Ukraine’s civilization and geopolitical choice is facing a new challenge. While public attention was gripped by the language confrontation provoked by the Presidential Administration and the European football championship final, the government opened the door to Ukraine’s increased financial and economic dependence on China. On 28 June 2012, the Ministry of Agriculture and the Export-Import Bank of China signed a Memorandum of Cooperation, which allows Ukraine to borrow USD 3bn for the implementation of agricultural projects. On 13 July 2012, the Ministry of Fuel and Energy and the China Development Bank (CDB) signed a protocol on cooperation for the implementation of a USD 3.66bn programme to replace the consumption of natural gas in Ukraine with coal. All these deals are already backed by amendments to Ukrainian legislation providing state guarantees for Chinese loans. A precedent was set by a project called Air Express, conducted by a Chinese company, which was exempted from taxes. After a false start in December 2011, Air Express was re-launched in July 2012, only after Ukraine fulfilled all of Beijing’s demands to make the project as beneficial for China as possible and minimize risks through insurance, tax exemption, government guarantees, the involvement of Chinese companies in the construction, the use of materials imported from China and so on.

THE PRICE OF ISOLATION

Both parties are interested in the new lending and investment stage of Chinese economic expansion to Ukraine. The current government has made great efforts to discourage private foreign investment in Ukraine and FDI growth rate is slowing down every year. A research of Ukraine’s investment attractiveness conducted by the European Business Association (EBA) in Q2’2012 with 115 top managers of its member-companies showed that growing pressure on business from government authorities, cronyism, difficult tax administration and increasing corruption are the key reasons for poor FDI growth. All of this is unfolding against a backdrop of suspended cooperation with the EU and international financial institutions, as well as the lack of “equal and pragmatic” relations with Russia, since some major economic issues with the latter remain unresolved. Thus, Beijing is virtually the only remaining powerful source of the financial resources that Ukraine urgently needs. Unlike the West, it does not demand that the Ukrainian government sticks to certain values or unlike Russia, that it makes a clear geopolitical choice. Off the record, sources within the party in power confirm that this was the key motivation behind the choice of China.

MADE IN CHINA, BOUGHT IN UKRAINE

Chinese economic expansion has two components: trade and lending-investment. On the one hand, they complement each other; on the other, the latter signals the growth and cementing of China’s influence in one region/country or another. The first component brings a rapid growth of trade surplus between China and the potential victim. At the latter’s expense, China accumulates the assets that will give it financial and credit influence over a given country. This, in turn, fuels demand for Chinese goods and services. Eventually, the circle closes as the real assets of the country undergoing expansion are gradually transferred to China’s control. Based on international experience, the logic of Chinese intervention ultimately leads to the economic and demographic colonization of the given country by means of Chinese employees being brought in to work at the newly-built facilities. With a temporary opportunity to consume more than they are able to produce, potential victims slowly turn into a pioneer land of sorts, with abundant natural resources and other valuable benefits for China.

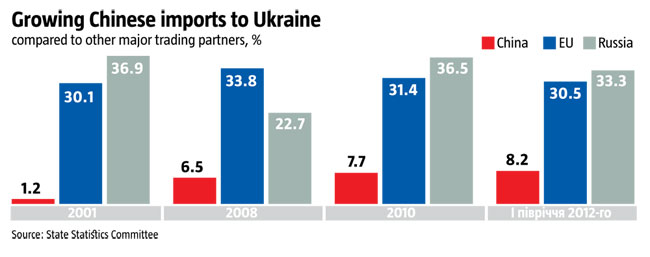

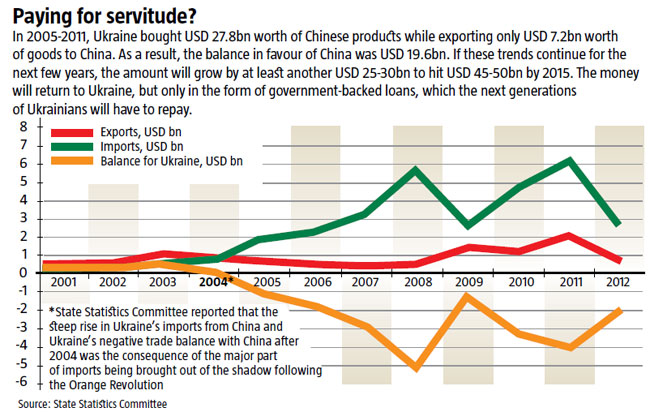

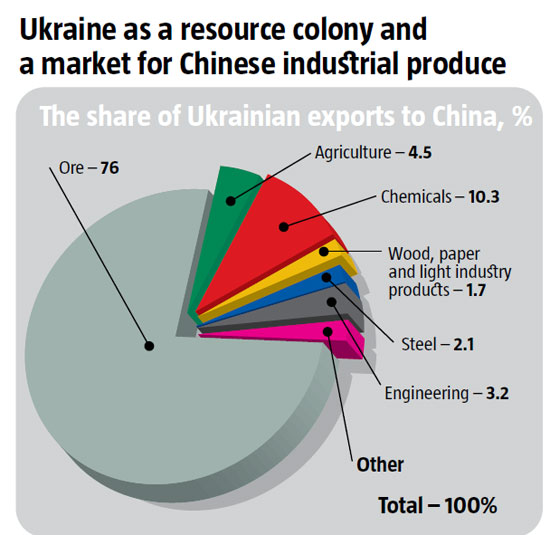

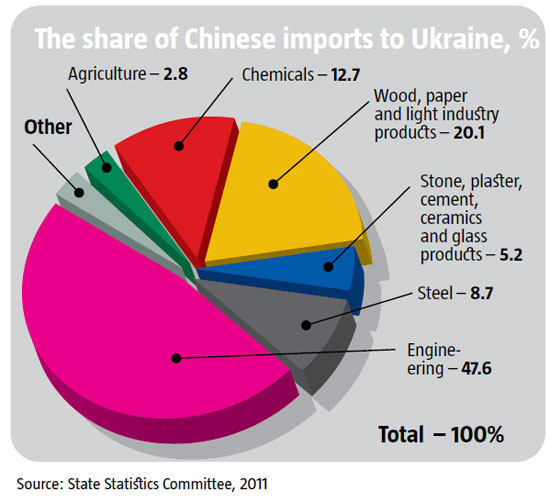

Ukraine has quickly gone through the first stage of such subjugation and is now on the verge of the second. The recent changes in the mutual trade structure signal the transformation of Ukraine into a supplier of raw materials and a market for Chinese products. Ore now accounts for more than 76% of Ukrainian exports to China, while 47.6% of Chinese exports to Ukraine are made up of engineering and electrical equipment. The rest constitutes chemical, textile and steel products. The trade balance is deteriorating at an alarming rate. In 2000, Ukrainian export to China was worth USD 0.63bn and exceeded Chinese export to Ukraine fivefold. In 2011, the balance changed dramatically with Chinese export growing more than 45 times to USD 6.27bn, exceeding the USD 2.18bn worth of Ukrainian export to China threefold. Over 2005-2011, China sold goods worth a total of USD 26.8bn to Ukraine and bought Ukrainian goods worth USD 7.2bn earning USD 19.6bn in the process from Ukraine. If this trend continues, this figure will grow by at least USD 25-30bn by 2015, reaching USD 45-50bn over the indicated period.

PRIORITIES

Apparently, China’s interest in Ukraine is the opportunity to gain control over the banking system and receive general subcontracts for the implementation of infrastructure projects, in order to increase the export of Chinese construction materials, equipment and building services, as well as the increased supply of industrial raw materials and food from Ukraine to China. The problem is that China is not ready to invest in Ukraine through FDI with all the underlying risks, as private businesses do in a market economy. Chinese state capitalism prefers to restrict itself to government-backed loans and deciding how the borrowed money will be spent at its own discretion, primarily guided by the potential benefits for the Chinese economy. The borrowed money should then quickly leave the “country of destination” in the form of payment for additional volumes of imports from China.

In November 2011, Serhiy Arbuzov, the Governor of the NBU said that he was soon expecting the expansion of Chinese capital in the Ukrainian banking sector, on a background of the reduced activity of the subsidiaries of Western groups, experiencing liquidity problems caused by the Eurozone debt crisis. For China, with its foreign currency reserves of more than 15 times the Ukrainian GDP, this is possibly the simplest form of expansion. As pertains the transportation infrastructure, in addition to “Air Express”, China intends to implement other projects, first and foremost in Kyiv and the Kyiv Oblast, such as a tunnel under the Dnipro River, the outer ring road in Kyiv and others. A relevant framework agreement was already signed on 18 April, 2011. In the energy sector, China is implementing a project to upgrade the Melnikov Mine worth USD 85mn between Lysychansk Coal OJSC and Tiandi Science and Technology Company. In the chemical industry, a pilot project was the modernization of the potash fertilizer plant in Kalush, Ivano-Frankivsk Oblast, by the Wuhan Engineering Co., Ltd. corporation. The cooperation of Chinese car manufacturers generally boils down the assembly of their car models in Ukraine.

China’s interest in the Ukrainian agricultural sector comes from its search for sustainable and long-term food supplies to the Chinese market. Over the first decade of the 21st century, China’s import of agricultural production has grown by an average of 22.3% per annum, reaching USD 72.55bn in 2010. Experts at the Da Vinci AG analytical company say that the most promising strategy for Chinese investors will be to buy Ukrainian agricultural holdings – market leaders, because the Chinese will not be interested in companies with less than 200,000 hectares of land. According to experts, the difficult situation surrounding medium-sized business in the agricultural industrial complex and the exit of small Ukrainian investors from the market will facilitate the quick acquisition of the necessary amount of “turnkey” land. A mandatory condition will be that people close to the government, who can guarantee the stable operation of the holdings, are among the founders or come in as the new owners of the company being purchased.

Eventually, Ukraine may end up with a new kind of business where small farming companies will be bought out in order to collect vast land plots for subsequent re-sale to Chinese investors. It looks like Oleh Bahmatiuk, a new Ukrainian billionaire, would like to take on the mission with his UkrLandFarming holding that controls nearly 0.5mn hectares of farmland, 18 meat plants, 6 each seed and sugar plants, 4 grain elevators and 10-15% of sugar and beef production. He also owns Avantgarde, the biggest producer of eggs and egg products in Ukraine. According to People’s Daily, a Chinese publication, in April 2012, Oleh Bahmatiuk signed a memorandum with CAMC Engineering, a subdivision of SINOMACH, the biggest engineering corporation in China, on the intent to invest up to USD 4bn into UkrLandFarming’s agricultural projects. The document included plans to build grain elevators, upgrade sugar plants, create protein clusters for the production of pork and poultry, and set up a joint venture for the assembly of farming equipment at AgroMash IF, which is to be sold on the Ukrainian market. Exim Bank of China gave its preliminary approval for financing such cooperation at the same time. Thus, the latest decisions of the Verkhovna Rada could be aimed at creating favourable conditions for the implementation of these agreements.

PREVENTING THREATS

“Unless we change our direction, we are likely to end up where we are headed” goes the old Chinese saying. The latest attempt of the Yanukovych regime to find “mutually beneficial cooperation and equal partnership” without irritating political demands in its focus on China, threatens to turn Ukraine into China’s mothballed raw material supply colony and a market for Chinese goods, as well as a potential destination for Chinese migrants. All this is likely to be accompanied by Kyiv’s intensified credit and financial dependence on Beijing. Having signed the law on 6 August, giving the green light to backing two Chinese “investment” projects for a total of USD 6.7bn with government guarantees, the president has opened a Pandora’s box, because government-backed debt often becomes public debt in the reality of Ukraine.

Another concern is that the expansion of Chinese capital often leads to the conservation of traditional corruption mechanisms that exist in the countries it enters. Unlike Western investors, the Chinese feel perfectly comfortable with them. The experience of Africa and other post-Soviet countries only proves this. As a result, such countries are deprived of the incentive to make any progress in the implementation of transparent and legal conditions for conducting business or choosing better civilization prospects, becoming doomed to social and economic degradation. Direct, as opposed to portfolio Chinese investments can only be of benefit for Ukraine on the preliminary adjustment of its legal and business environment to European standards and providing that Ukraine sets clear boundaries and terms for attracting Chinese investment that will serve the priorities of Ukraine’s development, and not that of other countries.