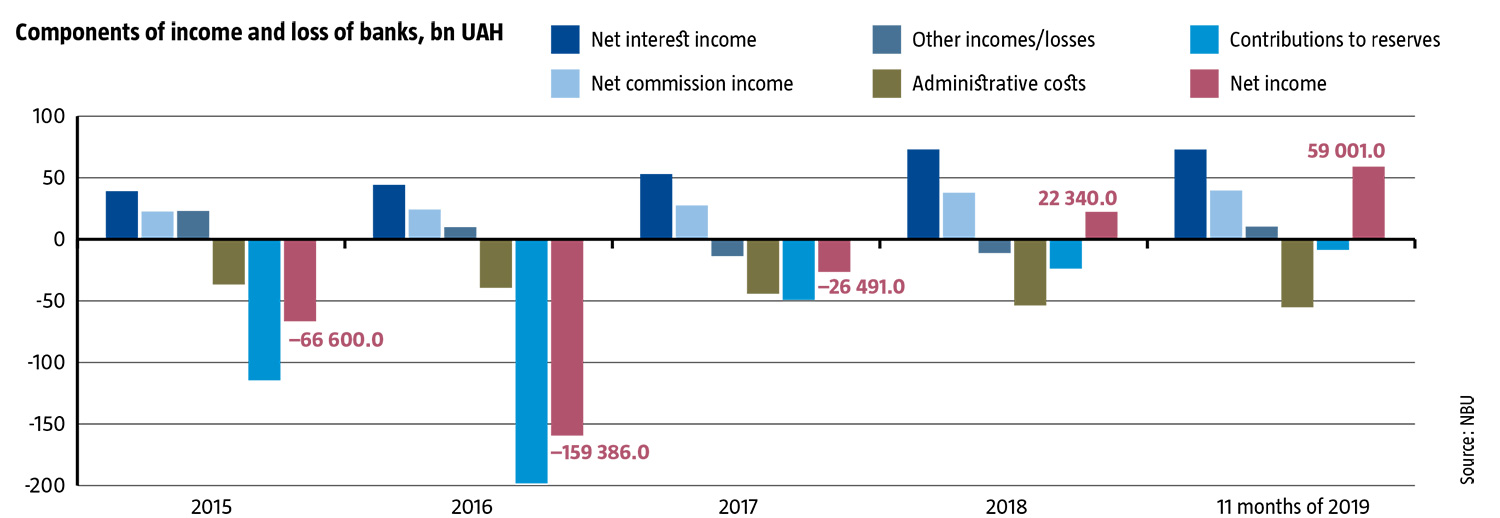

2019 was the best year for Ukraine’s banking system since the beginning of the crisis in 2014, and one of the most successful years in its history. The cumulative profits of domestic banks were UAH 59bn for 11 months of 2019, which is 2.6 times more than what they earned over all of 2018. Just two years ago, however, Ukraine’s banks finished the year posting a loss of UAH 26.4bn. Cost-to-income ratio (CIR), the best indicator of operating margins, was 47.4% after QI-III of 2019, meaning that income from banking activities was almost double costs. In 2018, CIR was 58%. This is one of the best figures in the world, where globally banking tends to be a profitable but low-margin business.

The number of banks operating at a loss, i.e. banks whose income from their main activities does not cover their costs, has declined every year. There were 18 such banks in 2017, 14 in 2018 and only 10 by November 2019. For three years now, not a single bank has gone bankrupt, and those banks that have left the market since January 2017 have reorganized into financial companies. In other words, they handed back their licenses but stayed in the market.

The inflow of deposits from individual and business clients has increased steadily: hryvnia-denominated deposits from both categories have grown 30% or almost UAH 150bn. The money coming in from local depositors serves as the key resource for banks, accounting for over 80% of the funding they draw, compared to 50-60% before the crisis. This means that the banking system is far more resilient to potential external and internal shocks, and an outflow of non-resident money than it was before the crisis. At that time, interbank and foreign lending accounted for 40% of liabilities.

High revenues, operating profits, stable domestic deposits, favorable macroeconomic conditions, and low vulnerability to potential external problems show that, today, Ukrainian banks are no longer at threat from any serious systemic risks. The only potential risk is a default on the government bonds that account for 25% of net assets in the banking system. Yet, there are no reasons for this to happen, even if a serious global crisis emerges. In short, the resilience of the Ukrainian banking sector is real, and while the position of some individual banks is questionable, the overall system is healthy.

This does not, however, mean that Ukraine’s banking system is completely problem- or risk-free. Trends in the banking sector suggest that the record-breaking profits of 2019 were an exception rather than a developing rule. Profitability is likely to decline this year and to keep falling further on as deposit and loan rates continue to slip and competition among banks grows. In fact, this cycle has already begun. Banks that failed to build up sufficient resilience, that is, to accumulate capital or to find a profitable business model, risk leaving the market in 2020 or the next few years. Moreover, the NBU will gradually increase capital requirements for banks in order to keep the sector from excessive risk and strengthen its resilience against potential crises, which means that banks will have to work harder and harder with every passing year to earn profits.

RELATED ARTICLE: Fear and loathing in the banking sector

Interest and commissions

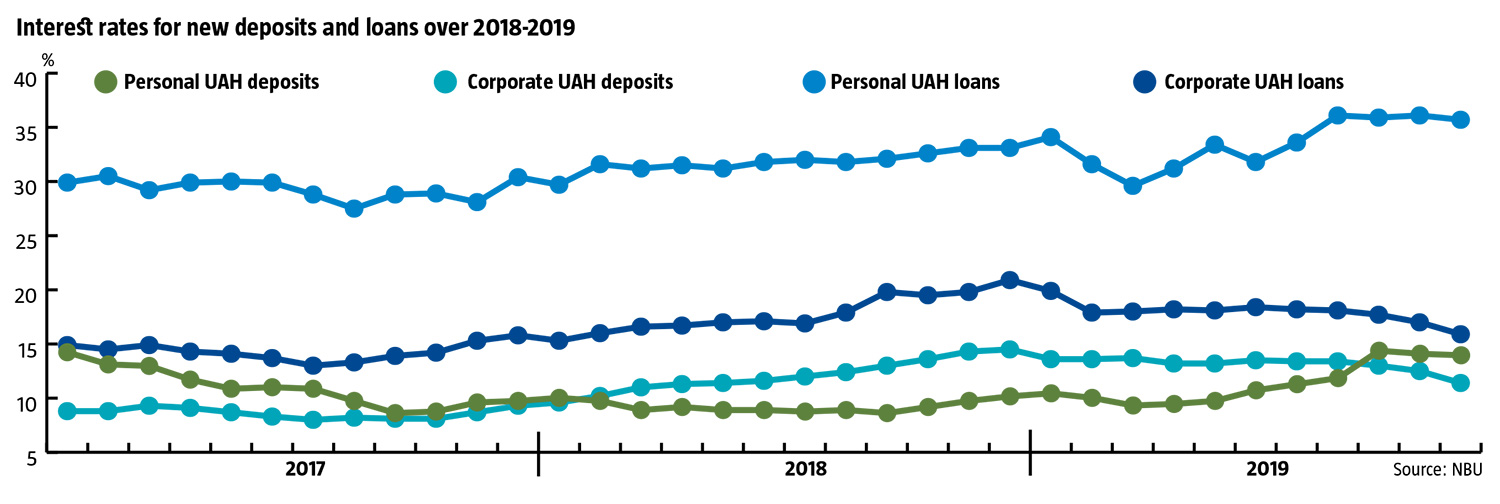

The primary factor that generated record-high profits in 2019 was the spread between loan and deposit interest rates. Over 2018-2019, high rates on loans and securities were coupled with moderate rates on both commercial and personal deposits. Net interest margin (NIM), the margin between return on assets and the cost of borrowing, was 5.8% in 2019, the highest since 2009. As a result, net interest income grew on average 17% year-on-year over the past three years.

A second factor was the rise in high-yield consumer lending, the only category of loans growing 30-40% yearly in the last three years. Interest rates on these loans are more than double the rates on corporate ones. The third factor contributing to profitability was an economic revival that guaranteed a spike in bank settlements and fees. Net commission income grew 20% annually over 2018-2019, partly due to consumer lending, as banks tend to charge fees when issuing such loans. Commissions in 2019 accounted for over 25% of all income in the banking system, up from 16% in 2016.

The final factor was a significant decline in funding set aside as reserves against expected losses on issued loans due to devaluation. Accounting rules require banks to report such losses as incurred and reflect them in their statements, decreasing the amount of net income accordingly. This sum shrank from UAH 49bn in 2017 to UAH 24bn in 2018, and barely UAH 9bn in 2019, the lowest in a decade. The shrinkage of these reserves essentially indicates that banks have cleaned unprofitable assets off their books, an endeavor they launched back in 2015 under the supervision of the NBU. After a series of stress tests, which turned into an annual exercise in 2018, and regular checks of lender solvency launched in 2017, banks were forced to report the real quality of their assets, which had proved far poorer than what they were showing in statements. In mid-2017 alone, banks recognized that over half of all the loans they had issued at that point were non-performing.

Over 2015-2017, contributions to reserves against these loans essentially ate up all the banks’ operating income, making the sector unprofitable during those years. After banks acknowledged all the bad debt in their portfolios and accumulated reserves against them, they returned to profitability in 2018 and showed record-breaking financial performance in 2019, as contributions to reserves declined rapidly.

Liquid and solvent… for now

Liquidity and solvency are two main components that ensure resilience for individual banks and the banking system as a whole. The ability to meet liabilities to depositors and other lenders at any point in time is critical. Problems with deposit and loan servicing were the key reason for the closure of so many banks over 2014-2016. The ability to service liabilities over a long period, which determines solvency, is basically the capacity to generate sufficient income to cover interest on deposits. These two concepts are often mixed up. In reality, liquidity problems do not always reflect on a bank’s insolvency, and sometimes the most profitable banks can struggle when faced with a sudden outflow of funds. Indeed, insufficient solvency most often causes liquidity problems.

Virtually all banks in Ukraine have enough liquidity, even an excess of it today. The share of highly liquid assets, including monetary assets and NBU certificates of deposit, was nearly 25% of net assets in early 2019. For an individual bank, its liquidity coverage ratio or LCR reflects its ability to pay out clients when a massive outflow of money happens during a month when it has had virtually no income. Nearly all Ukrainian banks have an LCR of over 100% of the NBU’s requirement. For the biggest banks, it’s 300-500%, which means that they essentially have enough funds to settle with depositors over three to five months, even if income from loans and commissions plummets.

The situation with solvency situation is less cheering. Formally, all Ukrainian banks meet the 10% capital adequacy norm (H2). But some, including big banks, meet it quite narrowly. What this means in practice is that the banks will face solvency difficulties if one or more major debtors stop servicing their loans for some reason. At the beginning of 2019, the capital adequacy ratio at eight mid-sized and large banks was barely above the minimum.

The first indicator of potential solvency problems is performance in the annual stress tests published by the NBU at the end of each year. According to the results published in December 2019, 11 of the 29 banks that did stress tests could potentially experience solvency issues. Most banks where stress tests revealed poor capital adequacy addressed that problem during the year, but their measures were often ad hoc – neither their business models nor their lending practices changed. The next stress tests will likely reveal the need to recapitalize again.

Not the right time for corporate lending

In terms of structural problems facing Ukraine’s banking sector, the main issue is an imbalance in lending portfolios that favors consumer loans, which generate higher yields but are more short-term and riskier than corporate lending (see Interest rates for new deposits and loans over 2018-2019). Banks have shown their ability to effectively redistribute funds among individual clients, including wealthy depositors and low-income borrowers, but their new corporate lending is feeble. Statistics actually show a decline, although this took place after banks wrote off and sold non-performing loans at a discount, and reevaluated loans denominated in foreign currencies to match the hryvnia revaluation. NBU data shows that the amount of non-performing loans shrank almost 5.5% or UAH 33bn between early 2018 and mid-2019. Over 65% of those were non-performing corporate loans that banks either sold or wrote off. But new corporate loans have been growing at an average of 2-3% a year, which is too slow compared to the pace of lending to consumers.

Instead, banks have been investing their free money in securities –primarily public securities, government bonds and NBU CDs, which accounted for 25% of total assets by the end of 2019. Banks have kept investing in CDs even in H2 of 2019 when yields declined significantly, even though corporate loans offer much higher returns. Such a serious gap suggests that Ukraine’s banks don’t see enough large-scale, reliable borrowers. In a nutshell, corporate lending looks too high-risk to them.

The statistics on non-performing corporate loans offer the best explanation for this perception. The total share of such loans in the system was 48.9% at the end of 2019. So, almost half of all corporate loans issued by banks are not being paid off. This is the highest indicator in the world. By comparison, this share in Greece and Portugal is 45% and 12%. Obviously, many of these loans were issued to major business groups by state-owned banks and PrivatBank before the crisis. For example, the share of non-performing loans at PrivatBank is over 80%, and almost all of these loans were issued to the companies related to its former shareholders.

Yet, nearly 20% of corporate loans in the portfolios of private banks are also non-performing. As the market for selling non-performing corporate loans is not nearly as active as that for consumer loans, corporate lending is unlikely to pick up significantly, even if interest rates go down.

State-owned outliers

Ukraine’s state-owned banks, especially OshchadBank and UkrEximBank, are the weak links in the domestic banking system. Their profits are below the sector’s overall average, and below the performance of the two other big state-owned banks, PrivatBank and UkrGazBank.

“OshchadBank’s cost-to-income ratio is 94%,” the NBU’s Financial Stability Report noted in December 2019. “For UkrEximBank, the CIR was over 100% a year ago and should remain at the same level in 2020 provided that foreign currency-denominated items on the balance sheet are not revaluated.” Indeed, both banks posted profits only thanks to the income from the interest on government bonds used to recapitalize the banks earlier. Their main activities – lending and payment transactions – are operating at a loss.

Despite the fact that their deposits are guaranteed by the government – directly for OshchadBank and indirectly for UkrEximBank – both banks offer some of the highest interest rates on deposits and current accounts on the market. Meanwhile, a good share of their loans is not generating any income at all. Over 50% of their loans are non-performing, which is among the top levels in the entire banking system. The NPL share of private banks with Ukrainian capital is only 18%.

PrivatBank had similar problems after nationalization, including a very high proportion of non-performing loans, high interest rates on deposits, and reliance on government bonds for income. But it managed to quickly improve efficiency, such as by cutting interest rates on deposits. It was already operating in the black in 2018, even with no government bonds. Its income from loans, mostly retail, and commissions was enough to cover the cost of deposits, staff and branch overheads. Today, PrivatBank is the most profitable bank in the system, with UAH 32bn or 54% of all net profits earned by Ukraine’s banks over 11M 2019.

RELATED ARTICLE: 7 steps to a new strategy for public banks

Time for the price-cutters

Three main challenges for Ukraine’s banking system in the next two-three years are shrinking profit margins, the sluggish corporate lending market, and the two unprofitable state banks (see Components of income and loss of banks).

The factors driving strong profits are unlikely to remain in the future. The era of high interest rates is ending. Inflation was far below forecasts in 2019, so the NBU started cutting the prime rate in the second half of the year. Starting in July, it was trimmed from 17% to 13.5%, going down another 150-200 basis points in January 2020. The NBU has already indicated plans to continue cutting it until it is down at 8% over the next two years. This will allow banks to make corporate loans more attractive while offering lower rates on deposits. Given current trends in the banking sector, the NBU expects interest rates on loans to decline faster than interest on deposits. This will, of course, make deposits more expensive than loans and banking transactions will become less profitable.

Another factor putting downward pressure on profit margins will be rising overheads: payroll, office maintenance, new technology, marketing and advertising. These costs have grown over 20% annually in the past few years, but high interest rates and commissions offset the costs. Starting in 2020, Ukraine’s banks will increasingly find themselves caught between the shrinking margins on transactions with interest, such as lending and investment in securities, and growing administrative costs. As a result, most banks, except maybe the state banks, will already see their profits go down this year.

Yevhen Dubohryz, financial analyst who was deputy director of the NBU’s financial stability department over 2015-2019

Translated by Lidia Wolanskyj

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook