“Foreign currency deficit is a serious threat to Ukraine’s independence”

Volodymyr Lanovyi, President of the Centre for Market Reforms

This year, Ukraine is experiencing a shortage of foreign currency to meet its foreign currency liabilities and repay foreign debt on a timely basis. BoP deficit in 2013 is not likely to be less than that of 2012. The shortage of foreign currency makes Ukraine vulnerable to pressure from Russia which is demanding its membership in the Customs Union. This is commonly understood as a serious threat to Ukraine’s independence, and potentially to its sovereign rights to participate in international relations.

This year, Ukraine is experiencing a shortage of foreign currency to meet its foreign currency liabilities and repay foreign debt on a timely basis. BoP deficit in 2013 is not likely to be less than that of 2012. The shortage of foreign currency makes Ukraine vulnerable to pressure from Russia which is demanding its membership in the Customs Union. This is commonly understood as a serious threat to Ukraine’s independence, and potentially to its sovereign rights to participate in international relations.

Another component of Ukraine’s vulnerability is the continued insolvency of Naftogaz of Ukraine. The only way to keep it afloat is by increasing its authorized capital with newly-issued government bonds. Apparently, some lenders are interest in it: should Naftogaz go bankrupt – and this is getting inexorably closer – its assets may fall into the hands of those who hold the bonds. Russian banks are known to be actively working in this direction.

Moreover, if Ukraine’s gas transit system ends up in Gazprom’s hands, Ukraine will have no opportunity to negotiate discounts for gas and fees for transiting Russian gas through Ukraine with Gazprom.

The NBU’s FX reserves are being depleted at an alarming rate. At the end of 2012, they amounted to nearly USD 25bn compared to USD 38.5bn in April 2011 – an all-time peak, according to the proud Mykola Azarov, who forgot to mention, though, that this was due to new borrowings. Moreover, the structure of FX reserves is unknown. When the NBU disclosed the data for the last time in 2008, liquid FX reserves were a mere USD 0.5bn, plus USD 15bn more in other freely convertible currencies, while the rest was in bonds. Since the NBU has mostly been selling US dollars, not bonds, since 2008, there are few reasons to claim that the structure of Ukraine’s FX reserves has improved. The assumption is that half of all reserves are now in freely convertible currencies.

Even so, Ukraine’s total FX reserves amount to just 90% of its foreign debt. The comparison of the NBU’s liquid FX reserves, estimated at USD 12-13bn, with payments under foreign debt due in 2014, plus nearly USD 10bn bought annually by the population, shows that Ukraine does not have adequate liquid FX reserves to cover even these needs. Three months ago, international rating agencies downgraded Ukraine to a pre-default level.

There are a number of key reasons behind depleting FX reserves. The first is the current account deficit that skyrocketed from USD 1.75bn in 2009 to USD 14bn in 2012, exceeding the level of the 2008 crisis year. The second is the repayment of foreign loans by Ukrainian banks borrowed in the turbulent 2005-2007 period. At this time, huge amount of funds entered Ukraine. Even large international financial institutions thought that they could operate here on a serious scale and rushed to buy overpriced local banks. They have since realized their mistake and begun to return the money they invested into the Ukrainian market to parent banks. USD 2-3bn flows out of the country annually. Since 2008, they have withdrawn USD 13bn, and this signals trouble. The NBU says that Ukraine is growing less dependent on the dollar, using the USD 13bn-reduction of Ukrainian banks’ debt as an example. However, banks exist to have debts rather than repay them: they have to expand their loan portfolios, operations and investment rather than to reduce them. This shows how negative trends are traditionally presented as positive accomplishments in Ukraine.

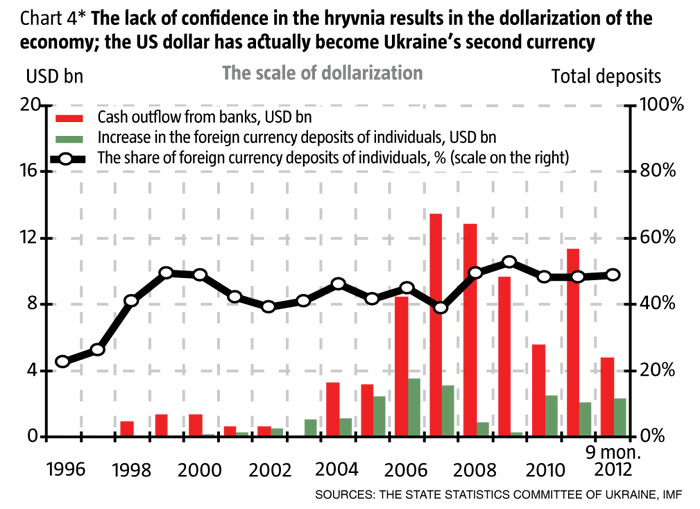

Another reason is the lack of the trust of Ukrainians in their national currency. They buy over USD 10bn of foreign currency annually, thus signaling mistrust for the banking system and the hryvnia. This will only change when there are no restrictions for people to freely convert hryvnias into dollars, and back; or for banks to issue loans in dollars. Any restrictions regarding the dollar in Ukraine fuel the lack of trust in the hryvnia. As long as the restrictions are in place, trust in the national currency will plummet and Ukrainians will continue to buy up foreign currencies.

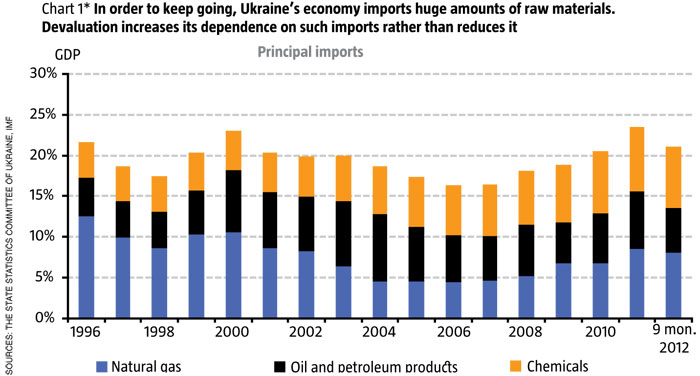

The solution is to change norms, methods and policies in its various aspects. The government should not ban lending in dollars. Instead, it should transfer FX risks to banks and introduce insurance for their FX transactions, rather than have the NBU manually craft and support currency exchange rate. It is equally important to reduce the import of Russian gas (see Chart 1 – Ed.) and improve Naftogaz’s financial standing. The government should stop subsidizing gas for industrial consumers. As long as it does, thus boosting excessive gas imports, it will force taxpayers to support the current chemical industry, for instance, with its 2-3,000 employees. This only hampers the economy. Instead, Ukraine needs a favourable investment climate that will draw foreign business to the country rather than scare it away; encourage foreign companies to open branches in Ukraine to produce items that are currently imported, thus boosting demand for foreign currency. Moreover, only a favourable business climate can facilitate the exports of products other than raw materials (see Chart 2 – Ed.) and items of high added value, which will in turn increase the inflow of foreign currency.

What will happen this year? I tend to think that the government will choose the path of default as it will not be able to draw resources from the foreign or domestic market. Moreover, it will not be able to get these funds by May or June – the peak months for due payments under its foreign debt.

“If the government turns to Russia or China for loans, Ukraine is at risk of becoming a source of raw materials for another source of raw materials”

Andriy Pyshnyi, MP, All–Ukrainian Union Batkivshchyna (Fatherland)

It is my understanding that there are two basic problems in Ukraine. First of all, monopolism, which is convenient for the regime. Financial and industrial groups worked for many years on its creation. It is this kind of monopolism that shaped the existing political situation within Ukraine. It ensures the control of 10 oligarchic clans over 80% of the national economy. The monopolism problem in Ukraine has specific names: Firtash (100% control of fertilizer production), Akhmetov (100% of electricity exports, 70% of metallurgy or 60% of coal extraction). Two oligarchic families control 70% of air transportation in Ukraine. Such an economy is very convenient from the point of view of manual administration.

It is my understanding that there are two basic problems in Ukraine. First of all, monopolism, which is convenient for the regime. Financial and industrial groups worked for many years on its creation. It is this kind of monopolism that shaped the existing political situation within Ukraine. It ensures the control of 10 oligarchic clans over 80% of the national economy. The monopolism problem in Ukraine has specific names: Firtash (100% control of fertilizer production), Akhmetov (100% of electricity exports, 70% of metallurgy or 60% of coal extraction). Two oligarchic families control 70% of air transportation in Ukraine. Such an economy is very convenient from the point of view of manual administration.

The strategic purpose of necessary transformations is to change the structure of the economy. And this is right, but it means that those who have devised it will be deprived of income. At the same time, the income of the main oligarchic groups is currently increasing rapidly, in spite of the problems in the Ukrainian economy. For example, Dmytro Firtash’s income increased by 560% last year.

So the key issue for today’s agenda is change in the political regime. I’m not talking about this as a politician, but as a citizen, since I well remember the first budget that Mykola Azarov prepared in 1994. He himself admitted that he was the direct or indirect author of 18 Ukrainian budgets (!). Yanukovych has governed Ukraine for one third of its independence: twice as premier and now almost three years as president with extensive powers and total control over the administrative, economic and judicial hierarchy, not to mention the information policy. What stood in the way of their changing the economic structure? When he came to power in 2010, the share of raw material industries in exports constituted 67%, and grew to 70% in 2012. As a result, Ukraine has grown dependent on external market trends and vulnerable in the face of challenges.

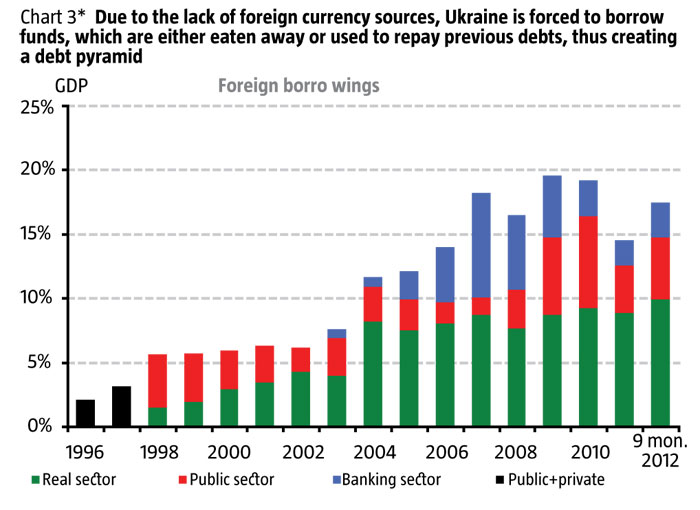

For me, the issue of sovereignty, together with that of foreign currency and debt security are bound into a single system. In 2013, Ukraine has to repay USD 9bn of external and UAH 45bn of internal debt. What is the source? Economic growth or new debts to repay the old ones. Economic growth is virtually non-existent. So, we are incurring indebtedness to repay debts (see Chart 3 – Ed.).

There is a basic index, which determines both monetary and debt security, and the stability of state finances – the state budget deficit. In 2013, it was planned at a level of almost UAH 50bn, while in 2012 – it was at a level of UAH 8bn, although in actual fact, the year ended with a deficit of UAH 40bn. I feel that the actual deficit for the 2013 state budget will be at least UAH 100bn. Add to this subsidies for Naftogaz and the Pension Fund, government bonds to draw funds for the authorized capital of Oschadbank (government-owned Savings Bank), Agrarian Fund, state guarantees, etc. This raises the question: how will the budget be balanced? At the expense of further borrowing, apparently.

Another question: who do we go to for money? This is an issue of both monetary, and debt security – the IMF and the World Bank? It’s cheap there and they can give long-term loans. But they demand an extensive list of substantiated economic demands, beginning with increasing gas prices for the population, the restructuring of Naftogaz and privatization. These are all objective demands. But they also have a political demand. I remember how, in the summer of 2012, the Deputy US Secretary of State said that in order to renew cooperation between the Ukrainian government and international financial institutions, it is necessary to resolve issues of political persecution and the status of democracy in Ukraine. This means that today’s government is forced to either resolve these issues, or it will not receive funds and will apply to other financial sources. But they are more short-term, expensive and have relevant political motivation.

We are talking about the Russian Federation and China. As a result, Ukraine is at risk of becoming the raw material source of another raw material source, which is an issue of economic sovereignty. After all, the issue of entry into the Customs Union in exchange for obtaining loans from banks that are controlled by Russia, is unequivocally waved in Ukraine’s face. And what follows entry into the Customs Union, is vividly illustrated by the experience of Kazakhstan where production facilities close and investment activities fold. What efficiency can there be in the RF, if, having 30% of world mineral resources, it has 2% of the world’s population and 2% of global GDP. Where is its efficiency and where is its modernization?

The structural problems in the economy, monopolism and corruption – this is all a consequence of the fact that Ukraine is actually governed by the same clans throughout the entire period of its independence. It is not the national debt amount that poses a threat, but the behavior of the leaders of the country, who have accumulated funds, spent them ineffectively and now don’t know how to resolve the problem.

Under Yanukovych’s presidency, Ukraine has actually doubled its government and guaranteed national debt. But have we experienced at least one structural reform, which would lead to the changes that Ukraine so desperately needs? Not one. And we won’t see one, since the resources accumulating in the state budget, are not directed towards the resolution of structural issues. UAH 400-500bn passes through the public procurement system each year. This is more than the state budget amount. At the same time, the volume of the corruption component in the state procurement system constitutes almost 50%. Euro-2012 became the most corrupt shady business since independence.

As far as devaluation is concerned, I don’t even have cautious optimism. It will happen. The only question is the extent and how tangible it will be for Ukrainian citizens. If we should succeed in getting a loan from the IMF, devaluation will be more or less controlled, but if not, we could be getting up to UAH 12 per US dollar by the end of the year.

How is our political force planning to react? Last week, I submitted a draft law On Ensuring Debt Security. It entails the return of parliamentary control functions to the Verkhovna Rada and demands quarterly reports from the government to parliament should the budget deficit or national debt reach threshold levels and prohibits the exceeding of threshold levels without a parliamentary decision. I am willing to discuss proposals and take them into consideration.

However, I am convinced that the role of this parliament does not even lie in what we can do, but in what we have to prevent: the loss of sovereignty, using all possible means (communicating with society, participating in protests, organizing resistance in parliament, etc.). We must ensure Ukraine’s European integration-oriented development as the only possible course. Because there is no point in waiting for a different, more adequate reform plan, than the one determined in the Association Agreement and all-encompassing Free Trade Zone Agreement with the EU.

“When people begin to be afraid of what is going on, they begin to switch to foreign currency”

Oleksandr Myrnyi, MP, All–Ukrainian Union Svoboda (Freedom)

There are two problems: external and internal. We really don’t have any foreign investments. Foreigners have no faith in either Ukraine, or its society. We cannot currently convince foreign partners that they can have any dealings with us. And accordingly, we cannot attract significant financial resources from the West.

There are two problems: external and internal. We really don’t have any foreign investments. Foreigners have no faith in either Ukraine, or its society. We cannot currently convince foreign partners that they can have any dealings with us. And accordingly, we cannot attract significant financial resources from the West.

Svoboda has registered a draft law in parliament regarding the liquidation of artificial monopolies. But there is also another problem – corruption. Money in the form of bribes is not invested in the economy. It is converted into foreign currency and efforts are made to take it out of the country. The system that produces corruption is not interested in a working economy or transparent rules of the game.

There is one more aspect: is big capital interested in the devaluation of the hryvnia? Of course it is. After all, each person in Ukraine with assets of more than USD 1mn, earns this money either from exports, or from distributing the budget among themselves, but definitely not from the domestic market. I don’t see a single Ukrainian billionaire, who would earn a lot of money on the domestic market. The only exception is the agrarian sector, but the money there is very specific – the only people in the agrarian sphere who have become billionaires are those, who have unlimited access to budget funds.

Ukraine has a very poorly developed domestic market. Devaluation was noted in 2012. What does this mean? That there is a catastrophic decline in people’s purchasing power; that this year, people cannot afford to buy more than last year. Accordingly, even with the meager production volume that Ukraine has, it’s becoming clear that there are more goods than the market can consume. Therefore, the price of goods is falling. What are the consequences of this? A decrease in jobs and salaries, followed by people saving on everything possible. A vicious circle. What happens when people begin to be afraid of what is going on – they buy up foreign currency (see Chart 4 – Ed.). Under such conditions, it is necessary to do something, so that this money, that is in people’s hands and according to some estimates, is at a level of USD 100–200bn, is returned to the banking system and begins to work for the economy. But when Arbuzov initiates a 15% tax on the sale of foreign currency, this is a signal that there is a critical situation in the country, and that this is only done for people to exchange their money in banks out of fear. In other words, people understand that they are spoken to from the position of power? Some are afraid, while others try to scare them even more.

Therefore, if we, as the opposition, want to change the rules of the game in Ukraine, there is only one way that they can be changed: this government must be replaced by a completely different one. Otherwise, absolute incompetence, the aggressive behavior of the government towards the population, the reluctance to listen to society, the inability to communicate with it and the rejection of the right ideas, simply because they are initiated by the opposition, will take place over the over again.

I have already mentioned the draft law on the cancellation of artificial monopolies that we have submitted. We have also sponsored a law on the cancellation of so-called pension reform and that the minimal and maximum pension cannot differ more than five times over. But these are not reforms. It’s an attempt to stop that, which has been done, while we have to clearly show society where we are leading it. For example, we have to find a way to encourage the right way to invest in Ukraine. After all, if we have a developed domestic market, we give people the opportunity to accumulate and use the foreign currency that they have saved for a rainy day. But, by not attracting foreign investments, we do not receive the foreign currency that we need so urgently. This can be ensured with laws. For example, all importers of agricultural machinery can be informed that we will close our market in five years, but will create favourable conditions for its production in Ukraine.

If all we do is criticize, ultimately there will be no change. And society should see the difference between us and those who govern. Otherwise we, as the opposition, will not have the right to call for changes, we will be no different than the existing government.