If you travel even a little around Ukraine, then you have probably noticed the changes in rural areas over the last few years. Fields are being aggregated, they are being worked seemingly according to schedule, the wheel tracks on them are even as seams, farm equipment is looking newer and more powerful, and in some villages, even the social infrastructure is being upgraded. These are visible signs and the result of development in the farm sector. This agricultural industry is the subject of high-level discussions, it is referred to as the engine driving the domestic economy, and great expectations are being placed on it. Why? Because the farm sector is making money: hard currency for the country, revenues for the budget, investment capital for the entrepreneurs, interest payments for the banks, and a slice of bread and butter for those living in the countryside.

RELATED ARTICLE: How the ban on land sale affects small owners of land, farmers and big agribusinesses

On track or slowing down?

The question is whether this will continue or will agribusiness turn into a bubble of the type that has been all too common, both in Ukraine and elsewhere. To answer this question, it’s important to understand what’s going on with prices for farm products, financial resources for farming businesses, and the fundamentals of the industry itself.

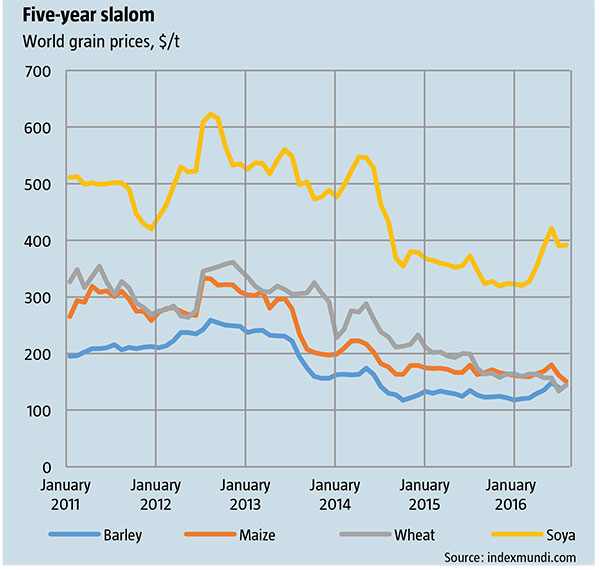

Let’s start with prices. World prices for food have been sliding pretty much since 2011 (see Five-year slalom). According to IMF data, at the end of this past  summer, the consumer price index for foodstuffs, a basket that includes grains, vegetable oils, meat, seafood, sugar and fruit, was 21% below its peak in April 2011. Although prices have risen 16% since the end of 2015, as the chart shows, this dynamic is not caused by those components of the basket on whose production and exports Ukraine specializes. For instance, the average price of wheat in mid-September was 22% below last year’s average and maize was down 11%. In short, world prices are exerting downward pressure both on hard currency income that Ukraine earns from exporting agricultural products, and on the incomes of agribusiness in hryvnias and kopiykas.

summer, the consumer price index for foodstuffs, a basket that includes grains, vegetable oils, meat, seafood, sugar and fruit, was 21% below its peak in April 2011. Although prices have risen 16% since the end of 2015, as the chart shows, this dynamic is not caused by those components of the basket on whose production and exports Ukraine specializes. For instance, the average price of wheat in mid-September was 22% below last year’s average and maize was down 11%. In short, world prices are exerting downward pressure both on hard currency income that Ukraine earns from exporting agricultural products, and on the incomes of agribusiness in hryvnias and kopiykas.

It’s hard to say whether a global situation that is disappointing for Ukraine’s farmers will continue for long. But the fact that since the beginning of 2016 prices for some farm products have been quickly recovering suggests that things have pretty much bottomed out. Similar trends were seen in the late 1990s: over 1997-1999, the consumer price index fell by nearly a third and prices began to recover gradually and by discrete groups. The first to recover were prices for oil and other fuels—prices for farm products returned to pre-crisis levels only in 2005-2007, that is, on average 8 years after they fell. If this happens again this time—a slowdown in developing economies tends to support this hypothesis—farmers may have to suffer for a few more years.

Given that land is Ukraine’s global competitive advantage, the farm sector is not really under threat and it remains in the black, even if not by that much. But if world prices for foodstuffs continue to fall, then some of the least efficient producers will have to leave the market—and, together with them, some of the least efficient grain-exporting countries.

However, Ukraine’s growers have not been sitting on their hands. They began even earlier to switch to more expensive and more profitable products and are now doing rather well with them. In the last 10 years, territory sown with soya has nearly tripled: 15 years ago, it was barely even known in Ukraine. Sunflower has expanded 150%, among others because farmers have learned how to grow it efficiently. Today, the yields of nearly all grains are at least 150% higher than they were then and they continue to rise. The Agricultural Policy Ministry says that this year, record yields since the country became independent were seen among both grains and legumes: 43.9 centners/hectare. Although the domestic harvest was not quite as good as the peak harvest of 2014, farmers certainly aren’t about to leave it at that.

Logistics and market logic

The other factor that can make the difference between success and failure when the global marketplace is down is the right use of logistics. Although the record crop was in 2014—63.8mn t of grains—, the 2014/2015 marketing year saw only 34.8mn t exported. In 2015, the crop was smaller, 60.1mn t, but exports in the 2015/2016 marketing year were noticeably higher, at 39.5mn t. In other words, Ukraine’s farm sector has developed solid logistical infrastructure in the last few years, which has made it possible to store grain while prices are down and sell it quickly the minute the price is right. The industry has learned to take effective advantage of the situation to maximize profits.

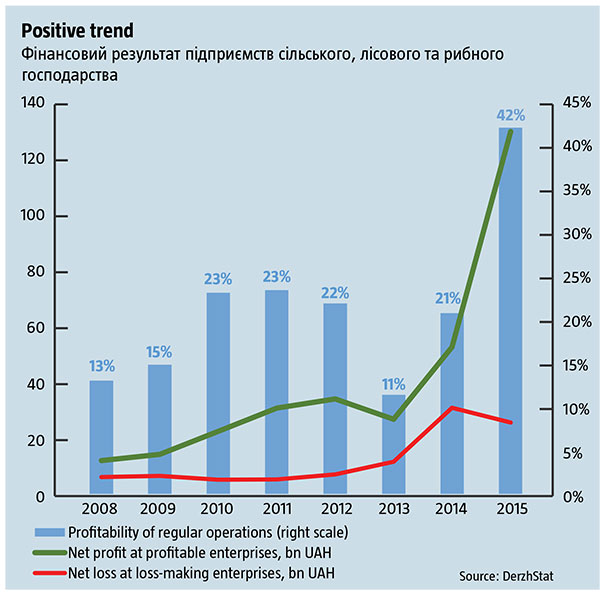

This opens the way to an understanding of the current financial standing of domestic agribusiness. According to Derzhstat, last year, farming, forestry and fisheries, among which farming dominates, earned record profits and demonstrated record profitability (see Positive trend). In the last two years, net profits at profit-making farm enterprises grew fivefold—despite the negative situation on world markets. The first factor was that part of the crop produced two years ago at an appropriate production cost was sold only last year.

This opens the way to an understanding of the current financial standing of domestic agribusiness. According to Derzhstat, last year, farming, forestry and fisheries, among which farming dominates, earned record profits and demonstrated record profitability (see Positive trend). In the last two years, net profits at profit-making farm enterprises grew fivefold—despite the negative situation on world markets. The first factor was that part of the crop produced two years ago at an appropriate production cost was sold only last year.

The second factor was the devaluation of the hryvnia. Indeed, this time around, farm businesses took advantage of the logistics infrastructure to wait out, not so much the fall in world grain prices—even if a priori this was part of the original calculus, prices have not yet recovered while surplus inventory has been sold—, as the instability of the hryvnia at home, until such time as there was a more-or-less clear exchange rate in the context of a new macroeconomic equilibrium.

With prices for farm goods tightly tied to the dollar while part of the production cost remains hryvnia-based—wages, a small portion of the seed funds, depreciation of equipment purchased in the past, and so on—, profits were sky-high last year. Thus, the financial state of the industry is the best it has been for many years. And it’s quite possible that it will continue to be so for many more years, as costs will climb while the devaluation of the hryvnia on such a scale might be the last such devaluation, so there won’t be much purpose to holding back product.

Good news, bad news

These super-profits in the farm sector have had a number of consequences, both good and not so good. Firstly, growers have begun investing actively. Last year, capital investment in agriculture rose 26.1%, to UAH 27.1bn, despite the fact that the country was still in crisis. By contrast, total capital investment in the entire domestic economy shrank 1.7%. In the first six months of 2016, capital investment in the sector skyrocketed 74.0%, compared to only 9.6% in the entire economy. That huge flow of cash to farming had to be spent on something, and so Ukraine is at a crossroads: if it is spent unproductively—on price wars for market share, yachts and expensive buildings for farmers, uneconomic purchases of components of the production cost—, this could all turn into a bubble, which will greatly cost the AIC in terms of development. Otherwise, the sector is set to continue growing apace.

Secondly, the super-profits being enjoyed by farmers have provided a solid basis to cancel the sector’s tax breaks. Such a decision is timely, but it’s not quite ripe, because the livestock industry will suffer a lot as a result. Furthermore, the proportion of large holdings among those enjoying these super profits is high, so the benefit for small and medium farmers could be limited. This means that the strong support for farmers initiated by the Ag Ministry should make it possible to eliminate this distortion.

RELATED ARTICLE: Agriculture Minister Taras Kutoviy on land reform, priority problems in Ukraine's agribusiness

Thirdly, international financial institutions are starting to more confidently provide credits to the sector. Despite a generally difficult situation in the bank sector, the NBU says that the agribusiness credit portfolio slipped 0.9% over January-July 2016, while the entire portfolio contracted by 4.6%. Needless to say, fundamentals such as the lack of a land market and the low quality of collateral, which make agribusiness less than attractive for banks to lend to, have not disappeared. But over the last year or two, a number of IFIs have begun to look for opportunities to finance agricultural enterprises and have been noticeably expanding credit portfolios focused on the industry.

It’s clear that Ukraine’s agricultural producers have spare cash today and will likely continue to have it for at least a few more years. The question is how much of a horizon they have to expand into, that this cash is placed to assist with. What about structural prospects? Much here will depend on the regulator, i.e., the state. The latter, through the Ag Ministry, has been initiating large-scale reforms, the main one being setting up a market for leasing land in order to resolve the country’s land woes. Conceptually, this is the right decision. But the fact that the farm sector has a lot of spare cash right now means that the cost of leasing land could quickly become too high. This risk is something the state needs to anticipate. At the same time, a market for leasing land should untie the hands of the banks, which will then have access to a class of valuable, quality assets that can be used for collateral. Could this lead to an exaggerated boom of lending in the AIC—and eventually to problems for many companies who borrowed to expand and then discovered that the potential for growth was far less than the money they had borrowed?

The second reform is targeted support for SMEs in the farm sector. Judging from the concept that has been presented so far, this assistance is meant to help farmers fill those niches that are not being supplied today. This offers considerable potential for growth for at least a few years.

RELATED ARTICLE: How Soviet authorities fought against private-property based economic in Ukraine

In any case, today agribusiness has money and the state seems to have good ideas for quality reforms and is ready to carry them out. This combination should foster sharp growth in the sector over the next few years. And the state, as the regulator, needs to control the situation so that this phase of acceleration is dominated by efforts to be efficient, not a dash for cash that threatens to cause a bubble and the inevitable crash.

Some skeptics say that this is all just to turn Ukraine into Europe’s farming arm with room for only 10-20 million Ukrainians to live comfortably. The hope is that the AIC will become the driver to pick up related sectors: heavy machinery, chemicals, fuels and so on. But regardless of this, Ukrainians need, above all, to take advantage of the God-given potential of their soil. Today, they have everything they need, to do so.

Translated by Lidia Wolanskyj

Follow us at @OfficeWeek on Twitter and The Ukrainian Week on Facebook