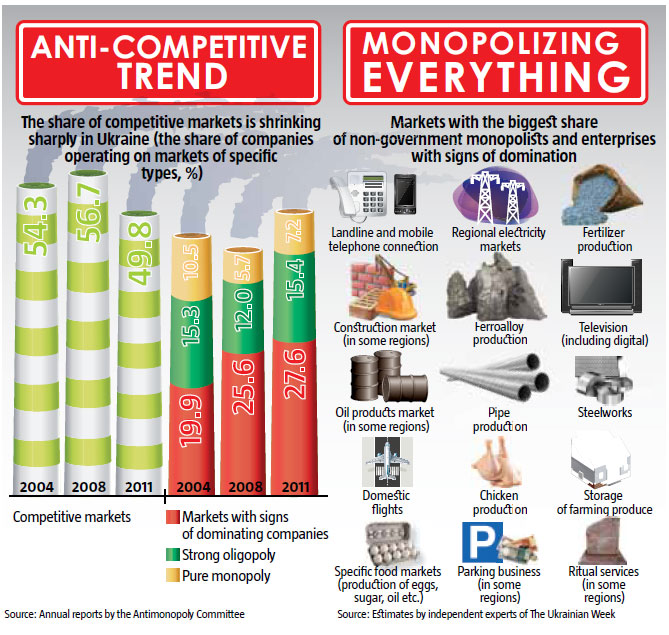

The Ukrainian economy is highly monopolized and this trend has been aggravated since the last shift in government. Even official data from the Antimonopoly Committee reveals that monopolization increased in 29 spheres in 2010, including the gas, electricity, oil product imports, mining, steel and chemical industries. In 2011, the committee could only trace 49.8% of produce sold on the market where there were no constraints to competition.

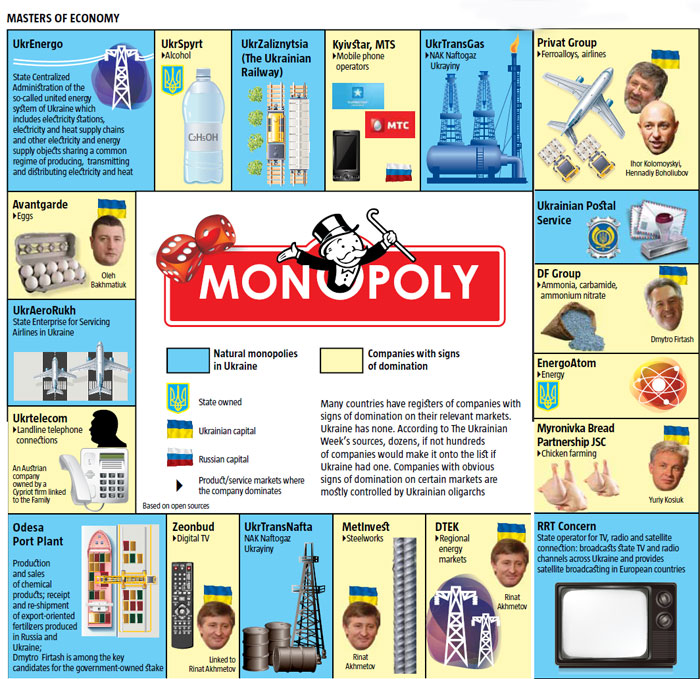

Monopolists fall into four categories. One is the ‘natural’ monopoly that does not see the emergence of any new players because investors find entrance onto the market too costly to be interested in the project, for instance. A reasonable scenario is when a natural monopoly is owned by the government which should allow the entire population to benefit from the windfall profits it generates. The Ukrainian Railway is a good example of this, where investing into yet another railway track is too expensive, hence no competition. “Overlapping the functions of these companies does not do any good for society on the whole,” says Oleksandr Zholud, an analyst at the International Centre for Policy Studies. “Say, every town has a water supply system. You can build another one but the cost is extremely high, while the benefit to society is not. Typically, authorities try to restrict natural monopolies by setting a cap on their profits and controlling the pricing policy of such corporations.” Other examples of natural monopolies are gas and water supply enterprises and utility companies.

The second category includes regional players which have significant privileges in a certain territory. According to the National Committee for State Regulation of Communication and Computerization, over 400 Ukrainian operators enjoy market privileges.

The Antimonopoly Committee found eight companies on the retail drug market with signs of monopoly status abuse. According to the Committee, competition is seriously limited on a great number of regional markets, including those for funeral services, bus stations, parking, paid health care and more. “Limited competition is the result of difficulties in entering the markets, such as the high cost of setting up facilities to provide the services, or organizational details such as obtaining licenses and certificates,” Committee employees explain.

The third category is nation-wide Ukrainian companies that work on markets with dynamic competition and have significant coverage of consumers, such as Kyivstar and MTS, two mobile phone operators that, according to the iKS ratings for mobile operators of June 2012, cover 45.8% and 35.3% of the market respectively. Other companies on the rating include life:), Intertelecom, Ukrtelecom, Peoplenet and ITC. During 2010-2012, monopolization intensified. Both of the abovementioned players controls over 35% of the market; therefore they qualify as monopolies under Ukrainian law. Until recently they competed severely for new clients, yet lately they have been acting in a more coordinated manner which evolved into an unjustified steep rise in prices in the spring and summer of 2012. Apparently, this was caused by the fact that both companies are now under Russian control and the market has become oversaturated.

The fourth category includes the most proactive dominating companies that are part of financial and industrial groups. Due to privileges and access to administrative leverage, they continually increase their shares in specific markets. According to experts from the Institute of Economy and Projections at the National Academy of Sciences, this is why “the key elements of competition are not expenditures or the price and quality of a product, but the level and the amount of corporate power and control over the market gained through non-economic tools.”

Surprisingly, the Antimonopoly Committee with Rafael Kuzmin, the cousin of First Deputy Prosecutor General Renat Kuzmin, as First Deputy Chairman does not see any signs of monopolization in the economy, or the domination of companies owned by some oligarchs on specific markets. However, a few people close to the administration have been proactively buying up Ukrainian assets over the past two or three years which has resulted in the monopolization of some major industries, such as ferroalloy, mineral fertilizers, electricity supply, steelworks, airlines and more. Companies owned by Rinat Akhmetov, Dmytro Firtash and Ihor Kolomoysky, who always manages to find his way round the administration, have become particularly proactive lately. And to add to this, a group of new Ukrainian billionaires including Yuriy Kosiuk, Andriy Verevskyi and Oleh Bakhmatiuk, is also coming onto the scene. Investment analysts project that only two or three players will very soon dominate many food markets, unless the trio slows down their buying up of agricultural companies.

Monopolists, and limited competition, obviously have an adverse effect on the quality and price of products and services. Ukrainians who frequently travel, for instance, wonder why domestic flights within Ukraine cost several times more than domestic flights in the EU. A Kyiv-Donetsk-Kyiv ticket for the end of September with Dniproavia or AeroSvit, both part of Ihor Kolomoysky’s Privat group, costs UAH 870-2,000UAH (approx USD 108 – 250). By contrast, LOT, which is the most expensive Polish airline, charges the equivalent of up to UAH 740 or USD 92 for a Warsaw-Krakow round trip. And to add to this, clients are often unhappy with the quality of services provided by Ukrainian airlines. AeroSvit, for example, are known to start departures earlier than scheduled, postpone, or even in some cases cancel them, which happened again this summer with understandable consequences for clients who did not find out about the schedule change on time. After several airlines, including AeroSvit, Dniproavia and Windrose, all came under an umbrella linked to the Privat Group; the group has come to control almost 30%, by various estimates, of the total airline market in Ukraine. The group managed to grab a lion’s share of the market yet it is still unable to service all flights with their available fleet of aircraft.

The domination of monopolies on a number of markets also has a negative impact on the economy. Ukraine’s growing trade deficit is partly provoked by monopolization in some industries. For instance, ferroalloys are produced by the Nikopol, Stakhanov and Zaporizhzhia plants; again, all linked to the Privat group and recently the rate of ferroalloy imports has been increasing. The State Statistics Committee reported the import of 256.4mn kg of ferroalloy, totalling USD 602mn over January-December 2011. In 2010, by contrast, Ukrainian companies imported only 107.67mn kg and spent USD 280mn.

The tycoons that typically redistribute national wealth are trying to take it all from the enterprises they buy while ignoring the need to upgrade them, or create new assets. Instead, they tend to invest all their profits into gaining control of other entities from which they can also squeeze everything last drop of ‘blood’, thus they continue the trend. With this current business model they are not interested in improving the professional skills of their employees or raising their pay. As a result, the country degrades.