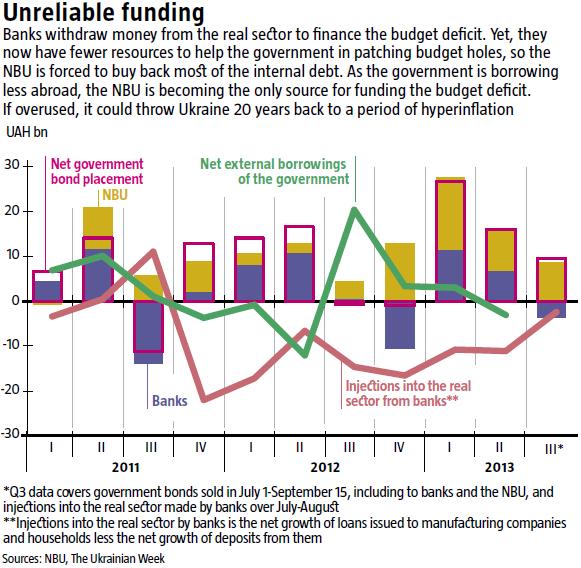

The numbers would not look so sad if the non-manufacturing sector contributed to the development of manufacturing. This is not the case, especially in the banking sector (see Unreliable funding).

So far, the banking system seems stable. It does not have exorbitant interest rates as it did last year, nor is there any news of financial troubles at individual banks. Its balance over seven months is positive at USD 1.9bn. The amount by which gold and currency reserves shrank since the beginning of this year (USD 2.8bn) came from the National Bank (NBU) to pay Ukraine’s debt to the IMF. They are not included in the balance of payments nor do they affect the interbank market. Otherwise, residents would buy foreign currencies in the amount of the deficit, using the hryvnia they keep on their bank accounts. The currency would go abroad while the hryvnia would end up on the NBU’s balance sheets. This would deplete banks’ balance sheets and liquidity and boost interest rates.

READ ALSO: For Quick Sale: One central bank. Great starter for DIY fans

So far, the balance of payments has been positive thanks to an artificial decrease in imports through the postponed purchase of gas for the heating season or shadow imports of oil products; high borrowings by the real sector and low outflow of foreign currency from banks. Each of these factors may soon vanish. Then, the banking system will face a new wave of troubles. So far, banks have been taking money out of the real sector by accepting deposits and payments for loans issued earlier while hardly returning anything (see Unreliable funding). They do not care about the fact that manufacturing companies are facing more and more problems (plummeting income, mounting tax pressure and non-residents are as reluctant as banks to lend to them). Instead, they use the funds deposited by households and companies to repay their own outstanding debts to non-residents and patch holes in the budget. As their resources for the latter deplete, banks have been net sellers of government bonds since July. This means that they will not be able to help out the private sector or the government in times of trouble. As a result, both could have to deal with their looming financial problems alone, which will boost the risk of their default and aggravate economic decline.

PUBLIC SPENDING FOR THE CHOSEN

The worsening position of the private sector, unreliable banks as sources of funding and the lack of access to external markets would make the budget a last resort for manufacturing companies. In this case, fiscal stimulus could support monetary circulation at the present level and prevent the deepening of the recession and collapse in some sectors.

The government does indeed support business through public procurements and funding, but these companies are few.

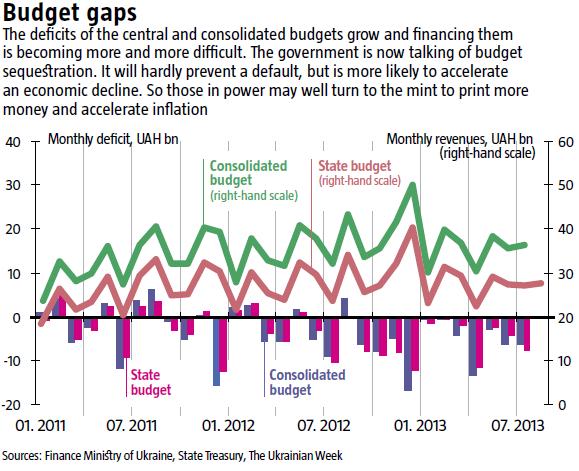

State finance is in a very bad position. Firstly, revenues to the central and consolidated budgets in April, May and June 2013 were less than in April-June 2012. Even though the situation changed slightly in July, preliminary data in August signals that the decline is accelerating. State budget revenues in August were UAH 27.8bn, i.e. 18.7% less than in August 2012. This is the impact of the tax policy imposed by the Cabinet of Ministers led by Premier Mykola Azarov and First-Vice Premier Serhiy Arbuzov that has exhausted business, particularly over the last year to 18 months. Some experts estimate that the government will have a revenue shortfall of UAH 20-40bn by the end of 2013.

READ ALSO: The Azarov/Arbuzov Government

Secondly, the government is already having difficulties financing the budget deficit. It has not borrowed anything on external markets for the past five months and has been failing to raise internal debt for the past two months. Virtually all the money coming to its accounts from government bond placement is immediately spent to redeem maturing securities (see Unreliable funding). Unless the budget is revised, the government will have to find nearly UAH 85bn including UAH 20bn to cover the planned deficit of the consolidated budget, UAH 45.6bn to pay maturing internal and external debt and nearly UAH 20bn to cover the revenues it was supposed to collect but never did. This amount seems unattainable: the government’s internal reserves will not even cover half of it.

The Cabinet of Ministers seems to realize this. It is planning external borrowings in smaller amounts, at higher interest rates and for shorter terms. The market understands this as well: 4-10-year government bonds are traded with a yield of over 10%. The worst thing is that the Ukraine-2014 Eurobonds that are repayable in eight months are traded at 8.75%. Thus, the yield curve for Ukrainian Eurobonds has almost gone from normal to problematic, and may soon fall into pre-default. This will mean that the market projects a very high risk of the Ukrainian government’s default in the short term.

READ ALSO: WHERE’S THE MONEY?

This time, delays in some parts of public spending will not solve the problem. If postponed, the payments will only mount. Perhaps this is why the government is now talking of budget sequestration to revise public spending, in order to cut the deficit. On the one hand, it will help prevent the default and support the government’s financial position. On the other, it will hit business hard and aggravate the crisis, since entrepreneurs that have already experienced difficulties will get even less money. The only chance to avoid an accelerating economic decline is to cut the part of public spending that is stolen and transferred to the shadow. However, this runs counter to the nature of the current regime. It is more likely to force the NBU to print more unsecured money, which it is actually doing already.

If the budget is not revised and access to affordable borrowings is blocked for an extended period, internal reserves will not last long. The average annual inflation rate planned in the 2014 draft budget is around 8%. Given the current low inflation rate, this will only be possible if one of the two following conditions is in place: either the 15-20% devaluation of the hryvnia at the end of 2013 to adjust prices for imported goods – this will immediately lead to the planned price rise – or the NBU will once again turn to the mint.

THE NEGLECT OF THE REAL SECTOR

Companies and households have found themselves between the devil and the deep blue sea. Banks are extracting huge sums from the market to solve their problems and finance the government. The budget is increasing tax pressure on business while returning most of the collected revenues to only a few privileged companies. The external sector is no longer lending to Ukrainian businesses, and earnings from exports are shrinking. Statistics signal that entrepreneurship is on the brink of crisis.

In Q2 2013, profitable companies in Ukraine reported UAH 40.1bn of earnings before tax which is only 2% more than EBT over the same period in 2012. Meanwhile, unprofitable companies reported UAH 33.8bn of pretax losses, i.e. up 83% from Q2 2012. As a result, business activity declines and investment plummets. Gross fixed capital formation (GFCF) fell by 19.7%. This signals that neither long-time business owners in Ukraine nor new investors are willing to invest here, nor will they be anytime soon. This makes the prospects of economic growth dim.

If the government allows the default, the likelihood of which increases with each passing month, even a deeper recession may not seem that critical. There is no other option, with the policies of the Azarov-Arbuzov Cabinet leading to the destruction of business.