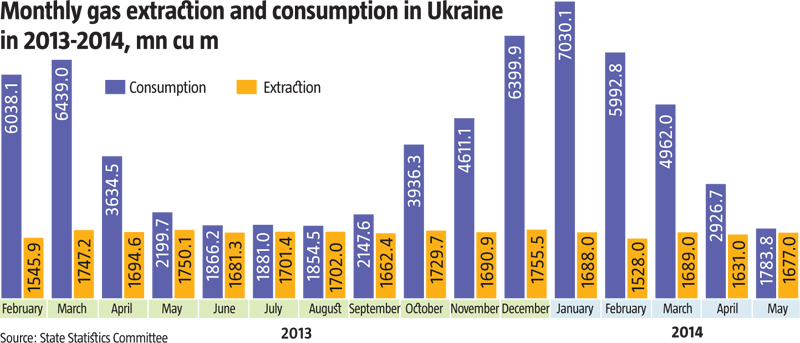

On 16 June 2014, Gazprom discontinued gas deliveries to Naftohaz, and both companies sued each other in the Stockholm Court of Arbitration. The Russian monopolist demands the payment of “debts” accumulated through previous purchases of highly overpriced Russian gas. Naftohaz wants Gazprom to cut the price of gas and compensate for the extra money paid over the past years by reducing what Gazprom describes as Ukraine’s debt for gas. Given the volumes of gas extraction and consumption in Ukraine in 2013, as adjusted for lower consumption expected this year, Ukraine’s domestic extraction could well meet its need for natural gas through September. Gas received through reverse deliveries from Europe can be pumped into underground storage facilities (USF) which already contain over 14bn cu m.

However, another gas row with Russia could last for no-one knows how long, so the Ukrainian government has started preparing for the heating season without waiting for Russian gas. On 4 July, parliament passed in the first reading the Cabinet-sponsored law “On the Special Period in the Heating and Energy Complex” which envisages a series of measures to be taken if the government calls a state of emergency in the energy sector. These include possible cutoff or restriction of energy and gas supply to various categories of consumers and mandatory sale of natural gas to district heating utilities by privately owned companies. On 7 July, Vice Prime Minister Volodymyr Hroisman, who is in charge of the utilities sector, said that the energy crisis headquarters developed a comprehensive plan to reduce gas consumption and implement a gas replacement strategy for all categories of consumers.

How cold will this winter be?

The government or Naftohas have not disclosed details of how Ukraine is preparing for survive the coming winter without Russian, but available data allows an educated guess.

Traditionally, the heating season lasts from 15 October to 15 April. It can occasionally start and end one or two weeks later or earlier, depending on the weather. Private consumers turn the heating on and off when they see fit. Gas consumption in October 2013 through April 2014, when an effort was made to be economical, was at 36bn cu m. Over the same period, Ukraine extracted nearly 12bn cu m of gas, which left a deficit of 24bn cu m. Crimea extracted and consumed roughly the same amount, so the deficit for Ukraine minus the peninsula remains the same for 2014. Of the 14bn cu m currently stored under the ground, some 9bn cu m can be consumed, while 15bn cu m more will have to be obtained from Europe or saved.

In June, Ukraine imported 0.32bn cu m of gas from Europe, a little more than half of the maximum capacity of pipelines in that direction. The pipelines from Poland are used to full capacity, while reverse supply from Hungary could be doubled. Inefficient use of the pipeline from Hungary is alarming because it makes no use for the excess of natural gas usually available on the market in the summertime (apparently, there is none currently). In early July, the daily deliveries in this direction fell to less than a third of the capacity. If they remain so low, Ukraine will not have even 10.5bn cu m of gas in its USFs available by October.

RELATED ARTICLE: Gas or No Gas?

However, Slovakia is scheduled to begin reverse gas deliveries to Ukraine in September. Naftohaz has already purchased most of the outgoing throughput capacity of the Vojany-Uzhgorod gas pipeline from Slovakia’s Eustream. More than 20 European companies have submitted gas supply bids for this pipeline. It can deliver up to 800mn cu m of gas per month. Whether it will be used to the maximum is an open question, considering how poorly the available reverse pipelines are being used now. Gas consumption typically spikes in late September, while reverse supply from Slovakia may not kick in by mid-September or even later, so Ukraine is unlikely to accumulate even 11bn cu m in its USFs by October.

In the seven months of the heating season (October to April), Ukraine may receive up to 10.5bn cu m of gas from Hungary, Poland and Slovakia combined. The existing problems with filling the pipelines will only be exacerbated in wintertime. Gazprom, and Vladimir Putin personally, threatened to reduce gas supply in order to minimize possible reverse deliveries to Ukraine. Thus, there is a high risk that no more than 4-5bn cu m of gas will actually come from Europe over this period. This would leave a deficit of at least 10-11bn cu m which would have to be saved inside the country. A lot will depend on whether the central government will restore its control over the Donbas and secure full-fledged operation of industrial enterprises there. This region consumed nearly 6bn cu m of gas in 2013. Without the need to supply gas to territories controlled by terrorists, Ukraine would almost halve the projected gas deficit. However, the calculations below assume the optimistic scenario.

According to a detailed balance of gas consumption (published by the State Statistics Committeeonly for 2012, but not for 2013), the biggest gas consumers outside the utilities sector were chemical plants with nearly 7bn cu m of gas consumed. Gas accounts for 60-80% or more of their production costs in most cases. They export most of their products, which makes them, in a way, re-exporters of Russian gas, something that is not advisable given the current price level and the ongoing gas war. Chemical plants employ a mere 0.4% of the total workforce (3% of industrial workers), and of these just 25% work at the plants of Dmytro Firtash’s Osthem Holding which leads the pack among industrial gas consumers. If these workers are laid off and the government decides to fully compensate their salaries, it will spend an equivalent to the cost of 200-300mn cu m of gas. Moreover, Firtash has recently assured that his plants can do without gas, using imported semi-finished products, mainly ammonia, instead.

RELATED ARTICLE: The Third Gas Revolution

However, even if chemical plants are factored out, this will still leave a sizeable hole – 6-7bn cu m of gas which will need to be saved in the utilities sector. All these calculations are based on the assumption that the 2014-2014 winter will not be colder than the previous ones and that the utilities sector will require 7-10bn cu m of gas. Half of it can be saved even this season by switching part of the boiler houses to alternative fuel (charcoal, firewood, etc.). According the sources that spoke to The Ukrainian Week, this process is already underway in communally owned boiler-heated houses in villages and raion (county) capitals. The rest will probably have to lower the temperature of water delivered to residential buildings for heating.

Thus, even if the coming winter turns out to be colder, the country will, in general, have enough gas. But a large part of chemical plants and possibly some others will have to be cut off from gas supply. Most Ukrainians, especially those whose houses or flats lack proper insulation, will have to come to terms with the fact that indoor temperatures in wintertime will range between 16-190 C rather than the usual 20-230 C. Quite a discomfort, but not a catastrophe: electric heaters or simply warmer clothes could be used if necessary. Communal district heating utilities lend themselves better to these austerity measures, while private consumers can only be forced to comply by lowering pressure in the gas distribution network and reducing the consumption norm for the existing tariff, while at the same time charging the full price for over-the-limit gas (UAH 6-7 or more per cu m, depending on the UAH/USD exchange rate). Residents of villages and towns who now use gas-heated boilers would do well by purchasing electric heaters or solid-fuel boilers.

Not stopping halfway

In general, one can be safe in assuming that, given proper mobilization of all available resources, the country will be able to live through the winter even without Russian gas. If accomplished, this feat would be another devastating blow to the stereotype of “Ukraine’s critical dependence on Russia”.

However, the 2015-2016 heating season will be a bigger challenge. This season, Ukraine will have nearly 9bn cu m of Russian gas in its USFs, which was stored there before gas supply was cut off in June. If these reserves are exhausted by May 2015, at least the same amount of gas will need to be pumped into USFs in just five months of the break in the heating season. The existing reverse supply capacities (7-7.5bn cu m over five months) will not suffice, especially considering that it may be hard to utilize them in full. Moscow is aware of the fact and will wait, if necessary, for the next heating season which, in this case, would require even stricter austerity measures or finding alternative sources.

RELATED ARTICLE: A Pipe of Discord

This suggests that, in addition to emergency measures for 2014, large-scale, long-term projects of gas replacement need to be implemented or new gas supply routes developed. The government has reported that the Ministry of Finance and other relevant agencies are considering multiple options for replacing Russian gas. Each may be implemented when advisable for a specific region or group of towns.

First, biofuel (wood, straw and agricultural plants) may be used. This option is especially attractive for towns with no more than 20,000 residents, and they happen to account for nearly half of the country’s population. Second, storage heaters can be used to store electrical energy at night. It takes merely 25 working days to implement this project, because the equipment is easy to adapt to the existing heating system. Third, synthetic gas obtained by gasifying charcoal waste can be used for heating. Fourth, coal-water mixtures can halve the cost of thermal energy. Fifth, domestic gas extraction volumes can be increased using deep drilling technology. In the past decades, dozens of condensed gas deposits have been found at depths exceeding five kilometres. This gas would be much more expensive to extract, but if sold at a price comparable to the current prices of imported gas (and exempt from all taxes and duties, if necessary), it may be economically efficient.

The main thing, however, is to finally move from words to actions, especially those that can secure desired results within 1.5-2 years. There is enough time left to implement many of the scenarios outlined above by the start of the next heating season and even build additional sections of gas pipelines running dozens kilometers or even more than 100 km. It is also possible to use a floating LNG terminal, purchased or leased, as was the plan several years ago. Most of the apparent challenges here can quickly be resolved by securing comprehensive U.S. support and involving American business. The Unites States is preparing to start exporting gas and will be able to deliver several billion cubic metres to Ukraine next winter, if not this one. To this end, American tankers and a leased LNG terminal could be used, and get Washington to help persuade Turkey to remove any obstacles for traffic through the Black Sea straits.

RELATED ARTICLE: Black Sea (In)Security

To accomplish real diversification, political will must be exerted now and guarantees have to be extended to all partners to assure them that current or planned projects in which they are involved, including the one with the LNG terminal, will be realized even if Russia offers another discount or sets a damping price on its gas. For this purpose, Ukraine’s legislation or the Constitution needs to be amended to the effect that the proportion of gas coming from Russia or any other country cannot exceed 20-25% of Ukraine’s total consumption. And this quota will need to be enforced even if Gazprom offers half the price charged by other gas suppliers in order to regain control over Ukraine’s market.

In this decision-making process, the key consideration should be national security risks stemming from dependence on Russia rather than economic efficiency. Russia and companies totally dependent on the Kremlin’s wishes have proven time after time that they will never be reliable and predictable partners to Ukraine. Every effort needs to be made to safeguard the country against inevitable future breakdowns in relations with Russia. It would be a fatal mistake for the government and Naftohaz to continue to harbor any illusions that, even without implementing these and other alternative projects, Gazprom will “sooner or later be forced to make concessions to avoid losing the Ukrainian market”. This approach would drive Ukraine into a still worse situation immediately after Gazprom builds the South Stream or implements other possible projects.

If the lawsuit in Stockholm takes too long, Ukraine should unilaterally stop fulfilling the agreements with Gazprom on the transit of Russian gas no later than on 1 May 2015. This can be done, for example, by taking the right to exploit Ukraine’s gas transportation system away from Naftohaz, which signed these agreements, and transferring it to some other company. In this way, the Russian gas monopolist and European importers will have to make changes to the existing agreements in line with a key principle – Russian gas is sold on Ukraine’s eastern border as an external border of the Energy Community to which Ukraine is a party. By forcing Gazprom to sell a large part of its gas on the Ukraine-Russia border starting from the next heating season, Ukraine will boost its standing and make it much simpler for itself to purchase gas from European companies.

RELATED ARTICLE: Aspirations to Control the Gas Market