At first glance, the Ukrainian and Russian governments are now in a sort of a Nash equilibrium state, where each party continues to stick to its own strategy: Putin demands that Ukraine joins the Customs Union with Russia, Kazakhstan and Belarus, while Yanukovych demands cheaper gas. This equilibrium does not look likely to last. The players’ weight categories are too different, especially as the conflict of the Yanukovych regime with the West deepens. A crisis scenario whereby Yanukovych will have to take this “last chance” to maintain power is possible, yet the most likely scenario for 2013 is for Ukraine to continue to stay away from the Customs Union. The first reason for this is that joining it runs counter to the “Family’s” key goal: to grab unlimited power in the state.

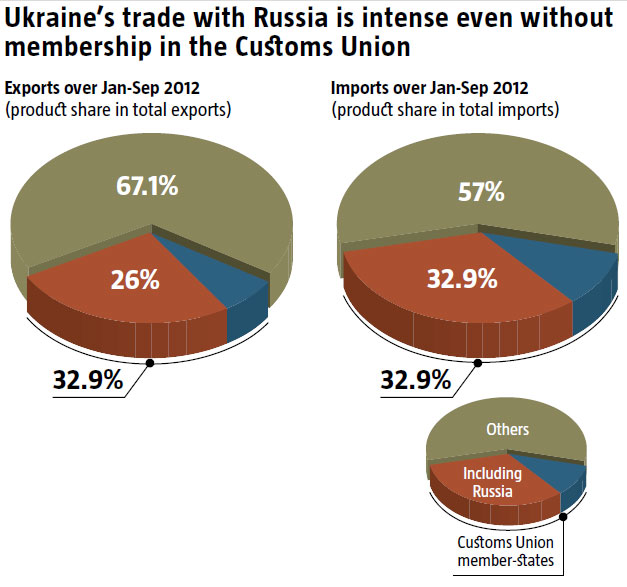

In fact, Ukraine’s exports to Customs Union markets are growing, even without membership, while Kazakhstan’s and Belarus’ membership experience suggests that this does not save them from all kinds of trade restrictions by Russia. For Ukraine, joining the Customs Union does not guarantee that it will be possible to avoid discrimination against Ukrainian producers for economic or political motives. However, economic dependence on Russia may grow significantly in 2013 even if Ukraine does not join the Customs Union. The key tools used for this will be Moscow’s financial expansion and Russian-controlled transnational holdings, set up on the basis of acquired Ukrainian assets. Russian financial institutions are currently among the key lending instruments Ukraine uses to buy Russian gas or cover its budget deficit as they arrange the placement of Ukraine’s Eurobonds. They will continue to lend funds to Ukrainian oligarchs. The key Russian-Ukrainian project in 2013 may be the merger of the nuclear power and mechanical engineering industries of the two countries – at least it may formally begin next year. Essentially, it has already started with the construction of a joint venture – a plant for the production of nuclear fuel in Kirovohrad Oblast.

Apparently, Russia also wants to use this scheme to gain access to Ukraine’s strategic uranium resources. Already in 2012, 90% of fuel for Ukrainian nuclear power plants was supplied from Russia compared to 70% in 2011. Russia and other Customs Union member-states are major foreign consumers of Ukrainian mechanical engineering products, since Ukraine cannot compete on international markets. This will facilitate the acquisition of Ukrainian mechanical engineering assets, especially railway, ship and aircraft building plants, by Russian companies in 2013.

More specifically, Russian expansion in railway carriage building – the major part of Ukraine’s exports to Russia – will continue, bringing forth the threat of being replaced with imported products. In 2012, an entity owned by Russian businessman Stanislav Gamzalov bought 25%+1 share of the Kriukiv Car Building Plant – possibly from Serhiy Tihipko’s TAS Group. This may signal that Russians will later target other industry assets.

Deals with entities that are part of Dmytro Firtash’s empire can also be interpreted as an element of Russian expansion. Firtash’s companies get Russian loans, including those from Gazprombank, and cheap gas to increase their assets in Ukraine. Under certain circumstances, these can be sold to their lenders.

Russians will also gain a foothold in the retail oil product market. First and foremost, this will be done by means of Rosneft’s entrance onto the Ukrainian market. It appears that Rosneft will soon own the Lysychansk Oil Refinery.

Finally, Russia may invest significantly in Ukrainian agriculture. Presented as a “strategic partnership” in grain exports, this may involve deals to buy terminals at Ukrainian Black Sea ports.

Forcing the Eurasian integration of Ukraine under Moscow’s control, justified by the motivation to survive the crisis, is another likely scenario. Supported by many Party of Regions members – some of them in the government – the Kremlin is already making technological arrangements for this “alternative” path and pro-Russian projects in Ukraine. Efforts are being made to persuade Ukrainians that integration with Russia is the only right way. The media is massively focusing attention on joint Russian-Ukrainian economic research with conclusions on the benefits of Ukraine’s membership in the Customs Union and useless cooperation with the EU. The Kremlin will probably continue to use “stick” tactics, although more aggressively, fueling the tension around the construction of South Stream that bypasses Ukraine and discrediting Kyiv’s plans to diversify its gas suppliers. In the meantime, it could threaten to take Ukraine to the Stockholm court for violation of the “take or pay” principle, and cut off gas in the coldest seasons. Notably, think tanks loyal to the Party of Regions spread more and more comments about the crisis in the EU and the “myths of European integration”, while Ukrainian officials talk well of the Customs Union or choose not to criticize it. Another pillar supporting Ukraine’s membership in the Customs Union will be producers oriented at the Russian market and non-diversified producers of cars, refrigerators, airplane engines and aerospace equipment, still mostly headed by red directors.

KEY TARGET SECTORS FOR RUSSIA’S POSSIBLE ECONOMIC EXPANSION IN 2013

The monopolization of the nuclear power sector. 90% of fuel for Ukrainian nuclear power stations is supplied from Russia compared to 70% in 2011. If Russians fund the construction of a nuclear fuel production plant in the Kirovohrad Oblast and two nuclear reactors at Khmelnytsk Nuclear Power Station, they could claim access to nuclear power in Ukraine in the future.

The banking sector. Russian entities already control nearly 20% of the Ukrainian banking system. They are also major lenders to private business, government and some oligarchs in Ukraine. In 2013, the Ukrainian banking sector may grow more dependent on Russian capital as Western investors flee the country.

Mechanical engineering. Uncompetitive in international markets, the Ukrainian mechanical engineering sector mostly sells its products to Russia and other Customs Union member-states. This will escalate the acquisition of Ukrainian mechanical engineering companies, especially railway carriage, ship and airplane builders, by Russian companies.

The oil and gas sector. It depends on raw materials and loans, as well as the priority role that the Kremlin grants to the oil and gas sector. Therefore, this sector of the Ukrainian economy will be one of the most vulnerable ones to Russian expansion. Government-owned monopolist, Rosneft, can increase its presence on the oil market after it acquired TNK-BP. In the future, it may begin to dictate its rules on the Ukrainian market following Gazprom’s suit. If the Firtash-Liovochkin Group happens to lose its current political influence, Dmytro Firtash’s entities could sell their assets, including oblast gas suppliers and chemical plants, which are often acquired with Russian loans and using Russian gas. In this case, the Kremlin will end up with additional instruments of political and economic pressure against Yanukovych.