With Ukraine’s economy in recession for over a year now, companies are struggling to deal with the lengthy decline: some are receding into the shadows, others are reporting losses and some have terminated production. However, not all companies face the same difficulties. Income and income tax dynamics show that non-oligarch businesses are left to struggle through the crisis and satisfy the state’s growing fiscal appetite while the biggest oligarch industries enjoy the best tax privileges.

INCOME DRAIN

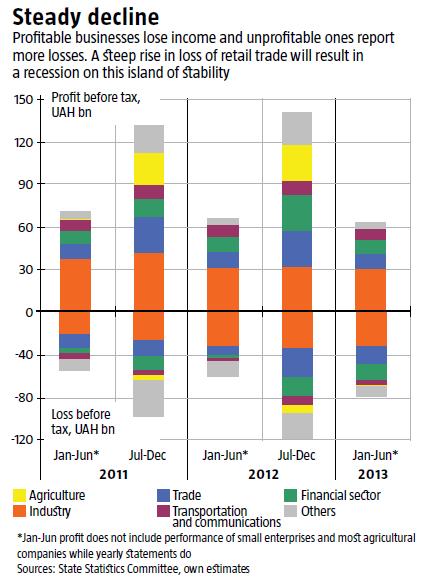

Crisis developments began to appear long before Q3 2012 statistics reported a decline in GDP and the beginning of a new recession (see Steady decline). From January to June 2012, profitable enterprises reported a 16% decrease in profits before tax compared to the previous year, while non-profitable companies reported a 48% increase in losses. This negative performance was initially confined to the industrial sector but was likely to spread to other sectors. Since then, corporate profits and the inflow of corporate tax have been shrinking.

This is due to several factors. Thanks to high grain prices and despite a poor harvest last year, agriculture boosted overall income. This trend is unlikely to continue into 2013 since grain prices are falling even though the 2013 harvest is good. However, even if farmers’ income did grow, income tax revenue from agriculture would hardly change since farmers pay a flat tax.

The financial and insurance sectors performed unexpectedly well: in 2012, their profit before tax hit UAH 49bn, which was UAH 18bn or 59% higher than the year before. Out of this, UAH 23bn was collected in Q4 2012. Where did this revenue come from if neither banks—with UAH 2.5bn higher profits before tax (UAH 9.7bn)—nor insurance companies (with a similarly moderate rise) contributed to it? Since real tax inflow was recorded based on those amounts (the financial sector paid UAH 12bn more in income tax in 2012 compared to 2011), the boost in budget revenues was probably due to holdings, asset management companies and other profit centres. In Q1 2013, however, they fell back: the financial sector reported a slight rise in income and a loss of UAH 15bn, i.e. sevenfold from last year. Most likely, this is not due to the introduction of an excise tax on securities transactions or other government decisions.

READ ALSO: Capital Outflow

In fact, the financial sector was not the only one that showed signs of recession in Ukrainian business in the first six months of 2013. Virtually all industries have gone through a painful 31% rise in losses (before tax) to UAH 78bn compared to the first six months of 2012. Even retail trade which was an island of growth throughout 2012 and part of 2013 reported 77% higher losses totalling UAH 16bn. Clearly, payroll cuts and a decline in sales will follow, further curbing tax revenues.

AFTER US, THE DELUGE

Despite the visible decline of the corporate tax base, tax pressure on businesses has been growing for the past few quarters (see Tightening the screws to them). This began last year when tax pressure was abnormally high during Q1-3 2012. Effective tax rates were 29%, 36% and 24%, or 4-7pp higher than in 2011. In Q1 2013, it grew further to 41%. Meanwhile, the basic income tax rate envisioned by the 2010 Tax Code was gradually decreased from 23% in 2011 to 19% in 2013. The government uses this and some other positive changes in the tax legislation, such as fewer taxes and shorter time expenditures needed to fulfil tax statements, as a showcase for international organizations. In reality, tax authorities use their own interpretations of the tax legislation and their powers to squeeze money out of businesses and collect far more corporate tax payments than the companies' profit suggests.

In the first quarter of 2013, for instance, most profitable SMEs paid advance taxes estimated in proportion to their income in the previous year rather than the tax on their actual income. They were obliged to pay 1/9 of their income for 9M 2012 in January-February, and 1/12 of their total 2012 income for the following months. This boosted the effective tax rate to a record 41%.

READ ALSO: After Them the Deluge

Tax inspectors may get very inventive in pumping money out of businesspeople, but this tax strategy will have a destructive effect in the longer run. First, such an environment does not encourage people to start new businesses or industries. This means that escaping the recession will depend on where external demand for the products of existing enterprises moves. Secondly, an excessive tax burden depletes working capital. Thus, entrepreneurs are pushed to turn to the financial sector where high interest rates make any business expansion unreasonable. As a result, turnover and production stop, economic downfall continues and the tax base depletes.

WHO PAYS THE BILL?

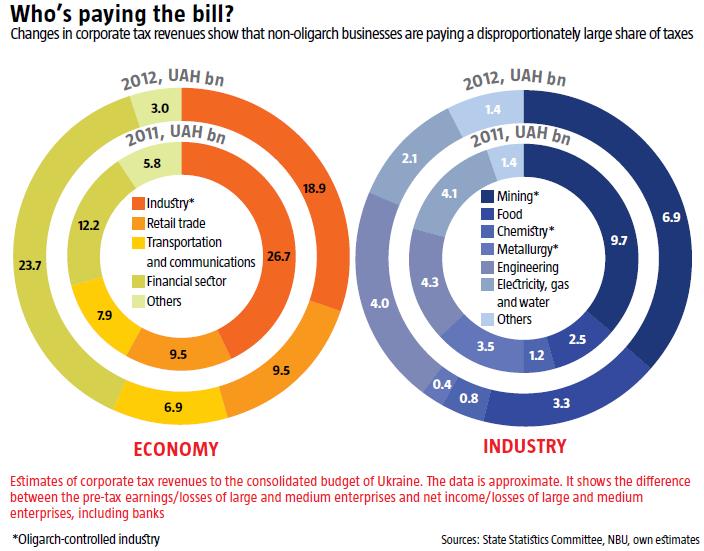

The tax pressure shown in statistics turns out to vary depending on who is paying. Some industries are in perfect harmony with the tax authorities despite the crisis. This is easy to see in the breakdown of corporate tax revenues by industries. When The Ukrainian Week asked the Ministry of Revenues and Duties to provide information on individual sectors, it only made excuses – apparently, it prefers to keep some things out of the public eye. So we have made approximate calculations based on the available data. They reflect major trends in taxation fairly reliably. The below estimates of corporate tax paid by economic and industrial sectors in 2011-2012 are based on a comparison of the financial performance of large and medium enterprises before tax (the estimates cover 83% of all products sold by commercial entities) and their net income as published by the State Statistic Committee (see Who’s actually paying taxes?)

In 2012, industrial enterprises paid UAH 18.9bn or UAH 7.8bn (29%) less than they paid in 2011 in corporate tax. This is hardly surprising as the before-tax profits of profitable industrial entities shrank from UAH 107bn to UAH 86bn, while non-profitable industrial businesses reported a total loss of UAH 65bn compared to UAH 48bn in 2011. Paradoxically, industrial enterprises reported growing revenues: the 0.5% decline in physical output was offset by a 3.7% rise in product prices. If this is correct, the original cost of their products should have risen as well. However, since the prices of key imported raw materials used in production (especially fuels) have virtually not changed (due, among other things, to the unchanging hryvnia exchange rate), what could have reduced the income of enterprises and the taxes they pay? Meanwhile, the problem is worsening: industrial enterprises paid UAH 4-6bn in taxes in previous quarters, and just UAH 2bn in the first quarter of 2013.

THE PRIVILEGED CASTE

Income tax revenues analyzed by industry signal that the taxes paid by oligarch-dominated sectors of the economy declined dramatically in 2012. The drop was 87% in metallurgy, almost 1/3 in chemistry and 29% in mining. Overall, the two most oligarch-controlled industries – metallurgy and chemistry – accounted for 11.3% of gross revenues in the Ukrainian economy while paying only 2.1% of total corporate tax. In metallurgy, the gap was tenfold with 8% and 0.8% in paid taxes. Their key argument was that these industries faced the biggest losses in the entire industry in 2012, losing UAH 16 and 7bn respectively, so they claimed to have no income to tax.

However, their financial statements help to clarify the situation: they pay most of their taxes offshore. Viktor Pinchuk’s Interpipe paid just 12% of its total taxes in 2012 in Ukraine. The remaining 88% went to the budgets of different countries through different schemes. Unlike Interpipe, steel giant Metinvest did not provide a regional breakdown of the corporate tax it paid last year in its statement. However, all of the group’s Ukrainian plants (nine, except for ZaporizhStal, which Metinvest controls since 2012) paid total corporate tax of USD 266mn, and only USD 166mn of this in Ukraine – this came mostly from mining plants.

READ ALSO: Questionable Improvement

Ukraine’s economic recession is systemic and comprehensive: as of mid-2013, business profitability was falling in virtually all sectors. However, not all businesses face equally burdensome effects. Oligarchs are reporting losses in Ukraine while transferring most income offshore and paying taxes there. This results in a steep decline in the revenues that the Ukrainian budget gets from their assets. The government is trying to offset this through increased tax pressure on non-oligarch sectors. For example, the food industry paid 33% more corporate tax in 2012 than it did in 2011; engineering plants paid just 8% less than in 2011 although their income had plummeted even lower. Together with retail trade (-1%) and construction (+27%), these entrepreneurs are bearing the brunt of the Ukrainian business sector’s growing tax burden as oligarch-controlled industries evade it.

In addition, non-oligarch businesses pay most VAT unlike steelworks and chemical plants. Meanwhile, oligarchs have the necessary leverage to get full VAT reimbursement for the products they actually export, and probably faked exports as well. In 2012, the amount of reimbursed VAT was well above even half of the value-added tax paid by Ukrainian producers (UAH 46 and 83bn respectively). Ultimately, the lion’s share of taxes is paid by Ukrainian citizens not only through personal income tax (UAH 68.4bn) but through VAT on most imported goods (over UAH 101.6bn). These taxes are paid by millions of ordinary Ukrainians from SMEs, health care and education systems and other public-financed sectors forced to deal with the burden of rescuing the state’s budget during the worsening economic crisis.

WHAT CAN BE DONE?

Many widely promoted myths portray oligarchs as a crucial element of Ukraine’s economy that fills the budget and international reserves. In reality, they remain a privileged caste that barely pays any taxes. Meanwhile, the taxes paid by everyone else enrich entities close to the government and oligarchs through profoundly corrupt public procurement schemes. As a result, Ukraine’s economy is like a sinking Titanic where those in power push the non-oligarch business to the lower decks while rushing to the lifeboats with their oligarch friends.

READ ALSO: The Tycoon Effect

In the current situation, Ukraine needs policies focused on driving economic growth. This must be based on three major elements:

- The first is to stop or strongly restrict corruption in public procurements, which outprice the revenues from all taxes and duties in Ukraine.

- The second is to expand the tax base, cancel privileges for oligarch businesses close to the government and gradually cut the effective tax rate for enterprises to facilitate their development.

- The third is to switch from pageantry to real efforts to prevent schemes whereby incomes and capital end up abroad. The key missing ingredients here are political will and the transformation of Ukraine’s oligarch economy into a market one. Apparently, the current regime will never possess these.