A hybrid war brings “hybrid” results to every aspect of a society’s daily life. Just as we can’t understand what’s really going on at the front, where conflicting information comes from — it can be either very good news, “Everything’s ok,” or really bad news, “Everything’s lost” —, we also can’t understand what’s going on with other areas of the society, including with the economy.

Good news or bad news?

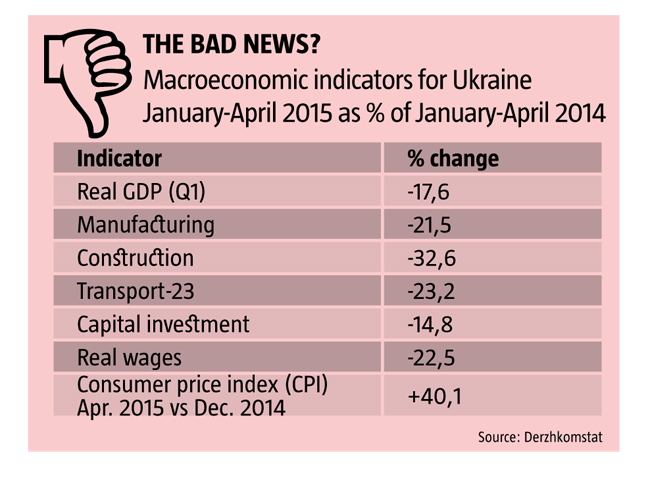

On the one hand, we see negative data and it is quite justified. GDP, roughly speaking being the net cash that a country can distribute, consume or invest, declined 17.6% in Q1 of 2015, which means that Ukraine is now operating with nearly 20% less cash than a year ago. This is the main wealth that the government can manage in real time, so a drop of 20% is an enormous loss.

In addition to this, industrial output has declined 22%, transport has dropped 23.2%, and construction has plunged 33%. Meanwhile, real salaries have shrunk by 22.5%, while prices soared 40% by April 2015, compared to December 2014. And whoever knows these numbers, especially those outside Ukraine, looks at them and says, “Good Lord, what a mess! How can people survive in a country like that?” And Vladimir Putin adds: “Time for the third Maidan, my Maidan!”

In addition to this, industrial output has declined 22%, transport has dropped 23.2%, and construction has plunged 33%. Meanwhile, real salaries have shrunk by 22.5%, while prices soared 40% by April 2015, compared to December 2014. And whoever knows these numbers, especially those outside Ukraine, looks at them and says, “Good Lord, what a mess! How can people survive in a country like that?” And Vladimir Putin adds: “Time for the third Maidan, my Maidan!”

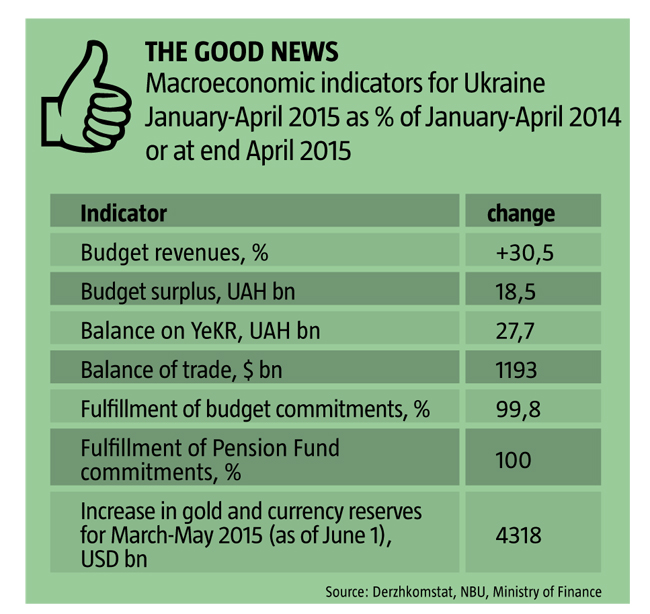

Let’s start with the bad news: “We’re goners! We’ve been conned!” is a widespread sentiment in Ukraine. But if we put aside these numbers and look at some other, equally official statistics instead, the situation begins to look “just a tad” different and not so bad at all. According to official financial numbers, at the macroeconomic level, where all the financial and economic streams run together in a society, we will notice that both in the first quarter and over April–May, the government covered all its budgetary commitments in full, paying out wages and supporting institutions involving defense, national security, education and other branches and programs. Local administrations also covered all their budget commitments. There have been no hold-ups in paying pensions or other social benefits.

What’s more, the Unified Treasury Account (YeKR) where all contributions to the State Budget go from commercial entities, individuals, physical and legal persons, contains nearly UAH 28 billion today, although at the beginning of the year, the country had only UAH 3 billion. This is the money that is taken in as revenues and distributed further. Part of it is already allocated and is supposed to cover the country’s budget commitments, but part of it is surplus, reserve cash, and is supposed to be distributed anew. This is about nearly UAH 18.5bn.

This means that Ukraine has not only fulfilled all the commitments to individual citizens and legal entities that it took on in the budget law, but has also accumulated additional financial resources that can now be allocated to other projects within the budget. This money now has to be distributed, which means amending the current budget, as no one can simply go ahead and spend this cash.

As Margaret Thatcher once aptly put it: “There is no ‘state money.’ There’s only taxpayer money.” And there is a fair chunk of this despite the poverty besetting the country today. Back in 2008, the YeKR also had about that amount of money, although the exchange rate was still UAH 5/USD then, whereas it is now UAH 20/USD. But that money was poorly used. The Government issued one-time pension rises just in the run-up to the 2010 presidential election, taking on colossal commitments that have continued to destroy the balance in the Pension Fund to this day. But today we don’t have the option of frittering away this surplus. It’s not the time and the options are simply not there.

If we take a look at statistics from the National Bank of Ukraine, at the trade balance and balance of payments, then we can also see a lot of good news there. Yes, exports and imports fell, but exports remain US $1.193bn higher than imports, something the country has not seen for a very long time. This means that Ukraine brought in more hard currency through trading goods and services than it paid out, which provides the basis for a more stable hryvnia. The deficit in the balance of payments has shrunk severalfold compared to last year and continues to slow down. Since the huge devaluation, currency markets have been operating steadily. What’s more, the hryvnia has even grown stronger and currency reserves are growing. What should we make of this good news?

Shock Therapy: Worthwhile sacrifices?

The first four months of 2015 were for Ukraine what the early 1990s were for the Poles: shock therapy. For Ukrainians, it was very concentrated and swift, although the impact of this shock was enormous and complicated. According to the UN, which just recently completed a study on the standard of living of Ukrainians, nearly 80% of the people are now at the poverty level, that is, according to UN standards, they are living on less than US $5 or UAH 105 a day. Business profits have plummeted, manufacturing has plunged into the red, and sales are in the doldrums—on top of the huge devaluation of the hryvnia and double-digit inflation already mentioned.

Still, it looks like shock therapy may have also brought some good news (see The good news). This was possible, firstly, because of solid financial and macro-economic policy, and secondly because the Finance Ministry and Cabinet acted correctly to balance macroeconomic proportions and the financial situation in the country. And these proper actions put enormous pressure on purchasing power, sharply cutting back consumption among the population and working capital among businesses. Cutbacks in salaries and pensions and an effective halt to lending were the sacrifices that ordinary Ukrainians and Ukrainian business brought to the altar in return for the current macrofinancial stability and the uninterrupted functioning of the country’s financial system.

But such sacrifices should not be in vain. Not only because they brought Ukrainians considerable pain in the midst of a war against Russia and its proxies, but more importantly because they provide a basis for carrying out real economic reforms at last. Macroeconomic stability must be in place before any real reforms can be undertaken in individual sectors and areas.

RELATED ARTICLE: Head of National Anti-Corruption Bureau Artem Sytnyk: "Our task is to break the stereotypes of society accustomed to living in a corrupt environment"

Wanted: Rational economic policy

Driving from Zhytomyr to Kyiv recently, trucks carrying brand-new cars, all of them imports, could be seen on the highway for the first time in a long, long while. This signals not only about demand, as there are always some people who have money. The point is that the “elastic importer” waited until the economy was once again in balance, when the hryvnia was stable again, because a fluctuating hryvnia means that this kind of importer will do nothing. A rise in direct investment in Ukraine since the beginning of the year is another signal that there have been changes at the macro level and real reforms can be undertaken. This means that, war or no war, investors are starting to move again.

So the first condition for serious reform, macroeconomic stability, is in place. The next step is specific actions in specific sectors in both the economy and the social sphere.

At this stage, it’s extremely important to begin easing pressure on demand because a dramatic decline in demand not only means less income for consumers and hardship in their daily lives—both those who are working and those living on pensions—, but it also makes it impossible for businesses to grow. A company can’t sell its products when there is no purchasing power.

Right now, what Ukraine needs is for consumption to increase as soon as there are some resources and the shoots of macroeconomic stability become visible. That means removing the most draconian caps on pensions and wages, introducing indexing, dropping the most burdensome taxes, and withdrawing the strictest restrictions on the currency market. A new version of the pension law—which has been languishing in the legislature thanks to the machinations of two female deputies who were one-time “social” ministers and the support of well-known populists—needs to be passed immediately. Discount rate needs to be reduced and business loans given a jump-start.

RELATED ARTICLE: Decentralization: The Wrong Solution to the Wrong Problem?

The economy has to be slowly liberalized as its current severity no longer corresponds to the current reality. And, of course, that UAH 18.5bn “surplus” needs to be very wisely distributed. Some part of it should go to a critical national project, preferably energy conservation, and another part to stimulate greater consumption using either budgetary or other mechanisms. Preparations should slowly be made for the upcoming fall (local elections are scheduled for October 2015 – Ed.), increasing consumption among ordinary Ukrainians so that the country can meet it in a normal fashion. Then there won’t be any talk about a “third Maidan.” In short, Ukraine needs thoughtful economic policies.

This economic policy should not just be about decentralization and deregulation, but about infrastructure and the very conditions for commercial activity. That is the key. This economic policy should mean specific projects and specific actions in specific areas. There are not enough of such thoughtful and contemporary actions today. What is worse, it is not clear who personally will actually undertake them. Ukraine’s current Government does not even have a deputy premier in charge of economic policy. In fact there has never been such a post. This, as much as anything, demonstrates just how unprepared state institutions are to working positively. But we have to give ordinary Ukrainians their due: they have survived this colossal pressure and the shock, making many sacrifices in order to gain the necessary results, so no one has the right to waste them.

Why don’t the numbers match?

Statistics make sense when they are comparative. If a given company worked last year and is still working now, it is easy enough to compare its results. The same goes for a territory, be it oblast or country. But how can you compare if a territory has changed, when part of it is now occupied and the border keeps shifting? Clearly, that territory that cannot be accounted for has to be excluded. At one point, Ukraine’s statistics failed to reflect this but then the adjustments began to be made. A few months after Crimea was taken, statistics came out that no longer included it. Crimea itself once had a republic-level statistics office, but it now works for a different country, so data about the peninsula is no longer forthcoming.

With the occupied counties of the Donbas, things are a bit more complicated. When economic statistics are published, there is a footnote stating that they are “without the counties of Donetsk and Luhansk Oblasts where the ATO is taking place.” But the ATO is also on territories controlled by Ukraine, and there are also areas that are temporarily occupied by Russia. Are they also part of this excluded territory? How precisely is all this calculated? It is impossible right now for any boundary to be precisely established, because some companies were registered on Ukrainian territory while others remained in the occupied areas. There are also doubts about the accuracy of the baseline from 2014 that is being used for comparison purposes. We are talking, more or less, about the economic potential, up to 20% of Ukraine’s GDP, that Donetsk and Luhansk Oblast produced prior to the war with Russia.

RELATED ARTICLE: What reforms are going on in Ukraine's energy sector and what is their outlook?

In this situation, to completely rely on basic macroeconomic indicators makes little sense. They are at best simply orientation points. On the other hand, the figures for real money that has been received by the Finance Ministry’s institutions are precise data and can be relied on. Of course, there has been devaluation of the hryvnia and inflation. But the money is there: Ukrainians have shifted into a new system of coordinates and this is cash that is “in pocket” and really exists. Yet many do not want to believe these figures. Yes, in her recent meeting with the IMF head of mission, NBU Governor Valeria Hontareva announced that Ukraine has positive indicators for its banking system and hryvnia exchange rate. She stated that Ukraine needs to start slowly easing pressure on consumers and businesses, including the restrictions that were instituted. But they answered her that it was still “too soon” because of the poor macroeconomic indicators.

It is hard to dispute with the IMF representatives, as they use the same statistical data that we provided here (see The bad news) and he only sees bad results. After seeing these, they won’t even bother looking at the second page (see The good news) and they won’t be bothered trying to understand our very mixed results. Yet this is what needs to be talked about because right now, Ukraine’s economy and other spheres are very much in a “bad news, good news” situation. This is a hybrid reality against the background of a hybrid war and we need to learn to live with it—and take advantage of the situation.

We cannot waste this opportunity as it has cost Ukrainians far too much!