Following the meeting with the Russian Minister of Economic Development Alexey Ulyukayev in early March, European Commissioner for Trade Cecilia Malmström announced that she supports the resumption of trilateral talks between Brussels, Kyiv and Moscow to once again try "to find ways to address the concerns expressed by Russia, within the flexibility provided by the EU-Ukraine DCFTA." According to sources, Ukrainian and European sides both agreed that it is impossible to further postpone the implementation of the FTA, but they do not rule out possible amendments to the implementation.

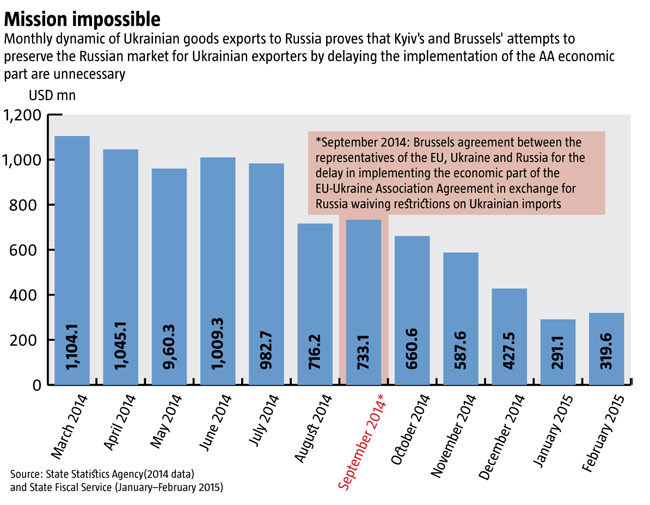

However, earlier experience shows that Kyiv does not benefit from the Association Agreement-related compromises with Russia. On September 12, 2014, an agreement was reached between the representatives of Ukraine, EU and Russia in Brussels that in exchange for postponing the implementation of the economic part of the Association Agreement until 2016, Russia will refrain from introducing restrictions on Ukrainian goods. Ever since, customs statistics have not shown any positive effects of this "compromise." To the contrary, the exports of Ukrainian goods to Russia in the first two months of 2015 (USD 0.6 bn) shrank almost threefold compared to July–August 2014 (USD 1.7 bn), the two months preceding the Brussels agreement, and compared to January–February 2014 (USD 1.6 bn). It is unlikely that even if the economic part of the Association Agreement had been implemented without delay (in November 2014) and Moscow had cancelled preferential custom duties for Ukrainian goods in response, Ukrainian exports to Russia would have dropped much more.

RELATED ARTICLE: How Ukraine can survive the next heating season without Russian gas and coal

Ukraine is being pushed out of the Russian market as a result of both objective and subjective reasons. The objective factors include Russia’s long-term strategy of import substitution and the recent ruble devaluation that reduced the purchasing power of Russian consumers, as well as the fact that many companies in the Donbas are going out of operation due to military hostilities. The subjective factors include the ongoing undeclared trade war waged against Ukraine, despite the "compromise" made in Brussels in September 2014, as well as the voluntary withdrawal of a number of Ukrainian suppliers from the Russian market through its unpredictability and unreliability. The Ukrainian Week predicted earlier that if the current trends in bilateral trade are preserved until the start of 2016, the share of Russia in Ukrainian exports will have dropped to 10-12% by the end of 2015. In reality, the share of the Russian market in Ukrainian exports has shrunken to 10.1% during the first two months of this year.

The postponement of or amendments to the implementation of the economic part of the Association Agreement cannot change the long-term trend whereby Ukrainian producers will lose the Russian market. The minimum that is required to keep it is complete surrender in the form of the complete cancellation of the economic part of the AA and the beginning of Ukraine's integration into Putin's Eurasian Union, which is not acceptable to either Kyiv or Europe. Any other concessions will not force Russia to stop its discrimination against Ukrainian suppliers. Thus, any efforts to achieve another "compromise" seem to be just the attempts to turn a blind eye to the reality, refusing an effective compensation package, which the Ukrainian economy badly needs today from the EU.

At the same time, Moscow’s continued Moscow's attempts to blackmail Kyiv or Brussels after three and a half years of permanent trade wars no longer have any grounds. Ukraine no longer depends on trade and economic relations with Russia. Instead, both future and present of the country depend on redeeming the inevitable losses on this market by finding new niches both on the European market and on elsewhere in the world.

RELATED ARTICLE: Alan Riley: Ukraine has enough potential to turn itself into the center of gas trading for Central Eastern Europe and Baltic States

Meanwhile, the "compromise" games send a dangerous message to Putin, encouraging him to continue pressure on Ukraine and the EU in order to make them freeze the economic part of the AA, and subsequently have them cancel it altogether. The earlier Moscow gets a clear message that the economic integration and association of Ukraine with the EU is a fait accompli (and this requires the full ratification of the Association Agreement and its dynamic implementation), the more it is likely to abandon this issue.

Instead, Ukraine needs more efficient support from its European partners that would offset the unavoidable loss of foreign exchange earnings and jobs through the final breach of trade and economic relations with Russia. This support should not come from attempts to preserve preferential terms in trade between Ukraine and Russia within the CIS FTA Agreement, but in promoting increased exports of competitive Ukrainian products to the EU. It should also include the EU-sponsored microcredit programs and consultations provided to Ukrainian small and medium-sized producers, giving them information on how and where they can sell their products in the EU and what is required to do so.

In order to increase Ukraine’s exports to the EU and elsewhere and attract new investment, incentives from Brussels are also required, as well as its control over the implementation of European standards and harmonization of Ukrainian laws with the European framework. Much more important support on the side of the EU would be to encourage European manufacturers to establish production facilities in Ukraine to make their parts and components here, against the guarantee of European institutions, their governments and the government of Ukraine. In fact, at the current hryvnya rate, the average salary level in Ukraine today is nearing that in the not-so-rich countries of Asia, and is lower than in China. At the same time, Ukraine has a number of obvious advantages compared to remote Asian countries.

RELATED ARTICLE: A Road Map for Economic De-Sovietization

The analysis of the current customs statistics published by the State Fiscal Service reveals the reduction in the number of Ukrainian product groups for which the Russian market remains the main one, as well as a significant diversification of exports of even those products that until recently were focused almost exclusively on the Russian market. In terms of foodstuffs, these now include beef (USD 4.8 mln; hereafter, unless otherwise indicated, the data is provided for January–February 2015) and pork (USD 3.7 mln since the beginning of the year), frozen and canned vegetables (USD 3 mln), cocoa paste (USD 5 mln), salt (USD 3.7 mln) and wine (USD 2.7 mln). Russia still gets the largest share of Ukrainian exports of ceramic products, perfumes, household chemicals, paper, wallpaper, packaging containers, labels, printed matter, and certain types of building materials (gravel, chippings, and clay). However, the manufacturers of all these products work mainly for the domestic market, the demand on which is much more important to them.As a matter of fact, the volume of Ukrainian exports to Russia since the beginning of 2015 is equivalent to only 28.3% of Ukrainian supplies to the EU during the same period. In this way, its increase by 20-25% could almost completely offset the loss of even all of Ukraine’s exports to Russia.

Russia remains a large and almost the only importer of Ukrainian aluminum hydroxide (USD 74.4 mln), which currently accounts for 1/8 of all Ukrainian exports to Russia. However, it is unlikely that Russia will refuse the imports of this material. The exports of mechanical products still depend mostly on the Russian market. But even these goods, whose exports amount to hundreds of millions or billions of hryvnyas per month, have more diversified market outlets.