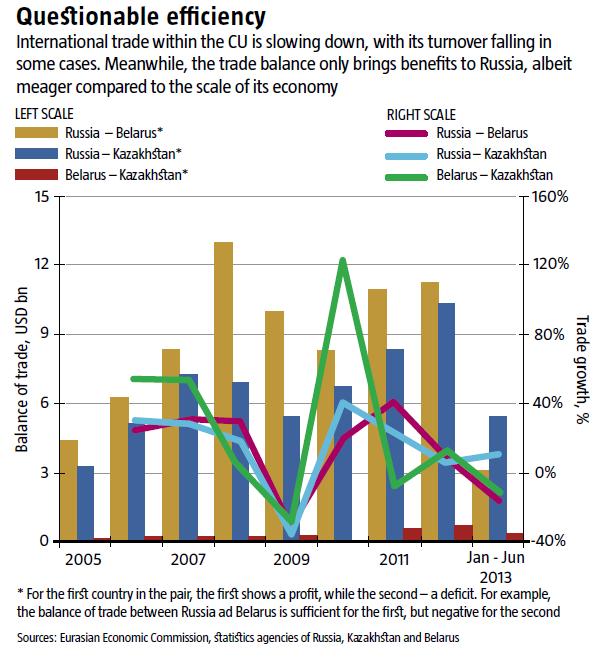

The Customs Union (CU) was enacted in July 2010, so member-states had a chance to experience all of its benefits by 2011 (see Questionable efficiency). Initially, they were indeed visible, as trade between Russia and Belarus grew that year by 42%, and between Russia and Kazakhstan – by 23%. Meanwhile, trade between Belarus and Kazakhstan shrank by 7% but that had no particular impact since in any case, it is much lower than that between Russia and other CU member-states. Instead, the effect was comparable to the growth of trade as a result of the post-crisis economic revival in 2010. However, it did not last. Economic growth slowed down shortly thereafter. Trade between Kazakhstan and both Belarus and Russia ultimately began to decline in the first six months of this year. This revealed a crucial problem: membership in the CU gave each state some short-term benefits while its general long-term effect is too paltry to justify the economic purpose of this union.

A YOKE FOR KAZAKHSTAN

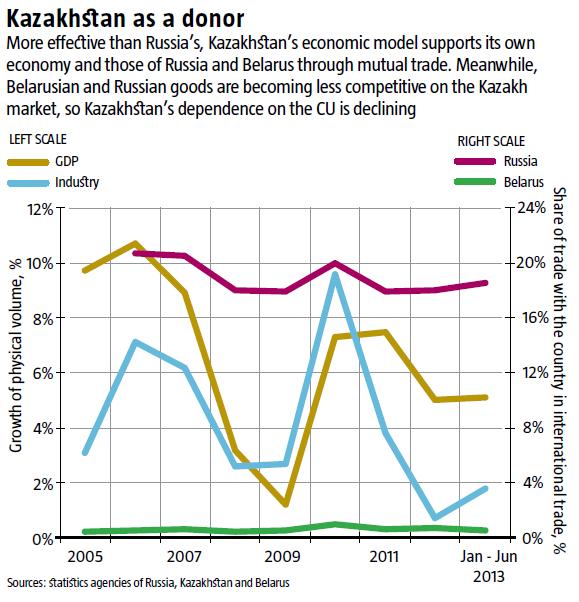

The Kazakh economy has had the fastest growth in the CU. Last year, real GDP increased by 5%. This pace continues in 2013 (see Kazakhstan as a donor). This mostly comes from the service industry which grew by 10.4% in 2012, while internal trade, as well as IT and communications have been a driving force of the economy.

In fact, services are not the primary source of Kazakhstan’s development. Its major economic driving force is oil and gas, which generates 26% of GDP and 74% of total exports. A large chunk of revenues from the production and export of fuel goes to the Sovereign Wealth Fund which channels it to the priority development of the economy and the service sector. This is where the Kazakh economic model differs from that in Russia, where revenues from oil and gas exports are used to maintain international influence, including financial, through investment abroad, and high domestic consumption that provides a luxurious lifestyle for the chosen few and bread and circuses to the masses.

READ ALSO: In Whole or in Part?

Thanks to its model, the Kazakh economy is enjoying significant growth. Even though this rate is now lower compared to the nearly 10% before the crisis because the oil and gas sector had already hit its peak (last year’s output was the same as in 2011), careful and reasonable spending of oil dollars will still keep economic dynamics high for a while.

This model defines the position of Kazakhstan’s economy in the CU. Since energy accounts for 75% of its total exports, Kazakhstan is not interested in the markets of other CU member-states. Russia is a fuel exporter itself and a monopolist supplier to Belarus. If Ukraine were to join the CU, Russia and Kazakhstan would in theory compete for its market. However, this does not seem plausible. In practice, there would be no competition, as Ukraine would turn into an energy monopoly of Russia similar to Belarus. This was why Kazakhstan’s exports to Russia shrank by 4% in 2012, and to Belarus – by 13%.

The structure of Kazakh imports fits into this economic model as well: oil dollars are carefully invested in innovations to make the entire economy more competitive. In 2012 and 2011, the import of machinery, equipment and vehicles accounted for 39% of the whole. Commodity-oriented and technologically backward, Russia and Belarus are not capable of meeting Kazakhstan’s needs, shaped by its economic model. Unsurprisingly, Russian and Belarus exports to Kazakhstan grew by 89% over 2009-2012 compared to a 108% rise in Chinese exports. When it comes to competition, it is efficiency rather than unions that counts (see Kazakhstan as a donor).

READ ALSO: The Kremlin’s Bluff

Thanks to brisk economic growth and continued strong trade ties with CU member-states, Kazakhstan’s imports from them grew until 2013 (it was still increasing by 13% with Russia but falling by 9% with Belarus in the first half of 2013). As a result, the trade balance with these countries has been gradually declining (see Questionable efficiency). Compared to the insignificant trade deficit with Belarus at USD 0.7bn in 2012, with Russia it rose from USD 6.7bn in 2010 to USD 10.4bn in 2012. In fact, once Kazakhstan became a member of the CU, it voluntarily began to support the Belarus and Russian economies. However, it is not getting any benefits in exchange.

BELARUS’ MISERIES

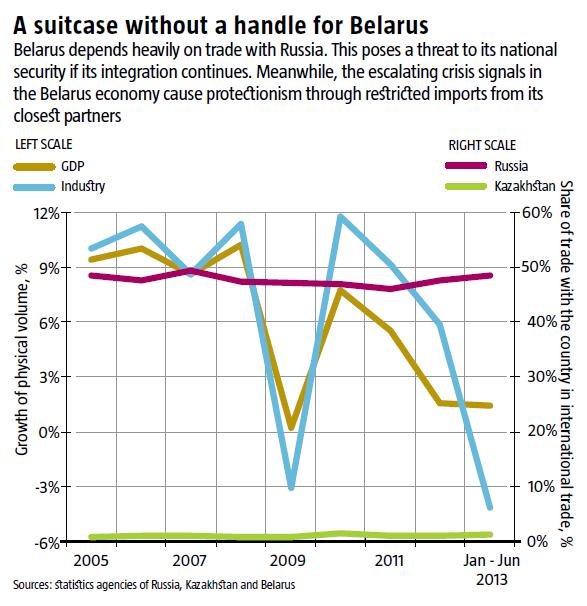

The Belarus economy is much more similar to that of Ukraine than Kazakhstan. It is equally industrialised, although focusing on chemicals and petrochemicals that accounts for nearly 40% of Belarus’ industry and a lion’s share of its exports. This makes its economic development heavily dependent on revenues from exports. If these shrink, the negative impact on economic growth multiplies (see A suitcase without a handle for Belarus). Over the first six months of 2013, Belarus’ GDP growth slowed down to 1.4% (the country has been in recession since Q2’2013), while industrial production plummeted by 4.2%. Even the threefold devaluation of the Belarus ruble and joining the CU in 2011 did not help.

READ ALSO: Russia’s Last Chance

Belarus has very close trade ties with Russia. In the first six months of 2013, it sold 42% of its exports to Russia, while Russian goods accounted for 54% of Belarus’ total imports. It is arguable whether the boost in trade with Russia from 47% in 2010 to 48% in Jan-Jun 2013 was due to Belarus becoming a member of the CU. However, the countries are unlikely to generate further growth, plus it is very risky for the national security of Belarus. Trade with Kazakhstan accounts for a mere 1% of international trade. Thus, the cumulative effect of Russian, Belorussian and Kazakh integration seems pretty miserable so far, nor does it look very promising in the long run.

Given the growth of the trade balance in Russia’s favour since Belarus joined the CU, its membership has a negative impact on Belarusian citizens. Belarus seems to have realized this: as soon as its macroeconomic indicators began to worsen, it applied protectionist tools to improve its trade balance. This affected its CU trade partners, as imports from Russia and Kazakhstan fell by 24% and 29% respectively over Jan-Jun 2013 compared to a decline in total imports of only 11%. In fact, this Minsk-style protectionism is the first signal of how CU member-states will act when times get tough. Any crisis will push CU integration and all of its far-fetched benefits to the sidelines. No CU member-state will support its partner. This makes it profoundly different from cooperation within the EU and the eurozone.

RUSSIA: NEW TOOLS FOR COLONIALISM

In 2012, the Russian economy proved 10 times bigger than that of Kazakhstan and 32 times that of Belarus. Poor economic benefit from this integration is the first indicator that Russia pursued different goals when it set up the CU. A comparison of cumulative Russian exports to Belarus and Kazakhstan (USD 45bn in 2012) with its total export of energy commodities (USD 369bn or 70% of total exports) reveals that the CU is not likely to become a driving force for the Russian economy anytime soon or ever.

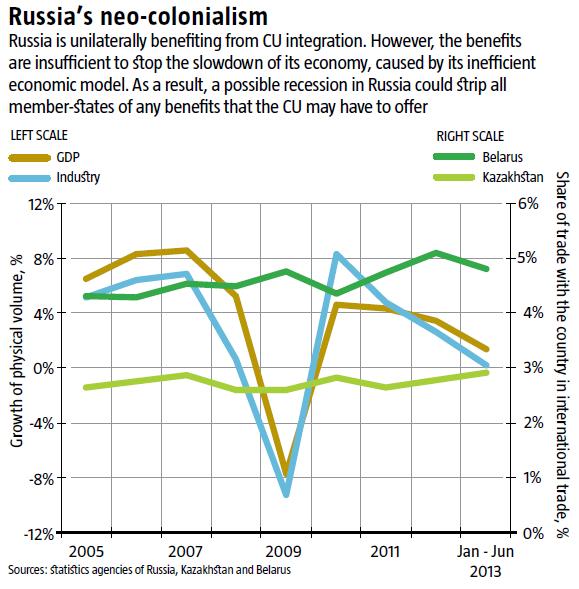

Russia’s economic model would be similar to that of Kazakhstan if it spent its oil dollars to create new jobs within the country. Instead, it splurges on politics and social populism. As a result, its economy, where, similarly to Kazakhstan, fuel production is stagnating, performs much worse than the Kazakh economy and is just a step away from recession (see Russia’s neo-colonialism). If it employs Belarus’ techniques to overcome an economic crisis, the meager effect of CU integration that is already barely noticeable, may grow into a serious problem for CU economies. The increase of Russian imports from Kazakhstan and Belarus has already plummeted from 22% and 46% in 2011 to 3% and 6% in Jan-Jun 2013 respectively, and this is hardly the bottom line.

Meanwhile, Russia is arguably the only beneficiary of CU integration (the political benefits are obvious). Its trade with Belarus and Kazakhstan has grown. So has the share of its international trade with these countries, rising from 7.1% in 2010 to 7.9% in 2012 (see Russia’s neo-colonialism). The trade surplus increased from USD 8.3bn and USD 6.7bn in 2010 to USD 11.3bn and USD 10.4bn in 2012 respectively (see Questionable efficiency).

READ ALSO: Till the Cows Come Home

This is not much, given the scale of Russia’s economy but the main thing is how Russia spends this money. Developed economies that have an international trade surplus with weaker economies normally return a large chunk of it through investment, since poorer economies offer better potential and higher returns on investment. This is seen in the flow of goods and financing among EU member-states. By contrast, Russia’s investment in Kazakhstan has never exceeded USD 1bn per year. According to the National Bank of Kazakhstan, the inflow of foreign investment from Russia peaked at USD 1bn in 2011 but fell by 25% in 2012. FDI stock from Russia was USD 1.8bn at the end of Q1’2013. It invests more in Belarus but the National Bank of Belarus reports that its FDI stock there was USD 9bn, i.e. below the annual balance of trade between the two countries. Russia’s efforts to increase its trade surplus with its CU partners without giving anything back indicate the real purpose of the union.

Another curious aspect of the CU is the impact of the global goods flow on trade within it. Both Belarus and Kazakhstan are WTO observers, while Russia has been a full member since 2012. In the future, the growth of Russia’s goods flow to other CU member-states may come from the re-exports of non-Russian goods, thanks to the price differentiation that makes it convenient for Russia to resell goods to Kazakhstan and Belarus. This once again proves that neither Minsk nor Astana benefit from the CU.

LESSONS FOR UKRAINE

The above analysis leads to a number of conclusions. Firstly, the positive impact of the CU was short-lived and is barely noticeable today. Secondly, no CU member-state will enjoy significant economic benefit from membership in the long-term, since the core of their economic models are not linked to the CU. Kazakhstan is likely to become a permanent donor while Belarus does not need the CU to deepen trade with Russia – the latter is swallowing it up anyway. The economic effect of this integration is too insignificant for Russia to be seriously interested in it. Thirdly, the CU is an egocentric entity rather than a partnership. As soon as any of its member-states face economic troubles, none of its CU partners will support it. The first years of its existence have already proved this.

The CU is quite a strange integration project. The expected decline of the Russian economy will reveal its dark sides to the full extent. It will fall apart, since there may not be any point in free trade with Russia for Belarus and Kazakhstan once crisis trends grow to a certain level in Russia. In 2011, Uzbek President Islam Karimov stated that his country will not join the CU because it “could go beyond economic interests and gain a political colour and essence.” So far, the project only seems to have been of a political essence.

Voluntary membership in the CU appears to be economic suicide for Ukraine. The arguments of its advocates do not stand criticism. They say that Ukraine’s international trade will grow annually by USD 9bn if it joins the CU. Even if we assume that this is not a random figure, it is only 16% of Ukraine’s trade with CU member-states in 2012 and a mere 5.8% of Ukraine’s total international trade. Given the trade records of CU member-states, this may be the case in the first year or two after joining but the growth will not last.

READ ALSO: The Mythical Benefits of the Customs Union

Also, CU proponents state that the cumulative effect of Ukraine’s integration into it will be a GDP growth of 15-18% within just a few years. If credible, this number shows that Ukraine’s integration into the CU will make it only four to six times poorer than developed countries, rather than the five to seven times poorer it is now. In addition, the economic model of Russia as the core country in the union will push it and its satellites farther behind the world’s leading economies that will continue to develop.

The final, supposedly most persuasive argument that CU advocates use is the revival of a synergy from the collaboration of hi-tech industries – something they assume will bring long-term benefits. However, Russia’s economy is hardly innovative. Plus, it has been replacing hi-tech imports from Ukraine with substitutes produced at its own plants. This is the case in many sectors where Russia has replicated production technologies, such as railway transport, energy mechanical engineering, pipes and so on. With industries where Ukrainian technologies are unique (some airplanes, aircraft engines, turbines and more), Russia-based facilities that were part of the production chain in the USSR have largely gone to rack and ruin. A Ukrainian aircraft engineer once joked that you have to call some plants in Russia before lunch, because all of the people in charge there are drunk or out of the office in the afternoon – there is no smoke without fire. Thus, Ukraine may find the real effect of this synergy much less attractive and it will require much more time than portrayed.

The only possible impact of Ukraine’s membership in the CU is a paltty one-time benefit. Eternal backwardness is the price to pay. Economically, such integration will not only close most developed markets for Ukraine, but block access to investment, innovative technologies, development and support in times of crisis. Without all this, sustainable economic development will be unrealistic for Ukraine. Its economic model will grow more and more similar to that of Russia or Belarus, which are far less effective than even the Kazakh economy, let alone developed economies.