It goes beyond reasonable finance centralization and cuts the share of productive economic spending—including salaries, individual and corporate income and investment—in the GDP through fiscal charges, as it did in 2010-2011 from 60-63% to 52-54%. Lending and tax aggression hits Ukraine’s unproductive business sector hard.

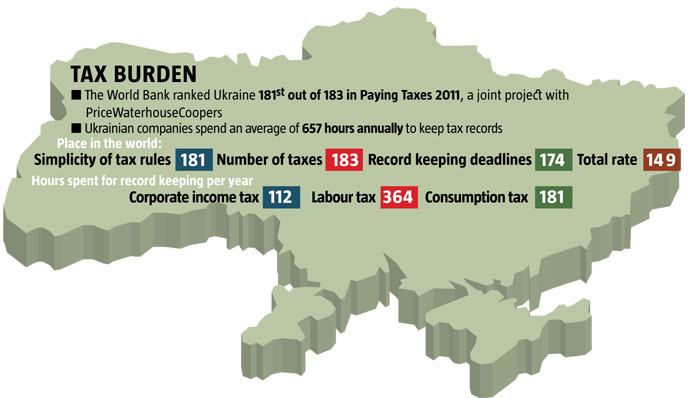

The local tax system largely results from the struggle between bureaucracy and entrepreneurship. It emerged from new capitalist-era taxes layered over old soviet fees and charges. Bureaucrats have been winning this struggle as they continue to increase their impact on society and execute financial re-distribution persistently and steadily, introducing new taxes and charges almost every year as part of the strategy. According to the Paying Taxes 2011 report by the World Bank, Ukraine has 135 taxes in various forms, which is the highest index in the world. Before 1992, it had 20-22. With this huge fiscal power in hand, officials control a growing share of social funds and have the necessary tools to punish or show mercy to taxpayers.

Government officials often say that the share of budget and pension flows in Ukraine’s GDP is nearly 40%, no higher than that in Germany or Italy. What they leave out, though, is that this moderate burden on producers often leaves some paying just a few taxes, while others pay more than they should. If the rules were the same for all and were universally obeyed, the abovementioned tax and pension burden share would amount to 65-70% of the GDP. Therefore, most companies find paying taxes in full unaffordable as they often exceed business income. Businesses thus become tax debtors that face the threat of property seizure and the loss of ownership. Conducting private business in this situation is a risky undertaking. Neither Germany nor other countries have tax rates at 150-300% of the company’s income, yet this is commonplace in Ukraine. Meanwhile, privileged corporations usually pay 10-12% of their net profit to the budget. As a result, some pay while others stuff windfall profits into their pockets, even if the average figures are the same as in Western Europe.

Actual tax rates are absurdly high in Ukraine, yet many companies evade paying them by using political privileges, personal deals or slipping into the shadows. Thus, the total fiscal pressure goes beyond all reasonable limits. In practice, the tax system is based on feudal rather than legal terms.

The pressure on entrepreneurs peaked when the Tax Code was passed in 2010. It neglects constitutional principles that protect individuals, private ownership and the right of individuals to legal protection in dealing with law enforcement authorities. Also, it made it possible for officials not to report to the public. Taxpayers were deprived of opportunities for timely judicial review of the actions of officials and the ability to make material or other claims against them. At this point, bribery is flourishing. The seizures of business assets that paralyze day-to-day operations have grown more frequent. Court appeals often end in favour of the government. The Tax Code has virtually suspended the effective laws of Ukraine that used to regulate bankruptcy, banking and other activities as the fiscal service now has the priority right to manage the assets of debtor companies.

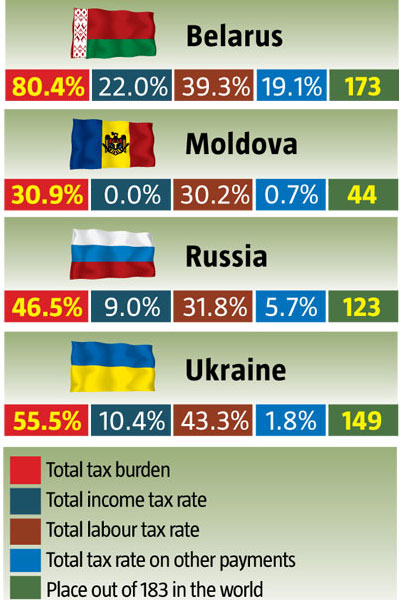

Source: 2011 study by the World Bank and PriceWaterhouseCoopers

Using tax authorities to bully entrepreneurs out of political battles unless they are on the side of the Party of the Regions is another big issue. This democratic country is sliding down into a semi-totalitarian enclave. The economic consequences of these “reforms” won’t remain hidden for long: businesses will crumble, workers will leave the country, assets will flow out and illegal deals will increasingly replace investment. These trends are already plain to see. However, this is a perfectly natural response from the business community signaling an inevitable economic downturn.

International organizations are right to list Ukrainian tax systems among the most burdensome in the world. According to the World Bank, only the Central African Republic and Belarus are worse than Ukraine.

Below are some of the unacceptable components of Ukraine’s tax system.

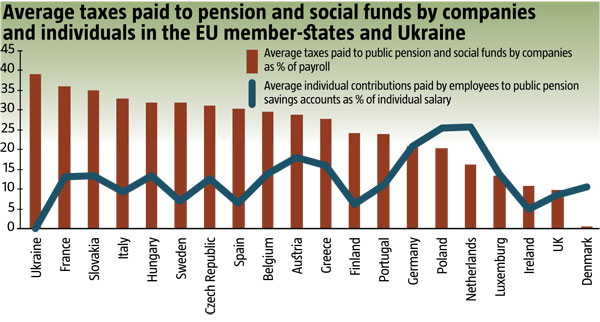

Source: 2011 study by the World Bank and PriceWaterhouseCoopers

The first one is the tax businesses pay to the pension and social funds. For most companies, it totals 39% of the payroll varying by industry (45% in coal mining). This rate was effective in the soviet times. In Europe, the tax ranges from 0.5% in Denmark to 33-35% in France, Italy and Slovakia (see chart), with the average EU rate at nearly 22%.

Ukrainehas to gradually cut taxes on payroll to facilitate new jobs in labour-consuming industries. The average tax rate should be brought down to the European 22-24% diversified by industries, which means 4-5% lower for textile, engineering and service (household, hotel, restaurant, repair, legal and other) industries and higher for raw material production.

The tax rate for corporations in Ukraine should be cut alongside the implementation of individual retirement savings insurance to cover employees of all categories and age groups. Individual contribution rates should be decreased regressively for various salary and income rates: low-income categories should pay 25% or the highest contributions, while the richest should pay 5-6%. The average rate of individual accumulation contributions should amount to 17-18% of the earnings.

The current government seems to care little, if any, about such innovations. The only thing Mr. Azarov’s cabinet managed to do was increase the retirement age and cut retirement benefits to some categories. The reason is plain to see: even MPs do not control the Pension Fund and bureaucrats are tempted by the opportunity to manage billions every year.

Individual income tax is the second component. Ukraine has only a vague principle of applying different tax rates to different types of income. Employed taxpayers pay 17% to the budget, while the owners of profitable assets pay only 5% of their income that includes dividends and income from rent and royalties, while interest on deposits is untaxed. Legal entities that own small businesses pay a flat tax at two rates: 3% if registered separately as VAT payers and 5% for those who pay VAT as part of the flat tax. That is the percentage of their total income, i.e. all money and goods received free of charge. Thus the apparent discrimination: salaried workers compared to the owners of property assets, and small business owners who pay a flat tax regardless of whether they have profits or losses. Moreover, the salary tax rate was raised by 2% twice from 13% in 2006, while the tax on dividends and other income from assets has not changed since it was introduced in 1994.

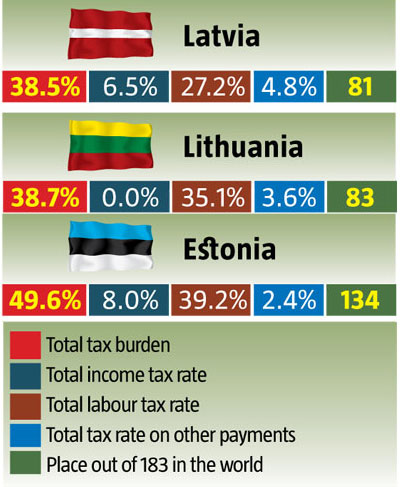

Source: 2011 study by the World Bank and PriceWaterhouseCoopers

With this approach, the fiscal burden on the owners of enterprises, stocks and other assets seems lenient. Why is that? This category of taxpayers embraces big asset owners skilled at controlling government initiatives and the voting of some factions in the parliament to prevent the passing of inconvenient laws.

Payroll taxes are clearly burdensome and raising them signals the neglect of average Ukrainians. This policy looks wrong and obsolete.

The tax burden on small businesses in Ukraine proves the intent to squeeze them out of the national economic process more than anything else, while governments in civilized countries do their best to support them. Europeans have developed a different model: small business owners often buy patents (the right to conduct business) and act freely with no statements or taxes. Bigger business operates under unified rules that provide for no special simplified tax systems.

The third component of Ukraine’s tax system, unacceptable as it is today, is corporate income tax. The drawback of the local practice of collecting this tax is frequent violation of the taxpayers’ rights at the stage of calculating their income rate. This is the unique practice of the tax administration that has nothing to do with the rules and standards of civilized countries. They apply all kinds of tricks to diminish gross expenditures and overstate income on the books of companies they inspect. For this purpose, they remove the costs of R&D, educational campaigns, written-off technological deficiencies, promotions, the repayment of loans taken earlier and payment for products obtained from flat-tax payers as excessive expenses from the statements. Also, they apply understated rates of capital depreciation and do not index the cost of depreciated item renewal. They look for forged breaches and errors in tax statements. All controversial aspects are interpreted in favour of tax inspectors. They have many more similar tricks that look like traps created intentionally through corrupt loopholes.

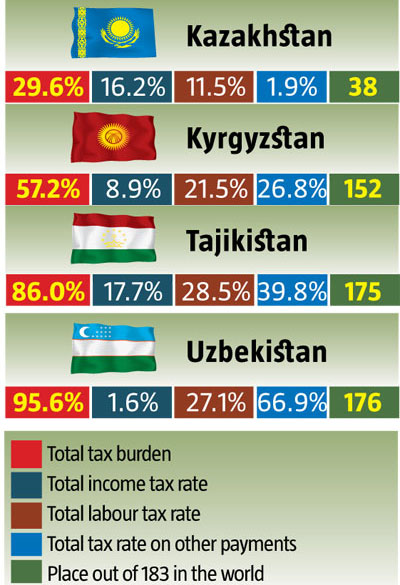

Source: 2011 study by the World Bank and PriceWaterhouseCoopers

In this situation, companies that report legitimately and have no administrative protection in fact pay 50% rather than 23% of their income to the budget compared to the corporate income tax rate at 19% in Poland and Slovakia, 17.7% in Hungary, 15% in Lithuania and Latvia, 12.5% in Ireland and 0% in Estonia. How can Ukraine compete with them and how can it possibly draw investment?

All this results in bribery, wasted time and effort waiting in queues to visit tax inspectors, a lack of firm rules for financial transactions making it nearly impossible for companies to plan their development strategies far ahead and increases risks, the decline of private financial funds and the expansion of grey economy.

The manipulation of laws and selective taxation often used by tax inspectors can easily ruin the whole tax system. It will bring less and less revenue to the budget, eventually leading the government and its model to bankruptcy. The state will no longer be able to fulfill its functions.