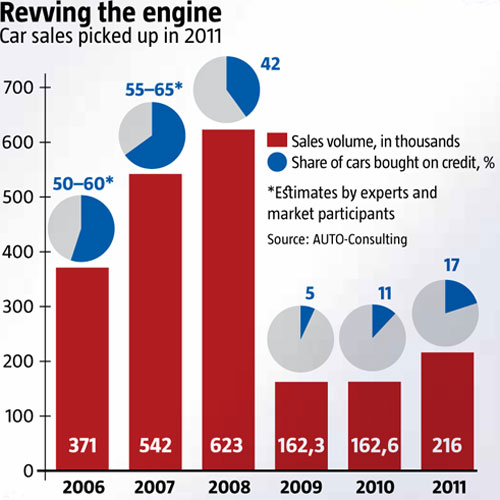

2011 was marked by a sharp increase in car sales volume in Ukraine. The trend has continued into 2012 but has slackened off somewhat. Few expected this kind of paradox. Market participants and experts projected a 10-15% increase in sales volume in 2011, given favourable circumstances and availability of bank loans. A total of 216,000 new cars, up by 33% from the previous year, were sold in Ukraine in 2011, according to AUTO-Consulting. People even had to wait in line to purchase certain models – something we have not seen since pre-crisis times –while dealers, inspired by the booming market, began to open new car dealerships and service centres.

The financial aspect of the situation is astounding. According to AUTO-Consulting, Ukrainians spent a sum comparable to a monthly national budget – €3.6 billion, up by 35% from 2010. One third of all purchases fell within the €6,500-10,000 range, while cars that cost €10,000-15,000 and €15,000-22,000 accounted for roughly 20% (each group) of the total sales volume. A new car cost an average of €16,300 in 2011.

THE OBVIOUS AND THE IMPOSSIBLE

Many experts and car market participants offer traditional explanations for this unlikely trend, citing official indices of economic development which turned out to be much more optimistic than previously predicted. They reason that the GDP increased by 5.2% rather than 4.5% and the inflation rate was 4.6% instead of the projected 8.9%, while the income of the population increased by an estimated 20% in 2011. Moreover, the dollar-hryvnia exchange rate was surprisingly stable. “Car sales grew largely on higher consumer confidence. The economy went from a stage of sustainable growth (largely owing to exports) to a phase when the dynamics depend on domestic demand and investments. Moreover, the above trend was largely linked to revived bank lending,” says Iryna Mykhalieva, chief of the Department for Marketing Communications at UkrAUTO Corp.

Oleksandr Sokolov, head of the analytical department at PRO-CONSULTING, begs to differ: “It would be adequate for the condition of the economy if car sales remained at the level of 2010.” President of the Ukrainian Analytical Centre Oleksandr Okhrymenko is also careful not to put too much weight on the macroeconomic factor: the real, rather than officially declared, inflation rate in Ukraine was 17-18%, he says. Other experts also cite an inflation rate close to 20% and note that a higher standard of living in Ukraine is largely illusory and is linked to a redistribution of national income through increased fiscal pressure on and control over businesses. The real income and profit of small and medium businesses, which are the core client group for car dealers, dropped in 2011. “The contribution of small enterprises to the national GDP fell from 14.2% in 2010 to 13% and medium businesses from 37% to 35%. The number of individual entrepreneurs dropped by 4% to 1.8 million. Moreover, some businessmen shut down their operations but are still registered,” Sokolov says.

The importance of bank loans should not be overestimated as a factor in car sales. According to AUTO-Consulting, loans were used to purchase a little over 11% of cars (17,000 vehicles) in 2010 and 17% (38,000) in 2011. This amount is both considerably large and rather small. To compare, 250,000 cars were bought on credit in 2008. The question still remains: Where does the 33% increase in car sales in 2011 come from? Consider, moreover, that an average loan did not exceed €10,000 and in most cases fell in the range of €7,000-8,000 in 2011. This means that loans accounted for 8-11% (€300-400 million) of the car sales pie.

GROWTH FACTORS

The key to understanding the car sales boom in 2011 is a noticeable increase in the number of cars purchased with cash: 178,000 in 2011, up from 148,000 in 2010. Ninety percent of all cars were purchased by individuals, so one is led to wonder: How did Ukrainians come by so much money?

It normally takes 3 to 4 years to save enough money to buy a decent car. Few people have managed to increase their savings during the crisis. So the reason, as we can see, is that Ukrainians pulled out their old savings and took them to car dealerships. “Many people found they lacked the money to buy an apartment. Our compatriots do not have a habit of investing in gold. But a car has traditionally been an attractive option,” Sokolov explains. Earlier, economist Erik Nayman estimated that by early 2009, Ukrainians had $48 billion in hard-currency cash savings, which was four times the hard-currency deposits at the time. So there was a latent, effective demand for cars in Ukraine. But why was it realised precisely in 2011?

To a large extent, the surge in demand was caused by rumours that customs duties on imported cars would be raised in 2011. A lot was said to this effect in the Verkhovna Rada and even more in the mass media. For example, in June 2011, some people publicly called on the government to protect Ukrainian car manufacturers through higher customs duties on imported vehicles. In July, the Interdepartmental Commission on Foreign Trade even launched a special investigation. There were fears that higher customs duties (34% and 47%), quotas and other unpleasant things would be introduced. Political statements were even made that the conditions Ukraine agreed to as it joined the WTO would be revised. None of that happened – the customs duties were not revised, and only the excise duty on cars was raised by 9%. However, car sales volumes shot up, which suggests a planned campaign to stimulate demand.

Sales peaked in September-October when the National Bank of Ukraine issued a regulation under which financial institutions had to request and make copies of IDs whenever an individual wanted to exchange currency. This somewhat unhealthy interest on the part of the central bank made Ukrainians uneasy, especially considering that Belarus completely banned currency exchanges for individuals at the time. The prospect of being left with a pile of dollars or euros salted away and not easily exchangeable was quite palpable and unappealing. Add to this the analytic reports about a hazy outlook for currencies due to their excessive issuance. In a word, car sales in Ukraine exceeded, as has been said above, €3.6 billion in 2011 with prices going up by 5-7% on average.

Will this trend continue in 2012? “We predict a car market of 250,000 vehicles. The contributing factors are economic stabilisation, a stable hryvnia exchange rate, expanded automotive lending, financial infusions leading up to Euro 2012 and the elections,” Mykhalieva says. But independent experts assure that 250,000 is too optimistic a figure. The slumping economy, declining income of the population, and more expensive car loans will be working against the car dealers. However, demand may be fueled through another PR campaign. Watch the news.