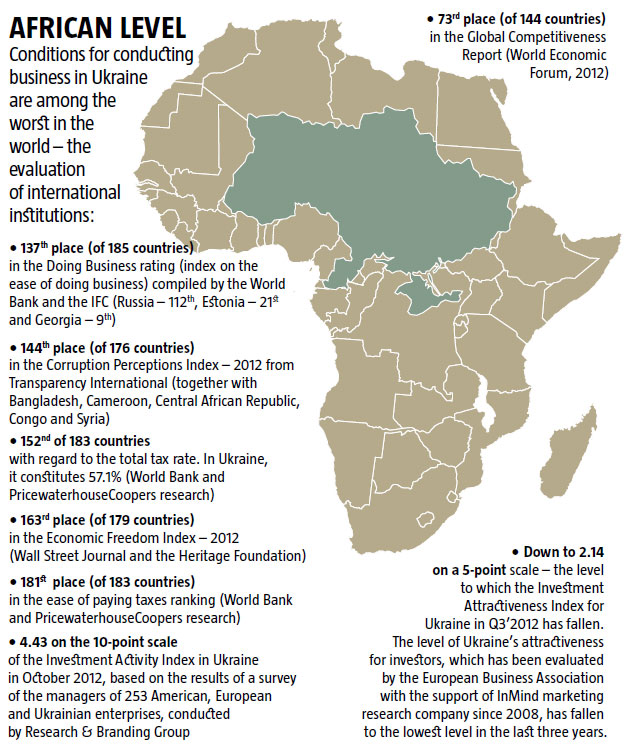

If the current situation with foreign investments is compared with data from 2009, it emerges that 2012 was the worst of the last decade. From October 2011 until October 2012, for the first time since comparative data has been available, foreign investment in Ukraine, with the exception of that from Cyprus and the British Virgin Isles, was less than USD 1bn. The Investment Attractiveness Index for Ukraine, calculated by the European Business Association, reached a historic minimum rating of 2.14 points, while at the peak of the previous crisis in 2008–2009, it only fell to 2.22.

Investors are fleeing Ukraine, not so much because of the global economic crisis, but because of the reality of the business environment in Ukraine. The main factor is the arbitrariness of the government as its principle of administration. There is no independent judiciary – everything is resolved as it was during Soviet times, “on the phone” – in private discussions. Laws, following the traditions of the Russian Empire, were written for idiots; but never before has it been less funny than now. Property rights are more nominal: according to the level of its protection, Ukraine is on the same level as Angola 128th – 129th place (of 130 countries) in the IPRI rating. Even if government-related raider attacks for the most part currently avoid companies with foreign investments (although even here there have already been several exceptions!), their owners are well aware that their turn will come, “foreign” enterprises will be targeted in order not to touch “their own”, in other words, those with direct links to Yanukovych’s circle. Much has been learned from the Russian and Belarussian experience.

Ukraine’s symbolic rise in the Doing Business rating was achieved as a result of a certain simplification in the registration of a typical LLC and a reduction in the number of tax payments for such LLCs. But neither one, nor the other is a true barrier for business in the reality of Ukraine. It is simply a “facade” of deregulation. Instead, the number of managers who admit that personnel changes in the government’s control bodies can significantly impact their success, has tripled.

While foreigners (and the civilized part of the national business community) were previously supported by optimism regarding prospects for overcoming a problem, today, disenchantment prevails. The more visitors learn about Ukraine, the more they understand that the problem does not simply lie in “political will”, but also in the system itself, under which this will simply cannot emerge, because the government is held together on personal (largely informal) privileges for individual enterprises and branches of industry. And even the hypothetical emergence of an individual politician, interested in the creation of equal and honest rules of the game, will not resolve anything. More and more investors, both domestic and foreign, are beginning to seriously consider whether a real catastrophe is looming. After all, a country with a ruined judiciary and corrupt law enforcement agencies is far too reminiscent of a human organism, deprived of immunity. At the same time, even within the opposition, there don’t appear to be any people, but too many instructions/teams, capable of averting such a catastrophe.

2012 is marked by the mass withdrawal of foreign banks from Ukraine, which in their time, were the first to take a “bite” at the prospects of its European integration. They are either selling their assets much cheaper than what they paid for them, such as Commerzbank, or are folding their operations, such as Swedbank. It is currently difficult to forecast whether those that have remained will follow their example, or hold out until the bitter end. Right now, based on the logical development of events, it’s the turn of the immigration of industrial investors. But first of all, they are far less flexible – more specifically, it’s more difficult to sell their assets and secondly, they can pursue more long-term goals. However, if there should be new investments, they will generally support projects that are already in place and at minimal levels.

Thus investment growth in 2013 will clearly be weak: less investment will depart, but less will come in. Maybe though, Ukraine will obtain investments for the extraction of gas, or less likely, for agriculture – only on condition that the moratorium on the purchase and sale of land is lifted. Countries with rich natural resources are generally ruled by dictators who, for the most part, are corrupt. So the companies involved in such business are used to relevant risks. The situation with investors from CIS countries, first and foremost Russia, is similar: they are fully adapted to the specific features of doing business in Ukraine. After all, they grew up under similar circumstances. It follows, that even if the official index of the volume of attracted investments can be maintained at the same level, their quality may be found to be significantly worse.